Professional Documents

Culture Documents

Certificate Under Section 203 of The Income Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"

Uploaded by

vimaljayaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate Under Section 203 of The Income Tax Act, 1961 For Tax Deducted at Source From Income Chargeable Under The Head "Salaries"

Uploaded by

vimaljayaCopyright:

Available Formats

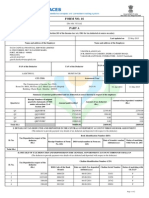

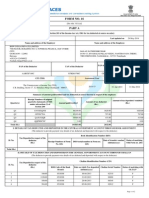

FORM NO.

16

[See Rule 31(1)

Income Tax Rules,

CERTIFICATE UNDER SECTION 203 OF THE INCOME TAX ACT, 1961 FOR TAX DEDUCTED AT

SOURCE FROM INCOME CHARGEABLE UNDER THE HEAD "SALARIES"

NAME AND ADDRESS OF THE EMPLOYER

INDIAN OVERSEAS BANK

GANDHI ADIGAL SALAI BRANCH

KUMBAKONAM

NAME AND DESIGNATION OF THE EMPLOYEE

VIMALANATHAN S SPECIAL ASSISTANT

INDIAN OVERSEAS BANK

GANDHI ADIGAL SALAI BRANCH

KUMBAKONAM

PAN / GIR NO.

AADPV0581C

PAN / GIR NO.

TAN

CHEI 03378E

TDS Circle where Annual Return / Statement

Under Section 206 is to be filed :

PERIOD

ASSESSMENT YEAR

TDS CIRCLE

FROM

TO

2013-2014

KUMBAKONAM

APRIL MARCH

2012

2013

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

1 Gross Salary

a. Salary as per provisions contained in Section 17

(1)

389131

b. Value of perquisites under Section 17(2)

(As per Form No.12 BA, Where Applicable).

c. Profits in lieu of salary under Section 17(3)

(As per Form No.12 BA, wherever applicable).

d. TOTAL

2 Less : Allowance to the extent exempt under Sec.10

0

Rs.

0

0.00

0

3 Balance (1 - 2)

4 Deductions :

a. Entertainment Allowance Rs.

b. Tax on Employment

Rs.

5 Aggregate of 4 (a) and (b)

Rs.

6 Income chargeable under the head "Salaries" (3 - 5)

7 Add: Any other income reported by the Employee :

Rs.

A. ADD :(NSC INT., FLY.PEN ETC.,)

B. LESS:LOSS ON HOUSE PROPERTY(SHL INT)

389131

0

0

389131

480

0

8 GROSS TOTAL INCOME (6 + 7)

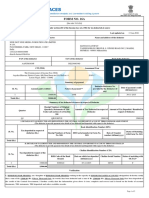

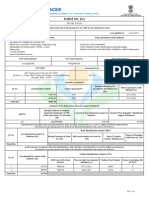

9 DEDUTIONS UNDER CHAPTER VI-A

A. Sections 80 C, 80 CCC and 80 CCD

a. Section 80 C

Provident Fund

NSC Purchased

NSC INTEREST

LIC Premium

LIC Premium Direct

Housing Loan Instalment

EDUCATON EXP I

Education Expenses II

PPF

TAX SAVER DEP

PLI

b.Section 80 CCC-Jeevan Suraksha

c,Section 80 CCD

TOTAL

Rs

480

389611

Gross

Amount

Eigible Amt

27332

0

27332

18144

0

0

3596

0

4592

0

0

1000

0

0

Rs.

27332

27332

You might also like

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Form No 16 in Excel With FormuleDocument3 pagesForm No 16 in Excel With FormuleSayal Ji33% (6)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamNo ratings yet

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDocument34 pagesI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNo ratings yet

- Form 16Document2 pagesForm 16orkid2100No ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- 6-3-569/1, Surana House Somajiguda, Hyderabad-83Document2 pages6-3-569/1, Surana House Somajiguda, Hyderabad-83seshu18098951No ratings yet

- Form 16Document2 pagesForm 16Hari Krishnan ElangovanNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Form 16Document3 pagesForm 16tid_scribdNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- From 16 & 12ba (Dev)Document6 pagesFrom 16 & 12ba (Dev)jindalyash1234No ratings yet

- Form 16 For The AY 2017-18Document4 pagesForm 16 For The AY 2017-18Suman HalderNo ratings yet

- 1827 PDFDocument3 pages1827 PDFhelloitskalaiNo ratings yet

- New Tds CertificateDocument1 pageNew Tds Certificatechowdhary_akshayNo ratings yet

- "FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument1 page"FORM NO.16B: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceKKumar SantoshNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604No ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Form 16Document1 pageForm 16Manish Varghese MathewNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- 103497Document5 pages103497Ashok PuttaparthyNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)prathameskaNo ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalNo ratings yet

- TdsDocument4 pagesTdsSahil SheikhNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- PDF ReportsDocument3 pagesPDF ReportsSIVANo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Form 16Document2 pagesForm 16jwadje1No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Retired Under VRS During October 2012 After Rendering Thirty One Years ofDocument2 pagesRetired Under VRS During October 2012 After Rendering Thirty One Years ofvimaljayaNo ratings yet

- Welcome To Internet BankingetokenDocument2 pagesWelcome To Internet BankingetokenvimaljayaNo ratings yet

- Internet BankingetokenDocument2 pagesInternet BankingetokenvimaljayaNo ratings yet

- Hare Rama Hare Rama Rama Rama Hare Hare! Hare Krishna Hare Krishna Hare Hare!Document1 pageHare Rama Hare Rama Rama Rama Hare Hare! Hare Krishna Hare Krishna Hare Hare!vimaljayaNo ratings yet

- Hare Rama Hare Rama Rama Rama Hare Hare! Hare Krishna Hare Krishna Hare Hare!Document1 pageHare Rama Hare Rama Rama Rama Hare Hare! Hare Krishna Hare Krishna Hare Hare!vimaljayaNo ratings yet