Professional Documents

Culture Documents

Monthly Accruals Date Changes

Uploaded by

Sonali KawaleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Accruals Date Changes

Uploaded by

Sonali KawaleCopyright:

Available Formats

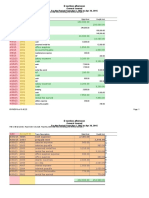

Fiscal year period for Year 2016 are given below:

e. company code

V_T51A1

COC

D

110

0

110

0

110

0

110

0

110

0

110

0

110

0

110

0

110

0

110

0

110

0

110

0

YE

AR

201

5

201

5

201

5

201

5

201

5

201

5

201

5

201

5

201

5

201

5

201

5

201

5

PERI

OD

1

2

3

4

5

6

7

8

9

10

11

12

FINAL

DATE

30.04.20

15

31.05.20

15

30.06.20

15

31.07.20

15

31.08.20

15

30.09.20

15

31.10.20

15

30.11.20

15

31.12.20

15

31.01.20

16

28.02.20

15

31.03.20

15

Currennt in AEP

1100 1

29.06.2015

1100 2

13.07.2015

1100 3

27.07.2015

1100 4

10.08.2015

1100 5

24.08.2015

1100 6

07.09.2015

1100 7

21.09.2015

1100 8

05.10.2015

1100 9

19.10.2015

1100 10

02.11.2015

1100 11

16.11.2015

1100 12

30.11.2015

1100 13

14.12.2015

1100 14

28.12.2015

1100 15

11.01.2016

1100 16

25.01.2016

V_T549S

04:Posting Date

05: ACC: Earliest

Current in AEP 100 for

Date Modifier (01): Period Parameters (62)-Pay Y (2015)-Period (03)-D ID(04)Date(10.08.2015)

Date Modifier (01): Period Parameters (62)-Pay Y (2015)-Period (03)-D ID(05)Date(23.08.2015)

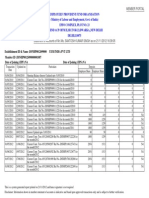

Payroll Periods

Payroll Period 5 is cross over period:

As per requirement the posting date of the previous period e.g. 04 needs to be

made as 31.08.2015.

Kindly let me know what should be the dates for PP and D ID 04 and 05.

For example:

Scenario 1

For period 03 Payroll period end date is 13.08.2015 in table t549Q which will

remain same.

New final posting date in table v_T51A1 is 30.06.2015 instead of 27.07.2015

So new posting date in table T549S against period and D ID 4 will be 13.08.2015

instead of 10.08.2015.

As equals to payroll period end date is not the cross over date.

Date against period 4 and D ID 05 - ACC: Earliest (Currently it is 23082015)

Ideally in this scenario only posting date needs to be change as per the payroll

period end date.

Kindly correct me if anything wrong.

Is there any change required in the existing entry or not?

Scenario 2

For period 04 Payroll period end date is 27.08.2015 in table t549Q which will

remain same.

New final posting date in table v_T51A1 is 31.07.2015

So new posting date in table T549S against period and D ID 4 will be 31.07.2015

instead of 24.08.2015.

Date against period 4 and D ID 05 - ACC: Earliest (Currently it is 06092015)

Ideally in this scenario only posting date needs to be change because next payroll

period is the cross over period(28.07.2015 to 10.09.2010) As per the

Andrews Excel sheet.

Kindly correct me if anything wrong.

You might also like

- Journal EntreisDocument2 pagesJournal EntreisRabia KhanNo ratings yet

- Advances To EmployeesDocument2 pagesAdvances To EmployeesLorraine CalderonNo ratings yet

- Results: Tutor - Developing A Workforce ScheduleDocument15 pagesResults: Tutor - Developing A Workforce ScheduleKaren GoinesNo ratings yet

- Accrued PayableDocument9 pagesAccrued PayableLorraine CalderonNo ratings yet

- Eyagendafiscala2015 150127002314 Conversion Gate01 PDFDocument136 pagesEyagendafiscala2015 150127002314 Conversion Gate01 PDFEuglena VerdeNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- Gu - Sap s4 Hana - Message No. f5286Document5 pagesGu - Sap s4 Hana - Message No. f5286Mickael QUESNOTNo ratings yet

- Dealer Payment - Summary Report Scan Date Invoice R Invoice Id Cbo Trackdept Branch Channel Type of Chvendor Coinvoice PeDocument4 pagesDealer Payment - Summary Report Scan Date Invoice R Invoice Id Cbo Trackdept Branch Channel Type of Chvendor Coinvoice PedanisamdNo ratings yet

- Scan 0082Document1 pageScan 0082chief engineer CommercialNo ratings yet

- View BillDocument2 pagesView BillJordan Soberano CabuyadaoNo ratings yet

- Excel GL (Participants)Document8 pagesExcel GL (Participants)Ron Benlheo OpolintoNo ratings yet

- PTS379Document18 pagesPTS379SANUNo ratings yet

- TransactionsOnline20150407231030 PDFDocument1 pageTransactionsOnline20150407231030 PDFzeljkogrNo ratings yet

- Apps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FRDocument2 pagesApps - Hrmsorissa.gov - in Portal Page Portal HRMS Bill FRPramod KumarNo ratings yet

- Mhban01256350000013286 2015Document1 pageMhban01256350000013286 2015katiyar81No ratings yet

- Report of Date 2015-09-08 Total Amount: 32467: Paid Consum Er Id Consum Er No Amount Bill Month Paid Date Company NameDocument16 pagesReport of Date 2015-09-08 Total Amount: 32467: Paid Consum Er Id Consum Er No Amount Bill Month Paid Date Company NameFarhanAwaisiNo ratings yet

