Professional Documents

Culture Documents

Results Press Release For December 31, 2015 (Result)

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Press Release For December 31, 2015 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

UNITED BANK OF INDIA

Head Office : 11, Hemanta Basu Sarani, Kolkata - 700 001

fel : 033-22481054; Fax : 033-22485852, Email: co.sec@unitedbank.co.in

Board Sec/BM/PR/

February 11,2016

t2016

Listing Department

Gorporate Relations Cell

Bombay Stock Exchange Ltd.

P. J. Tower, Dalal Street, Fort

Mumbai - 400001.

Scrip Code: UNITEDBNK (533171)

National Stock Exchange of lndia Ltd.

Exchange Plaza, Plot - C/1, Block - G

Bandra Kurla Complex, Bandra (E)

Mumbai- 400051

Scrip Code: UNITEDBNK

Dear Sir,

Sub: Press Release

The Bank has issued the attached press release on the occasion of the announcement of its

unaudited Financial Results for the quarter and I months period ended December 31,2015.

The same is filed in terms of Regulation 30 of the SEBI Listing Regulations.

Thanking you,

ny

& Compliance Officer

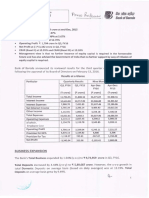

United Bank of lndia Financial Results

03 (FY 15-16) and FY 14-15

Feb 11,2016

a

Operating Profit at Rs 470.00 crore (down 22.03% Y-o-Y)

Net Profit at Rs.17.00 crore in Q3FY16 (down 59.31% Y-O-Y)

Net lnterest lncome (Nll) at Rs 608.08 crorc (down 2.31Yo Y-o-Y)

Gross NPA at Rs.6721.53 crore (down 13.93% Y-O-Y)

CASA share 40.80% as on 31$ December 15 vis-d-vis

NfM at 2.160/o for Q3 of FY:16

ROAA (annualized) at 0.05% for Q3 of FY:16

ROE (annualized) at 3.36%

CRAR (Basel tll) at 9.92% with Tier 1 at7.12% as on 31"1Dec, 2015

39.34o/o as on

31st Dec2014

United Bank of lndia has announced its reviewed financial results for the third quarter (a3) of FY 2015-16

following the approval of its Board of Directors on Feb 11,2016.

Results at a Glance

rore

Quarterly Results

Q3.FY 16 Q3.FY 15

Yearly

Change (%)

Total lncome

2827.91

2934.66

-3.64

FY 15

11927.39

lnterest lncome

lnterest Expenses

2470.70

1862.61

2508.60

1886.13

-1.51

-1.25

10180.48

7689.82

Net lnterest lncome

608.1 0

622.47

-2.31

2490.66

Other lncome

Operating Expenses

Staff Expenses

Total Expenses (Excluding

Provisions, Contingency &

Taxes)

Operating Profit

Provisions, Contingencies

& Taxes

Net Profit

357.21

-16.16

495.30

282.66

426.06

445.76

258.52

9.34

1746.91

1809.63

1038.29

2357.91

470.00

2331.89

602.77

1.12

-22.03

9499.45

2427.94

453.00

560.99

41.78

-19.25

-59.31

2171.95

255.99

17.00

11.11

Profits

The Bank's Operating Profit stood at 470.00 crore in Q3, FY16 versus Rs 602.77 crore in e3, Fy15 (down

22.03o/o y-o-y) Bank's Net Profit stands at Rs.17.00 Crore against Rs.41.78 crore in Q3 Fy 15. Reduction in

operating profit as well as net profit reduction is due to reduced interest income and reduction in trading

profit. The Bank has reduced it's Base Rate from 10.25o/o to 9.65% in last one year. The trading profit

reduced by Rs.98 cr in current quarter due to adverse fluctuation in the yields of Bonds.

Income

Bank's Net lnterest lncome (Nll) stood at Rs 608.10 crores in Q3 FY 16 against Rs.622.47 crore in the

corresponding quarter of the previous year showing a decline of 2.31o/o.

