Professional Documents

Culture Documents

PR and The Party - The Truth About Media Relations in China - en

PR and The Party - The Truth About Media Relations in China - en

Uploaded by

MandyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PR and The Party - The Truth About Media Relations in China - en

PR and The Party - The Truth About Media Relations in China - en

Uploaded by

MandyCopyright:

Available Formats

MSL China Executive Whitepaper

PR and the Party

- the truth about media relations in China

By Bill Adams, Catherine Cao, Linda Du and Charlotta Lagerdahl

Chinese Media

State Controlled or Freewheeling Tabloids?

As China becomes more important to MNCs, Communications and Public Affairs

About MSL China

executives at global headquarters are being asked to provide support for company

Following the union with Eastwei MSL, MSL China is now a top 5 international strategic communications

business plans in China, as well as ensuring that local political or market issues do

agency in Mainland China. With 200 colleagues across 4 offices, MSL China brings together over

not negatively influence global business or their reputation. Most business failures in

20 senior consultants with more than 12 years of strategic communications experience in this key

China from market entry difficulties or blocked mergers & acquisitions, to product

global market. Part of MSLGROUP Greater China, the largest PR & social media network in the region

flops and media crises are due to strategic misalignment and lack of communication

today, MSL China provides knowledge driven, integrated campaigns and advisory services spanning

between head office and local management. These problems could have been avoided if

nearly every industry and communications discipline. MSL China has received recognition from the

International Business Awards, The Holmes Reports PR Agency of the Year, the China International

PR Association and Chinas New Media Festival for its creativity and effectiveness in strategic

communications leaders at headquarters had been more in touch with their local proxies

and had a better understanding of the market.

communications and industry-leading social media offering.

Invariably, corporate heads of communications must rely on local colleagues and

consultants for support. But the Chinese communications landscape is complex, fluid,

and often contradictory how can you evaluate communication plans and messages in

a market characterized by state censorship and a sensationalizing, profit-driven media

serving the worlds largest group of Internet users and consumers? And when things

About MSLGROUP

MSLGROUP is Publicis Groupes speciality communications and engagement group, advisors in all

go wrong, and youre the one in headquarters explaining to your CEO why Chinese

newspapers or bloggers have placed your brand in the crosshairs, will you be able to

explain how the Chinese media works and why it behaves the way it does?

aspects of communication strategy: from consumer PR to employee communications, from public

affairs to reputation management and from crisis communications to event management. With more

than 3,000 people, its offices span 22 countries. Adding affiliates and partners into the equation,

MSLGROUPs reach increases to 4,000 employees in 83 countries. Today the largest PR network in

At MSL China we believe that in order to be effective in China, global PR and PA leaders

need to:

Greater China and India, the group offers strategic planning and counsel, insight-guided thinking and

big, compelling ideas followed by thorough execution.

Learn more about us at:

www.mslgroup.com http://blog.mslgroup.com Twitter YouTube

Understand which media are important and why

Know how Chinese media differ from their counterparts in the West

Apply best global PR practices adapted to local market conditions

This whitepaper, based on nearly two decades of advising multinational companies in

China, provides some guidelines and best practices for accomplishing these goals. We

have structured it as a China media primer for global communications executives;

providing local context and suggestions for how to best navigate the media market.

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

Media Landscape

With the worlds third largest advertising market, print, broadcast and digital media

are thriving in China. Even with the active participation of propagandists and censors,

Chinas hybrid of state-controlled and commercial media is an incubator for fledgling

media empires, muck-raking journalists and cutting-edge Internet platforms. Below

is a description of key media channels for corporate communications and marketing

campaigns.

Newspapers

China is a leading newspaper market with over 2,000

in print and over 100 million total copies sold daily

(compared to less than 1,500 in the United States and

51 million total copies sold daily). Unlike their Western

peers, Chinese newspapers

are not in financial distress;

print news media are still very

healthy.

others looking for the latest information and insights on

government policies and data, cannot afford to ignore

the official newspapers. PR professionals and marketers

in China are keenly aware of the value of appealing to

both categories in order to reach a broad readership.

Most newspapers are localized, and different regions

have distinctive characteristics. For example, Beijing

papers tend to be more

politically oriented; Guangzhou,

on the other hand borders

freewheeling Hong Kong, so

its newspapers often push the limits of government

censors. Every major city has one or two local papers

with wide distribution, but few reach national audiences.

Like their peers in the West, most people in China tend

to read their local paper.

Business News Media

During the 1990s, Chinas market economy began to expand rapidly and business media flourished along with it.

While chief editors in other sectors remained hyper-sensitive to government controls in the immediate aftermath

of the Tiananmen Square events of 1989, those in business media were given more leeway to operate and cover

capital markets and at times act as watchdogs for the fledgling market economy. The China Securities Regulatory

Commission (CSRC), the PRCs equivalent of the US Securities and Exchange Commission, explicitly supported

business media serving as unofficial regulators to monitor financial corruption.

Many of todays most talented Chinese journalists launched their careers in the business press, which at the

time offered higher salaries and more freedom to operate. By 2000, with economic reforms bolstered by Chinas

preparations to enter the W TO,

business media diversified and

multiplied with many new titles

reporting on the wider aspects of

Chinas political economy. However,

while the government values the role

of an independent press in a market economy, it still favors its own media and uses these resources to maintain its

influence. For example, the CSRC designates certain papers and magazines, such as the China Security News and the

Security Times as the only official forums for listed companies to disclose financial reports and official statements.

..most talented Chinese

journalists launched their

careers in the business press

Most newspapers

are localized

Although most media in China are ultimately stateowned, newspapers and magazines can be divided into

two categories: official state-run and independentcommercial. Almost all of the independent-commercial

publications are part of media groups led by Party or

government newspapers, but they behave differently.

