Professional Documents

Culture Documents

Form 16 PDF

Uploaded by

Joshua HicksOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 PDF

Uploaded by

Joshua HicksCopyright:

Available Formats

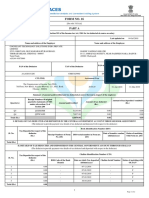

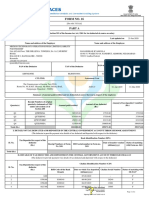

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. RFLLRNH

Last updated on

Name and address of the Employer

21-May-2014

Name and address of the Employee

METLIFE GLOBAL OPERATIONS SUPPORT CENTER PRIVATE

LIMITED

Maple,, Paharpur Business Centre,, 21,

Nehru Place,, New Delhi - 110019

Delhi

+(91)11-26207575

rramanan@metlife.com

BASANT TANWAR

SEC-12, CENTER COURT, SECTOR ROAD, DLF, GURGAON 122001 Haryana

PAN of the Deductor

TAN of the Deductor

AAFCM5000N

DELM15950E

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

AEZPT7395G

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no.

4 , Luxmi Nagar, Delhi - 110092

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

CUUXBWDA

129420.00

8637.00

8637.00

Q2

CUUXCRWB

129418.00

8635.00

8635.00

Q3

QASMJLIE

129435.00

8529.00

8529.00

Q4

QQPWZTOB

255664.00

34749.00

34749.00

643937.00

60550.00

60550.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

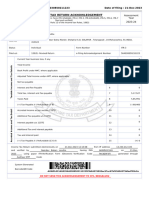

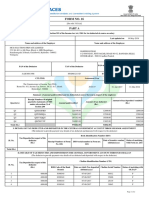

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

2879.00

6910333

06-05-2013

14021

2879.00

6910333

06-06-2013

15002

2879.00

6910333

05-07-2013

17431

2879.00

6910333

06-08-2013

15312

Page 1 of 2

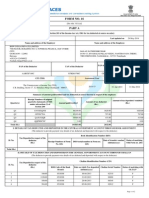

Certificate Number: RFLLRNH

Sl. No.

TAN of Employer: DELM15950E

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: AEZPT7395G

Assessment Year: 2014-15

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

2878.00

6910333

06-09-2013

15389

2878.00

6910333

05-10-2013

15070

2702.00

6910333

06-11-2013

14127

2914.00

6910333

06-12-2013

17675

2913.00

6910333

06-01-2014

13998

10

2913.00

6910333

06-02-2014

13021

11

4613.00

6910333

06-03-2014

17592

12

27223.00

6910333

05-04-2014

16380

Total (Rs.)

60550.00

Verification

I, RAMANAN VENKAT RAMANUJAM, son / daughter of RAMANUJAM KRISHNASWAMI working in the capacity of VICE PRESIDENT S E AND HUMAN CAPITAL

(designation) do hereby certify that a sum of Rs. 60550.00 [Rs. Sixty Thousand Five Hundred and Fifty Only (in words)] has been deducted and a sum of

Rs. 60550.00 [Rs. Sixty Thousand Five Hundred and Fifty Only] has been deposited to the credit of the Central Government. I further certify that the information

given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

DELHI

Date

27-May-2014

Designation: VICE PRESIDENT S E AND HUMAN CAPITAL

(Signature of person responsible for deduction of Tax)

Full Name:RAMANAN VENKAT RAMANUJAM

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by R V RAMANAN

Date: 2014.05.21 17:37:29 IST

Reason:

Location: Delhi

Page 2 of 2

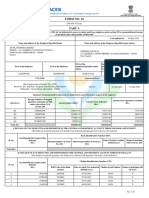

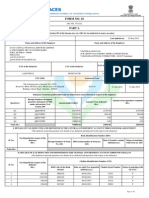

Certificate No. RFLLRNH

EMPID:1029375

Form No. 16

[See Rule 31(1)(a)]

PART B (Annexure)

Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source on Salary

Name and address of the Employer

Name and address of the Employee

METLIFE GLOBAL OPERATIONS SUPPORT CENTER PVT. LTD.

