Professional Documents

Culture Documents

Strategic Analysis

Strategic Analysis

Uploaded by

Nguyen Thuy QuynhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Analysis

Strategic Analysis

Uploaded by

Nguyen Thuy QuynhCopyright:

Available Formats

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

, GIS ASSESSMENT OF DEVELOPMENT GAPS AMONG ROMANIAN ADMINISTRATIVE UNITS

DIAGNOSIS OF THE INTERNAL STRATEGIC

CONTEXT OF THE COMPANY STRATEGIC

ANALYSIS

Vasile DEAC

Florin Alexandru DUN

Volume 2 Issue 2 / June 2012

Business Excellence and Management

The Bucharest Academy of Economic Studies, Bucharest, Romania

deac_vasile@yahoo.com

The Bucharest Academy of Economic Studies, Bucharest, Romania

florin_duna@yahoo.com

Abstract

The conclusion of the internal strategic diagnostic should not be "we know how to do this" but "how we do it in

relation to main competitors, based on the requirements imposed by the environment , the objective of this

diagnosis being determination of the strengths, weaknesses of the company and its distinctive competencies.

Identifying of the strengths, weaknesses and of the key success factors will allow the company, on the one hand,

to bring remedies to the likely aspects that may compromise its future development, and on the other hand, to

build the strategy based on its distinctive competence.

Keywords: Strategic diagnostic, Strengths, Weaknesses, Key success factors, Fundamental competences.

1. INTRODUCTION

Strategic analysis of a company involves a diagnostic strategic of the external environment (the

strategic analysis of the competitive environment) and a diagnostic strategic of the internal environment

(the internal strategic analysis of the company).

The internal strategic diagnostic of a company intends to investigate its internal potential having in mind

the other competitors positioning the field in which they deploy their activity, thus calculating the relative

position of the company compared to its competitors position in the markets on which it performs.

Its not all about saying we know how to do this, but how we do it compared to others, on the

respective market, this diagnostics objective being determining the strengths and the weaknesses of

the company and its distinctive competences.

The strengths of a company are its characteristics that put it on a superior position compared to the

companies that compete with it, which secures it a competitive advantage (for example: great financial

25

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

resources, owning of patents, a high degree of utilization of the production capacities, a strong

distribution chain etc.).

The weaknesses of a company are its characteristics that puts it on an inferior position compared to the

companies that compete with it (for example, an obsolete technology, high production costs, a rigid

organization, a faulty management, the lack of negotiation abilities with its clients etc.

The distinctive competence of a company represents an ability of a special, exclusive resource it has, a

competence at which the company excels and which represents a competitive advantage, a key

comes to identifying the strength and the weakness! For example, if in a classical diagnostic an

increase of the profit is no doubt a positive aspect, when it comes to an internal strategic diagnostic it

cant be drawn from an increase of the profit the conclusion that its a strong point of the company. In

the first place, this aspect relates to an activity in the past, which may not be relevant for the future and,

in the second place, if a company compares itself to its competitors, the strengths can be represented

by those aspects (the causes) that put the company on a superior position relative to its competitors

and, in the third place, if that profit is distributed as dividends and not in order to exploit some

opportunities of the external environment, in order to consolidate some existent strength or to eliminate

some current weakness, this positive aspect from the companys activity cant be seen as a strength.

Identifying the strengths, the weaknesses and the key success factors will allow the company, on the

one hand, to ameliorate the aspects that might compromise its future development and, on the other

hand, to build its strategy based on its distinctive competence.

Another important issue, which is essential for the strategic diagnostic, is represented by the emphasis

that must be laid on the necessary connection between the external and the internal diagnostic,

because determining if an aspect constitutes a strength or a weakness for the company, respectively if

its an opportunity or a threat is made only comparing and relating to the competition (Popa et al., 2007).

