Professional Documents

Culture Documents

Decision Making

Uploaded by

Raghav Arrora0 ratings0% found this document useful (0 votes)

15 views2 pagesxcvxcvxvxvxvxcvxv

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentxcvxcvxvxvxvxcvxv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesDecision Making

Uploaded by

Raghav Arroraxcvxcvxvxvxvxcvxv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

ExampleA food products company is thinking the introduction of a

revolutionary new product with new packaging or replace

the existing product at much higher price (S1) or a moderate

change in the composition of the existing product with a new

packaging at a small increase in price (S2) or a small change

in the composition of the existing product except the word

New with a negligible increase in price (S3).

The three possible states of nature or events are:

1

High increase in sales (N1)

2

No change in sales (N2)

3

Decrease in sales (N3)

The marketing department of the company worked out the

payoffs in terms of yearly net profits for each of the

strategies of the three events (expected sales). This is

represented in the following table:

Strategies

N1

N2

N3

S1

S2

S3

7,00,000

5,00,000

3,00,000

3,00,000

4,50,000

3,00,000

1,50,000

0

3,00,000

Which strategy should be concerned executive choose on the

basis of

1

Maximin Criterion

2

Maximax Criterion

3

Laplace Criterion?

4

Minimax regret Criterion

ExampleA marketing manager of a computer manufacturer is to

choose from three alternatives.

1 Modify the existing PC to improve its design and

processing power.

2 Launch a new PC having latest technology.

3 Do nothing, i.e. leave the PC as it is.

There are three states of nature that affect the pay-off from

each of the alternative strategies. These states of nature are:

1 A competitor may launch a new PC with latest

technology.

2 The government may impose high excise duty on the

manufacture of PCs and reduce excise to minimum on

laptops to encourage the use of laptops.

3 Conditions will remain the same as they are.

Pay-off Matrix

Strategies

S1 (Modify)

S2 (New Prod.)

S3 (Do Nothing)

Same

Condition

7,00,000

10,00,000

5,00,000

New

Competitor

5,00,000

3,00,000

1,00,000

Govt. Ban

-5,00,000

-13,00,000

-2,00,000

Which strategy should be concerned executive choose on the

basis of

1 Maximin Criterion

2 Maximax Criterion

3 Laplace Criterion?

4 Minimax regret Criterion

You might also like

- Dos and Donts For CitizensDocument1 pageDos and Donts For CitizensRaghav ArroraNo ratings yet

- CCP Fee Change SetDocument5 pagesCCP Fee Change SetRaghav ArroraNo ratings yet

- Marcellus Consistent Compounders Investment ApproachDocument8 pagesMarcellus Consistent Compounders Investment ApproachRaghav ArroraNo ratings yet

- 8899422138471044assignment1201Document10 pages8899422138471044assignment1201Raghav ArroraNo ratings yet

- Sahara IndiaDocument5 pagesSahara IndiaRaghav ArroraNo ratings yet

- IctDocument4 pagesIctRaghav ArroraNo ratings yet

- GrasimDocument1 pageGrasimRaghav ArroraNo ratings yet

- Common Application FormDocument4 pagesCommon Application FormRaghav ArroraNo ratings yet

- CB RaghavDocument2 pagesCB RaghavRaghav ArroraNo ratings yet

- Piedmont Trailer Custom Order Tracking Project FeasibilityDocument1 pagePiedmont Trailer Custom Order Tracking Project FeasibilityRaghav ArroraNo ratings yet

- HRM Report on Job Analysis and DesignDocument3 pagesHRM Report on Job Analysis and DesignRaghav ArroraNo ratings yet

- Eco AsssDocument7 pagesEco AsssRaghav ArroraNo ratings yet

- MIGA - InsuranceDocument2 pagesMIGA - InsuranceRaghav ArroraNo ratings yet

- Case BasicPricingDocument1 pageCase BasicPricingRaghav ArroraNo ratings yet

- Strategy GEDocument10 pagesStrategy GERaghav ArroraNo ratings yet

- International Management Institute Bhubaneswar Prof. Bindu Chhabra Chairperson (Programme)Document2 pagesInternational Management Institute Bhubaneswar Prof. Bindu Chhabra Chairperson (Programme)Raghav ArroraNo ratings yet

- MIGA - InsuranceDocument2 pagesMIGA - InsuranceRaghav ArroraNo ratings yet

- Group GDocument1 pageGroup GRaghav ArroraNo ratings yet

- Rameswar MathamaticsDocument6 pagesRameswar MathamaticsRaghav ArroraNo ratings yet

- LookupDocument3 pagesLookupRaghav ArroraNo ratings yet

- Conflict Resolution and Negotiation Skills GuideDocument11 pagesConflict Resolution and Negotiation Skills GuideRaghav ArroraNo ratings yet

- 0112052Document4 pages0112052Raghav ArroraNo ratings yet

- Big Bazaar's Strategy to Target Different SegmentsDocument12 pagesBig Bazaar's Strategy to Target Different SegmentsRaghav ArroraNo ratings yet

- Synopsis (13050)Document1 pageSynopsis (13050)Raghav ArroraNo ratings yet

- Attitude and Job SatisfactionDocument12 pagesAttitude and Job SatisfactionRaghav ArroraNo ratings yet

- HPCLDocument3 pagesHPCLRaghav ArroraNo ratings yet

- MIS Course at International Management InstituteDocument4 pagesMIS Course at International Management InstituteRaghav ArroraNo ratings yet

- Students Details Table with Roll No, Name, Address, Marks, Total, PercentageDocument1 pageStudents Details Table with Roll No, Name, Address, Marks, Total, PercentageRaghav ArroraNo ratings yet

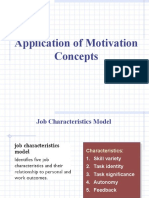

- Application of Motivation ConceptsDocument21 pagesApplication of Motivation ConceptsRaghav ArroraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)