Professional Documents

Culture Documents

Tax Calculator 2010-11

Uploaded by

Ashish DumbreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calculator 2010-11

Uploaded by

Ashish DumbreCopyright:

Available Formats

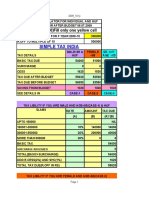

2010_11FY

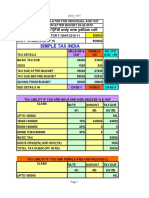

INCOME TAX CALCULATOR FOR INDIVIDUAL AND HUF

THE CALCULATOR AFTER BUDGET 26-02-2010

(F.YEAR 2010-11)Fill only one yellow cell

NET TAXABLE INCOME FOR F.YEAR 2010-11

500000

R.OFF TO MULTIPLE OF 10

500000

SIMPLE TAX INDIA

TAX DETAILS

BASIC TAX DUE

MALE<65 &

HUF

FEMALE

<65

SR. CITI

AGE >65

34000

31000

26000

1020

930

780

TAX DUE AFTER BUDGET

35020

31930

26780

TAX DUE BEFORE BUDGET

55620

52530

47380

SAVING FROM BUDGET

20600

20600

20600

CESS

SEE DETAILS IN

CASE-1

CASE-2

CASE-3

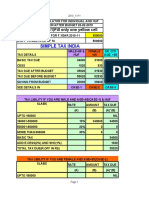

TAX LIBILITY IF YOU ARE MALE AND AGE<65(CASE-1) & HUF

SLABS

RATE

AMOUNT

TAX DUE

(A)

(B)

(A)*(B)

UPTO 160000

NIL

160001-500000

10%

340000

34000

500001-800000

20%

MORE THAN 800000

30%

BASIC TAX

34000

ADD:E.CESS(2%) AND SHC(1%)

1020

TOTAL TAX DUE(R.OFF IN RS)

35020

TAX LIBILITY IF YOU ARE FEMALE AND AGE<65(CASE-2)

SLABS

RATE

AMOUNT

TAX DUE

(A)

UPTO 190000

(B)

(A)*(B)

NIL

Page 1

2010_11FY

190001-500000

10%

310000

31000

500001-800000

20%

MORE THAN 500000

30%

BASIC TAX

31000

ADD:E.CESS(2%) AND SHC(1%)

930

TOTAL TAX DUE(R.OFF IN RS)

31930

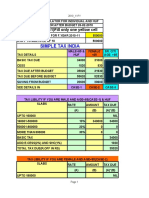

TAX LIBILITY IF YOUR AGE<65 IN FY 2010-10(CASE-3)

SLABS

RATE

AMOUNT

TAX DUE

(A)

(B)

(A)*(B)

UPTO 240000

NIL

240001-300000

10%

260000

26000

500001-800000

20%

MORE THAN 800000

30%

BASIC TAX

26000

ADD:E.CESS(2%) AND SHC(1%)

780

TOTAL TAX DUE(R.OFF IN RS)

26780

Page 2

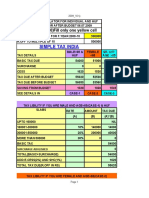

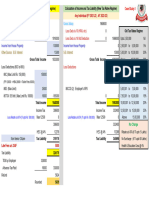

FY 2009_10

INCOME TAX CALCULATOR FOR INDIVIDUAL AND HUF

THE CALCULATOR AFTER BUDGET 06.07.2009

(F.YEAR 2009-10)Fill only one yellow cell

NET TAXABLE INCOME FOR F.YEAR 2009-10

400000

R.OFF TO MULTIPLE OF 10

400000

SIMPLE TAX INDIA

TAX DETAILS

BASIC TAX DUE

MALE<65 &

HUF

SEE DETAILS IN

SR. CITI

AGE >65

34000

31000

26000

1020

930

780

35020

31930

26780

CESS

Tax Due

FEMALE

<65

CASE-1

CASE-2

CASE-3

TAX LIBILITY IF YOU ARE MALE AND AGE<65(CASE-1) & HUF

SLABS

RATE

AMOUNT

TAX DUE

(A)

(B)

(A)*(B)