Both kinds of newspapers must compete in the market,

rely on circulation and advertisement for revenue, and

are subject to the same system of censorship. However,

official newspapers are older, conservative institutions

that tend to act as the mouthpieces of the government

or Party; whereas independent-commercial papers were

created after a wave of commercialization spurred by

economic reforms and are more consumer driven.

While both categories of newspapers are capable of

producing a professional level of journalism, official

media tend to be fairly sanitized, and the independentcommercial outlets can verge on the sensational.

Consumers gravitate towards the independentcommercial newspapers because of their hard-won

reputation for investigative journalism and tantalizing

content. However, bureaucrats, business leaders, and

This provincial focus remains in place even though most

local newspapers host dynamic websites. However, the

Internet has changed the way stories travel inside China.

A popular story can quickly become national news, even

when local cadres attempt to suppress it. For example,

when Xiamen officials attempted to use local media

to downplay protests over perceived dangers of a local

chemical factory, the story was widely covered by other

newspapers around the country and spread despite the

local efforts to suppress it.

Other developments to note: most major newspapers

now provide an online version; some use Weibo (a

Chinese equivalent of Twitter) and other social media

accounts. Many such as CBN Weekly, Oriental Morning

Post, and China Daily have iPad or iPhone apps as well.

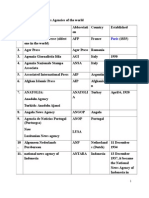

Top 20 Newspapers by Circulation

1. Reference News () 3,180,000

13. Yanzhao Metropolis News () 995,000

2. Peoples Daily () 2,800,000

14. Qianjiang Evening () 951,000

3. Yangtze Evening Post () 1,800,000

15. Urban Express () 950,000

4. Guangzhou Daily () 1,680,000

16. This Evening () 910,000

5. Information Times () 1,480,000

17. Peninsula City Daily () 900,000

6. South Metropolis News () 1,400,000

18. Southern Daily () 850,000

7. Yangcheng Evening News () 1,170,000

19. Wuhan Evening () 850,000

8. Chutian Dushibao () 1,140,000

20. Dahe News () 830,000

9. News Express () 1,130,000

10. Qilu Evening News () 1,050,000

11. Global Times () 1,040,000

12. Xinmin Evening News () 998,000

Source: Baidu Zhidao (Media claims of their size of circulation

are unverifiable; this list is for reference only and indicates

relative market position of Chinas leading newspapers.)

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

Lifestyle

Media

Internet

Portals

Television

Lifestyle media in China have proliferated along with

the growth of the Chinese middle-class and consumer

culture. Many of the Wests leading lifestyle magazines,

including Cosmopolitan, VOGUE, GQ, Mens Health, Elle,

and Harper's Bazaar now produce Chinese editions.

Due to their reputation as premium international

publications and their readerships high income level,

these publications have among the highest advertising

revenues in the market. Meanwhile, Chinas homegrown

lifestyle media remain the most adept at using local

insight to catch reader attention, and offer their glossies

at lower prices.

The largest commercial news websites in China are

owned by Sina, Sohu, Netease and QQ, the first three of

which are listed on NASDAQ. Second only to television,

these portals are key sources of information in China

the first place younger and more highly educated people

go for news. Since government regulations prevent

these sites from producing their own news, they have

become aggregators of content, compiling stories from

other media while allowing Internet users to voice their

opinions through blogs, micro-blogs and electronic

bulletin boards. Blogging and micro-blogging have

become especially popular in China as many journalists

blog to share views they might otherwise be unable to

express in their full-time media jobs.

Television is king in China

Because young Chinese consumers are, in the vast

majority of cases, the first generation in their family

to enjoy high disposable incomes, they have a

voracious appetite for topics such as fashion trends,

new technologies, and health & leisure. Case in point:

by focusing on advising nouveau riche men on which

clothes and

accessories

to wear, which

cars to drive

and what ultrastylish cuttingedge smart phone will best help them to manage their

lives, fashion magazines for men have achieved an

annual growth rate of more than 30% in China since

2006.

Web portals such as Sina and Sohu can be regarded

as just another form of traditional media, but China

is also a leading social media market more than 265

million people log on to the Chinese equivalents of

Yo u Tu b e , F a c e b o o k ,

Tw i t te r, a n d L i n ke d I n .

Social media have already

become a critical area

for all communications

professionals, and

no media strategy is complete without them. (See

MSL Chinas whitepaper Best Practices in Chinese

Microblog Communications for more information on this

fast-changing topic.)

many journalists maintain

blogs and microblogs to

share views

State-controlled television is king in China. It is the

farthest-reaching medium, penetrating into 97% of all

Chinese households. In 2010, television captured 76% of

Chinas $96 billion advertising market. However, despite

its staggering ubiquity, television lacks a strong hold on

some important niche audiences. Because programming

is understood to be strictly censored, younger and

more highly educated demographics tend to trust it

less than the middle-aged and older generations do

(especially as a source for news). As in the West, Chinese

television faces fierce competition from online news and

entertainment.

The bureaucratic and political nature of Chinas television

industry is reflected in its organizational structure. The

top player in the market is China Central Television

(CCT V), which is directly controlled by the State

Administration of Radio, Film and Television (SARFT).

In a US context, this would be akin to combining the

three major networks under one company and placing it

under the management of the Federal Communications

Commission. While every province has its own network

for hosting local channels and programming, CCTV is

the only national network.

Although CCT V is the reigning king,

provincial and municipal networks have

gained national audiences via cable and satellite. Some

such upstarts have proven to be significant challengers.

