Professional Documents

Culture Documents

Loan Loss Accounting Basics

Loan Loss Accounting Basics

Uploaded by

mehedhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Loss Accounting Basics

Loan Loss Accounting Basics

Uploaded by

mehedhiCopyright:

Available Formats

Loan Loss Accounting Basics

Starting on 12/31/2009, the bank has 5,000 in loans on the balance sheet and 100 in the loan loss

reserve account (contra-asset). So, net loans are 4,900:

Loans 5,000 - Loan Loss Reserve 100 = Net Loans 4,900

On 5/25/2010, a loan in the amount if 5 becomes totally uncollectible and is written off:

Debit: Loan Loss Reserve 5

Credit: Loans 5

Now, net loans are still 4,900 (4,995-95)

On 8/10/2010, a loan in the amount if 20 becomes totally uncollectible and is written off:

Debit: Loan Loss Reserve 20

Credit: Loans 20

Now, net loans are still 4,900 (4,975-75)

As of 12/31/2010, bank management estimates that the loan loss reserve should be 120, so the loan loss

reserve account must be increased by 45 (from 75 to 120):

Debit: Loan Loss Provision*

45

Credit: Loan Loss Reserve 45

Now, net loans are 4,855 (4,975- 120). The decrease in net loans over the year of 45 results from writeoffs of 25 and a net increase in the reserve of 20.

*Loan Loss Provision is an expense on the income statement for 2010.

You might also like

- Cash FlowDocument25 pagesCash Flowshaheen_khan6787No ratings yet

- Ratio Back SpreadsDocument20 pagesRatio Back SpreadsOladipupo Mayowa PaulNo ratings yet

- KPMBM - Bad Debts and Doubtful DebtsDocument51 pagesKPMBM - Bad Debts and Doubtful DebtsAhmad Hafiz50% (2)

- (03A) AR NR Quiz ANSWER KEYDocument8 pages(03A) AR NR Quiz ANSWER KEYKhai Ed PabelicoNo ratings yet

- Receivable FinancingDocument18 pagesReceivable FinancingGab IgnacioNo ratings yet

- Execution Excellence: Making Strategy Work Using the Balanced ScorecardFrom EverandExecution Excellence: Making Strategy Work Using the Balanced ScorecardRating: 4 out of 5 stars4/5 (1)

- Marriott ValuationDocument16 pagesMarriott ValuationOladipupo Mayowa PaulNo ratings yet

- Trade and Other PayablesDocument54 pagesTrade and Other Payablesland YiNo ratings yet

- Problem I PDFDocument20 pagesProblem I PDFsino akoNo ratings yet

- Hotels and Motels - Industry Data and AnalysisDocument8 pagesHotels and Motels - Industry Data and AnalysisOladipupo Mayowa PaulNo ratings yet

- C214 Practice Questions Answer KeyDocument18 pagesC214 Practice Questions Answer Keydesouzas.ldsNo ratings yet

- RTP Nov 15Document46 pagesRTP Nov 15Aaquib ShahiNo ratings yet

- Projected Cash FlowDocument5 pagesProjected Cash FlowSaif Muhammad SazinNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 25Document21 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 25daood abdullah100% (1)

- Steps by Step Process in Projecting Income Statement and Balance SheetDocument8 pagesSteps by Step Process in Projecting Income Statement and Balance Sheetjennie martNo ratings yet

- Week6 SampleExamQuestionDocument16 pagesWeek6 SampleExamQuestionyow jing pei67% (3)

- Aud Theo Part 2Document10 pagesAud Theo Part 2Naia Gonzales0% (2)

- Name Roll No.Document10 pagesName Roll No.Shakeel ShahNo ratings yet

- Detailed Solutions To Problem 5Document3 pagesDetailed Solutions To Problem 5Maria AngelicaNo ratings yet

- MGT211 Assignment 1 Solution Spring 2021Document5 pagesMGT211 Assignment 1 Solution Spring 2021Beaming Kids Model schoolNo ratings yet

- Jiclepa Plásticos - MarkschemeDocument4 pagesJiclepa Plásticos - Markschemenooralsouri06No ratings yet

- SMU A S: Finance and Management AccountingDocument11 pagesSMU A S: Finance and Management Accountingpara2233No ratings yet

- Answers For The Receivable Financing ExercisesDocument5 pagesAnswers For The Receivable Financing ExercisesyelenaNo ratings yet

- Final Accounts Revision ProblemsDocument4 pagesFinal Accounts Revision Problemsblazingsun_11No ratings yet

- CH 06 Accounting For Musharakah FinancingDocument23 pagesCH 06 Accounting For Musharakah FinancingMOHAMMAD BORENENo ratings yet

- Cash Flow Statement: Projected Income Statement and Balance SheetDocument14 pagesCash Flow Statement: Projected Income Statement and Balance SheetAagam SakariaNo ratings yet

- Financial Management and ApplicationDocument4 pagesFinancial Management and ApplicationAhmed Khan WarsiNo ratings yet

- Topic 5 Tutorial QuestionsDocument3 pagesTopic 5 Tutorial QuestionsPardeep Ramesh AgarvalNo ratings yet

- Gurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesDocument16 pagesGurukripa's Guideline Answers To May 2015 Exam Questions CA Final - Direct TaxesBhavin PathakNo ratings yet

- Advance Accounting I Partnership - Changes in Ownership InterestDocument2 pagesAdvance Accounting I Partnership - Changes in Ownership InterestKriza Sevilla MatroNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument38 pages© The Institute of Chartered Accountants of IndiaSarah HolmesNo ratings yet

- CorporateLiquidation ProblemswithAnswerKeyDocument5 pagesCorporateLiquidation ProblemswithAnswerKeyJayPee BasiñoNo ratings yet

- Miscellaneous ExpensesDocument5 pagesMiscellaneous ExpensesHannah Loren ComendadorNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNo ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- Bank ReconciliationDocument19 pagesBank ReconciliationnafeesNo ratings yet

- Financial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsDocument22 pagesFinancial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsMOVIEZ FUNDANo ratings yet

- TA U6 Salaries 4 PA3 PDFDocument5 pagesTA U6 Salaries 4 PA3 PDFRafaelKwongNo ratings yet

- RB - Budget Approved by Finance CommitteeDocument8 pagesRB - Budget Approved by Finance CommitteekobekahnNo ratings yet

- 5678Document3 pages5678chang181915No ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Chap V Risk ManagementDocument87 pagesChap V Risk ManagementGing freexNo ratings yet

- Topic 9 - Year End Adjustment On Bad Debt, ADD, Bad Debts RecDocument14 pagesTopic 9 - Year End Adjustment On Bad Debt, ADD, Bad Debts RecAriff DanielNo ratings yet

- Financial Accounting & Analysis Dec'22Document3 pagesFinancial Accounting & Analysis Dec'22ankurNo ratings yet

- DPS - Shaping The FutureDocument21 pagesDPS - Shaping The FutureClickon Detroit100% (1)

- Assignment Front Sheet: BusinessDocument13 pagesAssignment Front Sheet: BusinessHassan AsgharNo ratings yet

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Assignment - 1 OF Personnel Finance PlanningDocument5 pagesAssignment - 1 OF Personnel Finance Planningvikas anandNo ratings yet

- Bad Debts and Doubtful Debts PDFDocument4 pagesBad Debts and Doubtful Debts PDFSanjiv KubalNo ratings yet

- Short-Term Financial Planning: Mcgraw-Hill/IrwinDocument23 pagesShort-Term Financial Planning: Mcgraw-Hill/IrwinUmair Latif KhanNo ratings yet

- AE 111 Final Summative Assessment 2Document3 pagesAE 111 Final Summative Assessment 2Djunah ArellanoNo ratings yet

- Capital StructureDocument9 pagesCapital Structuref4farhansiddiqui17No ratings yet

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocument12 pagesBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11No ratings yet

- Bill Baddorf W 915-3654: Dbaddorf@Ngu - EduDocument52 pagesBill Baddorf W 915-3654: Dbaddorf@Ngu - EdusaminaJanNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Tutorial MGS 405 2022-2023Document6 pagesTutorial MGS 405 2022-2023FOBASSO FRANC JUNIORNo ratings yet

- IAS 12 Part 1 - KNSDocument10 pagesIAS 12 Part 1 - KNSsehrish.cmaNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

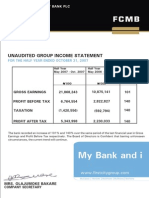

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- 2007 Q1resultsDocument1 page2007 Q1resultsOladipupo Mayowa PaulNo ratings yet

- Full Year 2011 Results Presentation 2Document16 pagesFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNo ratings yet

- Unaudited Half Year Result As at June 30 2011Document5 pagesUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNo ratings yet

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- June 2012 Investor PresentationDocument17 pagesJune 2012 Investor PresentationOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- International Hotel Appraisers4Document5 pagesInternational Hotel Appraisers4Oladipupo Mayowa PaulNo ratings yet

- 2012 Year End Results Press ReleaseDocument3 pages2012 Year End Results Press ReleaseOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- 2013 Year End Results Press Release - Final WebDocument3 pages2013 Year End Results Press Release - Final WebOladipupo Mayowa PaulNo ratings yet

- Val Project 6Document17 pagesVal Project 6Oladipupo Mayowa PaulNo ratings yet

- Margin Requirement Examples For Sample Options-Based PositionsDocument2 pagesMargin Requirement Examples For Sample Options-Based PositionsOladipupo Mayowa PaulNo ratings yet

- Banking Finance Sectorial OverviewDocument15 pagesBanking Finance Sectorial OverviewOladipupo Mayowa PaulNo ratings yet