Thus, the existence of skilled workmen can be appreciated as strength only if its reflected through a

superior value (quality) of the products and services the company has to offer, a value which is

acknowledged on the market in which the company offers its products and services. To that effect, we

estimate that the emphasis shouldnt be necessarily laid on a certain order, but on the highlighting of the

influence of the two environments: the external and the internal one over the companys activity. Having

in mind the new characteristics of the external environment of the company, we believe that in the

26

Volume 2 Issue 2 / June 2012

The same confusion is unfortunately made even in the specialty literature from our country, when it

Business Excellence and Management

success factor.

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

, GIS ASSESSMENT OF DEVELOPMENT GAPS AMONG ROMANIAN ADMINISTRATIVE UNITS

current stage and in the future, the external environment has and will continue to have a greater area of

influence and, as a consequence, any action of strategic diagnostic of a company must start with the

external strategic diagnostic and to continue with the internal strategic diagnostic (Carstea et al., 2002).

In the specialty literature from our country, in the early 90s there were written a lot of papers about the

way a company diagnostic must be performed (and in many cases, these papers spoke about the

strategic diagnostic, because it sounded right), suggesting a lot of strategies to do this, structured in

various ways, to the extent of suggesting to measure the companys global internal potential, based on

the evaluation of the various internal factors, using grades and coefficients of importance (without

those attempts, the essential characteristics that we highlighted at the beginning of this paper were

Volume 2 Issue 2 / June 2012

Business Excellence and Management

specifying how they were established from the first place). We believe that, in the most of cases, in

overlooked.

In this article, we intend to approach from a different perspective the internal strategic diagnostic, having

in mind the real purpose of this undertaking and its connection with the external strategic diagnostic.

We believe that an internal strategic diagnostic undertaking must allow a companys management:

to identify the strengths and the weaknesses of the company both on the whole and of its

various strategic fields of activity;

to allow a comparison of a companys strengths and weaknesses with the ones of the

competition;

to allow an evaluation of the relative position of a company compared to an ideal company

profile imposed by the external environment and the competitors position;

to allow the establishing of the companys strategic potential in terms of existent or possible

competitive advantages in relation to the competition.

The diagnostic of a companys internal potential groups the following four partial diagnostics [8], that will

allow a company to understand the true sources of existent competitive advantage and to identify the

way in each it can reinforce an existent advantage or to create a new one.

the strategic diagnostic of the resources, which intends to identify the assembly of

technical, human, financial and both external and internal informational resources which the

company can exploit to apply and consolidate its strategy;

the strategic diagnostic of the companys competences, respectively the identification of

the advantages, of the key success factors, of the savoir faire of that company. This

27

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

diagnostic will allow the reinforcement of the competitive advantage in the fight for supremacy

with the competitors, using these distinctive competences;

the value chain analysis, which allows the systematic identification of the sources of

competitive advantage of the company and of its activities;

the financial diagnostic, which will allow a better positioning of the company compared to its

main competitors in terms of efficiency and effectiveness.

about the resources of the company, on the whole and at the level of each field (segment) of strategic

activity, regardless of the field of activity. It can be done a systematization of the most important aspects

regarding the companys resources, for ulterior analysis, for different lines of activity in that company, as

it results from the Table 1.

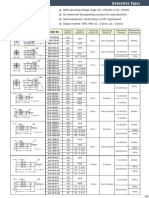

TABLE 1 - DIAGNOSIS OF COMPANY RESOURCES

FIELD OF

ACTIVITY

Commercial

Production

Research and

Development

CHARACTERISTICS

- range of products

- product quality

- market shares for products

marketed- prices

- customer loyalty

- quality and cost of distribution

- promotion policy

- sales forces used after-sales

services, etc.

- production equipment

- technology used

- capacity and its use

- the production cycle

- production costs

- location of production units

- experience and scale effects

- unfinished production stocks,

etc.

- new and upgraded products

- innovations, rationalization

- research and development

potential, etc.

FIELD OF ACTIVITY

CHARACTERISTICS

Human Resources

- staff structure

qualification

of

personnel,

recruitment and selection

- motivation system

- communication system

- working conditions

- use of work time, etc.

Financial

- sources of funding

- profitability

- debs

- liquidity and solvency

- capital assets, etc.

Management

- the size and the organization of the

management

- organizational flexibility

- decision-making process

- administrative procedures

- control process

- managerial methods and techniques

used, etc.

After we establish the characteristics of the resources involved in the respective fields, they should be

evaluated; this evaluation may be performed categorizing the aspect that should be diagnosed in

28

Volume 2 Issue 2 / June 2012

When it comes to this diagnostic, in the first stage there are collected a range of data and information

Business Excellence and Management

2. THE STRATEGIC DIAGNOSTIC OF THE RESOURCES

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

, GIS ASSESSMENT OF DEVELOPMENT GAPS AMONG ROMANIAN ADMINISTRATIVE UNITS

several performance classes (for example, weak, relatively weak, average, relatively high and

high), an aspect that will allow to establish the profile of the competitive capacity of the company on

the whole and of each segment of strategic activity, as it results from the Figure 1. We have to specify

that the process of categorizing in a certain performance class is not done as such, but in terms of

strengths and weaknesses. Categorizing the production costs in the relatively weak category doesnt

Volume 2 Issue 2 / June 2012

Business Excellence and Management

imply that the production costs are relatively low, but, on the contrary, that they are relatively high.

FIGURE 1 PROFILE OF THE COMPETITIVE STRENGTH OF A COMPANY ON A STRATEGIC BUSINESS SEGMENT

We have to specify that the categorizing of a certain characteristic in a certain performance category is

often a subjective one; no matter how many internal sophisticated economic and mathematic

estimations are made, we cant eliminate the subjective aspect, especially having in mind that the

estimation of a characteristic as a strong or weak point will be done according to the profiles of the main

competitors capabilities and the one imposed in the competitive environment (figures 2 and 3).

It can be noticed from the figure no. 1 that the only aspect in which the company is superior to others is

that it isnt indebted to no one. If we keep in mind the current financial context, many will certainly say

that its extraordinary not to be in debt, in this crisis context, but, if we relate to the requirements of the

environment and to the competitors (figure 3 and 2), this positive aspect could transform into a

weakness for the company. From the ideal profile imposed by the environment (figure 3), it can be

drawn the conclusion that in the segment of strategic activity weve analyzed, it may be an usual

29

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

practice to pay the strategic suppliers relatively late, and the fact that the respective company isnt in

debt, in relation to the position of the main competitor in this aspect (figure 2), we inevitably draw the

logical conclusion that the negotiation power with the strategic suppliers of the company is on their part,

the respective company being an insignificant client and, as a consequence, it doesnt benefit from the

The importance of this diagnostic stands in the fact that:

it allows the identification of some elements (aspects) that are really weaknesses having the

competition in mind and relative to the requirements of the environment, highlighting the fact

that an effort is necessary to be made if the company wants to reduce the difference between

its existent performance and the one imposed to it by the environment;

it allows the identification of these elements (aspects) that are really strengths, based on

which the company will have to consolidate its position or to build its strategy.

The identification of the strengths and the weaknesses in the strategic resources diagnostic is a

necessary action, but its not a sufficient one when its performed the internal strategic diagnostic,

because it doesnt allow an estimation to be done about their importance in the strategic plan and these

30

Volume 2 Issue 2 / June 2012

FIGURE 2 COMPARISON BETWEEN THE COMPETITIVE ABILITY PROFILE OF THE COMPANY AND THE MAIN COMPETITORS

Business Excellence and Management

facility of paying in time. As a result, this aspect can be transformed into a weakness.

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

, GIS ASSESSMENT OF DEVELOPMENT GAPS AMONG ROMANIAN ADMINISTRATIVE UNITS

resources cant be placed in a hierarchy according to their strategic importance. As a result, after this

first type of diagnostic it must be performed the diagnostic of the companys competences.

