Professional Documents

Culture Documents

Commission Rates For General Insurance - Irda Cirular DT 28.08.2008 PDF

Uploaded by

Srikanth DubbakuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commission Rates For General Insurance - Irda Cirular DT 28.08.2008 PDF

Uploaded by

Srikanth DubbakuCopyright:

Available Formats

Commision on General Insurance Business

Ref: 011/ IRDA/ Brok-Comm/ Aug-08

Date: 25-08-2008

Limits on payment of commission or brokerage on general insurance business with effect from 1 st October

2008

By virtue of the power vested in the Authority under Section 14 of the Insurance Regulatory and Development

Authority Act, 1999 and in terms of the provisions of Sections 40(1), 40A(3) and Section 42E of the Insurance Act,

1938, the Authority hereby directs that the percentage of premium that can be paid by way of commission or

brokerage on a general insurance policy shall not exceed the percentages of premiums set out below. No brokerage

can be paid in respect of an insurance where agency commission is payable and likewise, no agency commission

can be paid in respect of an insurance where brokerage is payable.

Maximum percentage of premium

payable as agency commission or

brokerage

Class of Business

S. No.

Fire, IAR and Engineering insurances

1.

i. General

ii. Risks treated as large risks under

3

4

5

6

para 19(v) of File & Use Guidelines

Motor insurance business (OD portion),

WC/EL & statutory Public Liability

Insurance

Motor Third Party insurance

Marine Hull insurance

Marine Cargo business

All other business

(% of final premium excluding

service tax)

Agency Comm.

Brokerage

12.5%

10%

5%

6.25%

10%

10%

Nil

10%

15%

15%

Nil

12.5%

17.5%

17.5%

No payment of any kind, including administration or servicing charges is permitted to be made to the agent or the

broker in respect of the business in respect of which he is paid agency commission or brokerage.

This direction supersedes all existing directions on the subject and shall take effect in respect of insurances or

renewals commencing on or after 1 st October 2008 .

/Sd(J. Hari Narayan)

Chairman

You might also like

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5From EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5No ratings yet

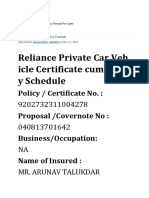

- Two Wheeler Insurance Package PolicyDocument2 pagesTwo Wheeler Insurance Package PolicyJai Deep43% (21)

- Final TestDocument9 pagesFinal TestBharath NayakNo ratings yet

- Law of Insurance AssignmentDocument10 pagesLaw of Insurance AssignmentAmbrose YollahNo ratings yet

- Hasrat, Mva TortsDocument15 pagesHasrat, Mva TortsHasrat KaurNo ratings yet

- Two Insurance Copy ITDocument1 pageTwo Insurance Copy ITbaranimba5No ratings yet

- ComGI 6th Ed Ver 1.2 - Chapter 4Document38 pagesComGI 6th Ed Ver 1.2 - Chapter 4AndyNo ratings yet

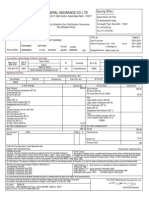

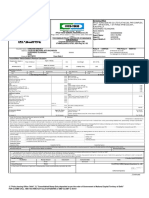

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- Document InsuranceDocument23 pagesDocument InsurancePriti PathakNo ratings yet

- Schedule - 2020-10-13T172846.298Document5 pagesSchedule - 2020-10-13T172846.298psakeer770No ratings yet

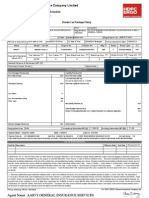

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Document4 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 2006 7301 2900 000Ameer SyedNo ratings yet

- Bike InsuranceDocument2 pagesBike InsuranceAnil Kumar56% (41)

- Longterm Motor Products-RDocument10 pagesLongterm Motor Products-Rvikrant sehgalNo ratings yet

- m4 3fDocument19 pagesm4 3fPraveen KumarNo ratings yet

- Motor Third Party Claims ManagementDocument555 pagesMotor Third Party Claims ManagementBhavin Karia67% (3)

- Toyota Bus Policy 2022Document4 pagesToyota Bus Policy 2022Swam T WNo ratings yet

- Ukpga 20180018 enDocument24 pagesUkpga 20180018 enahmed architectureNo ratings yet

- N A T I o N A L I N S U R A N C e C o M P A N y L I M I T e DDocument3 pagesN A T I o N A L I N S U R A N C e C o M P A N y L I M I T e DSonu KumarNo ratings yet

- 29 Certificate P & I OwnedDocument5 pages29 Certificate P & I OwnedRuben RodriguezNo ratings yet

- QuotationDocument3 pagesQuotationvivien baisdenNo ratings yet

- Markerstudy Insuredaily PolicyDocument13 pagesMarkerstudy Insuredaily Policypavneet19No ratings yet

- Motor Insurance and Fire InsuranceDocument7 pagesMotor Insurance and Fire InsuranceabcdNo ratings yet

- AwesomeDocument2 pagesAwesomeAmit BanerjeeNo ratings yet

- Motor Vehicle Insurance: Class NotesDocument3 pagesMotor Vehicle Insurance: Class Notesgoyal_divya18No ratings yet

- TL I Development Authority: 7FtwmDocument29 pagesTL I Development Authority: 7FtwmkomalbhattNo ratings yet

- Motor InsuranceDocument7 pagesMotor InsuranceAadi saklechaNo ratings yet

- Sunrise Logisticks - 1Document2 pagesSunrise Logisticks - 1niren4u1567100% (2)

- Torts Assignment Sem-1Document13 pagesTorts Assignment Sem-1TanishaNo ratings yet