BASANT TANWAR

MAPLE, PAHARPUR BUSINESS CENTRE, 21

NEHRU PLACE, NEW DELHI

Delhi

INDIA

PAN of the Deductor

TAN of the Deductor

AAFCM5000N

DELM15950E

PAN of the Employee

Employee Reference No.

provided by the Employer (if

available)

AEZPT7395G

1029375

Assessment Year

Period with the Employer

CIT(TDS)

Address : The Commissioner of Income Tax (TDS)

Aayakar Bhawan, District Centre, 6th Floor Room no 610, Hall no.4 ,

Luxmi Nagar

City : Delhi

2014-2015

FROM

TO

01-Apr-2013

31-Mar-2014

Pin code : 110092

Details of Salary Paid and any other income and tax deducted

1.Gross Salary

Rs.

a)Salary as per provisions contained in sec.17(1)

Rs.

Rs.

753,358.00

b)Value of perquisites u/s 17(2) (as per Form No.12BA,

wherever applicable)

0.00

c)Profits in lieu of salary under section 17(3) (as per

Form No.12BA, wherever applicable)

0.00

d)Total

753,358.00

2.Less :Allowance to the extent exempt u/s 10

Allowance

Rs.

House Rent Allowance

66,382.00

66,381.90

3.Balance(1-2)

686,976.10

4.Deductions :

a)Entertainment allowance

0.00

b)Tax on employment

0.00

5.Aggregate of 4(a) and 4(b)

0.00

6.Income chargeable under the head 'Salaries'(3-5)

686,976.10

7.Add: Any other income reported by the employee

Income

Rs.

0.00

8.Gross Total Income(6+7)

686,976.10

9.Deductions under Chapter VIA

(A)Sections 80C,80CCC and 80CCD

Gross Amount

Deductible Amount

a)Section 80C

Children Education Tuition fees

Provident Fund

b)Section 80CCC

c)Section 80CCD

7,500.00

7,500.00

35,540.00

35,540.00

0.00

0.00

0.00

0.00

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed one lakh rupees.

Page 1 of 2(Form 16 Part B)

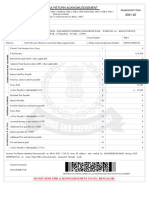

Certificate No. RFLLRNH

EMPID:1029375

(B)Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

Gross amount

Qualifying amount

Deductible amount

0.00

10.Aggregate of deductible amount under Chapter VI-A

43,040.00

11.Total Income(8-10)

643,940.00

12.Tax on total income

58,788.00

13.Surcharge (on tax computed at S.No.12)

0.00

14.Education cess @ 3% (on tax computed at S.No.12 +

1,764.00

on surchage computed at S.No.13)

15.Tax Payable(12+13+14)

60,550.00

16.Less: Relief under Section 89 (attach details)

0.00

17.Tax Payable(15-16)

60,550.00

Verification

I, RAMANAN VENKAT RAMANUJAM, Son of RAMANUJAM KRISHNASWAMI working in the capacity of VICE PRESIDENT S E AND HUMAN

CAPITAL do hereby certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS

statements, and other available records.

This document is digitally signed.

Place

Delhi

(Signature of person responsible for deduction of tax)

Date

21-May-2014

Designation : VICE PRESIDENT S E AND HUMAN CAPITAL

Full Name : RAMANAN VENKAT RAMANUJAM

Page 2 of 2(Form 16 Part B)

Certificate No. RFLLRNH

EMPID:1029375

Form No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites,other fringe benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of the employer:

METLIFE GLOBAL OPERATIONS SUPPORT CENTER PVT. LTD.

MAPLE, PAHARPUR BUSINESS CENTRE, 21

NEHRU PLACE, NEW DELHI

Delhi

INDIA

2. TAN

DELM15950E

3. TDS Assessment Range of the employer:

4. Name,designation and PAN of the employee:

BASANT TANWAR

Unit Manager - Facilities

AEZPT7395G

5. Is the employee a director or a person with

substantial interest in the company (where the

employer is a company):

6. Income under the head 'Salaries' of the employee

(other than from perquisites):

686,976.10

7. Financial Year:

2013-2014

8. Valuation of Perquisites:

SL.

No.

Nature of perquisites(see rule 3)

Value of perquisite

as per rules (Rs.)

Amount,if any

recovered from

employee (Rs.)