3. THE STRATEGIC DIAGNOSTIC OF THE COMPANYS COMPETENCES

In more than a few cases a companys success in a certain segment of strategic activity depends not

only on its advantages on that specific line of business, but on a series of aspects related to the whole

company. In general, at a companys level, when it comes to strategy, there are three main categories

of competence (Thietart and Xuereb, 2009): additional competence, necessary competence and

Volume 2 Issue 2 / June 2012

Business Excellence and Management

fundamental competence.

FIGURE 3 COMPARISON BETWEEN THE COMPETITIVE ABILITY OF THE COMPANYS PROFILE WITH THE ONE REQUIRED BY

THE COMPETITIVE ENVIRONMENT

The additional competences are related to the companys existence itself, not being related to the line

of business of the company. For example, the companies which keep their own accountancy or those

who keep track of their own stuff, have a minimum of competences in accountancy, respectively in labor

law and wage plans.

These competences are widely spread inside companies, they allow their good management, and just

in a few cases they can consist in a value source for the company and the clients, thus being elements

of competitive advantage.

31

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

Necessary (specific) competences are tightly related to the companys line of business.

In order to deploy an activity in any line of business, all the companies which want to take part to that

line of business must have some absolutely necessary capabilities (a certain technical facilities, a

certain qualification and structure of the labor force, a certain structure of the costs) and, generally

speaking, the majority of the companies in a certain field have the competences that are specific to that

field. There can be some differences between the level of competences of different companies, related

to the level of these competences, the level of the necessary expertise, but the company cant build its

being easy to eliminate (even through the simple process of imitation).

The fundamental competences are the ones which are given by those unique or extremely rare

advantages which a company has in its respective line of business. For a capability a company has to

situate in the category of fundamental competences, it must comply with the following requirements:

to belong to several strategic lines of business;

to contribute in a significant way at the process of creating value for the clients,

to be a distinctive one and hard to emulate by the competition.

In order to have a fundamental competence, you dont necessarily have to invest a lot of money

(especially in the research and development field) and you dont have to integrate the activities as much

as some people tend to believe. These aspects help to create a fundamental competence, but there

arent enough to create a new fundamental competence.

The fundamental competence stems in the unique body of knowledge a company has and from its

capacity to coordinate and integrate its various structures in using this body of knowledge.

The strategic diagnostic of the competences allows the establishment of a global portfolio of

competences, which are the basis necessary for substantiating the decisions of using these

competences according to the environment of each segment of strategic activity that has been

analyzed. An efficient management of the competences portfolio will, on one hand, allow to obtain a

competitive advantage by using the fundamental competences or some competences which are specific

to a certain line of business in other lines of business, where the competition doesnt have this specific

competence (the portfolio of activities being different from one company to another), and, on the other

hand, can consist in a source of synergy between the various activities of the company.

32

Volume 2 Issue 2 / June 2012

(which is an absolutely necessary requirement), the differences between the necessary capabilities

Business Excellence and Management

strategic competitive advantage based on these differences, because there isnt something constant,

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

, GIS ASSESSMENT OF DEVELOPMENT GAPS AMONG ROMANIAN ADMINISTRATIVE UNITS

4. THE VALUE CHAINS ANALYSIS

In order to establish the sources of the competitive advantage, the specialists suggested various

analysis models; a model which was adopted by a lot of specialist is the one suggested by M. Porter

and its entitled the value chain (Porter, 2008), a well known model, therefore we will not address the

issue.

5. THE FINANCIAL DIAGNOSTIC

strategic advantage; on the contrary, its perceived as a constraint. This kind of approach from a

Volume 2 Issue 2 / June 2012

Business Excellence and Management

As a rule, a companys financial policy is not perceived as a factor of competitive differentiation, not as a

strategic perspective can prove to be dangerous on the long term, having in mind the tight connections

between the finances and the share markets, the growing dynamic, the portfolio strategy, the price

strategy, etc. The financial risk and the competitive risk are tightly related one to another.

