Professional Documents

Culture Documents

ABC Co. Started Its Operations

Uploaded by

Queen ValleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Co. Started Its Operations

Uploaded by

Queen ValleCopyright:

Available Formats

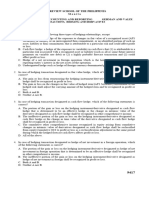

ABC Co. started its operations on January 1, 20x1.

Information on temporary differences during the

first two years of operations is shown below:

Dec. 31, 20x2 Dec. 31, 20x1

Carrying Differenc Carrying

amount Tax base e amount Tax base Difference

Assets 100,000 90,000 10,000 120,000 100,000 20,000

Liabilities 50,000 43,000 7,000 60,000 45,000 15,000

Pretax incomes were ₱400,000 and ₱500,000 in 20x2 and 20x1, respectively. Income tax rate is

30%.

How much is the current tax expense in 20x2?

Solutions:

20x1

The 20x1 income tax expense and current tax expense are computed as:

Multiply by

Description of items Tax rate

Description of items

Pretax income 500,000

Permanent difference: -

Acctg. profit subj. to tax 500,000 30% ITE 150,000

Less: TTD (20,000) 30% Less: DTL (6,000)

Add: DTD 15,000 30% Add: DTA 4,500

Taxable profit - 20x1 495,000 30% CTE 148,500

20x2

The 20x2 income tax expense and current tax expense are computed as:

Multiply by

Description of items Tax rate

Description of items

Pretax income 400,000

Permanent difference: -

Acctg. profit subj. to tax 400,000 30% ITE 120,000

ADD: TTD (10,000) 30% ADD: DTL 3,000

LESS: DTD 8,000 30% LESS: DTA (2,400)

Taxable profit - 20x1 402,000 30% CTE 120,600

You might also like

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- FAR Final PreboardDocument13 pagesFAR Final PreboardMarvin ClementeNo ratings yet

- AUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument12 pagesAUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyKathrine Gayle BautistaNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- MAS 3 SamplesDocument10 pagesMAS 3 SamplesRujean Salar AltejarNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDocument3 pages1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNo ratings yet

- Abm QuizDocument5 pagesAbm QuizCastleclash CastleclashNo ratings yet

- MAS Product Costing Part IDocument2 pagesMAS Product Costing Part IMary Dale Joie BocalaNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- Exercises Tax2Document9 pagesExercises Tax2Helen Faith EstanteNo ratings yet

- AFAR06-01 Partnership AccountingDocument8 pagesAFAR06-01 Partnership AccountingEd MendozaNo ratings yet

- Performance AgreementDocument3 pagesPerformance AgreementAnita WilliamsNo ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Activity Chapter 1: Ans. SolutionDocument3 pagesActivity Chapter 1: Ans. SolutionRandelle James FiestaNo ratings yet

- Chapter 18Document6 pagesChapter 18Xynith Nicole RamosNo ratings yet

- 1Document20 pages1Denver AcenasNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- Acctg 16 - Midterm Exam PDFDocument4 pagesAcctg 16 - Midterm Exam PDFKarla OñasNo ratings yet

- Corporate LiquidationDocument7 pagesCorporate LiquidationAcads PurposesNo ratings yet

- Chapter 1: Introduction To Consumption TaxesDocument6 pagesChapter 1: Introduction To Consumption TaxesJoody CatacutanNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Set A Leases Problem SERANADocument6 pagesSet A Leases Problem SERANASherri BonquinNo ratings yet

- Introduction To Audit Services and Financial Statements AuditDocument35 pagesIntroduction To Audit Services and Financial Statements AuditBryzan Dela CruzNo ratings yet

- The University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16Document5 pagesThe University of Manila College of Business Administration and Accountacy Integrated CPA Review and Refresher Program Pre-Final Examination AE 16ana rosemarie enaoNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Quiz 3Document3 pagesQuiz 3Mon RamNo ratings yet

