Professional Documents

Culture Documents

"FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

KKumar SantoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

KKumar SantoshCopyright:

Available Formats

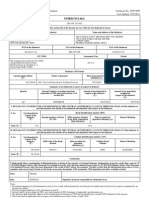

FORM NO.

16B

[See rule 31(3A)]

Certificate No.

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

Last updated on

Name and address of the Deductor

(Transferee/Payer/Buyer)

PAN of the Deductor

Name and address of the Deductee

(Transferor/Payee/Seller)

PAN of the Deductee

Financial Year of deduction

Summary of Transaction (s)

S. No.

Unique Acknowledgement

Number

Amount Paid/

Credited

1

2

Total Rs.

Amount of tax deducted and

deposited in respect of the

deductee

Date of payment/credit

(dd/mm/yyyy)

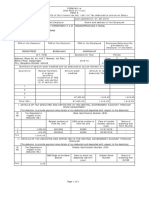

DETAILS OF TAX DEPOSITED TO THE CREDIT OF THE CENTRAL GOVERNMENT

FOR WHICH CREDIT IS TO BE GIVEN TO THE DEDUCTEE

S. No.

Challan Identification number (CIN)

Amount of tax deposited in

respect of deductee

(Rs.)

1

2

Total

BSR Code of the

Bank Branch

Date on which tax

deposited (dd/mm/yyyy)

Challan Serial

Number

Verification

I,

son/daughter of

(designation) do hereby certify that a sum of (Rs.)

#VALUE!

0

(in words)]

has been deducted and deposited to the credit of the Central Government. I further certify that the information given

above is true, complete and correct and is based on the books of account, documents, challan-cum-statement of

deduction of tax, TDS deposited and other available records.

Place

(Signature of person responsible for deduction of tax)

Date

Full Name:

Finotax

1 of 1

You might also like

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- New Tds CertificateDocument1 pageNew Tds Certificatechowdhary_akshayNo ratings yet

- TDS Certificate DetailsDocument2 pagesTDS Certificate DetailsAnonymous SMqp9rZuNo ratings yet

- Form 16A TDS Certificate DetailsDocument2 pagesForm 16A TDS Certificate DetailsKovidh GoyalNo ratings yet

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Form27d Applicable From 01.04Document2 pagesForm27d Applicable From 01.04sudhrengeNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Annual Tax Statement PAN Financial Year Assessment YearDocument3 pagesAnnual Tax Statement PAN Financial Year Assessment YearNiteshwar ShuklaNo ratings yet

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument3 pagesFORM 16 TAX DEDUCTION CERTIFICATEdugdugdugdugiNo ratings yet

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDocument34 pagesI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNo ratings yet

- ViewDocument2 pagesViewVenkat JvsraoNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- FORM 16 TDS CERTIFICATE DECODEDDocument4 pagesFORM 16 TDS CERTIFICATE DECODEDSuman HalderNo ratings yet

- Form No. 16ADocument1 pageForm No. 16ASiyad AhammedNo ratings yet

- Form VAT ReturnDocument3 pagesForm VAT ReturnYf WoonNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Umesh C-Form16 - 2020-21Document10 pagesUmesh C-Form16 - 2020-21Umesh CNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONgrover.jatinNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAbhishek SharmaNo ratings yet

- 1601 CDocument16 pages1601 CROGELIO QUIAZON100% (1)

- Nidhi Form 16 UpdateDocument3 pagesNidhi Form 16 UpdateAbhinav NigamNo ratings yet

- TDS Certificate Form 16 SummaryDocument3 pagesTDS Certificate Form 16 SummarySvsSridharNo ratings yet

- Form 16A TDS CertificateDocument2 pagesForm 16A TDS CertificateMohd QadeerNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Form 16 Salary CertificateDocument1 pageForm 16 Salary CertificatevimaljayaNo ratings yet

- OBC Bank Form - 15H PDFDocument2 pagesOBC Bank Form - 15H PDFKrishnan Vaidyanathan100% (1)

- BIR monthly tax returnDocument5 pagesBIR monthly tax returnVeronica GrahamNo ratings yet

- Form No. 15H: Part - IDocument2 pagesForm No. 15H: Part - Itoton33No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Pay TDS and TCS via Challan FormDocument2 pagesPay TDS and TCS via Challan Formbrayan uyNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument26 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationWinchelle Dimaapi ManalaysayNo ratings yet

- 15 CaDocument8 pages15 CadamanNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet