Professional Documents

Culture Documents

2013 Year End Results Press Release - Final Web

Uploaded by

Oladipupo Mayowa Paul0 ratings0% found this document useful (0 votes)

6 views3 pagesGuaranty Trust Bank plc announced its 2013 audited full-year results with a profit before tax of N107.09 billion, a 3.94% increase from 2012. Key highlights included strong loan book and deposit growth of 28.58% and 23.09% respectively, total assets of N2.10 trillion, and a proposed final dividend of 145 kobo per share bringing the total dividend for 2013 to 170 kobo per share. The bank maintained its leadership position with a return on equity of 29.32% despite regulatory headwinds and expanded its operations to Kenya, Rwanda, and Uganda through the acquisition of Fina Bank Limited.

Original Description:

ANNUAL REPORT

Original Title

2013 Year End Results Press Release_final Web

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGuaranty Trust Bank plc announced its 2013 audited full-year results with a profit before tax of N107.09 billion, a 3.94% increase from 2012. Key highlights included strong loan book and deposit growth of 28.58% and 23.09% respectively, total assets of N2.10 trillion, and a proposed final dividend of 145 kobo per share bringing the total dividend for 2013 to 170 kobo per share. The bank maintained its leadership position with a return on equity of 29.32% despite regulatory headwinds and expanded its operations to Kenya, Rwanda, and Uganda through the acquisition of Fina Bank Limited.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pages2013 Year End Results Press Release - Final Web

Uploaded by

Oladipupo Mayowa PaulGuaranty Trust Bank plc announced its 2013 audited full-year results with a profit before tax of N107.09 billion, a 3.94% increase from 2012. Key highlights included strong loan book and deposit growth of 28.58% and 23.09% respectively, total assets of N2.10 trillion, and a proposed final dividend of 145 kobo per share bringing the total dividend for 2013 to 170 kobo per share. The bank maintained its leadership position with a return on equity of 29.32% despite regulatory headwinds and expanded its operations to Kenya, Rwanda, and Uganda through the acquisition of Fina Bank Limited.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

1 of 3

Guaranty Trust Bank plc

2013 Audited full-year results

Announces PBT of N107.09billion

Lagos Nigeria March 14, 2014 Guaranty Trust Bank plc (GTBank), (Bloomberg:

GUARANTY:NL/Reuters: GUARANT.LG), provider of diversified financial services, announces its Audited

Financial Results, in accordance with IFRS, for the year ended December 31, 2013, and declares a Final

dividend of 145 kobo* per share bringing the total year dividend to 170kobo.

Commenting on the results, Mr. Segun Agbaje, Managing Director and CEO of Guaranty Trust Bank plc

stated that As a growing franchise and in spite of the regulatory headwinds, our Bank has posted

respectable results that reaffirm our reputation as a market leader and a highly ethical financial

institution. We have maintained our ROE leadership position as seen by our December 2013 ROE of

29.32% (31 December 2012: 33.98%).

He further stated that with this performance, we will maintain our commitment to maximizing

shareholder value with a proposed dividend pay-out of 1.70 per share, an increase of 10% over the

1.55 paid in 2012 and a share price appreciation of 17% in 2013. Our acquisition of Fina Bank Limited, a

Kenyan bank with significant business footprint in Rwanda and Uganda gives us the opportunity to

commence business in three East African countries via the acquisition of one bank. This will give us great

mileage and an opportunity to leverage our brand equity. We hope to further tap into the growth

potentials of emerging African economies thus bringing us closer to our philosophy of being A proudly

African and truly international financial brand.

Financial Highlights

Strong Earnings

- Profit before tax of N107.09bn (31 December 2012: N103.03bn) an increase of

3.94%. Relatively strong growth considering the severe dampening effect of regulatory

headwinds in 2013. Growth driven primarily by increased transaction volumes and strong

loan growth.

- Profit after tax for the year of N90.02bn (31 December 2012: N87.30bn) up 3.13%.

- Earnings per share of 317kobo (31 Dec 2012: 305kobo per share)

- Final 2013 Dividend of 145kobo per share. Total-Year Dividend of 170kobo

(inclusive of 25kobo interim dividend issued at half-year 2013)

Subsidiaries

- In January 2014, Fina Bank and its subsidiaries were rebranded to GTBank Kenya,

GTBank Rwanda and GTBank Uganda

- GTBank now operates in 9 countries outside of Nigeria

Revenue

- Interest Income of N185.38bn (31 December 2012: N170.30bn) up 8.86%. Growth

driven primarily by strong loan book growth of 28.58%. The Bank aggressively grew its

loan book to compensate for income lost as a result of the New Bankers Tariff, and other

regulatory headwinds.

- Non-Interest Income of N57.28bn (31 December 2012: N52.76bn) up 8.55%as a

result of increased transaction volumes and loan book growth, despite regulatory induced

fee reductions and eliminations in 2013.

- Net interest margin remained strong at 8.87%(31 December 2012: 9.46%)

Balance Sheet

- Total assets and contingents of N2.67trn (31 December 2012: N2.198trn)

- Total assets of N2.10trn (31 December 2012: 1.73trn) up 21.2%

- Strong loan book growth of 28.58%. Net loans and advances to customers of

N1.01trn (31 December 2012: N783.91bn) Loan book growth driven by decent deposit

2 of 3

growth and the Banks aim to offset the effects of the industry-wide, regulator induced

reduction in income.

- Total Deposits from customers of N1.44trn (31 December 2012:N1.17bn) up

23.09%. Strong deposit growth driven by impressive performance of our retail franchise.

- GTBank issued a $400m, 5year note at 6% in 2013 to further drive its loan book growth

Credit Quality

- Non-performing loans to total loans of 3.58% (31 December 2012: 3.75%)

- Coverage (with Regulatory risk reserves) at 110.60% (31 December 2012:

101.60%)

Continued focus on efficiency

- Cost to income of 43.53% (31 December 2012: 43.10%) Despite an increase in the

AMCON levy and other regulatory induced expenses, the Banks expenses grew by 5.8%

in 2013

*Subject to shareholder approval at GTBanks AGM to be held on April 14, 2014

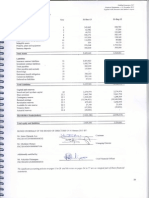

Full Year 2013 Financial Analysis and Ratios

Key Financials (N' billion) 2013 2012 %

Interest Income 185.38 170.3 8.9%

Net Interest Income 136.94 130.69 4.8%

Operating Income 189.63 181.03 4.8%

Operating expense 82.54 78.00 5.8%

Profit before tax 107.09 103.03 3.9%

Profit for the year 90.02 87.30 3.1%

Earnings per share 3.17 3.05 3.9%

Total Assets 2,102.85 1,734.88 21.2%

Net Loans 1,007.97 783.91 28.6%

Total Deposits 1,442.70 1,172.06 23.1%

Key Ratios 2013 2012

ROE(post-tax) 29.32% 33.98%

ROA(post-tax) 4.69% 5.22%

ROE (pre-tax) 34.87% 40.10%

ROA (pre-tax) 5.58% 6.16%

Net interest margin 8.87% 9.46%

Cost-to-income ratio 43.53% 43.09%

Loans to deposits 70.61% 68.27%

Liquidity ratio 50.31% 53.32%

Capital adequacy ratio 21.85% 23.80%

NPL/Total Loans 3.58% 3.75%

Cost of risk 0.31% 0.10%

Coverage (with Reg. Risk Reserves) 110.60% 101.60%

14 March 2014

Enquiries:

GTBank

Muyiwa Teriba, Head, Investor Relations

ir@gtbank.com

+234-1-4484156

Lola Odedina, Head, Communications & External Affairs

+234-1-2715227

3 of 3

Pascal Or

corpaff@gtbank.com

Notes to the Editors:

Guaranty Trust Bank is a diversified financial services company with N2.10trillion in assets, providing

commercial banking services through 241 local branches, 1051ATMs, our international subsidiary offices

and the Internet (gtbank.com).

The Group operates as one of the leading Nigerian banks offering a wide range of financial services and

products throughout Nigeria and in the West African sub-region. The Bank is rated BB- by Standard and

Poors and B+ by Fitch, a reflection of the Bank's stability and reputation of being a well established

franchise with strong asset quality and consistently excellent financial performance.

The Bank has nine bank subsidiaries established outside of Nigeria

1) Guaranty Trust Bank (Gambia) Limited (GTB Gambia),

2) Guaranty Trust Bank (Sierra Leone) Limited (GTB Sierra Leone),

3) Guaranty Trust Bank (Ghana) Limited (GTB Ghana),

4) Guaranty Trust Bank (Liberia) Limited (GTB Liberia),

5) Guaranty Trust Bank (United Kingdom) Limited (GTB UK)

6) Guaranty Trust Bank (Cote DIvoire) (GTB Cote DIvoire),

7) Guaranty Trust Bank (Kenya) Limited (GTB Kenya),

8) Guaranty Trust Bank (Rwanda) Limited (GTB Rwanda),

9) Guaranty Trust Bank (Uganda) Limited (GTB Uganda).