Expenses

During

16, the Bank's lnterest Expended (at Rs 1862.61 crore) posted a decline ot 1.25 '/" (y-o-y)

Q3 FY

due to the Bank's strict monitoring of funding costs coupled with declining interest rate scenario.

Provisions

"Provisions and Contingencies" of the Bank for the quarter was at Rs.453.00 crore during Q 3 FY16.

Provision against non performing loans and advances has gone up from Rs.355.87 crore as on Dec'14 to

Rs.393.00 crore as on Dec'15, The AS-15 "Provision for Retirement Benefits of Employees" increased from

Rs.1 12.45 cr to Rs.235.31 cr on y-o-y.

Business Expansion

The total business of the Bank increased by Rs.12714 crore registering a moderate groMh ol7.4lo/o.The

deposit grew up by Rs.7370 crore (7.01o/o) . Similarly the advances saw a muted groMh of Rs.5344 crore

(8.23%).CASA grew from Rs.41353 crore to Rs.45894 crore (10.98%) yoy.

Asset Quality

The Gross NPA has shown a decline of from Rs.7809.38 crore as on Dec'14 to Rs.6721.53 crore in

Dec'15. The Net NPA of the Bank has come down from Rs.5240.32 crore to Rs.3965.13 crore (down

24.33 % Y-o-Y) during the same period. ln percentage terms also the Gross NPA has come down

frcm 12.03o/o as on Dec'l 4 to 9.57o/o as on Dec'15, and Net NPA has come down from 8.50% to 5.91%.

However, the slippage increased sequentially due to economic slowdown and also during the quarter, as a

part of Assets Quality Review (AQR), RBI has advised the Bank to revise asset classification/provision in

respect

of certain advances over two quarters ending

31.12.2015 and 31.03.2016. The Bank has

accordingly classified the advances and made the requisite provisions.

The fresh slippage in Q3 FY 16 stood at Rs.1159.84 cr against Rs.1621 .77 crore in Q3 FY 15. Stippage

Ratio 1.85% in Q3 FY 16.

The Cash Recovery from NPA during the nine months stood at the level of Rs.943.49 crore (including sale

of assets of Rs.553.18 cr.).

Ratio improved from 52.48% as on Dec ,14to 60.89% in Dec'15

Provision

-t4-

_.-1

-

--,

Se'-.

r'S

'

Capital Adequacy

The Bank's Capital Adequacy Ratio was at 10.53% (as per Base! l!) as of Dec

maintained at the level of 7.52o/o.

31

Under Basel !l!, the Bank's Capital Adequacy Ratio stood at9.92"/o with the Tier

31st Dec,2015.

I capital at7.12o/o as on

,2015.Its Tier 1 was

Key Financial Ratios

The NIM of the Bank is2.16 %

The Cost to lncome Ratio of the Bank is 51.31%

ln annualized terms, the Bank's Return on Equity (%) stood at 3.36%

The Return on Average Assets 0.05% for Q3 of FY:2015-16

The Bank's Book Value per Share stood at Rs.61.95

Key Strategic Initiatives and awards

1. Enabling of chip based personalized debit card in Card lnventory Module

2. Customization of Sukanya SamriddhiAccount in GBM.

3. Enabling Mobile Banking based payments at Merchant Outlets

4. Participation in Sovereign Gold Bonds 2015, notified by the Reserve Bank of lndia and launched by the

Hon'ble Prime Minister Dtd, the 5th November,2015

5. Participation by Bank in "Start up lndia" program launched by Hon'ble Prime Minister of lndia United

Affordable Housing Loan Scheme (UAHLS) under Pradhan Mantri Awas Yojana for Economically

Weaker Section (EWS) and Low lncome Group (LlG)

6. Launching of Pledge Loan Scheme for implementation under tie up arrangement with the Collateral

Managers, M/s National Collateral Management Services Ltd. (NCML) & M/s. Star Agriwarehousing &

Collateral Management Ltd. (SACML).

7. One of the first banks to launch Mudra Card ( Rupay)

8. The Bank has been awarded with the Certificates of Excellence in October'2015 for maximum coverage

of SSAs (Sub Service Area) and Deposit mobilized under PMJDY.