The financial diagnostic represents one of the most used way of measuring a companys performance

making a ratio between the financial means it had and the results. A range of efficiency indicators are

considered in this analysis.

profitability indicators: the commercial profitability ratio, the economic profitability ratio, the

assets profitability ratio, the financial profitability of the capital belonging to a company, the

stocks profitability, etc.;

indicators regarding the financial balance: the general liquidity ratio, the immediate liquidity

ratio, the global financial autonomy ratio, etc.;

indicators regarding the claims and debts: the period of recuperation of the claims (debts) , the

degree of indebtness, the global indebtness degree, etc.;

indicators regarding the activity of a company: the degree of utilizing of the production capacity,

the working efficiency, the efficiency of the utilization of the production equipment, the

efficiency of the assets utilization, etc.;

indicators regarding the costs: the allocation of the costs between various activities, the costs

structure, etc.

The main constraint regarding the financial diagnostic results from the difficulty with which some

pertinent and detailed information about the competitors are obtained. The publishing of the accounting

33

Deac V. and Dun F.A.

DIAGNOSIS OF THE INTERNAL STRATEGIC CONTEXT OF THE COMPANY STRATEGIC ANALYSIS

audit by companies and comparing various indicators at the level of the whole company dont provide

enough amount of strategic information, especially when it comes to a company which has multiple

segments of strategic activity.

Generally speaking, having in view the difficulty with which the necessary information regarding the

competition and the large amount of money invested can be obtained, the companies appeal to various

ways to obtain the information needed (information published by the respective companies), keeping in

the windy side of law (collecting information from the clients, suppliers, banks, recruiting the

improve the quality and the performance. Benchmarking basically represents the systematic collection

of data and information regarding the products, the activities, the managerial processes, the

performance indicators, etc. of the companies from the same line of business or of the top companies

from other lines of business, comparing them with the ones of the company. These comparisons will

allow the identification of the actions that must be done to increase the competitive advantage and,

implicitly, the companys performance.

REFERENCES

Crstea, G., Deac, V., Popa, I. and Podgoreanu, S. (2002), Analiza strategic a mediului concurenial,

Bucureti: Editura Economic.

Ducreux, J.M., Abate, R. and Kachaner, N. (2009), Le grand livre de la strategie, Paris: Editions

dOrganisation.

Garibaldi, G. (2009), Analyse strategique, Paris: Editions dOrganisation.

Popa, I., Cicea, C. and Dobrin, C. (2007), Modern Techniques for Documentation in the Managerial

Diagnosis, The International Journal of Interdisciplinary Social Science, 2(1), 337-345

Porter, M.E. (1982), Choix strategiques et concurence, Paris: Editions Economica.

Porter, M.E. (2008), On competition, Harvard Business Review Book.

Prahalad, C.K. and Hamel, G. (1990), The Core of the Competencies of the Organisation, Harvard

Business Review.

Thietart, R.A. and Xuereb, J.M. (2009), Strategies. Concepts. Methodes. Mise en oeuuvre, Paris:

Editions Dunod.

34

Volume 2 Issue 2 / June 2012

Lately, more and more companies appeal to benchmarking as an innovative technique and a method to

Business Excellence and Management

competitors key staff, etc) and even transgressing the law (appealing to industrial espionage).

You might also like

- AC03 Pramac Operator Guide EnglishDocument7 pagesAC03 Pramac Operator Guide Englishnicoss69100% (16)

- Mtcna - Training - materials-JAN 2023Document353 pagesMtcna - Training - materials-JAN 2023Giovanni Kuncara100% (1)

- M E S Project: Arket Ntry TrategyDocument26 pagesM E S Project: Arket Ntry Trategygeddun100% (1)

- Marketing Report With Reference To Sainsbury'sDocument17 pagesMarketing Report With Reference To Sainsbury'sAdnan Yusufzai100% (2)

- Lifestyle Upper - Intermediate CB 2012 177p PDFDocument177 pagesLifestyle Upper - Intermediate CB 2012 177p PDFMonicaMartirosyan100% (1)

- PWC Feedback Program FY13 FAQs PDFDocument13 pagesPWC Feedback Program FY13 FAQs PDFsupriyacnaikNo ratings yet