Hunan Satellite Televisions Super Girls, an American

Idol-like talent contest, became the nations number one

series. The final episode drew over 400 million viewers,

making it one of the most popular shows in Chinese

broadcast history. The show consequently drew official

and public criticism for promoting "vulgarity". Eventually

the SARFT issued a regulation barring the primetime

airing of all talent shows with mass participation via

satellite TV channels at provincial or vice-provincial

level". Critics argue that the SARFT issued this regulation

as a result of CCTV lobbying to protect its position as the

market leader.

Post-Mao Media Reforms

and Milestones

1979 Newspapers, magazines, TV and radio stations allowed to sell advertising; 69 newspapers nationwide,

all run by government officials of the Communist Party.

1980s Government begins to cut subsidies for state-controlled media.

1983 Media outlets permitted to profit from ad sales.

1990s Government phases-out subsidies for all but a select few state-controlled media, mouthpieces such

as Xinhua News Agency and Peoples Daily.

2003 Communist Party ends mandatory subscriptions to most official party newspapers and magazines;

subsidies to some government mouthpieces are phased out.

2009 Regulations ban websites from conducting online polls on current events; Internet users are required

to use real names when posting responses to news stories.

2011 Market has over 2,200 newspapers, 9,000 magazines, and 500 million Internet users.

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

PR in the PRC

Communications and Public Affairs in China share fundamentals with the West;

professionalism, relationships, and the right message are what matter most. That said, PR

in China is unique for three main reasons: a single party monopolizes politics; commercial

media outlets are relatively new and developing institutions; and the economy is growing

rapidly. When building and executing any communications strategy under such conditions,

it is imperative to consider the risks associated with government influence, market

maturity, and the potential for corruption.

The Party-states Influence

on Media

No analysis of Chinas media landscape would be complete without a description of how media are controlled by the

Party and state. Chinas media controls are primarily political, rather than commercial, in nature. As a result, MNCs

operating in China have, by default, become a favorite target for criticism and negative press. The media space that

would otherwise be allocated to discussing the effectiveness of government policies and political scandals has to

be filled with something; and because consumers are highly aware of famous brands, media discussions on those

brands and what they are doing in China, for better or worse, remain a hot topic. It is also important to keep in mind

that anything, from the price of your products to your HR policies, your companys nation of origin, or a planned

acquisition, could suddenly turn into a political problem. All communications professionals dealing with the China

market need to have a basic understanding of how the media are controlled by the state.

A central question in Chinas communications industry is how to create and maintain market-driven and profitable

media outlets, but which do not question the Partys authority. Chinas Chief Propagandist, Li Changchun, has stated

that the essence of his job is to unite the spirit of the Party with public opinion. This is accomplished through two

main strategies: The Three Closenesses, a broad principle that sets guidelines for all media, and Public Opinion

Channeling, a recipe for how the Party leverages its command over media while allowing a relatively high degree of

freedom.

The Three Closenesses principle being close to reality, close to life, and close to the masses was launched by

the Party Central Committee after the ascent of the Hu Jintao administration in 2003. It is a call for all journalists

and media to accurately reflect the needs of Chinese society. It is taken to mean that official media should not

limit themselves to stale coverage of government leaders activities, the latest official pronouncements, and other

politically homogenized content, but neither should commercial media over-sensationalize events just to sell more

copies or advertisements. The policy is a two-pronged approach to make state-run media more competitive while

encouraging tabloids to take responsibility for accurate reporting and steer clear of inflammatory political discourse.

Opinion Channeling is an attempt to leverage Chinas dynamic media to benefit political stability. Rather than directly

prohibiting specific statements and/or topics, the Party, through its Propaganda Department, actively pushes a

general agenda that more subtly influences the content and quality of Chinese media. This strategy is a response to

the commercialization of information and the rapid development of new outlets and technologies like social media

and mobile devices. In cases of sensitive incidents, such as ethnic riots or tainted food, the Party attempts to get

ahead of the story. By creating timely messages delivered through the most popular channels, mass coverage is

generated. This is a much more sophisticated approach than the traditional force-feeding of messages to the public.

In short, the Party now tends to participate in the conversation as an authoritative source, rather than broadcasting

its messages as indisputable truths. This also means that the Party sometimes hides its presence while participating

in the conversation. For example,

a given journalist or online

commentator may not have overt

Party or government credentials,

but could be serving as a proxy.

the Party now tends to

participate in the conversation

as an authoritative source

Media Controls in Action

Treatment of a major railway accident in Wenzhou in July 2011 is an example of Chinas attempts at public

opinion control and the Three Closenesses. After allowing several days of active media scrutiny and public

venting online via tens of millions of Weibo (microblog) postings, the government ordered journalists to cease

reporting on questioning eyewitness accounts. (The disaster caused an estimated 40 casualties and 200

injured.) Instead, the spotlight was shifted to coverage of "touching stories", such as local villagers rescuing

passengers and blood donations from sympathetic citizens. The directive stated that further reporting on

the accident should be in the spirit of major love in the face of major disaster and ordered "Do not question.

Do not elaborate. No re-posting from micro-blogs will be allowed!" Furthermore, the directive forbade news

media from other provinces from sending reporters to the scene of the accident and stated that commercial

media and online portals in particular must carefully manage their behavior.

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

Maturing Market

Corruption

In the 1980s, there was a systemic over-reliance on paid-for Chinese media coverage. When the PR industry began

to emerge in China, most people, including industry professionals, interpreted public relations to mean simply

guanxi, or relationships the Chinese social custom of networking and favor mongering. This misunderstanding

of the communications profession was compounded by a lack of business ethics and journalistic guidelines in a

rapidly developing commercial media industry. The pay-to-play phenomenon became especially prevalent in the

1990s. The use of gifts or cash incentives between companies and PR representatives became a common way of

inducing journalists to write favorable stories. Some revenue hungry local media in second- and third-tier cities, as

well as some trade media, still behave this way today. However, with the development of the market economy, there

has been a surge in competition. The Internet has become a serious competitor of traditional media, and audiences

are becoming increasingly discerning. These factors challenge media on all fronts to attract readers through

viable, integrated content. Moreover, a gradual push for reporters and editors to become more sophisticated and

professional is now evident just as in more developed markets where PR professionals are expected to pitch a great

story that can hook a readers attention in

order to be effective.

While some companies continue to take shortcuts that may produce superficial, short-term results, it is no longer

possible for enterprises and PR companies to build sustainable and valuable media relations through guanxi or

payoffs. Unfortunately, the incentive for businesses and media outlets to forge corrupt business relationships

through bribery remains a characteristic of the industry in todays China.

PR professionals now need

to pitch a great story

Last year, the government confirmed that Zijin Mining Group, the countrys biggest gold producer, had tried to bribe

reporters from Shanghai Securities News and the Xiamen Evening News to hush up a major toxic waste leak at the

companys copper mine in Fujian province. In another case, a product manager from the Chinese dairy producer

Mengniu Dairy Group and a representative from the companys local PR agency were arrested for spreading

malicious rumors online, claiming that a competitors products were harmful by alleging there was a chemical that

caused premature sexual development in children. See the box below on media blackmail about another common

industry hazard.

While the media industry in China is still occasionally marred by unprofessional, unethical and even illegal practices,

at MSL China, we believe that the only way to build good media relations, and ultimately a strong reputation for your

brand, is by providing journalists with insights and valuable information. This approach needs to be founded on a

deep understanding of local media, our clients and their industries, as well as the mindset, habits, and preferences

of consumers and other stakeholders. We call this Knowledge-Driven Media Relations (KDMR). During the past

decade, MSL China has applied our KDMR philosophy for all of our clients with great success. We see this as the main

reason why our agency has grown faster than any other international agency in China. At a glance, our approach may

seem like standard operating procedure. By tailoring this global approach to China, however, we help our clients to

create a unique and sustainable competitive advantage over less sophisticated local and multinational competitors.

Media Blackmail

It can happen like this: the PR manager of a famous MNC opens a local newspaper or trade publication to

discover a reporter has trashed their company or product. After making a few calls the PR manager finds the

journalist who wrote the negative story never contacted anyone from the MNC to get their side of the story.

Extremely concerned, the PR manager calls the journalist to find out what prompted the attack on his brand.

The journalist replies, Oh, I heard some rumors in the market from my sources would you like me to do a

follow-up story to clarify the situation? By the way, do you mind talking to my advertising department first? If

you place an ad in our publication, we could certainly make room for another article about your company and

its success in the market.

Heres what you can do about it:

- Proactively build and manage your reputation in the market; if you have a solid reputation you can weather a

few unsubstantiated attacks from small voices in the media.

- If this is an important media source for you, and you or your agency has been diligent in building your

network, you can try going over the journalists head and diplomatically raise the issue with the editor, but

this is useless if the editor is in on the game.

- You can try the court system, but libel cases are extremely hard to win; and you run the risk of blowing a

relatively small issue out of proportion.

- Chinas Consumer Day is March 15; this day is a media feeding frenzy on product quality and safety issues.

Any consumer product company in China must have a strategy in place for monitoring and rapid response.

11

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

3. Build and Nurture Guanxi

"We Understand"

- MSL Chinas KDMR

In the following, we share some of the best practices and recommendations garnered

example, a journalist on the energy beat may want to

know about the interaction between oil prices and capital

markets, while a healthcare journalist may be interested

in the sociological aspects of, as well as the latest global

advances in, the treatment of a particular disease.

They will be highly appreciative when your company

offers them a short training seminar instead of a press

conference.

Insight, strategy, and appealing messages are critical,

but relationships are and will remain important in

China. Journalists do not want to be taken for granted

and want to know you care about them as people and

as professionals, and they want to know whats going

on at your company even when there is no news to

publish. Any ongoing media outreach program should

be based on regular visits, news updates, and other

points of contact to keep the relationship warm. Too

many PR managers in China take a transactional

approach, expecting every contact with a journalist to

result in coverage. But in fact, one of the best ways to

build an emotional connection with journalists is to

share knowledge, not just about your company but also

about your industry. This is especially useful because

many journalists in China are young and often have not

received much training from their organization they

may be eager to learn more about macro issues. For

Over the years, we have seen that such investments tend

to pay off because they establish you as a trusted source.

Whenever journalists need more information about your

industry, you will be the first person they call for a quote.

Another thing to keep in mind is the importance of a

systematic approach to guanxi. In a rapidly developing

market like China, both PR managers and journalists

tend to move from one employer to another. For this very

reason, successful companies and PR agencies must

take a state-of-the art, database-driven CRM approach to

media relations.

Methodology in China

4. Create Your Own Media

from two decades of working with the Chinese media.

5. Dont Ever Be Tempted By or

Tolerate Unethical PR Practices

4

5

1 2

1. Understand Local Target

2. Develop Tailored News Angles

Audiences, Industry, and Media that Catch Media Attention

It may sound standard, but many multinational

companies fail to properly analyze who they need to

communicate to through local media, which factors

are shaping their companys industry in China, and how

journalists perceive and report on the company and its

competitors. This is a simple and logical cornerstone of

any communications campaign, yet it is still surprising

how frequently PR managers in China are unwilling to

invest in it because they think their brand, their guanxi, or

some other factor will be enough to generate favorable

coverage. There are many ways of achieving deeper

understanding; focus groups with consumers, media

audits to gauge journalist and trend-setting perceptions,

as well as traditional and social media reviews to see

whats already available in print or in the blogosphere.

