Professional Documents

Culture Documents

Inputs: Just For Your Edification

Uploaded by

yrperdana0 ratings0% found this document useful (0 votes)

25 views2 pages1

Original Title

ImpliedROCROE

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views2 pagesInputs: Just For Your Edification

Uploaded by

yrperdana1

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

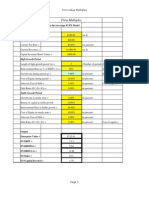

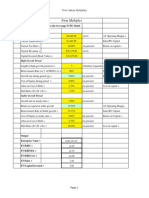

Inputs

Enter your after-tax operating earnings (EBIT (1-t)) in your terminal year = 1035

Enter your free cashflow to firm in your terminal year = 750

Enter your perpetual growth rate= 4%

Enter your cost of capital in perpetuity = 9.35%

Output

Your reinvestment rate in perpetuity is = 27.54%

Your return on capital (equity) in perpetuity has to be = 14.53%

Just for your edification

If your return on capital = cost of capital, your reinvestment rate would be 42.78%

! If you are doing an equity valuation, enter the net income

! If you are doing an equity valuation, enter the FCFE

! If you are doing an equity valuation, enter the cost of equity

! With equity valuation, return on equity = cost of equity

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Date of Valuation: Default AssumptionsDocument61 pagesDate of Valuation: Default AssumptionsАнна КуличNo ratings yet

- A Guide To Calculating Return On Investment (ROI) - InvestopediaDocument9 pagesA Guide To Calculating Return On Investment (ROI) - InvestopediaBob KaneNo ratings yet

- Cost of Capital ppt-157233Document20 pagesCost of Capital ppt-157233kuldipNo ratings yet

- Chap13 Exercise 56Document4 pagesChap13 Exercise 56John Lester C Alag0% (1)

- Starting numbers and default assumptions for DCF valuationDocument3 pagesStarting numbers and default assumptions for DCF valuationShubham SharmaNo ratings yet

- SprintDocument15 pagesSprintEli KoechNo ratings yet

- Leverage Analysis: Operating, Financial and Combined ImpactDocument98 pagesLeverage Analysis: Operating, Financial and Combined Impactthella deva prasadNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisMizanur RahmanNo ratings yet

- FirmmultDocument2 pagesFirmmultapi-3763138No ratings yet

- EuroTunnDCFDocument11 pagesEuroTunnDCFNgọc Hiền Nguyễn PhanNo ratings yet

- Template SesudahDocument59 pagesTemplate SesudahLevy ANo ratings yet

- PT Pupuk Kaltim valuation reportDocument55 pagesPT Pupuk Kaltim valuation reportLevy ANo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputssambarocksNo ratings yet

- Firm Multiples: Current InputsDocument2 pagesFirm Multiples: Current InputszNo ratings yet

- Finance 335 Exam 1 ReviewDocument5 pagesFinance 335 Exam 1 ReviewThùy DươngNo ratings yet

- FirmmultDocument2 pagesFirmmultPro ResourcesNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosArun PanwarNo ratings yet

- FCFF 2 STDocument24 pagesFCFF 2 STapi-3701114No ratings yet

- Eco CoventryDocument16 pagesEco CoventryAnonymous jhetHANo ratings yet

- Practice of Profitability RatiosDocument11 pagesPractice of Profitability RatiosZarish AzharNo ratings yet

- CFV600 Cash Flow Modeling Part 1Document33 pagesCFV600 Cash Flow Modeling Part 1Jermaine hammondNo ratings yet

- Prequin - PE Performance - Ratios - and - ExampleDocument5 pagesPrequin - PE Performance - Ratios - and - Examplevikas@davimNo ratings yet

- Return On Sales X Asset Turnover: ROS 0.3 or 30%Document5 pagesReturn On Sales X Asset Turnover: ROS 0.3 or 30%Elisha Lois ManluluNo ratings yet

- Key Assumptions: Investment DetailsDocument3 pagesKey Assumptions: Investment DetailsZulqarnainNo ratings yet

- Basic Financial Concepts TrainingDocument29 pagesBasic Financial Concepts TrainingSwan ye ThutaNo ratings yet