- Ey The Contingent Workforce PDFDocument21 pagesEy The Contingent Workforce PDFmogaliess sultanNo ratings yet

- Diesel Electric Power Plant - Bueno, Durante, Lariosa, Padla, TejereroDocument105 pagesDiesel Electric Power Plant - Bueno, Durante, Lariosa, Padla, TejereroJune Paulo Tejerero100% (3)

- Psy 1129Document7 pagesPsy 1129Satya Priya MishraNo ratings yet

- Financial Policy and Procedure Manual Template: How To Complete This TemplateDocument23 pagesFinancial Policy and Procedure Manual Template: How To Complete This TemplatecizarNo ratings yet

- Resume - Shamanth RaoDocument3 pagesResume - Shamanth RaoShamanth42No ratings yet

- How To Develop KpiDocument13 pagesHow To Develop KpiNarendra AsharNo ratings yet

- IV Strategic QuestionDocument5 pagesIV Strategic QuestionMeredith HamNo ratings yet

- Sample COO Job Description Operations Administration-FocusedDocument3 pagesSample COO Job Description Operations Administration-FocusedKarthick DhanasekaranNo ratings yet

- Performance Planning & Appraisal - Unit 2Document30 pagesPerformance Planning & Appraisal - Unit 2Anonymous TSXYi59ATv100% (1)

- Categorization of CompetenciesDocument3 pagesCategorization of CompetenciesAditi Ameya KirtaneNo ratings yet

- The Organizational Context: (Chapter 2)Document24 pagesThe Organizational Context: (Chapter 2)Muhammad AbdullahNo ratings yet

- Balanced ScorecardDocument9 pagesBalanced ScorecardSonali SinhaNo ratings yet

- Design ThinkingDocument15 pagesDesign ThinkingDevendra Sathawane0% (1)

- Marketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Document13 pagesMarketing Management: New Era University Graduate School of Business Master of Business Administration (Mba)Saima Binte IkramNo ratings yet

- 8 Steps Ebook Kotter 2018 PDFDocument34 pages8 Steps Ebook Kotter 2018 PDFWidodo DumadiNo ratings yet

- PWC Challenge 2020 - Round 1 PDFDocument4 pagesPWC Challenge 2020 - Round 1 PDFGarima TyagiNo ratings yet

- Deloitte - Sample Cases 20141210 - v2Document13 pagesDeloitte - Sample Cases 20141210 - v2Aman BafnaNo ratings yet

- Session 2 SR2a PMI - Pulse - 2014Document20 pagesSession 2 SR2a PMI - Pulse - 2014Chaitra MuralidharaNo ratings yet

- Performance Measurement of Human Resource by Design A Human Resource ScorecardDocument6 pagesPerformance Measurement of Human Resource by Design A Human Resource ScorecardMohamadchya HamasaiedNo ratings yet

- Project Work Specifications PDFDocument3 pagesProject Work Specifications PDFquiddivinumNo ratings yet

- Creating A Business Development FrameworkDocument31 pagesCreating A Business Development FrameworkRoel DagdagNo ratings yet

- Job Satisfaction SalaryDocument50 pagesJob Satisfaction SalaryCristiana GhermanNo ratings yet

- Erp Project Manager PDFDocument2 pagesErp Project Manager PDFHayleyNo ratings yet

- Introduction of Performance AppraisalDocument7 pagesIntroduction of Performance AppraisalMichael BobNo ratings yet

- The Business Vision and Mission: Chapter TwoDocument24 pagesThe Business Vision and Mission: Chapter Twofahadfiaz100% (1)

- ARGUS Global Compliance PolicyDocument8 pagesARGUS Global Compliance Policyxiaoshuang duanNo ratings yet

- Assesing Project Management MaturityDocument12 pagesAssesing Project Management MaturityFatima KhalidNo ratings yet

- Scorecard and KPI 101Document6 pagesScorecard and KPI 101Manuel Jesus Anhuaman ZamoraNo ratings yet

