Professional Documents

Culture Documents

3

3

Uploaded by

Joseph Moore0 ratings0% found this document useful (0 votes)

49 views6 pagessdfds

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsdfds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

49 views6 pages3

3

Uploaded by

Joseph Mooresdfds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

Mane!

%

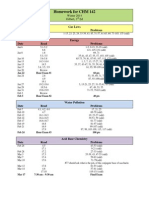

NOR 4 Spring 2015

ae

ans

ee

(a) Marginal

*b. Deprecated

© Paral

Segmented

2. The allocation of resources to specific projects based on economic analysis is known as:

‘Capital eonservation

i. Capital analysis

Capital assessment

© Capita desing

3. Ina replacement analysis, ‘defender’ and ‘challenger refer to

(a Existing equipment and replacement candidate, respectively

“6. Replacement candidate and existing equipment, respectively

‘e. Highest first cost and second-highest first cost replacement candidate,

respectively

4d, Second-highest fist cost and highest frst cost replacement candidate, respectively

w

4. Themnmber of years at which the FLIAC of exunership fs minimized is known asthe:

‘a. Recovery period

bb, Payback lite

> Minimum cos ite

‘@. Cost minimized lite

5. ‘The value of actual dollars is adjusted for inflation,

a. True

2 Fabe

6 Which ofthe following should not be considered when etng a MARR for a projet?

Coa of booed money

& Infaion

Z —& Sunkeoss

@ Cos afeapa

2. According othe text, allan sk equi that probabil ofits outcomes re

town

tne

Pale

wv

8. Alan schedule shows loan payments, interest paid, prineipal paid and remaining

balance.

(3) Amortization

‘6. Payback

. Economic

a Capital

9 Payback period may bean appropriate economic erterion when quits mor important

than profi.

, @ Te

2. False

10. The cost esis mins any deprecation is ul the:

Capital ein

Book value

2 '& Recovered depres

Aten vale

11. (Ai) eae known asthe

Uniform srs compound amount Gcor

®. Union unre worth fir

Uniform anal ponent factor

1 Unitorm series ning fund ator

12. Neglecting to consider non-monetary consequences of a decision is an example of an

ethical lapse at what stage ofthe decision-making process?

' Construct a model

4 b. Augit the result

Select the criterion to determine the best alternative

<4. Define the goal or objective

13. Which of the following is not one of the fundamental canons of ethical behavior for

‘engineers? Engineers shal

‘Hold paramount the safety, health and welfare of the public.

'. Perform services only in areas oftheir competence.

Ze. Avoid deceptive ats

© Maximize shareholder run,

14, At maturity, bond holders receive the _ value.

(® Par

Capit

© Coupon

@. Yield

2

15. The economic life ofa depreciable asst is always equivalent to its useful service life.

True

o

For any ofthe calculation problems, ifyou are unsure how to proceed, start with a cash flow

diagram.

16. A hospital in The Upper Cumberland area bought a diagnostic machine at a cost of

$40,000, Maintenance cost i expected to remain constant throughout the life ofthis

‘machine at $2,000 per yea. The salvage value i estimated to be “0” a the end ofthe

useful life of [0 years. Determine the economic life ofthis machine. MARR = 10%

a. Lyear

b. S years

e. Tyears

@ Wyeors

EURC = 46,000 (Mp tay, x) +2000

Sronfl mv ibe Qe EUR continues do deren e/ vtens o&

see.

Eeonerse (Kt UAL LUG FLO 086,

17. The cost data for equipment being considered ata local company are given inthe

‘lows. What isthe economic life?

a. 2years

3 years

@ tren

5 years

Year| EUAC of First Cost EUAC of TEUAC of Operating

Salvage Value) Maintenance Cost

T $9,000 $400) S800

2 6.000 800 1,600

3 4,000) 7,200 2,400

4 2.500) 1,600. 2,600

S 1,500 2,000) 3.500

Bune

\ 21000 + 460+ Bod = 19,200

2 Goce + TOS* uso * HE AO

= ose + I2es + 2400 = 47,608

4 geet Meo + T6OG =MeTSD => Loweck

5s \e004 2000+ 3550 = 187,000

wn

18. Ifthe real interest rate is 7% and the inflation rat is 5%, what i the matket interest rate?

@& 12.38%

b. 11.65%.