The Bank also has a non-bank GTB Finance B.V. (GTB Finance), a special purpose subsidiary

incorporated in The Netherlands.

You might also like

- Anthony Robbins Interview TranscriptsDocument63 pagesAnthony Robbins Interview TranscriptsAbdurrahman Luthfi TambengiNo ratings yet

- Cib Investor Day 2016Document35 pagesCib Investor Day 2016hvsbouaNo ratings yet

- MRO Inventory and Purchasing - Maintenance Strategy Series PDFDocument133 pagesMRO Inventory and Purchasing - Maintenance Strategy Series PDFDario Dorko100% (2)

- Duckworth Industries proposes new EVA incentive systemDocument16 pagesDuckworth Industries proposes new EVA incentive systemMuhammad Faisal Hayat100% (2)

- Fazendo Dinheiro Com A FotografiaDocument132 pagesFazendo Dinheiro Com A FotografiaGiuseppe DecaroNo ratings yet

- Swift Reports Informationpaper Phiso20022mar16Document12 pagesSwift Reports Informationpaper Phiso20022mar16XRP SharinganNo ratings yet

- 14 Lopez, Locsin, Ledesma & Co Vs CADocument4 pages14 Lopez, Locsin, Ledesma & Co Vs CADavid Antonio A. EscuetaNo ratings yet

- CPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISDocument16 pagesCPA REVIEW SCHOOL FINANCIAL RATIO ANALYSISZein SkyNo ratings yet

- Capital Projects Operational Readiness and Business RisksDocument10 pagesCapital Projects Operational Readiness and Business RisksjomoramaNo ratings yet

- Audit ProjectDocument57 pagesAudit Projectanupam cNo ratings yet

- MTN Annual Financial Results Booklet 2014Document40 pagesMTN Annual Financial Results Booklet 2014The New VisionNo ratings yet

- Heiken Ashi ExplanationDocument6 pagesHeiken Ashi ExplanationExpresID100% (2)

- 2012 Year End Results Press ReleaseDocument3 pages2012 Year End Results Press ReleaseOladipupo Mayowa PaulNo ratings yet

- 2011 Half Year Result StatementDocument3 pages2011 Half Year Result StatementOladipupo Mayowa PaulNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- ZBFH Audited Results For FY Ended 31 Dec 13Document7 pagesZBFH Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Annual Report 2011 Eng BNP Paribas IndonesiaDocument47 pagesAnnual Report 2011 Eng BNP Paribas IndonesiaAvenzardNo ratings yet

- Bank One Limited reports profit growth in challenging yearDocument1 pageBank One Limited reports profit growth in challenging yearJashveer SeetahulNo ratings yet

- Standard Chartered PLC - Half Year 2013 Press ReleaseDocument187 pagesStandard Chartered PLC - Half Year 2013 Press ReleaseSu JitdumrongNo ratings yet

- Brainworks Capital Management Interim Financial Results 30 June 2013Document42 pagesBrainworks Capital Management Interim Financial Results 30 June 2013Kristi DuranNo ratings yet

- Second Quarter 2013: Profit For The QuarterDocument58 pagesSecond Quarter 2013: Profit For The QuarterSwedbank AB (publ)No ratings yet

- Ig Group Annualres - Jul12Document39 pagesIg Group Annualres - Jul12forexmagnatesNo ratings yet

- Fitch RatingsDocument7 pagesFitch RatingsTareqNo ratings yet

- 3Q JulyMar 1213Document17 pages3Q JulyMar 1213frk007No ratings yet

- Manmohan Parnami: NSE Symbol: AUBANK Scrip Code: 540611, 958400, 974093, 974094 & 974095Document60 pagesManmohan Parnami: NSE Symbol: AUBANK Scrip Code: 540611, 958400, 974093, 974094 & 974095krishna PatelNo ratings yet

- FY 2012-13 First Quarter Results: Investor PresentationDocument31 pagesFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNo ratings yet

- HSBC Holding Ar 2013 Media ReleaseDocument44 pagesHSBC Holding Ar 2013 Media ReleaseHillary KohNo ratings yet

- Guinness Nigeria PLC - 2010 Annual ReportDocument4 pagesGuinness Nigeria PLC - 2010 Annual ReportOkeke Pascal Onyeka EinsteinNo ratings yet

- YES BANK Q2FY23 Net Profit Rs 153 CrDocument4 pagesYES BANK Q2FY23 Net Profit Rs 153 Crsaravanan aNo ratings yet

- Nedbank Group Financial StatementsDocument132 pagesNedbank Group Financial StatementsNeo NakediNo ratings yet

