Professional Documents

Culture Documents

Traffic Act Form C

Uploaded by

robert2030adOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Traffic Act Form C

Uploaded by

robert2030adCopyright:

Available Formats

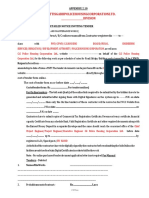

KENYA REVENUE AUTHORITY

_____________

THE TRAFFIC ACT

(Cap. 403, Section 9)

___________

TRANSFER OF OWNERSHIP OF MOTOR VEHICLE OR TRAILER

Form C

PART 1. STATEMENT: BY THE SELLER

I have transferred to the person named the registered vehicle described below:

(A) PARTICULARS OF VEHICLE

1.

Registration mark and number

2.

Make and body type ...

3.

Manufacturers chassis or frame number:

4.

For Official Use Only

Date

If a motor vehicle, engine number

(B) OTHER PARTICULARS

1.

Date of transfer , 20 ..

2.

New owner:

Name (in full)

(Block Capitals)

28

29

30

31

Postal Address .

..

I have also transferred the registration book to the new owner named above.

Name

Signature ..

ID/No. or Certificate of incorporation .

Address .

PIN No. .

Date .. 20 ...

Note: A copy of this transfer form should be sent to the Registrar of Motor Vehicles, PO.O Box 30440, Nairobi informing him of the names/name of the new

owners/owner and the address

TRANSFER OF OWNERSHIP OF MOTOR VEHICLE OR TRAILER.

PART II: STATEMENT BY THE OWNER.

I have assumed ownership of a vehicle with the following registration mark and number:

1.

2.

3.

Private

Commercial: goods

Trailers

FORM C

For official use only

Commercial public service

Tractors

Motor cycles

Name of company issuing third party insurance .

..

Expected normal company issuing third party vehicle:

. Road ..

Area/Estate

. Town . District

Signature

Name (in full)

(Block Capitals) .

Occupation .

ID/No. .. PIN No.

Name of Institution/Company employed .

Telephone Number

Postal Address

Town ..

NOTE: Forward to the registrar of Motor Vehicles P.O. Box 30440 Nairobi

Transfer fee is payable by the new owner.

Date

TRANSFER FEE

Sh ..

5

11

12 13

10

14

15

16 41

42 57

58- 77

This application form must be completed and sent to the

licensing officer together with:

a) Fee payable

b)

Registration book

c)

Current certificate of insurance

d)

Vehicle inspection report (for vehicles bought

through Auction)

e) Identification card

See overleaf for notes

REQUIREMENTS FOR TRANSFER OF MOTOR VEHICLES

SECOND HAND MOTOR VEHICLE PURCHASE TAX AND TRANSFER FEES

RATING CAPACITY

S.H.M.V.P/TAX (sh)

TRANSFER FEES (sh)

(i) Not Exceeding .. 1000cc

1001 .. 1200cc

1201 .. 1500cc

1501 .. 1700cc

1701 .. 2000cc

2001 .. 2500cc

2501 .. 3000cc

3001 .. and above

ii) A trailer less than four wheels

iii) A trailer with four wheels or more

v) Tractor

1,035/=

1,265/=

1,440/=

1,785/=

2,070/=

3,220/=

4,430/=

5,290/=

405/=

1,265/=

405/=

TRANSFER OF OWNERSHIP OF MOTOR VEHICLES

1. Application form - Form C duly filled by both the seller and buyer.

625/=

625/=

625/=

625/=

625/=

625/=

625/=

625/=

625/=

625/=

625/=

625/=

TOTAL

1,660/=

1,890/=

2,065/=

2,410/=

2,695/=

3,845/=

5,055/=

5,915/=

1,030/=

1,890/=

1,030/=

625/=

2. TRANSFERS:(a)

For Individuals

Copies of:National identification card (ID) for both buyer and seller.

PIN certificate for both buyer and seller.

(b)

For Companies

Copies of:Certificate of incorporation

PIN certificate for both buyer and seller.

(c)

For Business

Copies of:Certificate of Business Registration

PIN certificate for both buyer and seller.

3. Copy of valid Insurance Cover.

4. Original Registration Book (log book)

5. If the owner is deceased letters of Administration to be attached

6. In case of written off vehicle inspection Report to be attached

7. Incase of Parastatal, EX GKs and Local Authorities, letter signed personally by respective permanent

Secretaries

8. Sale Agreement indicating full vehicle particulars i.e Make, Chassis No. Engine No. etc

9. Incase a vehicle is held for resale, the registrar should be notified within 14 days otherwise a sum equal

to the prescribed fees payable

10. For Auction vehicles see Form A

You might also like

- Taxation Law Reviewer (San Beda)Document127 pagesTaxation Law Reviewer (San Beda)Ryan Aspe100% (4)