9. Felicitation of Bank by Forum For lnclusive FinancialSystem (FFIFS) as the Best Bank in West Bengal

under the category of "Highest Deposit in Account opened under Prime Minister Jan Dhan Yojana".

10. eKYC has been activated at the Branch as well as Bank Mitra level.

11. Launched lndia's first chip based RuPay Platinum Card

12. lnternet Banking services enhanced with new products like Flexi Deposit, Cheque Book Request and

Card module

13. DTH recharge service introduced in Mobile Banking

14. The Bank tied up with Kotak Securities to launch share trading product named Trio under the brand UConnect.Under this arrangement, willing customers of the Bank are offered a 3-in-1 Accounts - i.e.

Saving & Demat Accounts with UBI and trading account by Kotak Securities.

15. Bank celebrated its 66th foundation day on 18-12-2015. A series of technology-driven solutions - mobile

wallet services (United Wallet) and IMPS-based cash remittance facility through ba nking

correspondents' handheld d evices - were also launched. Apart from West Bengal Commerce, lndustry

and Finance Minister, Amit Mitra, other senior officials of the bank,

Director, P

Srinvas, was present on the occasion

,:'- --n,il

.

j'

Kolkata

Feb 11p016

,--

",1+''

,)\

Director & CEO

,1,

-.,,.'r,

You might also like

- The Platinum Card®: Page 1 of 4Document4 pagesThe Platinum Card®: Page 1 of 4Emma ChanNo ratings yet

- One Page Summary Millionaire FastLaneDocument9 pagesOne Page Summary Millionaire FastLaneHisfan NaziefNo ratings yet

- Negotiable Instruments Law Reviewer QuestionsDocument11 pagesNegotiable Instruments Law Reviewer QuestionsMelgen100% (1)

- Igrow FEB 2020 PDFDocument38 pagesIgrow FEB 2020 PDFJUstFreddyRahmanNo ratings yet

- Negotiable Instruments Case Digests PDFDocument94 pagesNegotiable Instruments Case Digests PDFAllan Lloyd MendozaNo ratings yet

- Cannon Ball Review Part 2 Cash and ReceivablesDocument30 pagesCannon Ball Review Part 2 Cash and ReceivablesLayNo ratings yet

- Accounting Fraud A Study On Sonali Bank Limited Hallmark ScamDocument42 pagesAccounting Fraud A Study On Sonali Bank Limited Hallmark ScamMostak AhmedNo ratings yet

- Blockchain Unconfirmed Transaction Hack Script PDF FreeDocument2 pagesBlockchain Unconfirmed Transaction Hack Script PDF FreeHealing Relaxing Sleep Music100% (2)

- Harshad Mehta Scam: Made By: Akshay VirkarDocument17 pagesHarshad Mehta Scam: Made By: Akshay Virkarseema sweetNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Financial Performance of Sundaram FinanceDocument53 pagesFinancial Performance of Sundaram FinanceAnonymous lOz8e6tl080% (5)

- Proposal BBS 4th YearDocument12 pagesProposal BBS 4th YearSunita MgrNo ratings yet

- Derivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorDocument90 pagesDerivative Market in India by ICICI, SBI & Yes Bank & Its BehaviorChandan SrivastavaNo ratings yet

- BOB PerformanceDocument33 pagesBOB Performancep2488100% (1)

- Results Press Release For March 31, 2016 (Result)Document4 pagesResults Press Release For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Summary Report OF Dena Bank: Prepared ByDocument6 pagesSummary Report OF Dena Bank: Prepared BySahil ShahNo ratings yet

- Press Release - 20 January, 2012: ST STDocument7 pagesPress Release - 20 January, 2012: ST STNimesh MomayaNo ratings yet

- Results Press Release For December 31, 2015 (Result)Document6 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Results Press Release, Result Presentation For December 31, 2015 (Result)Document34 pagesResults Press Release, Result Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Annual Report 2009-2010 Highlights Federal Bank's Growth and PerformanceDocument88 pagesAnnual Report 2009-2010 Highlights Federal Bank's Growth and PerformanceLinda Jacqueline0% (1)