- FcffsimpleginzuDocument75 pagesFcffsimpleginzuKasturi MazumdarNo ratings yet

- Analysis and Impact of LeverageDocument97 pagesAnalysis and Impact of Leverageapi-19482678No ratings yet

- CashflowandProfitability 5ChEA2 DacasinAB 2019Document7 pagesCashflowandProfitability 5ChEA2 DacasinAB 2019Joshua Daniel SolomonNo ratings yet

- Net Present Value (NPV) : Orporate InanceDocument27 pagesNet Present Value (NPV) : Orporate InanceCratos_PoseidonNo ratings yet

- Microsoft Aug 20Document60 pagesMicrosoft Aug 20anuNo ratings yet

- Breakeven Where No Profit No Loss. Cost Meet Up Cost: Variable Cost: Vary With Units Produced Fixed CostDocument11 pagesBreakeven Where No Profit No Loss. Cost Meet Up Cost: Variable Cost: Vary With Units Produced Fixed CostNouman SheikhNo ratings yet

- 9 Mas Capital Budgeting Sessions 3 4Document14 pages9 Mas Capital Budgeting Sessions 3 4seya dummyNo ratings yet

- FcffsimpleginzuDocument62 pagesFcffsimpleginzuJosé Manuel EstebanNo ratings yet

- Lecture7 PDFDocument7 pagesLecture7 PDFJeannette VillenaNo ratings yet

- Two-Stage FCFE Discount ModelDocument11 pagesTwo-Stage FCFE Discount ModelKacper BenedykcińskiNo ratings yet

- Analysis and Impact of Leverages DR Pawan GuptaDocument53 pagesAnalysis and Impact of Leverages DR Pawan Guptamithunbanerjee2009No ratings yet

- PROFITABILITY RATIOS MCQs PDFDocument30 pagesPROFITABILITY RATIOS MCQs PDFSylvester StanisNo ratings yet

- Engineering Economic Study MethodsDocument14 pagesEngineering Economic Study MethodsLeojhun PalisocNo ratings yet

- Overall Profitability RatiosDocument20 pagesOverall Profitability RatiosShobika RNo ratings yet

- Financial Statements, Cash Flow, and Taxes AnswersDocument2 pagesFinancial Statements, Cash Flow, and Taxes AnswersClaudio SamanezNo ratings yet

- Vale Conservative Valuation 2014Document8 pagesVale Conservative Valuation 2014Alok P SinghNo ratings yet

- Fcfe 2 STDocument13 pagesFcfe 2 STpawankumarsahu42No ratings yet

- Ideko Case Solution PDFDocument8 pagesIdeko Case Solution PDFNaimur Rahman JoyNo ratings yet

- Economic Value AddedDocument3 pagesEconomic Value AddedNoor Mohd AzadNo ratings yet

- Inputs: Before Restructuring After RestructuringDocument4 pagesInputs: Before Restructuring After Restructuringapi-3763138No ratings yet

- PDE Lecture 3Document48 pagesPDE Lecture 3fanusNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- Rate of Return Method ExplainedDocument11 pagesRate of Return Method ExplainedAira_DirectonerNo ratings yet

- FC FF Simple Ginzu CoronaDocument62 pagesFC FF Simple Ginzu CoronaDasari PrabodhNo ratings yet

- Discussion Unit 3 M.A.editedDocument6 pagesDiscussion Unit 3 M.A.editedsir jNo ratings yet

- Final Proforma Project: Development of A Manufacturing Space in CougarvilleDocument7 pagesFinal Proforma Project: Development of A Manufacturing Space in CougarvilleArslan HafeezNo ratings yet

- Date of Valuation: Default AssumptionsDocument57 pagesDate of Valuation: Default Assumptionssagar vaziraniNo ratings yet

- Date of Valuation: Default AssumptionsDocument81 pagesDate of Valuation: Default Assumptionsanubhav saraswatNo ratings yet

- Operating Financial LeverageDocument64 pagesOperating Financial LeverageArafatNo ratings yet

- Dividend Discount Model: AssumptionsDocument36 pagesDividend Discount Model: AssumptionsPro ResourcesNo ratings yet

- mODULE 3 ROI EVA RI 2021Document23 pagesmODULE 3 ROI EVA RI 2021vidur 17No ratings yet