- Economics Data and Statistics Analysis AssignmentDocument35 pagesEconomics Data and Statistics Analysis Assignmentdk1271No ratings yet

- MergedDocument185 pagesMergedIQBAL MAHMUDNo ratings yet

- LNL Iklcqd /: Page 1 of 5Document5 pagesLNL Iklcqd /: Page 1 of 5Sabuj SarkarNo ratings yet

- Witholding TaxDocument41 pagesWitholding TaxEstudyante BluesNo ratings yet

- Accounts Payable Year End Procedures 0809Document5 pagesAccounts Payable Year End Procedures 0809Aman Khan Badal KhanNo ratings yet

- Name:Jibi Gebriel Company Emp. No. Designation:ANALYZER TECH: Atsco 1613 Month November-December Year 2015 M24H ShiftDocument4 pagesName:Jibi Gebriel Company Emp. No. Designation:ANALYZER TECH: Atsco 1613 Month November-December Year 2015 M24H Shiftanon_31879670No ratings yet

- p45 Tomasz Jureczko Diamonds Digital LTDDocument3 pagesp45 Tomasz Jureczko Diamonds Digital LTDTomasz JureczkoNo ratings yet

- 6years KishoreDocument4 pages6years Kishoreprasad mvNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Compliance Calendar 2014Document1 pageCompliance Calendar 2014abmainkyakaruNo ratings yet

- SL No Assyst Portal ISIS Impact? Top 5? No. of Linked Incidents PL / Services or BothDocument34 pagesSL No Assyst Portal ISIS Impact? Top 5? No. of Linked Incidents PL / Services or Bothbal.vikram9354No ratings yet

- Calendar 2015: NotesDocument13 pagesCalendar 2015: NotesSudhir BansalNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- August Month CompliancesDocument1 pageAugust Month CompliancesNikhil KasatNo ratings yet

- Should DoDocument3 pagesShould DodarshansuNo ratings yet

- Timetable Fbe 2015-2016 (Web) 28 Aug 2015Document9 pagesTimetable Fbe 2015-2016 (Web) 28 Aug 2015wongtszyeungNo ratings yet

- List of Videos Per SubjectDocument101 pagesList of Videos Per SubjectRodmae VersonNo ratings yet

- PAYE2012 DemoDocument110 pagesPAYE2012 DemoNorvee ReyesNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Sno. Error Box Name. Error Line No.: Interstate ImportDocument20 pagesSno. Error Box Name. Error Line No.: Interstate ImportkhajuriaonlineNo ratings yet

- A & C Report of CLZDocument86 pagesA & C Report of CLZSubhas MishraNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- TotalDocument2 pagesTotalaskviNo ratings yet

- Updates On Financial Results For Sept 30, 2015 (Result)Document5 pagesUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNo ratings yet

- DSN HP 00126990000001087Document2 pagesDSN HP 00126990000001087Santosh Kumar SinghNo ratings yet

- C SSTSNJ Z2 TM Ibi 29Document4 pagesC SSTSNJ Z2 TM Ibi 29Rakesh ParaliyaNo ratings yet

- Financial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerDocument16 pagesFinancial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerYassin ElsafiNo ratings yet

- GSISDocument96 pagesGSISHoven MacasinagNo ratings yet

- Bad Debt Write Off-On NewDocument18 pagesBad Debt Write Off-On NewMilla MillaNo ratings yet

- 2 AprilDocument19 pages2 Aprilbalwant_negi7520No ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- SN Vertical Due Dates Particular Consequence of Non ComplianceDocument1 pageSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatNo ratings yet

- Invoice 978201Document1 pageInvoice 978201Umit OrhunNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- NAV Net Asset Value NAV Value Update at 3.00 PM Everyday Excep Sat and Sun and Holidays Depend On Market CalenderDocument3 pagesNAV Net Asset Value NAV Value Update at 3.00 PM Everyday Excep Sat and Sun and Holidays Depend On Market CalenderSumit TembhareNo ratings yet

- Final Result IES ISS 2015 EnglishDocument3 pagesFinal Result IES ISS 2015 Englishismav169No ratings yet

- Office PPT Template 001Document9 pagesOffice PPT Template 001Arman MuhammadNo ratings yet

- Communique: Information To EmployersDocument1 pageCommunique: Information To EmployersVassen MootooNo ratings yet

- Professional Bill 15 GH - 2Document1 pageProfessional Bill 15 GH - 2Rajesh PuniaNo ratings yet

- DP 1095 120018Document162 pagesDP 1095 120018sweetyNo ratings yet

- Stocks Daily Inventory Year 2015-2016 Butuan BranchDocument18 pagesStocks Daily Inventory Year 2015-2016 Butuan Branchapi-278354872No ratings yet

- Generate Time Wage Types by Configuring Table T510SDocument8 pagesGenerate Time Wage Types by Configuring Table T510SSai Shilpa Teju100% (2)

- PTMWDocument5 pagesPTMWSonali KawaleNo ratings yet

- Resume Sonali Kawale SAP-HR 5.4+ YrsDocument5 pagesResume Sonali Kawale SAP-HR 5.4+ YrsSonali KawaleNo ratings yet

- Ess ConfigDocument32 pagesEss ConfigSameer GovekarNo ratings yet

- Sem I PDFDocument1 pageSem I PDFSonali KawaleNo ratings yet

- First Set of Countries V2Document28 pagesFirst Set of Countries V2Sonali KawaleNo ratings yet

- JagdishDocument1 pageJagdishSonali KawaleNo ratings yet

- Test CasesDocument1 pageTest CasesSonali KawaleNo ratings yet

- Test CasesDocument1 pageTest CasesSonali KawaleNo ratings yet