©. 16.63%

4. 13.84%

207 O65 TO oXoo8

= OSs ISG

19. Liz Taylor bought some farming lands fr $100,000 five years ago. She sold the property

year for $500,000, If the annual inflation rate for the past 5 years has been at 6%,

‘compute the after-tax real interest rate fortis investment, Assume no deprecation anda

15% copital gains tax rate

a, 19.84%

b. 24.70%

& 26.88%

a. 28.13%

ceed spin = $00,008 - 00,000 400 600

cot ayn tors ©.1SG60,c80) = Hoo, 060

10 RGle doe cot Ges Ser yer S! 500, c06 - Go,008= HAO, 008

Ho. se92 100,808 (F/0, U.S) BE OHNT= BAG

Le Hehe EE OME {FOC TO.OOI = O.26BB = UE.W

20. n the cash flow diagram below, determine the value of x ifthe interest rte is 8%.

@ 3687

BD $2687 or meng. of He above

©. $329.16

4 $480.70

5

7 2000 oe (", 0%, 2-H (Me 8,1)

mee as cowl PF] Vise ge

‘rconn, rather than *

860 2PO= ANTY~ Logon

sete, Se oer 2e0e = LAs

et Sete tis

.

15

21, The cashflows for thre different alternatives are given in table below, MARR.

‘Based on an incremental rate of return analysis, the best alterat

a AIA

bale

@ ane

&. Doothing

AA [ARB [ARC

Tn cost [5,003,000 [7.500

Annual beni | $1487 2.518 [2.133

iRR 4% [13% Tae

0 Life mya 5

BK UA

ser cat * S00 wusso

RenBacbie SOF 1%

s

Gay §

zseoe Grte(tmisd

sse0= te5 (Pais

Crssy PANiS= B.GIBZ

TIRGGS = EG eee

See's kekwen Lote ae

Be eitve AB chose ©

ewe C

22. I is estimated thatthe annual maintenance cost of a statue erected in front of a public

building in a state capital would be $1,000. Assuming an intrest rate of 4% year

‘compounded quarterly, determine the capitalized cost for maintaining the statue.

5 @ 924631

b. $25,000

© $2867

4. $30, 124

ERelive orth tera rales (1 SUF o.04000 = Hoe %

p. AL. Brose

fe adits

$24,680.54

10

23. Philipp Inc, « German company, is considering the following two equipment alternatives

or the plat in Tennesse. The cost information for the two machines wr consideration

‘are in table below. Using present worth analysis, whichis the beter option?

@® Machine x

b. Machine ¥

Machine X Machine V

‘$80,000 $66,000

‘12,000 forthe first 10 years and $9,000 per year for 20 years

{8,000 forthe next 10 years

20)

330000 [s20.p00-

10% J

~ Bes + Goo (Ma, 10K 2) + Veoel P/A,,10%

* 0000( He 1%, 20)

OR rtey

= = Reece | Ree (a.SI4) + 4oee(g. 145) + 5e000(0.4R6)

= F160

[bors + Vooa( Hp, I8% 20) + 20000( Fe, lo%, 20)

= = Gboo0 + Wwoo(@S1H) + Zocee(0.14G)

#3558

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cool Chart: Tab 4 Tab 2 Tab 3Document14 pagesCool Chart: Tab 4 Tab 2 Tab 3Joseph MooreNo ratings yet

- On Student AthletesDocument1 pageOn Student AthletesJoseph MooreNo ratings yet

- Produced by An Autodesk Educational ProductDocument1 pageProduced by An Autodesk Educational ProductJoseph MooreNo ratings yet

- James Still Hase LSDF James Still ListDocument1 pageJames Still Hase LSDF James Still ListJoseph MooreNo ratings yet

- Homework For CHM 142: Gas Laws Date Read ProblemsDocument1 pageHomework For CHM 142: Gas Laws Date Read ProblemsJoseph MooreNo ratings yet