It used to be much easier for MNCs in China to grab

headlines. A decade ago, a CEO visit or a multi-million

dollar investment would ensure that journalists took

notice of your company. Not anymore. As official and

independent-commercial media compete for consumer

attention, successful communications in China will

depend on appealing to and aligning with a complicated

mix of government agendas, social concerns, broad

groups of constituents such as JV partners and influential

organizations, and geographically relevant audiences.

The latter is important as China is a large and diverse

country. MSL China consultants have helped clients tailor

messages to key audiences to reflect alignment with the

governments latest Five-Year Plan; created social media

addressing the wide generation gap between Chinese

born in the 70s, 80s and 90s; and provided consumer

information for a mixture of technology aficionados and

neo-luddites.

With the expansion of todays digital media platforms

and technologies, most of the worlds leading companies

have developed content-rich websites intricately

interwoven with social media, allowing them to broadcast

their messages 24/7. However, most MNCs have not

made corresponding investments in China. Local

corporate websites and social media initiatives could

benefit from simply reapplying the best practices from

global markets, while sourcing strong, locally-relevant

content to effectively engage local audiences. This is a

giant missed opportunity for multinational companies

most job seekers and business journalists in China

conduct in-depth reviews of corporate websites. Making

sure that your owned media are up to snuff gives you an

excellent channel for communicating your commitment

to the market, promoting your CSR programs, and

attracting increasingly scarce local talent.

Positive news coverage can be bought in China - each

year, a few journalists and PR managers are charged

with corrupt pay-to-play practices. It is important to

understand that, although some local practitioners

condone this practice, it is an approach that does not

deliver the best long-term results and violates Chinese

law. So even if your competitors attack you by paying

journalists for negative coverage about your company or

start negative rumors online, it pays off in the long run

to take the high moral road. Letting the market lower

your standards of practice can be costly; there are legal

penalties as well as huge reputational risks. Every year,

MSL China consultants are asked to support companies

who have run into trouble in China after following the

bad advice of local PR representatives.

13

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

Media Profiles

The following is a general lay of the land for Chinese news media. Included are

descriptions of a few influential newspapers, business and lifestyle publications, online

portals, and television networks. Since this is a general overview, we do not delve into

vertical media such as automotive, technology and healthcare, although these are vibrant

and highly influential in their respective sectors.

Global Times () (est. 1993, circ. 1.04 million)

Part of the Peoples Daily Media Group, this daily is dedicated to delivering international news and reporting

on Chinas engagement with the world. In 2009 the paper launched an English edition as part of the Chinese

governments growing interest in spreading its views in international forums; this publication focuses more on

business and economics and is an alternative English-language media to China Daily. Despite its affiliation with the

main Party mouthpiece, Global Times is relatively outspoken and sometimes publishes muck-raking or controversial

articles.

Guangzhou Daily () (est. 1952, circ. 1.6 million)

Newspaper Profiles

The official publication of the Guangzhou Municipal Government, Guangzhou Daily focuses on local news and

information, and is one of the most popular mainstream media in southern China, boasting one of the largest

circulations among dailies in the entire country. Despite being an official publication, it is highly readable, focusing on

lifestyle and popular news, especially local information from the Pearl River Delta area.

Cankao Xiaoxi () (est. 1931, circ. 3 million)

Southern Metropolis Daily () (est. 1997, circ. 1.4 million)

Published by the state-run Xinhua News Agency, Cankao Xiaoxi is one of Chinas leading national daily newspapers. Its

original purpose was to serve as an internal global news report for the PRCs political elite. Since 1985, its distribution

has been widened to the general public. Cankao Xiaoxi contains translations of news articles and commentaries from

foreign news agencies and newspapers. Although its content primarily consists of accurate translations of the original

source material, it runs its own headlines, creates its own captions, and often deletes references unfavorable to

China's image.

Distributed mainly in the Pearl River Delta area, this commercial newspaper is known for its hard-hitting investigative

journalism and edgy commentary. Its editors and journalists frequently come under fire from the authorities. As one

of the nations largest and most influential newspapers, its reports are reprinted in many smaller regional media

outlets.

Peoples Daily () (est. 1948, circ. 2.8 million)

Inexpensive and readable, the Beijing Evening News is one of the capitals most popular dailies especially with older

readers. However the Beijing Evening News faces challenges from other emerging general newspapers and online

portals, and its circulation has been declining.

A newspaper under the Central Committee of the Communist Party of China (CPC), People's Daily distributes the

latest news and policy information of the Party and government and major domestic and international news releases

from China. It is the mouthpiece of the CPC and distinctly patriotic in tone. MNCs achieving positive coverage in

Peoples Daily can be perceived in the market as being in favor with the Party and government. In addition to its main

Chinese-language edition, it has editions in English, Japanese, French, Spanish, Russian, and Arabic. It also has an

on-line version, peopledaily.com.cn, which is one of the largest Chinese news portals.

China Youth Daily () (est. 1951, circ. 500,000)

Run by the Central Committee of the Communist Youth League of China, China Youth Daily is a popular official daily

newspaper and the first independently-operated central government news media portal in the People's Republic of

China. Although its large reader base is due in part to mandatory subscriptions at universities and high schools, it is

a high-quality and well-respected newspaper, especially because of its focus on human interest over politics. As with

the Peoples Daily, positive coverage in this newspaper can provide MNCs in China some political cachet.

China Daily () (est. 1981, circ. 570,000)

The leading English language daily in China, it is the most popular local newspaper among foreigners living in the

PRC. Twenty years ago, China Daily was a dull litany of positive news about China and trite observations of foreign

countries. Because it is published in English, it receives less scrutiny from censors, so in recent years its editors have

significantly improved both print and web editions, and it has become a more compelling source of information about

China and the world. MNCs and their PR representatives value its coverage of their business and events such as CEO

visits, since headquarters can read the clippings without translation, but its local impact is not as high as Chineselanguage papers.