- Motor Write Up - ShortDocument3 pagesMotor Write Up - ShortqwertyNo ratings yet

- Insurance Law Assignment Roll No 33Document18 pagesInsurance Law Assignment Roll No 33Aditi SrivastavaNo ratings yet

- AckoPolicy-DCTR01058500701 00Document8 pagesAckoPolicy-DCTR01058500701 00sarashwathidharun8No ratings yet

- Apache Insurance 1Document1 pageApache Insurance 1natassidog0% (2)

- Surendrakumarmishra SulDocument1 pageSurendrakumarmishra SulRavi Kumar33% (3)

- Fire & Consequential Loss Insurance 57Document15 pagesFire & Consequential Loss Insurance 57surjith rNo ratings yet

- NgrgnddaDocument15 pagesNgrgnddajustinsitohjsNo ratings yet

- Iffco TokioDocument2 pagesIffco Tokioneel55% (11)

- HDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2312 1000 6143 1100 000Satish BojjawarNo ratings yet

- Duke Young P & I 2019 NewDocument4 pagesDuke Young P & I 2019 NewMuhammad Imam fadliNo ratings yet

- Final Requirement On Insurance Law: in Partial Fulfillment of The Requirements For JD 302 Insurance Law College of LawDocument15 pagesFinal Requirement On Insurance Law: in Partial Fulfillment of The Requirements For JD 302 Insurance Law College of LawErgel Mae Encarnacion RosalNo ratings yet

- PrivateMotorCar ComprehensiveDocument8 pagesPrivateMotorCar ComprehensivehamauetakeNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017SureshNo ratings yet

- Quasi Judicial Function ReferenceDocument35 pagesQuasi Judicial Function ReferenceparZeicaNo ratings yet

- SWAMINA INTERNATIONAL PVT LTD WC PolicyDocument10 pagesSWAMINA INTERNATIONAL PVT LTD WC PolicyDurgaprasad JanyavulaNo ratings yet

- AckoPolicy-DBTR00000915276 00Document1 pageAckoPolicy-DBTR00000915276 00ARAVINDNo ratings yet

- HAI DANG 168 - Certificate - 494422 - P & I OwnedDocument4 pagesHAI DANG 168 - Certificate - 494422 - P & I Ownedtomanhhung197No ratings yet

- Insurance MotorVehiclesThirdPartyRisksActCap405Document28 pagesInsurance MotorVehiclesThirdPartyRisksActCap405John WaithakaNo ratings yet

- Mva PDF ReadyDocument18 pagesMva PDF ReadyKunal DahiyaNo ratings yet

- 3rd Party InsuranceDocument13 pages3rd Party InsurancePraveen Rawat100% (2)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument2 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officesumit.raj.iiit5613No ratings yet

- Motor Insurance Underwriting: in House Training Program On "Basic Course On General Insurance"Document26 pagesMotor Insurance Underwriting: in House Training Program On "Basic Course On General Insurance"Raj HuqeNo ratings yet

- MV Trans Thalia - P&iDocument4 pagesMV Trans Thalia - P&i911swf911No ratings yet

- Two Wheeler Insurance Package PolicyDocument2 pagesTwo Wheeler Insurance Package Policy332233% (3)

- Motor Vehicles Act: TortsDocument10 pagesMotor Vehicles Act: TortsMoinak DasNo ratings yet

- Motor Policy - The New India Assurance Co. LTDDocument5 pagesMotor Policy - The New India Assurance Co. LTDu4rishiNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- ManeDocument2 pagesManeMukesh Manwani100% (2)

- Salama - L&D - T&C EnglishDocument14 pagesSalama - L&D - T&C EnglishabhiazadNo ratings yet

- Private Car Insurance KFDDocument7 pagesPrivate Car Insurance KFDNarayana MugalurNo ratings yet

- Executive SummaryDocument41 pagesExecutive SummaryAnonymous CgJjQiCu5ANo ratings yet

- NPCIL Sample PaperDocument16 pagesNPCIL Sample PaperAbhishek PandeyNo ratings yet

- Ram Lal V State of Rajasthan Watermark 1566573Document22 pagesRam Lal V State of Rajasthan Watermark 1566573Srikanth DubbakuNo ratings yet

- Claims Manual For Gipsa CompaniesDocument51 pagesClaims Manual For Gipsa CompaniesSrikanth Dubbaku78% (9)

- National Insurance Company LTD Vs Sinitha & OrsDocument39 pagesNational Insurance Company LTD Vs Sinitha & OrsAshish DavessarNo ratings yet

- Package Proposal - Commerical and Mise. VehiclesDocument3 pagesPackage Proposal - Commerical and Mise. VehiclesSrikanth DubbakuNo ratings yet

- Irda Protection of Policyholders Interests RegulationsDocument7 pagesIrda Protection of Policyholders Interests RegulationsSrikanth DubbakuNo ratings yet

- Driving Licence BasicsDocument9 pagesDriving Licence Basicsak09No ratings yet

- Driving Licence BasicsDocument9 pagesDriving Licence Basicsak09No ratings yet

- Irda Protection of Policyholders Interests RegulationsDocument7 pagesIrda Protection of Policyholders Interests RegulationsSrikanth DubbakuNo ratings yet

- Insurance Q@ADocument148 pagesInsurance Q@AAnonymous y3E7iaNo ratings yet

- Permit Violations in Supreme Court Judgment in NIC Vs Chall BharathammaDocument6 pagesPermit Violations in Supreme Court Judgment in NIC Vs Chall BharathammaSrikanth DubbakuNo ratings yet

- Indian Motor TariffDocument222 pagesIndian Motor TariffArun Parikshat100% (3)

- CMV RulesDocument174 pagesCMV Rulessunithascribd100% (1)