- Module 2 - Control Premium PDFDocument11 pagesModule 2 - Control Premium PDFTherese AlmiraNo ratings yet

- Lease Part2Document5 pagesLease Part2Gina Mae LeeNo ratings yet

- MOD2 Corporate LiquidationDocument4 pagesMOD2 Corporate LiquidationJasper Andrew AdjaraniNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- Standard Costing and Analysis of VarianceDocument13 pagesStandard Costing and Analysis of VarianceRuby P. Madeja100% (1)

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Acctg 4 Quiz 3 Debt Restructuring Payables 1Document11 pagesAcctg 4 Quiz 3 Debt Restructuring Payables 1Competente, Jhonna W.No ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- Answer: D: Use The Following Data For The Next Two QuestionsDocument2 pagesAnswer: D: Use The Following Data For The Next Two QuestionsROSEMARIE CRUZNo ratings yet

- Quiz 1 - Business CombiDocument6 pagesQuiz 1 - Business CombiKaguraNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- Law QuizDocument3 pagesLaw QuizRaljon SilverioNo ratings yet

- BA 118.1 SME Exercise Set 5Document1 pageBA 118.1 SME Exercise Set 5Ian De DiosNo ratings yet

- 2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersDocument3 pages2.0.1 Seatwork - Cost Behavior - Belle and Shinly - AnswersRoselyn LumbaoNo ratings yet

- Bam 241 Tos 1Document5 pagesBam 241 Tos 1Julian Adam PagalNo ratings yet

- Partnership Dissolution ProblemsDocument22 pagesPartnership Dissolution ProblemsMikhaella ZamoraNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership Liquidationyoj assenavNo ratings yet

- Tax Term Quiz TheoriesDocument6 pagesTax Term Quiz TheoriesRena Jocelle NalzaroNo ratings yet

- Taxation Final Preboard CPAR 92 PDFDocument17 pagesTaxation Final Preboard CPAR 92 PDFomer 2 gerdNo ratings yet

- CE On Agriculture T1 AY2020-2021Document2 pagesCE On Agriculture T1 AY2020-2021Luna MeowNo ratings yet

- 9417 - Foreign Currency Transactions Hedging and DerivativesDocument7 pages9417 - Foreign Currency Transactions Hedging and Derivativesjsmozol3434qcNo ratings yet

- Overhead Budget Johnston Company Cleans and Applies Powder Coat PaintDocument2 pagesOverhead Budget Johnston Company Cleans and Applies Powder Coat PaintAmit PandeyNo ratings yet

- ACC 142-PeriodicalDocument11 pagesACC 142-PeriodicalRiezel PepitoNo ratings yet

- Orca Share Media1577676507201Document4 pagesOrca Share Media1577676507201Jayr BVNo ratings yet

- Accounting For Special Transactions Partnership AccountingDocument15 pagesAccounting For Special Transactions Partnership AccountingJessaNo ratings yet

- 6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisDocument2 pages6&7 Chapter 7-Cost Volume-Profit Relationship and Break-Even AnalysisShenedy Lauresta QuizanaNo ratings yet

- Group Quizbowl FormattedDocument17 pagesGroup Quizbowl FormattedSarah BalisacanNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Stages in Statistical InvestigationDocument3 pagesStages in Statistical InvestigationQueen Valle100% (1)

- Project Management Is Not NewDocument2 pagesProject Management Is Not NewQueen ValleNo ratings yet

- Types and Categories or Cooperative - LawsDocument2 pagesTypes and Categories or Cooperative - LawsQueen ValleNo ratings yet

- The New Areopagi of Mission: I. Cultural SectorDocument2 pagesThe New Areopagi of Mission: I. Cultural SectorQueen ValleNo ratings yet

- The Mark of A True CICM The Zeal For Missionary WorkDocument2 pagesThe Mark of A True CICM The Zeal For Missionary WorkQueen ValleNo ratings yet

- Principles of Income and Business TaxationDocument3 pagesPrinciples of Income and Business TaxationQueen ValleNo ratings yet