- What Is A Strategy MapDocument18 pagesWhat Is A Strategy MapThayuri WickramapalaNo ratings yet

- Strategic Objectives in OrganizationDocument2 pagesStrategic Objectives in Organizationshafiqkhan120% (1)

- Cascading The Balanced Scorecard - A Case Study On Nova Scotia PowerDocument12 pagesCascading The Balanced Scorecard - A Case Study On Nova Scotia Powergschiro100% (9)

- Role of CEO 3Document7 pagesRole of CEO 3Prateek Vaishali PahujaNo ratings yet

- Peer-Graded Assignment Strategy Implementation Plan For E-TypesDocument2 pagesPeer-Graded Assignment Strategy Implementation Plan For E-TypesMihailNo ratings yet

- Global IT Project Management Survey 0508Document40 pagesGlobal IT Project Management Survey 0508surnj1No ratings yet

- TAPS - Balanced Score CardDocument6 pagesTAPS - Balanced Score Cardcesame81No ratings yet

- Exploring The Impact of Knowledge Management KM Best Practices For Project Management Maturity Models On The Project Management Capability ofDocument7 pagesExploring The Impact of Knowledge Management KM Best Practices For Project Management Maturity Models On The Project Management Capability ofDarlingtonGwenhureNo ratings yet

- TPPA PWC CBA - Final Report 021215 FINAL (Corrected)Document324 pagesTPPA PWC CBA - Final Report 021215 FINAL (Corrected)jhtan84No ratings yet

- Critical Review of Performance Management System at Telenor PakistanDocument7 pagesCritical Review of Performance Management System at Telenor PakistanFaisal Ahmad Jafri0% (1)

- Balanced Scorecard Basics (BSC)Document5 pagesBalanced Scorecard Basics (BSC)ni gede agung septiNo ratings yet

- Crafting StrategyDocument20 pagesCrafting StrategySameer PatelNo ratings yet

- Strategic Review Plan Template - SampleDocument22 pagesStrategic Review Plan Template - SamplemhlgoswamyNo ratings yet

- Strategic MGT MidtermDocument15 pagesStrategic MGT MidtermFayaz ThaheemNo ratings yet

- HR BrochureDocument2 pagesHR BrochureEazeWorkNo ratings yet

- EY - Consulting - RISK Internal Audit - ManagerDocument2 pagesEY - Consulting - RISK Internal Audit - ManagermadhuNo ratings yet

- How Important Is Decision Making in An OrganizationDocument3 pagesHow Important Is Decision Making in An OrganizationMairaj SiddiquiNo ratings yet

- Utilizing Kpis in Evaluating Academic Programs: Prof. Shaker Rizk Suez Canal UniversityDocument28 pagesUtilizing Kpis in Evaluating Academic Programs: Prof. Shaker Rizk Suez Canal UniversityShailendra Kumar SinghNo ratings yet

- Principles of Management Final Project GuidlinesDocument2 pagesPrinciples of Management Final Project GuidlinesAiman Fatima100% (1)

- Cadbury SMDocument8 pagesCadbury SMSmrutiranjan MeherNo ratings yet

- Performence Evalution FormDocument10 pagesPerformence Evalution FormJagat PatelNo ratings yet

- BUS3103 Assessment 3 Market Entry Report 201620Document6 pagesBUS3103 Assessment 3 Market Entry Report 201620Shoaib AhmedNo ratings yet

- HR Salary Survey TemplateDocument6 pagesHR Salary Survey TemplateJackson OyamoNo ratings yet

- Corporate Culture of VWDocument2 pagesCorporate Culture of VWUsman MahmoodNo ratings yet

- Strategic ManagementDocument4 pagesStrategic ManagementГендов ВалерийNo ratings yet

- PI-KPI Conference DubaiDocument9 pagesPI-KPI Conference DubaiTeodoraNo ratings yet

- Balanced Score CardDocument18 pagesBalanced Score CardRavi ShankarNo ratings yet