- FY 2012-13 First Quarter Results: Investor PresentationDocument31 pagesFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNo ratings yet

- Financial Results Dec 2015 PDFDocument23 pagesFinancial Results Dec 2015 PDFprashanthinithangaveNo ratings yet

- Results Press Release For December 31, 2015 (Result)Document3 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document6 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Corporation Bank ReportDocument11 pagesCorporation Bank Reportnit111No ratings yet

- Strategic Business Management: Factors Behind Bank FailuresDocument7 pagesStrategic Business Management: Factors Behind Bank Failuresswarna dasNo ratings yet

- Press Release - Q2 TMBDocument9 pagesPress Release - Q2 TMBDhanush Kumar RamanNo ratings yet

- Axis Bank Q2 profit up 38% to Rs 735 croreDocument7 pagesAxis Bank Q2 profit up 38% to Rs 735 croresmilealwayssgNo ratings yet

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBDocument4 pagesIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeNo ratings yet

- Ing Vy Sy A Bank Limited Annual ReportDocument156 pagesIng Vy Sy A Bank Limited Annual ReportJugal AgarwalNo ratings yet

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingNo ratings yet

- Presentation (Company Update)Document29 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Procredit Alb 2020Document60 pagesProcredit Alb 2020Thomas SzutsNo ratings yet

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document7 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Chapter - 6 Npa Analysis and Interpretation of Data of Kendrapara Urban Co-Operative BankDocument36 pagesChapter - 6 Npa Analysis and Interpretation of Data of Kendrapara Urban Co-Operative BankJagadish SahuNo ratings yet

- Directors Report Year End: Mar '11Document9 pagesDirectors Report Year End: Mar '11sudheerputhraya01No ratings yet

- HDFC Annual Report 2015 16Document220 pagesHDFC Annual Report 2015 16Billy Sam VargheseNo ratings yet

- Quarterly Report March 31, 2012Document38 pagesQuarterly Report March 31, 2012Zubair Ahmad BhuttaNo ratings yet

- Performance Highlights For The Third Quarter of Financial Year 2013-14Document7 pagesPerformance Highlights For The Third Quarter of Financial Year 2013-14NitinSrivastavaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ICICI Bank - ProjectDocument17 pagesICICI Bank - ProjectTejasvi KatiraNo ratings yet

- Consistent Growth All The Way: Allahabad Bank'S Business Crosses ' 2,00,000 CROREDocument6 pagesConsistent Growth All The Way: Allahabad Bank'S Business Crosses ' 2,00,000 CROREMangesh DhawaleNo ratings yet

- Audited Financial Results for Q4 FY15Document4 pagesAudited Financial Results for Q4 FY15Swagata MitraNo ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- GTBank FY 2011 Results PresentationDocument16 pagesGTBank FY 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- FS NBP December2010Document185 pagesFS NBP December2010Abdul Wahab ShaikhNo ratings yet

- JETIR2002031Document5 pagesJETIR2002031adilsk1019No ratings yet

- Project Report-Study On Credit AppraisalDocument57 pagesProject Report-Study On Credit AppraisalPramod Serma100% (1)

- Project Report: Submitted byDocument20 pagesProject Report: Submitted byathiraNo ratings yet

- Results Press Release For June 30, 2016 (Result)Document6 pagesResults Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- TLV 20221111164418 2022-Q3-ReportDocument84 pagesTLV 20221111164418 2022-Q3-Reportafrodita99977No ratings yet

- Bank's Profile September'2021 - EnglishDocument4 pagesBank's Profile September'2021 - EnglishHritik MurjaniNo ratings yet

- 3Q JulyMar 1213Document17 pages3Q JulyMar 1213frk007No ratings yet

- GTBank H1 2012 Results AnalysisDocument17 pagesGTBank H1 2012 Results AnalysisOladipupo Mayowa PaulNo ratings yet

- Earnings Update Q2FY16 (Company Update)Document44 pagesEarnings Update Q2FY16 (Company Update)Shyam SunderNo ratings yet