- Annual Report 2012-2013 Federal BankDocument192 pagesAnnual Report 2012-2013 Federal BankMoaaz AhmedNo ratings yet

- TFG 2012 Annual ReportDocument48 pagesTFG 2012 Annual ReportTenGer Financial GroupNo ratings yet

- GIPS Compliant Performance Report: March 31, 2013Document21 pagesGIPS Compliant Performance Report: March 31, 2013HIRA -No ratings yet

- Results Press Release For December 31, 2015 (Result)Document4 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- 2011 Annual ReportDocument96 pages2011 Annual ReportOsman SalihNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet OctoberDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Octoberapi-237717884No ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- Nations Trust Bank Annual Report 2008Document134 pagesNations Trust Bank Annual Report 2008Maithri Vidana Kariyakaranage100% (1)

- TTB Annual Report 2008Document80 pagesTTB Annual Report 2008Francis DansoNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Press Release - 20 January, 2012: ST STDocument7 pagesPress Release - 20 January, 2012: ST STNimesh MomayaNo ratings yet

- ADIB Investor Presentation FY 2011Document38 pagesADIB Investor Presentation FY 2011sunilkpareekNo ratings yet

- Prime Banks Credit CardDocument9 pagesPrime Banks Credit CardIsmat Jerin ChetonaNo ratings yet

- Stanbic Bank Uganda Annual - Report For 2015Document132 pagesStanbic Bank Uganda Annual - Report For 2015The Independent Magazine100% (1)

- ZPI Audited Results For FY Ended 31 Dec 13Document1 pageZPI Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNo ratings yet

- FY20 Media Release - 260620 (F)Document5 pagesFY20 Media Release - 260620 (F)Gan Zhi HanNo ratings yet

- Ocbc Ar2015 Full Report EnglishDocument232 pagesOcbc Ar2015 Full Report EnglishSassy TanNo ratings yet

- Axis Bank Q2 profit up 38% to Rs 735 croreDocument7 pagesAxis Bank Q2 profit up 38% to Rs 735 croresmilealwayssgNo ratings yet

- JSC Liberty Finance Factsheet - April 2014Document2 pagesJSC Liberty Finance Factsheet - April 2014LibertySecuritiesNo ratings yet

- Bank of Kigali Limited: Financially Transforming LivesDocument3 pagesBank of Kigali Limited: Financially Transforming LivesBank of KigaliNo ratings yet

- Annual Report 2009-2010 Highlights Federal Bank's Growth and PerformanceDocument88 pagesAnnual Report 2009-2010 Highlights Federal Bank's Growth and PerformanceLinda Jacqueline0% (1)

- FIN410.5 Team 2 Fall 2022 1Document6 pagesFIN410.5 Team 2 Fall 2022 1Mohammad Fahim HossainNo ratings yet

- Bank FYDocument1 pageBank FYTamil MasalaNo ratings yet

- ICICI Bank, 4th February, 2013Document16 pagesICICI Bank, 4th February, 2013Angel BrokingNo ratings yet

- BML Annual Report 2010 - EnglishDocument114 pagesBML Annual Report 2010 - EnglishmumdhoonNo ratings yet

- U BL Financial Statements Ann DecDocument122 pagesU BL Financial Statements Ann DecRehan NasirNo ratings yet

- Suffolk Bancorp Q1 Earnings Release 2013Document11 pagesSuffolk Bancorp Q1 Earnings Release 2013RiverheadLOCALNo ratings yet

- ING Groep Jaarverslag 2012 PDFDocument383 pagesING Groep Jaarverslag 2012 PDFsiebrand982No ratings yet

- Consolidated Profit and Loss Account For The Year Ended December 31, 2008Document16 pagesConsolidated Profit and Loss Account For The Year Ended December 31, 2008madihaijazNo ratings yet

- Draft Press Release Half Year 2012Document1 pageDraft Press Release Half Year 2012Khursheed AhmadNo ratings yet

- EasyCred Georgia. Financial Statement 2010Document34 pagesEasyCred Georgia. Financial Statement 2010Anatoli KorepanovNo ratings yet

- 2011.06.30 ASX Annual ReportDocument80 pages2011.06.30 ASX Annual ReportKevin LinNo ratings yet

- TFG 2013 Annual ReportDocument44 pagesTFG 2013 Annual ReportTenGer Financial GroupNo ratings yet

- Highlights For The Six Months Ended June 30, 2015 (Company Update)Document137 pagesHighlights For The Six Months Ended June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet FebruaryDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Februaryapi-237717884No ratings yet

- Activities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandActivities Related to Credit Intermediation Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Document3 pages9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNo ratings yet