- CH 16Document63 pagesCH 16Labonno Reza AshaNo ratings yet

- Session 04Document26 pagesSession 04Sajini KaushalyaNo ratings yet

- Innovation and Reflection On Peter Calthorpe's New Urbanism Lei YanDocument6 pagesInnovation and Reflection On Peter Calthorpe's New Urbanism Lei YanyrperdanaNo ratings yet

- Preliminary Study On Current Process of Bus Component Inspection Among Public Bus Transport in MalaysiaDocument7 pagesPreliminary Study On Current Process of Bus Component Inspection Among Public Bus Transport in MalaysiayrperdanaNo ratings yet

- 1 - Bruegmann, R. (2008) - Point-Sprawl and Accessibility. JTL PDFDocument7 pages1 - Bruegmann, R. (2008) - Point-Sprawl and Accessibility. JTL PDFHenil DudhiaNo ratings yet

- Exploring Recent Long-Distance Passenger Travel Trends in EuropeDocument10 pagesExploring Recent Long-Distance Passenger Travel Trends in EuropeyrperdanaNo ratings yet

- 2012 82 Urban Sprawl Measures PDFDocument9 pages2012 82 Urban Sprawl Measures PDFimanuelandrewNo ratings yet

- Road Safety Education For Children: Results of Children'S Behavior On Traffic Playground and Simulated Traffic SituationsDocument11 pagesRoad Safety Education For Children: Results of Children'S Behavior On Traffic Playground and Simulated Traffic SituationsyrperdanaNo ratings yet

- Escholarship UC Item 7wm9t8r6Document31 pagesEscholarship UC Item 7wm9t8r6yrperdanaNo ratings yet

- European Ways To Organise Public Transport: January 2002Document14 pagesEuropean Ways To Organise Public Transport: January 2002yrperdanaNo ratings yet

- 07 Ejem JSDTL 2018 3 3Document11 pages07 Ejem JSDTL 2018 3 3yrperdanaNo ratings yet

- Ibm: PBV and RoeDocument3 pagesIbm: PBV and RoeyrperdanaNo ratings yet

- Play and Behavior Characteristics in Relation To The Design of Four Danish Public Park PlaygroundsDocument28 pagesPlay and Behavior Characteristics in Relation To The Design of Four Danish Public Park PlaygroundsyrperdanaNo ratings yet

- Road Safetyin SingaporeDocument14 pagesRoad Safetyin SingaporeyrperdanaNo ratings yet

- PT BANK VICTORIA SYARIAH BALANCE SHEETS 2012-2011Document19 pagesPT BANK VICTORIA SYARIAH BALANCE SHEETS 2012-2011yrperdanaNo ratings yet

- Equity ValuationDocument24 pagesEquity ValuationyrperdanaNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007yrperdanaNo ratings yet

- From This Year's Income StatementDocument15 pagesFrom This Year's Income StatementyrperdanaNo ratings yet

- Betas CálculosDocument3 pagesBetas Cálculosjuan352No ratings yet

- Workshop ReportDocument3 pagesWorkshop ReportyrperdanaNo ratings yet

- Betas CálculosDocument3 pagesBetas Cálculosjuan352No ratings yet

- Betas CálculosDocument3 pagesBetas Cálculosjuan352No ratings yet

- Betas CálculosDocument3 pagesBetas Cálculosjuan352No ratings yet

- Dividend Discount Model: AssumptionsDocument15 pagesDividend Discount Model: Assumptionsminhthuc203No ratings yet

- 2017bookairports PDFDocument36 pages2017bookairports PDFyrperdanaNo ratings yet

- 2157 8431 1 PB PDFDocument15 pages2157 8431 1 PB PDFyrperdanaNo ratings yet

- Launch of The European Transport Research Alliance Press Release - 25092012Document2 pagesLaunch of The European Transport Research Alliance Press Release - 25092012yrperdanaNo ratings yet

- 2157 8431 1 PB PDFDocument15 pages2157 8431 1 PB PDFyrperdanaNo ratings yet

- Loading Preparation PDFDocument21 pagesLoading Preparation PDFyrperdanaNo ratings yet

- Managing OrganizationsDocument11 pagesManaging OrganizationsindosiataNo ratings yet

- Methods To Anticipate Skills DemandDocument43 pagesMethods To Anticipate Skills DemandyrperdanaNo ratings yet