Professional Documents

Culture Documents

TDS Rate Chart 2012-13

TDS Rate Chart 2012-13

Uploaded by

Manniinder SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Rate Chart 2012-13

TDS Rate Chart 2012-13

Uploaded by

Manniinder SinghCopyright:

Available Formats

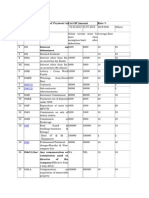

TDS RATE CHART FINANCIAL YEAR 2012-13 (ASSESSMENT YEAR 13-14)

Sl. Section Of Nature of Payment

No. Act

in brief

1

192

193

3

4

4A

5

6

7

8

9

10

11

12

13

14

15

16

Salaries

Cut Off Amount

Rate %

01.04.2012 01.07.2012

HUF/IND Others

Salary income must be

Average Rate

more then exemption limit

after deductions.

Interest on

2500

debentures

194

Deemed dividend

194A

Interest other than Int 10000

on securities (by

Bank)

194A

Interest other than Int. 5000

on securities (By

others)

194B

Lottery / Cross Word 10000

Puzzle

194BB

Winnings from Horse 5000

Race

194C(1)

Contracts

30000

194C(2)

Sub-contracts/

30000

Advertisements

194D

Insurance

20000

Commission

194EE

Paymentsout of

2500

deposits under NSS

194F

Repurchase of units 1000

by MF/UTI

194G

Commission on sale 1000

of lottery tickets

194H

Commission or

5000

Brokerage

194I

Rent (Land &

180000

building)

Rent (P & M ,

180000

Equipment, furniture

& fittings)

194J

Professional/Technical 30000

charges/Royalty &

Non-compete fees

194J(1)(ba) Any remuneration or NA

commission paid to

5000

10

10

10000

10

10

10

10

5000

10

10

10000

30

30

5000

30

30

30000

30000

1

1

2

2

20000

10

10

2500

20

1000

20

20

1000

10

10

5000

10

10

180000

10

10

180000

30000

10

10

NIL

10

10

17 194LA

18 194LLA

director of the

company(Effective

from 1 July 2012)

Compensation on

100000

acquisition of

immovable property

Payment on transfer NA

of certain immovable

property other than

agricultural land

(applicable only if

amount exceeds : (a)

INR 50 lakhs in case

such property is

situated in a specified

urban agglomeration;

or(b) INR 20 lakhs in

case such property is

situated in any other

area) (Effective from

1 October 2012)

200000

10

10

(a) INR 50

1

lakhs in case

such property

is situated in a

specified

urban

agglomeration;

or(b) INR 20

lakhs in case

such property

is situated in

any other area)

(Effective

from 1

October

2012)

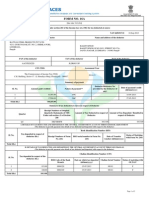

TCS Rates for the FY 2012-13

The Tax Collection at Source Rates for the Financial Year 2013-13 is tabulated below:

Sl.No. Nature of Goods

1.

2.

3.

4.

5.

6.

7.

8.

9.

10

11

Alcoholic liquor for human Consumption

Tendu leaves

Timber obtained under forest lease

Timber obtained by any mode other than a

forest lease

Any other forest produce not being timber or

tendu leaves

Scrap

Parking lot

Toll plaza

Mining & Quarrying

Minerals, being coal or lignite or iron ore

Bullion or jewellery (if the sale consideration

is paid in cash exceeding INR 2 lakhs)

Rates in %

01.04.2012

1

5

2.5

01.07.2012

1

5

2.5

2.5

2.5

2.5

2.5

1

2

2

2

NA

1

2

2

2

1

1

NA

No Education Cess on payment made to resident-Education Cess is not deductible/collectible

at source in case of resident Individual/HUF /Firm/ AOP/ BOI/ Domestic Company in respect of

payment of income other than salary. Education Cess @ 2% plus secondary & Higher Education

Cess @ 1% is deductible at source in case of non-residents and foreign company.

Surcharge on Income-tax - Surcharge on Income-tax is not deductible/collectible at source in

case of individual/ HUF /Firm/ AOP / BOI/Domestic Company in respect of payment of income

other than salary.

Due date for furnishing TDS return for the last quarter of the financial year has been modified to

15th May (from earlier 15th June). The revised due dates for furnishing TDS return are

Sl.

No.

1.

2.

3.

4.