- Amcon Bonds FaqDocument4 pagesAmcon Bonds FaqOladipupo Mayowa PaulNo ratings yet

- Filling Station GuidelinesDocument8 pagesFilling Station GuidelinesOladipupo Mayowa PaulNo ratings yet

- Abridged Financial Statement September 2012Document2 pagesAbridged Financial Statement September 2012Oladipupo Mayowa PaulNo ratings yet

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDocument1 pageIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNo ratings yet

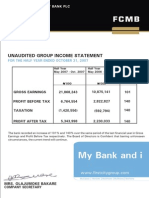

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDocument4 pagesFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADocument16 pagesBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNo ratings yet

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDocument31 pagesFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- 2006 Q1resultsDocument1 page2006 Q1resultsOladipupo Mayowa PaulNo ratings yet

- q1 2008 09 ResultsDocument1 pageq1 2008 09 ResultsOladipupo Mayowa PaulNo ratings yet

- FirstCity Group profit up 88% in 3 monthsDocument1 pageFirstCity Group profit up 88% in 3 monthsOladipupo Mayowa PaulNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- 2007 Q2resultsDocument1 page2007 Q2resultsOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Document5 pages9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNo ratings yet

- Diamond Bank Half Year Results 2011 SummaryDocument5 pagesDiamond Bank Half Year Results 2011 SummaryOladipupo Mayowa PaulNo ratings yet

- 2011 Year End Results Press Release - FinalDocument2 pages2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNo ratings yet

- June 2009 Half Year Financial Statement GaapDocument78 pagesJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNo ratings yet

- Fs 2011 GtbankDocument17 pagesFs 2011 GtbankOladipupo Mayowa PaulNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- 5 Year Financial Report 2010Document3 pages5 Year Financial Report 2010Oladipupo Mayowa PaulNo ratings yet

- Final Fs 2012 Gtbank BV 2012Document16 pagesFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNo ratings yet

- Post Office Life Insurance Rules - 2011Document3 pagesPost Office Life Insurance Rules - 2011abc100% (1)

- Subramanyam FSA Chapter 01 - ETJDocument44 pagesSubramanyam FSA Chapter 01 - ETJMaya AngrianiNo ratings yet

- Chapter 10 IFDocument25 pagesChapter 10 IFcuteserese roseNo ratings yet

- A Report On Deposit in RBB Bank NepalDocument45 pagesA Report On Deposit in RBB Bank NepalSantosh Chhetri0% (1)

- Elasticity, GDP, Costing, Valuation, Ratios, Break-even, VarianceDocument5 pagesElasticity, GDP, Costing, Valuation, Ratios, Break-even, Variancegoldenpeanut50% (2)

- Important Facts About India's Central Bank RBIDocument50 pagesImportant Facts About India's Central Bank RBIkrishna21988No ratings yet

- Bingham InstructionsDocument44 pagesBingham InstructionsDzung Tran33% (3)

- Accountancy GoodwillDocument5 pagesAccountancy GoodwillPrachi SanklechaNo ratings yet

- CFA Mock Exam QuestionsDocument2 pagesCFA Mock Exam QuestionsKumardeep SinghaNo ratings yet

- Journal Int 4Document6 pagesJournal Int 4Jeremia Duta PerdanakasihNo ratings yet

- Bharti Axa ProjectDocument62 pagesBharti Axa ProjectKishan Chauhan RajputNo ratings yet

- Quiz - iCPA PDFDocument14 pagesQuiz - iCPA PDFCharlotte Canabang AmmadangNo ratings yet

- Strategic Finance ManagementDocument8 pagesStrategic Finance ManagementShiv KothariNo ratings yet

- REvision Pack 08-Questions and AnswersDocument45 pagesREvision Pack 08-Questions and Answerssunshine9016No ratings yet

- Yield To MaturityDocument3 pagesYield To Maturitypreet13No ratings yet

- Chapter 16 - AnswerDocument9 pagesChapter 16 - AnswerKimberly Arena100% (1)

- Errors and Questionable Judgments in Analysts' DCF ModelsDocument37 pagesErrors and Questionable Judgments in Analysts' DCF ModelsSergiu CrisanNo ratings yet

- Financial Inclusion & Microfinance For Laundry ServicesDocument8 pagesFinancial Inclusion & Microfinance For Laundry ServicesGuneet KohliNo ratings yet

- Sun Valley Farm Land InvestmentDocument21 pagesSun Valley Farm Land InvestmentVrijendra PalNo ratings yet

- Marine Insurance Policy TermsDocument3 pagesMarine Insurance Policy TermswaleedyehiaNo ratings yet