UPTO 160000

NIL

160001-300000

10%

140000

14000

300001-500000

20%

100000

20000

MORE THAN 500000

30%

BASIC TAX

34000

ADD:E.CESS(2%) AND SHC(1%)

1020

TOTAL TAX DUE(R.OFF IN RS)

35020

TAX LIBILITY IF YOU ARE FEMALE AND AGE<65(CASE-2)

SLABS

RATE

AMOUNT

TAX DUE

(A)

(B)

UPTO 190000

(A)*(B)

NIL

190001-300000

10%

110000

11000

300001-500000

20%

100000

20000

Page 1

FY 2009_10

MORE THAN 500000

30%

BASIC TAX

0

31000

ADD:E.CESS(2%) AND SHC(1%)

930

TOTAL TAX DUE(R.OFF IN RS)

31930

TAX LIBILITY IF YOUR AGE<65 IN FY 2009-10(CASE-3)

SLABS

RATE

AMOUNT

TAX DUE

(A)

(B)

(A)*(B)

UPTO 240000

NIL

240001-300000

10%

60000

6000

300001-500000

20%

100000

20000

MORE THAN 500000

30%

BASIC TAX

26000

ADD:E.CESS(2%) AND SHC(1%)

780

TOTAL TAX DUE(R.OFF IN RS)

26780

Page 2

You might also like

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11bablooraiNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Priyanshu SharmaNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11subhodattNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Ravi ChandraNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11Syam ReddyNo ratings yet

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellPradip ShawNo ratings yet

- Tax Calculator AY 09-10Document4 pagesTax Calculator AY 09-10madhuamsNo ratings yet

- Simple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellDocument4 pagesSimple Tax India: (F.YEAR 2009-10) Fill Only One Yellow CellRaj PatilNo ratings yet

- Ques. Defered TaxDocument40 pagesQues. Defered TaxKALYANI JAYAKRISHNAN 2022155No ratings yet

- 1 Income Tax Chart Fy 09 10Document2 pages1 Income Tax Chart Fy 09 10jayant_2612No ratings yet

- Deffered Tax - MyDocument4 pagesDeffered Tax - Mychandel08No ratings yet

- Year-Wise Tax CalculatorDocument2 pagesYear-Wise Tax Calculatoramrut9No ratings yet

- Sol 1Document1 pageSol 1alex breymannNo ratings yet

- Tax CalculationDocument2 pagesTax CalculationShaun PollockNo ratings yet

- Case Studies On Tax Planning and Double TaxDocument19 pagesCase Studies On Tax Planning and Double TaxJayaNo ratings yet

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraNo ratings yet

- Old Vs New Tax Rates Regime (6 Cases)Document6 pagesOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNo ratings yet

- For Holders: Automated Income Tax CalculationDocument16 pagesFor Holders: Automated Income Tax Calculationmaruf048No ratings yet

- Sols-Dr RajniDocument5 pagesSols-Dr Rajnialex breymannNo ratings yet

- Tax Slab & Taxfree Limit1122Document13 pagesTax Slab & Taxfree Limit1122Kunal MevadaNo ratings yet

- Tax TaskDocument2 pagesTax TaskDharmendra Kumar MalihanNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Tax CalculatorDocument2 pagesTax CalculatoramitNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediNo ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax CalculatorDocument2 pagesIncome Tax CalculatorSuneel YadavNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Deductions Dec 21Document26 pagesDeductions Dec 21snowbell 95No ratings yet

- Income TaxDocument2 pagesIncome TaxsunilgswmNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- INCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per YearDocument1 pageINCOME TAX CALCULATION For Year 2008-2009: Male Per Year Per Yearpintoo23No ratings yet

- Bir Tax Table Salary Range (Annual) Income Tax RateDocument1 pageBir Tax Table Salary Range (Annual) Income Tax RatejamesNo ratings yet

- Salary TaxDocument4 pagesSalary Taxapi-3810632No ratings yet

- TaxTables20062010Document2 pagesTaxTables20062010Moazam FakeyNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- Direct Tax Rates For Last 11 Assessment YearsDocument4 pagesDirect Tax Rates For Last 11 Assessment YearsValera HardikNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- CRQS Final AccountsDocument54 pagesCRQS Final AccountsAtka FahimNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Fin420 Set 1 Syifa Cash BudgetDocument2 pagesFin420 Set 1 Syifa Cash Budgetsyifa azhari 3BaNo ratings yet