Date of ending of the quarter

of the financial year

30th June

30th September

31st December

31st March

Due date

15th July of the financial year

15th October of the financial year

15th January of the financial year

15th May of the financial year immediately

following the financial year in which

deduction is made

Due date for furnishing TDS certificate to the employee or deductee or payee is revised as under

:

Sl.

No.

Category

Periodicity of

furnishing TDS

certificate

(Form Annual

1.

Salary

No.16)

2.

NonSalary(Form

No.16A)

Quarterly

Due date

By 31st day of May of the financial year

immediately following the financial

year in which the income was paid and

tax deducted

Within fifteen days from the due date

for furnishing the statement of TDS

Due Date for Payment of March 2012 -The time limit for deposit of TDS for the entire month

of March is rationalized to 30 April instead of two separate time limits viz. 7 April for TDS up to

30 March and 31 May for TDS as of 31 March.

You might also like

- Assignment - Case Study Philip Morris and KraftDocument2 pagesAssignment - Case Study Philip Morris and KraftMuhammad Imran BhattiNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Xxx2016!12!12 Fake Social Media Is Run by The CIA and Creates Fake News To Demonize Truth Tellers and Overturn Trump Election Americans For Innovation Dec 12 2016Document28 pagesXxx2016!12!12 Fake Social Media Is Run by The CIA and Creates Fake News To Demonize Truth Tellers and Overturn Trump Election Americans For Innovation Dec 12 2016Michele DiamondNo ratings yet

- TDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14Document2 pagesTDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14CaCs Piyush SarupriaNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Tds Rates Chart ADocument2 pagesTds Rates Chart AshivshenoyNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Tds BookletDocument22 pagesTds BookletSanjayThakkarNo ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- Tds Rate ChartDocument49 pagesTds Rate ChartSANJEEVNo ratings yet

- With Holding Tax RatesDocument3 pagesWith Holding Tax Ratesvenkat6299No ratings yet

- Revised TDS Rate Chart (FY 2009-10)Document1 pageRevised TDS Rate Chart (FY 2009-10)haldharkNo ratings yet

- Accounts & Taxations Interview Related NotesDocument5 pagesAccounts & Taxations Interview Related NotesRahul Baburao AbhaleNo ratings yet

- TDS Chart FY 2010-11 & FY 2011-12Document1 pageTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- A) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Document17 pagesA) Commonly Used TDS Provision For Payments Made To Persons Resident in India (Individuals, Firms, Companies, Etc.)Sonika GuptaNo ratings yet

- Direct Tax Code: Ms. Ankita AgrawalDocument16 pagesDirect Tax Code: Ms. Ankita AgrawalPooja SwamyNo ratings yet

- Payment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumDocument1 pagePayment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumMadhan RajNo ratings yet

- ACN 4135: Taxation: Income From Other SourcesDocument11 pagesACN 4135: Taxation: Income From Other SourcesHasibur RahmanNo ratings yet

- Sl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %Document8 pagesSl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %amit2201No ratings yet

- TDS 3Document16 pagesTDS 3payal AgrawalNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Tax PlanningDocument6 pagesTax PlanningprasadNo ratings yet

- Form Sr. Instruction Instructions For Filling in Return Form & Wealth StatementDocument8 pagesForm Sr. Instruction Instructions For Filling in Return Form & Wealth StatementajgondalNo ratings yet

- For Individual and Other Taxpayers (Other Than Company) : IT-11GADocument9 pagesFor Individual and Other Taxpayers (Other Than Company) : IT-11GAsojol747412No ratings yet

- Videoton Autoelektronika KFTDocument2 pagesVideoton Autoelektronika KFTAleksandar BjelicaNo ratings yet

- 8 Taxation of NRDocument8 pages8 Taxation of NRchandrakantchainani606No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Sl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersDocument4 pagesSl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersLisa StewartNo ratings yet

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Document6 pagesFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNo ratings yet

- BIR 1702Q FormDocument3 pagesBIR 1702Q FormyellahfellahNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- TDS Tax Deduction at Source: Prepared By: Visharad ShuklaDocument25 pagesTDS Tax Deduction at Source: Prepared By: Visharad ShuklaPriyanshi GandhiNo ratings yet

- Bir 1600Document13 pagesBir 1600Adelaida TuazonNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Compliance Calendar 2013-14Document1 pageCompliance Calendar 2013-14Amitmil MbbsNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- Module-1: Basic Concepts and DefinitionsDocument35 pagesModule-1: Basic Concepts and Definitions2VX20BA091No ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605John Louise Tan100% (1)

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasYulo Vincent Bucayu PanuncioNo ratings yet