- Annual Report 2011Document233 pagesAnnual Report 2011Khalid FirozNo ratings yet

- BPR - PNBDocument12 pagesBPR - PNBPravah ShuklaNo ratings yet

- Promotion Reading Material PDFDocument72 pagesPromotion Reading Material PDFkandasamy004No ratings yet

- 4.1 Emergence of Retail Banking BusinessDocument18 pages4.1 Emergence of Retail Banking BusinessSteffy AntonyNo ratings yet

- Procredit Alb 2019Document62 pagesProcredit Alb 2019Thomas SzutsNo ratings yet

- GTBank H1 2011 Results PresentationDocument17 pagesGTBank H1 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- AXIS Bank AnalysisDocument44 pagesAXIS Bank AnalysisArup SarkarNo ratings yet

- Unaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)Document2 pagesUnaudited Financial Results (Quarterly) : As at Third Quarter of The Financial Year 2070/71 (13/04/2014)nayanghimireNo ratings yet

- PressRelease AnnualAccountsDocument2 pagesPressRelease AnnualAccountsAsif IqbalNo ratings yet

- 03-LBP2015 Executive Summary PDFDocument7 pages03-LBP2015 Executive Summary PDFFrens PanlarocheNo ratings yet

- CAMEL evaluation of Kotak Mahindra BankDocument22 pagesCAMEL evaluation of Kotak Mahindra BankAbideez PaNo ratings yet

- Rambling Souls - Axis Bank - Equity ReportDocument11 pagesRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNo ratings yet

- Press Release - Dec 2019Document2 pagesPress Release - Dec 2019RISHI KESHNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- Commercial Banking Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Banking Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Internship ReportDocument40 pagesInternship ReportAneeka ShahzadNo ratings yet

- Finanial Analysis of HDFC BankDocument15 pagesFinanial Analysis of HDFC BankShweta SinghNo ratings yet

- GSISDocument96 pagesGSISHoven MacasinagNo ratings yet

- Argenti A ScoreDocument1 pageArgenti A Scoremd1586100% (1)

- Ponzi SchemeDocument4 pagesPonzi SchemeLaudArchNo ratings yet

- Financial Institutions and Markets Exam Q&ADocument24 pagesFinancial Institutions and Markets Exam Q&AAnonymous jTY4ExMNo ratings yet

- Supervises Controls Agent and Adviser To The Government: Regulates The Activities of Commercial BanksDocument20 pagesSupervises Controls Agent and Adviser To The Government: Regulates The Activities of Commercial BanksYoseph KassaNo ratings yet

- Railway Works HandbookDocument67 pagesRailway Works HandbookSarada DalaiNo ratings yet

- Completing The Accounting CycleDocument18 pagesCompleting The Accounting CycleKaseyNo ratings yet

- Interest Rate Spread On Bank Profitability: The Case of Ghanaian BanksDocument12 pagesInterest Rate Spread On Bank Profitability: The Case of Ghanaian BanksKiller BrothersNo ratings yet

- Money vs Time Weighted ReturnsDocument4 pagesMoney vs Time Weighted ReturnsAmol ChavanNo ratings yet

- Abhay RPR First DrapDocument20 pagesAbhay RPR First DrapAbhay SrivastavaNo ratings yet

- A Study On Credit Risk ManagementDocument44 pagesA Study On Credit Risk ManagementShabreen Sultana100% (1)

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Income Tax Card 2023-24 (Finance Act 2023)Document1 pageIncome Tax Card 2023-24 (Finance Act 2023)shahidNo ratings yet

- Capital Structure Decisions NIDocument34 pagesCapital Structure Decisions NIHari chandanaNo ratings yet

- FC TransactionDocument40 pagesFC TransactionShihab Hasan ChowdhuryNo ratings yet

- 9 Principles of Income Tax LawsDocument82 pages9 Principles of Income Tax LawsVyankatesh GotalkarNo ratings yet

- Bank Reconciliation Statement: Learning OutcomesDocument33 pagesBank Reconciliation Statement: Learning OutcomesAkriti JhaNo ratings yet