- FM PracticalDocument7 pagesFM PracticalanishkhannaNo ratings yet

- Tax - Calc 09 10Document1 pageTax - Calc 09 10sahubh100% (3)

- Income Tax Calculation SheetDocument8 pagesIncome Tax Calculation SheetArajrubanNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorRohit KumarNo ratings yet

- 35 Income Tax Chart 2009 2010Document1 page35 Income Tax Chart 2009 2010Piyush MishraNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- For The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018Document1 pageFor The Years 2018-2022 Under The Approved TRAIN Tax Law Effective January 1, 2018Willy LagulaNo ratings yet

- It FormDocument13 pagesIt FormMani Vannan JNo ratings yet

- UntitledDocument4 pagesUntitleddeviNo ratings yet

- How To Calculate Total IncomeDocument16 pagesHow To Calculate Total IncomeAshish ChatrathNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- CS Professional DT Revision For Dec 19Document117 pagesCS Professional DT Revision For Dec 19Vineela Srinidhi DantuNo ratings yet

- ABC Co. Started Its OperationsDocument1 pageABC Co. Started Its OperationsQueen ValleNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- RMA User GuideDocument2 pagesRMA User Guidedhuvad.2004No ratings yet

- Balance SheetDocument1 pageBalance Sheetdhuvad.2004No ratings yet

- Balance SheetDocument1 pageBalance Sheetdhuvad.2004No ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11dhuvad.2004No ratings yet

- 3 I Infotech Campus PaerDocument11 pages3 I Infotech Campus Paerdhuvad.2004No ratings yet

- Repo Rate, SLR, CRRDocument3 pagesRepo Rate, SLR, CRRdhuvad.2004No ratings yet

- CAT Questions and TricksDocument30 pagesCAT Questions and Tricksimahere_suryaNo ratings yet

- HR ProjectDocument55 pagesHR ProjectRakshit BhardwajNo ratings yet

- Taxmann Books PDFDocument12 pagesTaxmann Books PDFSaurabhRawat100% (1)

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuNo ratings yet

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBiju DivakaranNo ratings yet

- 2018-003-Annexure-TAN AO Code Master V 4.8Document105 pages2018-003-Annexure-TAN AO Code Master V 4.8RanjanNo ratings yet

- A Project Report On Direct TaxDocument52 pagesA Project Report On Direct Taxrani26oct72% (18)

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Indian Tax SystemDocument17 pagesIndian Tax SystemSachin RanaNo ratings yet

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- 11 - Chapter 4 PDFDocument49 pages11 - Chapter 4 PDFVaidha SharmaNo ratings yet

- File PDFDocument197 pagesFile PDFarunnair2468No ratings yet

- ItlpDocument14 pagesItlpA_saravanavelNo ratings yet

- A Treatise On The Law Practice of Stay Recovery of Tax Arrears PDFDocument24 pagesA Treatise On The Law Practice of Stay Recovery of Tax Arrears PDFk.m.mohandassNo ratings yet

- Summary of DTDocument19 pagesSummary of DTin_indiaNo ratings yet

- Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Document3 pagesAkta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Teh Chu LeongNo ratings yet

- CA Final May 2020 Last Minute Revision PDFDocument390 pagesCA Final May 2020 Last Minute Revision PDFLaxmisha GowdaNo ratings yet

- Taxation ReportDocument109 pagesTaxation Reportkumaratulrai100% (1)

- Assesment Procedure: By: Smriti KhannaDocument25 pagesAssesment Procedure: By: Smriti KhannaSmriti KhannaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- Tax Laws Radhika Seth Very Good Notes For Llab StudentDocument66 pagesTax Laws Radhika Seth Very Good Notes For Llab StudentSurbhi Meera Sinha100% (1)

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Basics of TaxationDocument25 pagesBasics of TaxationAnupam BaliNo ratings yet

- Service Tax RulesDocument55 pagesService Tax Rulestps architectNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Basic Concepts Residential StatusDocument35 pagesBasic Concepts Residential StatuszaidansarizNo ratings yet