Beijing Evening News () (est. 1958, circ. 1.2 million)

Beijing Times () (est. 2001, circ. 800,000)

Comparatively lowbrow, the Beijing Times mostly covers local news and reacts quickly to breaking news, including

major political events, crime, and safety issues. It launched a supplement called CSR Weekly in June 2010, with more

than 8 pages dedicated to CSR related news, making it a mainstay for corporate PR.

West China City Daily () (est. 1995, circ 1.15 million)

Founded in 1995 by former staff members of Sichuan Daily, West China City Daily is the leading paper in Chinas

less-developed western region. It is the most popular source of news and information for all market segments in the

region, from white-collar professionals and luxury brand consumers to government decision-makers.

Oriental Morning Post () (est. 2003, circ. 150,000)

Managed by the Wenxin Media Group, this daily is circulated in Shanghai and neighboring Jiangsu and Zhejiang

provinces. Focusing on national finance and economic news, the target audience of the Oriental Morning Post is

the regions new generation of upper middle-class residents. The newspaper is known for its professionalism and

integrity; it professes to be the New York Times of China.

15

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

Newswire Profile

Xinhua News Agency () (est. 1931)

Caijing () (est. 1998, circ. 225,000)

As the state news agency of the Peoples Republic of China, Xinhua is the governments primary collector and

distributor of information in China and the most authoritative source of information on Chinese government affairs.

Employing more than 10,000 people in 107 bureaus worldwide, 31 of which are in China, Xinhua News Agency is

the largest wire service in the world. The agency provides daily 24-hour news information to the world in Chinese,

English, French, Spanish, Russian, Arabic and Portuguese. As most Chinese newspapers do not have overseas

bureaus, Xinhua is their primary source for international reporting. Just as with other media in China, the government

has cut its funding of the agency and it now generates revenue through public relations and information services. In

2010, it launched its 24-hour English-language news channel China Xinhua News Network Corporation (CNC World),

which is headquartered in Hong Kong. CNC World will reportedly be a strategic focus for Xinhua News Agency in the

next five years.

As a bi-weekly glossy magazine focusing on the countrys economics and politics, Caijing is one of the leading

business magazines and is widely quoted by international media such as The Wall Street Journal, Reuters, and the

Financial Times. Its chief editor Hu Shuli and the majority of its staff journalists left the magazine in 2009 due to a

dispute over editorial rights. Caijing was once considered to be one of the most aggressive and insightful publications

in China but subsequently seems to have lost some of its luster.

Business Media Profiles

21st Century Business Herald (21)

(est. 2001, circ. 632,000)

A member of the Nanfang Daily Group, this paper is published five days a week and is one of the most powerful

financial newspapers in China. The paper is known for its aggressive reporting and critical commentary. A pioneer in

the Chinese media industry, it was the first Mainland financial paper to enter Hong Kong with a special edition for the

market. It also has bureaus in New York, Los Angeles, London, and Moscow.

Lifestyle Media Profiles

Modern Weekly () (est. 1980, circ. 497,500)

A glossy tabloid published in Guangzhou with a focus on fashion and culture, Modern Weekly is Chinas leading paper

with weekly distribution. It is well known for its personal interviews and business section. Targeting upper income

Chinese and those that inspire to be, it is a favorite advertising platform for luxury, fashion, and other high-end

consumer brands.

The Bund () (est. in 2002, circ. 150,000)

Named after Shanghais famous riverfront, this weekly has a cosmopolitan slant and mainly focuses on the Shanghai

culture scene. It is popular for its interviews, as well as its fashion and entertainment content. Because of its focus on

Shanghai, the magazine is comparable in nature to The New York Times Magazine.

Economic Observer () (est. 2001, circ. 380,000)

Sanlian Life Weekly () (est. 1995, circ. 200,000)

A weekly published on Mondays, it strives to distinguish itself from other business media through in-depth analysis

and an attractive layout. Providing editorial space for a wide variety of experts and scholars, the magazine focuses on

economics, politics, and culture. The papers pink-tinted pages evoke those of the UKs Financial Times and appeals

to intellectuals.

Published by the Sanlian Bookstore, a unit of the China Publishing Group in Beijing, this weekly covers politics,

economics, human interest, culture and technology for smart, urban audiences. It can be compared to The Atlantic

or The New Yorker in the United States. After drawing criticism from censors, it has recently shied away from current

affairs and reports more on lifestyle related topics targeting the growing Chinese middle class.

China Business Journal () (est. 1985, circ. 380,000)

Lifestyle () (est. 1993, circ. 300,000)

Published weekly under the direction of the Chinese Academy of Social Sciences, the China Business Journal is one

of the most influential business and economic magazines, with a strong focus on the topic of business management.

The paper takes a management perspective and discusses how companies can improve, but without the tabloid

criticism of leaders, business performance or products which is common in other Chinese media.

Published twice a week in Beijing, with Style Weekly on Monday and Southern Life Weekly on Thursday, Lifestyle

includes sections such as Fashion, Hot Topics, Truth, New Knowledge, Showtime, Psychology, Nutrition, Mother and

Child, Tourism, and Autos. It is affordable and has strong mass appeal.

China Business News () (est. 2004, circ. 250,000)

Like Bloomberg, the CBN Group operates print and broadcast business news services. The Groups newspaper, China

Business News, is published Monday through Saturday; it focuses on breaking news in business, economics, and

finance. The Opinions & Comments section penned by guest columnists is increasingly popular with business readers.

Many international news media source information from the paper because it is fast and authoritative.