- Project Management Process GroupsDocument10 pagesProject Management Process GroupsQueen Valle100% (1)

- Project, Portfolio, Operation Management - PMDocument3 pagesProject, Portfolio, Operation Management - PMQueen Valle100% (1)

- Variables and Measurement ScalesDocument4 pagesVariables and Measurement ScalesQueen ValleNo ratings yet

- 2.2 Enterprise Environmental FactorsDocument4 pages2.2 Enterprise Environmental FactorsQueen ValleNo ratings yet

- Cooperative UnionsDocument5 pagesCooperative UnionsQueen ValleNo ratings yet

- Ethics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Document3 pagesEthics and Psychology "Ethics Has Something To Do With What My Feelings Tell Me Is Right or Wrong."Queen ValleNo ratings yet

- Business Combination (PFRS 3)Document5 pagesBusiness Combination (PFRS 3)Queen ValleNo ratings yet

- 2.4.2.2 Governance of Portfolios, Programs, and ProjectsDocument6 pages2.4.2.2 Governance of Portfolios, Programs, and ProjectsQueen Valle100% (1)

- Understanding The Discipline of Project Management.: ProjectsDocument5 pagesUnderstanding The Discipline of Project Management.: ProjectsQueen ValleNo ratings yet

- Escape From TaxationDocument3 pagesEscape From TaxationQueen Valle100% (1)

- Henry Has The Following Data For The YeaDocument3 pagesHenry Has The Following Data For The YeaQueen ValleNo ratings yet

- IllustrativeCas No2 - Trend AnalysisDocument3 pagesIllustrativeCas No2 - Trend AnalysisQueen ValleNo ratings yet

- Guyito Had The Following Data For 2010 Taxable YearDocument2 pagesGuyito Had The Following Data For 2010 Taxable YearQueen ValleNo ratings yet

- Genesis' Trial Balance Reflected The FollowingDocument1 pageGenesis' Trial Balance Reflected The FollowingQueen ValleNo ratings yet

- Definition of EthicsDocument2 pagesDefinition of EthicsQueen ValleNo ratings yet

- Introduction To Fundamentals of AccountingDocument4 pagesIntroduction To Fundamentals of AccountingQueen ValleNo ratings yet

- Financial Statements of An Entity That Have Been Reviewed by An AccountantDocument3 pagesFinancial Statements of An Entity That Have Been Reviewed by An AccountantQueen ValleNo ratings yet

- FINANCIALRATIOANALYSIS Fin - ManagementDocument4 pagesFINANCIALRATIOANALYSIS Fin - ManagementQueen ValleNo ratings yet

- FINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inDocument5 pagesFINANCE CYCLE - Chart of Accounts: Within The Chart of Accounts, You Will Find That The Accounts Are Typically Listed inQueen ValleNo ratings yet

- ExpenditureCycle (Purchase Order - Receiving Report - Voucher)Document3 pagesExpenditureCycle (Purchase Order - Receiving Report - Voucher)Queen ValleNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- India: "Truth Alone Triumphs"Document103 pagesIndia: "Truth Alone Triumphs"Rajesh NaiduNo ratings yet

- Induction Motor NotesDocument20 pagesInduction Motor NotesMani SaiNo ratings yet

- VedicReport2 28 202412 53 08PMDocument55 pagesVedicReport2 28 202412 53 08PM처곧ᄉJimmyNo ratings yet

- Shattered Pixel Dungeon The Newb Adventurer's Guide: Chapter I: The BasicsDocument15 pagesShattered Pixel Dungeon The Newb Adventurer's Guide: Chapter I: The BasicsFishing ManiaNo ratings yet

- Automatic Summarization of Youtube Video Transcription Text Using Term Frequency-Inverse Document FrequencyDocument9 pagesAutomatic Summarization of Youtube Video Transcription Text Using Term Frequency-Inverse Document FrequencyKarunya ChavanNo ratings yet