- Professional Marketing Competencies 2016 - InteractiveDocument19 pagesProfessional Marketing Competencies 2016 - InteractiveOriginalo VersionaNo ratings yet

- Uptime Maintenance Planner: Service IntervalsDocument2 pagesUptime Maintenance Planner: Service IntervalsJohn GrayNo ratings yet

- Assignment 3Document9 pagesAssignment 3Guillermo Rodriguez100% (1)

- Kitchen ErgonomicsDocument103 pagesKitchen ErgonomicsniknasnaimNo ratings yet

- The Companies Act, 2013: Learning OutcomesDocument40 pagesThe Companies Act, 2013: Learning Outcomesmap solutionsNo ratings yet

- Report LR BYOD 1Document29 pagesReport LR BYOD 1Bukan PujanggaNo ratings yet

- 2024년 수특+03강 유형별변형문제.hwpDocument59 pages2024년 수특+03강 유형별변형문제.hwpzhengyujin28No ratings yet

- Toc Pmt2204-Eng SFC2022Document8 pagesToc Pmt2204-Eng SFC2022Moez BellamineNo ratings yet

- How To Set WinDbg As A Default Windows Postmortem DebuggerDocument2 pagesHow To Set WinDbg As A Default Windows Postmortem DebuggeranilkumarjvjNo ratings yet

- PTB Gloria Ventura DraftDocument7 pagesPTB Gloria Ventura DraftPatrick TanNo ratings yet

- Bangladesh Threatens To Blacklist Non-Paying British BrandsDocument3 pagesBangladesh Threatens To Blacklist Non-Paying British BrandsshuvojitNo ratings yet

- International Business DirectoryDocument1 pageInternational Business DirectoryIvy Michelle HabagatNo ratings yet

- Instalar o Hyper-V Dentro Da Máquina Virtual Utilizando o VirtualboxDocument4 pagesInstalar o Hyper-V Dentro Da Máquina Virtual Utilizando o VirtualboxmariodesaNo ratings yet

- Agricultural Policy in NigeriaDocument6 pagesAgricultural Policy in NigeriaEmmanuel Umo Effiong100% (1)

- Cloud Pentesting CheatsheetDocument22 pagesCloud Pentesting CheatsheetLuis De Santana100% (1)

- Dufferin Construction Company Job OfferDocument3 pagesDufferin Construction Company Job OfferHimani PandeyNo ratings yet

- Osurnia Epar Product Information - en PDFDocument19 pagesOsurnia Epar Product Information - en PDFVicentiu PredescuNo ratings yet

- Outline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodDocument2 pagesOutline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodAgus YohanesNo ratings yet

- CommBox Interactive Classic V3 Brochure 2020 v1Document8 pagesCommBox Interactive Classic V3 Brochure 2020 v1Andreas DarmawanNo ratings yet

- Inventive Pricing of Urban Public TransportDocument19 pagesInventive Pricing of Urban Public TransportSean100% (1)

- Small Businesses and Their Challenges During COVID 19 Pandemic in Developing Countries: in The Case of EthiopiaDocument14 pagesSmall Businesses and Their Challenges During COVID 19 Pandemic in Developing Countries: in The Case of EthiopiaRegor AguinaldoNo ratings yet

- Datasheet Solis 110K 5GDocument2 pagesDatasheet Solis 110K 5GAneeq TahirNo ratings yet

- Dune 2000 Gruntmods Edition ManualDocument43 pagesDune 2000 Gruntmods Edition Manualkrishna murtiNo ratings yet

- WRO 2017 Regular Category Junior PDFDocument17 pagesWRO 2017 Regular Category Junior PDFAlaas AlvcaszaNo ratings yet

- Library BduDocument71 pagesLibrary BdushivaNo ratings yet

- HRKL - ISSB EOT RPM Delay Event Analysis R1Document11 pagesHRKL - ISSB EOT RPM Delay Event Analysis R1Loges SinniahNo ratings yet

- Huawei Parameters Used For PS ActivationDocument4 pagesHuawei Parameters Used For PS ActivationAnton HardoffNo ratings yet