New Weekly () (est. 1996, circ. 285,000)

Possibly the trendiest of Chinese lifestyle publications, after more than 15 years of development, New Weekly has

earned a reputation as a keen observer and reporter of social changes in the country. Based in Guangzhou, New

Weekly is one of the countrys first glossy magazines. A biweekly, it is published on the 1st and 15th of each month.

17

MSL China Executive Whitepaper

PR and the Party - the truth about media relations in China

I n t e r n e t Po r t a l P r o f i l e s

TV Station Profiles

Sina.com () (est. 1999)

China Central Television () (est. 1958)

Chinas leading Internet portal is headquartered in Shanghai. According to Alexa, Sina.com.cn was 14th in the Top Site

rankings and 3rd in Traffic rankings within China. Sina.com has over thirty integrated channels, including news, sports,

technology information, finance, advertising services, entertainment, fashion, and travel. Sina.com also provides

services such as SMS, email, a search engine, games, entertainment and Sina Blog. The Sina Micro-blog, Weibo, is

Chinas equivalent of Twitter. While Twitter is blocked by local authorities, Sina Weibo and has become hugely popular,

quickly amassing over 200 million users, nearly eight times as many as Twitter. According to its 2010 annual report,

Sinas net revenue reached $402 million, showing 12% annual growth.

Based in Beijing, this national network is directly controlled by the State Administration of Radio, Film, and Television

(SARFT). CCTVs most-watched program is the Network News which broadcasts daily from 7:00 to 7:30 p.m.,

simultaneously on at least one state-run TV channel in every provincial and municipal market. The networks annual

New Year's Gala is also markedly popular, drawing one of the largest TV audiences worldwide with an estimated 700

million viewers. The network comprises sixteen channels, including CCTV-2, its business channel.

Sohu.com () (est. 1996)

The hit series Super Girls propelled Hunan TV to become China's second biggest television network after CCTV. The

network is based in Changsha in Hunan Province and Xining in Qinghai Province. Since 2009, Hunan TV has sold its

popular programs to markets across East Asia and has signed contracts with international producers to produce and

distribute original programming.

While Sina.com is more news focused, its main competitor Sohu.com is more entertainment and lifestyle focused

in content. Sohu was ranked as the world's 3rd and 12th fastest-growing company by Fortune in 2009 and 2010,

respectively. As of August 2010, Sohu is currently 46th overall in Alexa's Internet rankings. Sohu was selected by

Chinas Olympic authorities to provide exclusive services to construct, operate, and host the official Beijing Olympics

website. According to its 2010 annual report, the companys net revenue was $612.8 million, showing annual growth

of 19%.

Netease () (est. 1997)

Operating the popular portal 163.com, the company is different from Sina and Sohu in that the company generates

huge revenues from fees it charges users for hosting online games (including World of Warcraft) and wireless valueadded and other fee-based premium services, as well as online advertisement sales. According to its 2010 annual

report, the companys net revenue for the year was nearly $834.5 million.

Tencent (QQ) (est. 1998)

(Referred to as QQ) QQ is the most popular free instant messaging platform in China. There are over 600 million

active QQ users (including QQ IM users), making it one of the world's largest online communities. In February 2011,

QQ.com ranked 10th overall in the Alexa Internet rankings, one place behind Twitter. Aside from its chat program, QQ

has also developed many other features including a search engine, games, virtual pets, ringtones, and blogs.

Hunan Television () (est. 1970)

Phoenix TV () (est. 1996)

This Hong Kong-based Mandarin-Chinese television-broadcaster is permitted to air its news in the PRC one of

the few non-government controlled television broadcasters. Phoenix TV has an excellent relationship with the

government; its Beijing offices are located in the Diaoyutai state guesthouse. Phoenix TVs news program has a

reputation for covering events and providing perspectives that are not available on other networks, and its announcers

are young and energetic compared to state TVs homogeneous anchors. Phoenix TV now broadcasts to over 150

countries and regions around the world and has an estimated 300 million viewers, 150 million of whom are in China.

News Corp holds a 17.6% stake in Phoenix Satellite Television Company Limited.

CBN TV () (est. 2003)

CBN TV is part of the second largest Chinese media group SMG and is the only professional Business TV channel

targeting investors. Broadcasting 20 hours per day with 12 hours of live programs, CBN TV covers core investment

markets in China and provides insights from over 30 market traders and security analysts. The channel mainly focuses

on finance, markets, and trading information and its portfolio includes programming such as Stock Today and Finance

Night Line. It covers 28 provinces and cities and has 12.9 million viewers in Mainland China, with another 880,000

viewers in Hong Kong. It was the first mainstream TV channel from the Mainland to enter Hong Kong.

Dragon TV () (est. 1998)

First launched in October 1998 as Shanghai TV, it changed its name to Dragon TV on October 23, 2003. It has the

widest broadcast news coverage among the provincial satellite TV stations, and more than six hours of daily live news

shows. Currently, Dragon TVs signal covers most of China, including Macao, Hong Kong, and Taiwan, and is also

available in North America, Japan, Australia, Europe and other areas. All of Dragon TV's news programs are owned by

the parent company SMG TVs news production center Asias largest television news production and broadcasting

organization.

Travel Chanel () (est. 2002)

As the only satellite channel focusing on tourism and leisure in China, it garners a large viewership and is a popular

advertising platform for high-end brands. The channel also broadcasts global golf and tennis events to support its

position as the lifestyle media for Chinas rapidly growing middle and upper classes.

19

MSL China regularly publishes Executive Whitepapers with insights

and comments on trends, the industry and society as a whole.

To get information from MSL China or to subscribe to future

whitepapers, as well as to contact us for any other matter, please send

us an e-mail on greaterchina@mslgroup.com

or call us +86 21 5169 9311 (SH) or +86 10 8573 0688 (BJ).