- Payment Form: Kawanihan NG Rentas InternasDocument3 pagesPayment Form: Kawanihan NG Rentas InternasMikylla HuertasNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- TDS Rate Chart PDFDocument2 pagesTDS Rate Chart PDFjdhamdeep07No ratings yet

- Bir Form 1702-ExDocument7 pagesBir Form 1702-ExdignaNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Business Taxation AssignmentDocument7 pagesBusiness Taxation AssignmentThe Social KarkhanaNo ratings yet

- Individual Paper Income Tax Return 2016Document39 pagesIndividual Paper Income Tax Return 2016aarizahmadNo ratings yet

- Tax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartDocument3 pagesTax Deducted/Collected at Source F.Y. 2015-16 (A.Y. 2016-17) A. Tds Rate ChartChandan KumarNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- June Magazine - 2008Document28 pagesJune Magazine - 2008api-26644987No ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Marketing Principles GabrielDocument27 pagesMarketing Principles GabrielZakiNo ratings yet

- 08 - Chapter 1 KeshavDocument71 pages08 - Chapter 1 KeshavSAGARNo ratings yet

- Chapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEDocument2 pagesChapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEMohit SinghNo ratings yet

- Summary of Investment LawDocument11 pagesSummary of Investment LawBarkhad HassanNo ratings yet

- Risk and ReturnDocument12 pagesRisk and Returnngkqd29fsyNo ratings yet

- Island Buyers GuideDocument60 pagesIsland Buyers Guidemsid255No ratings yet

- TRM ASSIGNMEN VietcombakDocument24 pagesTRM ASSIGNMEN Vietcombaktrung luuchiNo ratings yet

- Partha SapDocument5 pagesPartha Sapparthu sarathiNo ratings yet

- CH 13Document46 pagesCH 13Muhammad AmirulNo ratings yet

- 18 - IM - Role of Derivatives in Portfolio ManagementDocument15 pages18 - IM - Role of Derivatives in Portfolio ManagementGurnaaj GillNo ratings yet

- Allen Stanford Criminal Trial Transcript Volume 9 Feb. 2, 2012Document303 pagesAllen Stanford Criminal Trial Transcript Volume 9 Feb. 2, 2012Stanford Victims CoalitionNo ratings yet

- Equity Invest - MC Quest.w AnsDocument3 pagesEquity Invest - MC Quest.w AnsElaineJrV-Igot0% (1)

- A Comparison of Corporate Governance Systems in The U.S., UK and GermanyDocument12 pagesA Comparison of Corporate Governance Systems in The U.S., UK and GermanyAbrahamNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- Bank Bumiputra (M) BHD V Hashbudin Bin HashiDocument10 pagesBank Bumiputra (M) BHD V Hashbudin Bin HashiNorlia Md DesaNo ratings yet

- Australia Law Fair 2014 - UNSWDocument23 pagesAustralia Law Fair 2014 - UNSWMr WalkingsNo ratings yet

- 3rd Week Cash Flow AnalysisDocument19 pages3rd Week Cash Flow AnalysisCj TolentinoNo ratings yet

- Campus Activewear Limited IPO: NeutralDocument7 pagesCampus Activewear Limited IPO: NeutralAkash PawarNo ratings yet

- Wed., July 20, 2011Document12 pagesWed., July 20, 2011The Delphos HeraldNo ratings yet

- Alexander Macfarlane - Physical MathematicsDocument410 pagesAlexander Macfarlane - Physical MathematicsanonkidNo ratings yet

- Naqdown Clincher QuestionDocument13 pagesNaqdown Clincher QuestionsarahbeeNo ratings yet

- Frost Gang ReportDocument10 pagesFrost Gang ReportLee PedersonNo ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- No. 2014-10 June 2014: Development Stage Entities (Topic 915)Document38 pagesNo. 2014-10 June 2014: Development Stage Entities (Topic 915)viviNo ratings yet

- Public Administration Unit-95 Evolution and Expansion of Public SectorDocument12 pagesPublic Administration Unit-95 Evolution and Expansion of Public SectorDeepika Sharma100% (1)

- Summary The Intelligent InvestorDocument6 pagesSummary The Intelligent InvestorDion GerriNo ratings yet

- Corporate Finance Cheat SheetsDocument7 pagesCorporate Finance Cheat SheetsDianeDianeNo ratings yet

- E-Journal GJMBR (C) Vol 19 Issue 5Document112 pagesE-Journal GJMBR (C) Vol 19 Issue 5benedicta RiyantiNo ratings yet