- Churros (Homemade Recipe With Step by Step Photos) - Cooking ClassyDocument1 pageChurros (Homemade Recipe With Step by Step Photos) - Cooking ClassyRyleigh NoelNo ratings yet

- Joseph Brazier, Ltd. Et Al v. Specialty Bar Products Company - Document No. 7Document3 pagesJoseph Brazier, Ltd. Et Al v. Specialty Bar Products Company - Document No. 7Justia.comNo ratings yet

- Index of Appendices: Pmo - ConfidentialDocument149 pagesIndex of Appendices: Pmo - Confidentialonize mosesNo ratings yet

- LTE Throughput Troubleshooting GuidlelineDocument15 pagesLTE Throughput Troubleshooting GuidlelineTourchianNo ratings yet

- Fundamentals of Inviscid, Incompressible FlowDocument57 pagesFundamentals of Inviscid, Incompressible FlowpaariNo ratings yet

- What Is Splunk - (Easy Guide With Pictures) - Cyber Security KingsDocument9 pagesWhat Is Splunk - (Easy Guide With Pictures) - Cyber Security Kingsrokoman kungNo ratings yet

- Aldabbagh 4417Document322 pagesAldabbagh 4417michael ballNo ratings yet

- Chap 6 MCQDocument3 pagesChap 6 MCQMahad SheikhNo ratings yet

- A&D MGMU End Sem Exam Paper (2022-23) Part-IDocument5 pagesA&D MGMU End Sem Exam Paper (2022-23) Part-IAzar BargirNo ratings yet

- 118CP Selection of CP Systems For Reinforced Concrete StructuresDocument15 pages118CP Selection of CP Systems For Reinforced Concrete StructuresWill NashNo ratings yet

- Api-650 Storage Tank Design Calculations - DamasGate WikiDocument3 pagesApi-650 Storage Tank Design Calculations - DamasGate Wikipowder18No ratings yet

- Fibre Optic Cable SplicingDocument33 pagesFibre Optic Cable SplicingAmax TeckNo ratings yet

- 2019 Pathogenesis, Screening, and Diagnosis of Neonatal Hypoglycemia - UpToDateDocument14 pages2019 Pathogenesis, Screening, and Diagnosis of Neonatal Hypoglycemia - UpToDateSheyla Paola Alegre ParionaNo ratings yet

- Lenovo Ideapad V110-15AST - LV114A (15270-1 08A03)Document64 pagesLenovo Ideapad V110-15AST - LV114A (15270-1 08A03)Mahmut KaralarNo ratings yet

- Resume - Lifestyle Medicine RDDocument1 pageResume - Lifestyle Medicine RDapi-338995106No ratings yet

- Study of Steam Generation Units With Their Accessories and MountingsDocument64 pagesStudy of Steam Generation Units With Their Accessories and MountingsMasudur RahmanNo ratings yet

- Strategic Business Management November 2022 Mark PlanDocument34 pagesStrategic Business Management November 2022 Mark PlanWongani Kaunda0% (1)

- Idbi - 5685 - Apr 2022Document15 pagesIdbi - 5685 - Apr 2022Rohan GuptaNo ratings yet

- Lecture 16 - Bernoulli Applications 3Document14 pagesLecture 16 - Bernoulli Applications 3يوسف عادل حسانين100% (1)

- Module Bar PTX1.6 PDFDocument8 pagesModule Bar PTX1.6 PDFkumelachewbirre22No ratings yet

- 2 PassivetransportDocument8 pages2 PassivetransportFayeNo ratings yet

- Answers 1Document68 pagesAnswers 1Miguel Angel HernandezNo ratings yet

- Torque SpecsDocument21 pagesTorque SpecssaturnayalaNo ratings yet

- English Compulsory (1) PrintDocument15 pagesEnglish Compulsory (1) PrintZakir KhanNo ratings yet

- TOS BiologyDocument2 pagesTOS BiologyBea Noreen Ungab100% (3)