MSL China Executive Whitepaper

August 2011

Copyright MSL China

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MSLGROUP Reputation Impact Indicator Study 2015 (China Edition)Document48 pagesMSLGROUP Reputation Impact Indicator Study 2015 (China Edition)MSLNo ratings yet

- The Digital and Social Media Revolution in Public AffairsDocument35 pagesThe Digital and Social Media Revolution in Public AffairsMSL100% (1)

- Optimising Digital Collaboration From The Inside OutDocument26 pagesOptimising Digital Collaboration From The Inside OutMSLNo ratings yet

- Inside The Driving Forces of Disruptive InnovationDocument20 pagesInside The Driving Forces of Disruptive InnovationMSLNo ratings yet

- MSLGROUP Reputation Impact Indicator Study 2015Document40 pagesMSLGROUP Reputation Impact Indicator Study 2015MSLNo ratings yet

- Inspiring Innovations - People's Insights (Jan and Feb 2015)Document35 pagesInspiring Innovations - People's Insights (Jan and Feb 2015)MSL100% (1)

- 2013gad RT1Document6 pages2013gad RT1malledipNo ratings yet

- Keith Foulcher, (2000), Sumpah Pemuda - The Making and Meaning of A Symbol of Indonesian Nationhood PDFDocument34 pagesKeith Foulcher, (2000), Sumpah Pemuda - The Making and Meaning of A Symbol of Indonesian Nationhood PDFAfifatul IrsyadahNo ratings yet

- International News AgenciesDocument4 pagesInternational News Agenciessuruchi agrawalNo ratings yet

- Achievers C1 Vocabulary Worksheet Support Unit 8.1Document1 pageAchievers C1 Vocabulary Worksheet Support Unit 8.145psbkr927No ratings yet

- World News Agencies MCQs (Solved) - World General Knowledge MCQs SeriesDocument13 pagesWorld News Agencies MCQs (Solved) - World General Knowledge MCQs SeriesSifat ullah shah pakhtoonNo ratings yet

- Trade Union Press WorkDocument45 pagesTrade Union Press WorkPFJA - Pakistan Freelance Journalists AssociationNo ratings yet

- Index Products: ® ® ® ® SM SM SM SMDocument4 pagesIndex Products: ® ® ® ® SM SM SM SMskyping75No ratings yet

- Factiva TitlelistDocument948 pagesFactiva TitlelistjaykhorNo ratings yet

- News Agencies of The WorldDocument7 pagesNews Agencies of The Worldsaleembaripatujo100% (2)

- Incomplete Expanding It: Below Is The List of The Principal News Agencies. This List Is You Can Help byDocument10 pagesIncomplete Expanding It: Below Is The List of The Principal News Agencies. This List Is You Can Help byFazliAkbarNo ratings yet

- Indian News Agencies at A GlanceDocument3 pagesIndian News Agencies at A GlanceNetijyata MahendruNo ratings yet

- News SourcesDocument3 pagesNews SourcesSumant Sharma100% (1)

- Ission EAN Aptiste: E.mail: 13 BP: 79 Lome-Togo Tel. +228 9632785Document8 pagesIssion EAN Aptiste: E.mail: 13 BP: 79 Lome-Togo Tel. +228 9632785MJB Mission News, ISSN 1999-8414No ratings yet

- Report On Divya BhaskarDocument2 pagesReport On Divya BhaskarParesh ParmarNo ratings yet

- Christine Warren Fixed Book 1 Fantasy FixDocument143 pagesChristine Warren Fixed Book 1 Fantasy FixStacey ShawNo ratings yet

- Sanusi Pane: Kebangoenan (1936-1941) Together With Mohammad Yamin. Together With Armijn, Adam Malik, andDocument1 pageSanusi Pane: Kebangoenan (1936-1941) Together With Mohammad Yamin. Together With Armijn, Adam Malik, andKhairunnisa RNo ratings yet

- ယေန ့ထုတ္ေၾကးမုံDocument13 pagesယေန ့ထုတ္ေၾကးမုံfightforfreedomNo ratings yet

- News Agency Dominance in International News On The InternetDocument24 pagesNews Agency Dominance in International News On The InternetNinAaNo ratings yet

- Plantilla de Excel para Notas AcademicasDocument6 pagesPlantilla de Excel para Notas Academicasdopper_xtNo ratings yet

- Oman-Iran Foreign Relations: Will Fulton Ariel Farrar-WellmanDocument5 pagesOman-Iran Foreign Relations: Will Fulton Ariel Farrar-WellmanhamedNo ratings yet

- CBSE UGC NET Mass Communication Paper 3 Solved December 2012Document22 pagesCBSE UGC NET Mass Communication Paper 3 Solved December 2012Rohtash NimiNo ratings yet

- Final NewsWritingDocument78 pagesFinal NewsWritingChristine Jeffany GarciaNo ratings yet

- OMHS Procedures ManualDocument187 pagesOMHS Procedures ManualSusanoo12No ratings yet

- News SourcesDocument5 pagesNews SourcesSarath BNo ratings yet

- News Reading Ujian Praktek B IngDocument5 pagesNews Reading Ujian Praktek B IngFirraz Azzam Al-khawarizmiNo ratings yet

- The CIA and The MediaDocument13 pagesThe CIA and The MediaFlavio58ITNo ratings yet

- Newspaper VocabularyDocument7 pagesNewspaper VocabularyLoredana ȚicleteNo ratings yet

- Unit 3 - WEEK 3 - Grammar - VocabularyDocument3 pagesUnit 3 - WEEK 3 - Grammar - VocabularyNguyễn Phương100% (1)

- Kelompok 6-1Document8 pagesKelompok 6-1Eva AtnizaNo ratings yet

- List of Announced Executions 2010Document37 pagesList of Announced Executions 2010HRcommitteeNCRINo ratings yet