Amount of

perquisite

chargeable to tax

Col(3)-Col(4) (Rs.)

(1)

(2)

(3)

(4)

(5)

Accommodation

0.00

0.00

0.00

Cars/Other automotive

0.00

0.00

0.00

Sweeper, gardener, watchman or personal Attendant

0.00

0.00

0.00

Gas, electricity, water

0.00

0.00

0.00

Interest free or concessional loans

0.00

0.00

0.00

Holiday Expenses

0.00

0.00

0.00

Free or Concessional Travel

0.00

0.00

0.00

Free Meals

0.00

0.00

0.00

Free Education

0.00

0.00

0.00

10

Gifts, vouchers, etc.

0.00

0.00

0.00

11

Credit card expenses

0.00

0.00

0.00

12

Club expenses

0.00

0.00

0.00

13

Use of movable assets by employees

0.00

0.00

0.00

14

Transfer of assets to Employees

0.00

0.00

0.00

15

Value of any other benefit/amenity/service/privilege

0.00

0.00

0.00

16

Stock options (non-qualified options)

0.00

0.00

0.00

17

Other benefits or amenities

0.00

0.00

0.00

18

Total value of perquisites

0.00

0.00

0.00

19

Total value of Profits in lieu of salary as per section 17(3)

0.00

0.00

0.00

9. Details of Tax.

a)Tax deducted from salary of the employee u/s 192(1)

60,550.00

b)Tax paid by employer on behalf of the employee u/s 192(1A)

0.00

c)Total Tax Paid

60,550.00

d)Date of payment into Government treasury

Various dates as mentioned on Part A of the Form 16

DECLARATION BY THE EMPLOYER

I, RAMANAN VENKAT RAMANUJAM, Son of RAMANUJAM KRISHNASWAMI working as VICE PRESIDENT S E AND

HUMAN CAPITAL do hereby declare on behalf of METLIFE GLOBAL OPERATIONS SUPPORT CENTER PVT. LTD. that the

information given above is based on the books of account,documents and other relevant records or information available with

us and the details of value of each such perquisite are in accordance with section 17 and rules framed there under and that

such information is true and correct.

This document is digitally signed.

Place

Delhi

Date

21-May-2014

(Signature of person responsible for deduction of tax)

Designation : VICE PRESIDENT S E AND HUMAN CAPITAL

Full Name : RAMANAN VENKAT RAMANUJAM

Page 1 of 1(Form 12BA)

You might also like

- Employee EngagementDocument23 pagesEmployee EngagementMikha Jane MataNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Acknowledgement Itr PDFDocument1 pageAcknowledgement Itr PDFShobhit PathakNo ratings yet

- Form 16Document6 pagesForm 16CSKNo ratings yet

- Dosch V NLRC Case 128Document2 pagesDosch V NLRC Case 128Joey Denaga100% (1)

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusunilchampNo ratings yet

- CT20110377825Document13 pagesCT20110377825Raghuram DasariNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- SUMIFRU Vs NamasufaDocument11 pagesSUMIFRU Vs Namasufanikko janNo ratings yet

- Form 16 20-21Document2 pagesForm 16 20-21Mohammad AliNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Grievance Management & DisciplineDocument16 pagesGrievance Management & DisciplineSOUMYA SUCHARITA TRIPATHYNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Namdev ITR ACK 2022-23Document1 pageNamdev ITR ACK 2022-23cagopalofficebackupNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- Form 16 FYbilDocument8 pagesForm 16 FYbilBilalNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Payslip MarDocument1 pagePayslip MarMaheshKandguleNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRajneesh Khichar : MathematicsNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Questionnaire On Job SatisfactionDocument8 pagesQuestionnaire On Job SatisfactionningegowdaNo ratings yet

- Salary Slip June2020Document1 pageSalary Slip June2020rehan siddiquiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahesh JadhavNo ratings yet

- Rate of Interest (% P.a.)Document2 pagesRate of Interest (% P.a.)MeeNo ratings yet

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Bank StatmentDocument73 pagesBank StatmentSURANA1973No ratings yet

- Form 16Document5 pagesForm 16Jagdeep SinghNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearsumitNo ratings yet

- Pa 214 Human Resource Management ReportDocument29 pagesPa 214 Human Resource Management ReportMarielle Dindero ArcinoNo ratings yet

- PAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051Document1 pagePAYG Payment Summary Individual Non-Business: Ai Thi Hoai Nguyen 1/3 Mary ST North Melbourne Vic 3051hungdahoangNo ratings yet

- Sahrudaya Health Care Private LimitedDocument1 pageSahrudaya Health Care Private LimitedBabu MallelaNo ratings yet

- Work Life BalanceDocument5 pagesWork Life BalanceDrHarshada MulayNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro Limitedbharath50% (2)

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- Bank Statment SBI PDFDocument8 pagesBank Statment SBI PDFMUMALMOTORSNo ratings yet

- Indian CC Jan 2019Document6 pagesIndian CC Jan 2019SURANA1973No ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- (Oxford Bookworms Library 2) - Classics - Jungle Book - Oxford University Press (2000)Document27 pages(Oxford Bookworms Library 2) - Classics - Jungle Book - Oxford University Press (2000)Lia Tüzes100% (1)

- Certificate of RegistrationDocument1 pageCertificate of RegistrationMuaz AzizNo ratings yet

- Sevilla Vs CADocument1 pageSevilla Vs CASarah Cadiogan100% (2)

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAKASH KUMARNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- ITR FormDocument9 pagesITR FormAbdul WajidNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- 8A. HDFC Estatement NOV2017Document8 pages8A. HDFC Estatement NOV2017Nanu PatelNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Manav ChaudharyNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- OSHA 1926 Subpart L App ADocument16 pagesOSHA 1926 Subpart L App ABinoy GopinathanNo ratings yet

- Front Page Sri RawatpuraDocument6 pagesFront Page Sri RawatpuraSHOAIB MEMONNo ratings yet

- ESOP Calculator IndiaDocument2 pagesESOP Calculator IndiajdonNo ratings yet

- Luka LW 303 Labour Law - Assignment IIDocument5 pagesLuka LW 303 Labour Law - Assignment IIlucasNo ratings yet

- SJS HR Policies For Employees Working in StyloDocument4 pagesSJS HR Policies For Employees Working in StyloaliNo ratings yet

- Gratuity Nomintion FormDocument3 pagesGratuity Nomintion FormSiddhardh VarmaNo ratings yet

- Apex Door Co Case StudyDocument2 pagesApex Door Co Case StudyChristine Verghese100% (1)

- Reflection PaperDocument2 pagesReflection PaperJoceter DangiNo ratings yet

- HR Case StudiedDocument2 pagesHR Case StudiedSafuan Saad100% (2)

- Business Legend of IndiaDocument13 pagesBusiness Legend of IndiaAmit MishraNo ratings yet

- National Seminar 11Document4 pagesNational Seminar 11Sumit Shankar KunduNo ratings yet

- Obtain Director Identification Number (DIN) : WebsiteDocument2 pagesObtain Director Identification Number (DIN) : WebsitemitulNo ratings yet

- Total Amount Due 825.00: Statement of Premium Account (Spa) - Formal SectorDocument1 pageTotal Amount Due 825.00: Statement of Premium Account (Spa) - Formal SectorElboys IcafeNo ratings yet

- Case Study ObDocument3 pagesCase Study Obvanishreeanand22% (9)

- Scenario "A" Scenario "B" Scenario "C": Flowchart-Clause 13.3 - Variation ProcedureDocument2 pagesScenario "A" Scenario "B" Scenario "C": Flowchart-Clause 13.3 - Variation ProcedurevlatkoodgranitNo ratings yet

- YuLife - YouGov Infographic - NG Digitaldownload Update PDFDocument1 pageYuLife - YouGov Infographic - NG Digitaldownload Update PDFJDShahNo ratings yet

- Quarterly Return Form - Er-1Document3 pagesQuarterly Return Form - Er-1nishantu_2255705@gmail.comNo ratings yet

- Case DetailsDocument3 pagesCase DetailsRanjan ShagolsemNo ratings yet

- DOLE Sub Contractor ApplicationDocument2 pagesDOLE Sub Contractor ApplicationIvy Catherine Orozco-RollanNo ratings yet

- Poaching HRDocument25 pagesPoaching HRAnand AniconNo ratings yet