- From Silver To Cocaine Latin American Commodity Chains and The Building of The World Economy, 1500-2000Document385 pagesFrom Silver To Cocaine Latin American Commodity Chains and The Building of The World Economy, 1500-2000FranciscoAlejandro100% (2)

- Dynamics of Swaps SpreadsDocument32 pagesDynamics of Swaps SpreadsAkshat Kumar SinhaNo ratings yet

- MBA Warehouse Mangement ProjectDocument82 pagesMBA Warehouse Mangement Projectvasanthamurugan76% (21)

- Undertanding SNP Optimizer.2.0Document65 pagesUndertanding SNP Optimizer.2.0Ashutosh Kumar100% (4)

- Occupationaal Health and Safety QuizDocument2 pagesOccupationaal Health and Safety Quizrnp200712371% (17)

- Triple Play: Building the converged network for IP, VoIP and IPTVFrom EverandTriple Play: Building the converged network for IP, VoIP and IPTVNo ratings yet

- Branding and PackagingDocument9 pagesBranding and PackagingDanish SaeedNo ratings yet

- Tourism PromotionDocument29 pagesTourism PromotionMalik Mohamed100% (1)

- SAP PI For BeginnersDocument22 pagesSAP PI For BeginnersDinakar Babu JangaNo ratings yet

- Analytic Techniques Using Excel Power BIDocument7 pagesAnalytic Techniques Using Excel Power BIPankush0% (1)

- Form 25Document2 pagesForm 25YoyoNo ratings yet

- Form25 PDFDocument2 pagesForm25 PDFRabinarayanNo ratings yet

- Form25 PDFDocument2 pagesForm25 PDFसंदीप योगेन्द्र शर्माNo ratings yet

- Form 25Document2 pagesForm 25Basheer AhmedNo ratings yet

- Form25 PDFDocument2 pagesForm25 PDFRabinarayanNo ratings yet

- Form25 PDFDocument2 pagesForm25 PDFefefNo ratings yet

- Form 25Document2 pagesForm 25Abhayraj KambleNo ratings yet

- XYZ Financials ProfileDocument2 pagesXYZ Financials Profilesunil_nagarNo ratings yet

- Form 28 GURMEETDocument2 pagesForm 28 GURMEETGhanshyam SinghNo ratings yet

- Application Form For Tax ExemptionDocument5 pagesApplication Form For Tax ExemptionMacdonald RichardNo ratings yet

- Application For Grant or Renewal of A Hackney Carriage or Private Hire Vehicle LicenceDocument3 pagesApplication For Grant or Renewal of A Hackney Carriage or Private Hire Vehicle LicenceBruna EduardoNo ratings yet

- Form 47Document1 pageForm 47hunjan82No ratings yet

- Acc FormDocument3 pagesAcc FormArchides ARNo ratings yet

- Form 25Document2 pagesForm 25EnggSolutions33% (3)

- Form 25Document2 pagesForm 25Prathamesh KhairnarNo ratings yet

- Form of Application For Grant of Authorisation For Tourist Permit or National PermitDocument1 pageForm of Application For Grant of Authorisation For Tourist Permit or National PermitJuber AhmedNo ratings yet

- Form of Application For Renewal of RC FormDocument3 pagesForm of Application For Renewal of RC FormgoaltechNo ratings yet

- cmv25 PDFDocument3 pagescmv25 PDFMohammed Idrees IdreesNo ratings yet

- Form of Application For Renewal of RC Form-25Document3 pagesForm of Application For Renewal of RC Form-25goaltechNo ratings yet

- Form-25 Fitness RenewalDocument3 pagesForm-25 Fitness Renewalbalaji stationersNo ratings yet

- Form 25Document3 pagesForm 25goaltechNo ratings yet

- Form 28Document2 pagesForm 28AkkiNo ratings yet

- Inter-Site Transfer MemoDocument1 pageInter-Site Transfer Memomuhammad farisNo ratings yet

- Application Form For Upgrading of Contractors - 0Document16 pagesApplication Form For Upgrading of Contractors - 0Elisha WankogereNo ratings yet

- Form 24 Register of Motor VehicleDocument3 pagesForm 24 Register of Motor VehicleVarun RajegoreNo ratings yet

- Form 31Document2 pagesForm 31riyu4393No ratings yet

- R R R R R R R R R RDocument2 pagesR R R R R R R R R RJesse GibsonNo ratings yet

- Form-I TaxDocument3 pagesForm-I TaxNGL VenturesNo ratings yet

- Form 28Document2 pagesForm 28Pramod KumarNo ratings yet

- DisabledSelf PDFDocument2 pagesDisabledSelf PDFIsha PopNo ratings yet

- Nit FormDocument40 pagesNit FormLokesh ChandrakarNo ratings yet

- India RTO Form30Document3 pagesIndia RTO Form30Pranav SrivastavaNo ratings yet

- TR-47 New PDFDocument2 pagesTR-47 New PDFSapna SNo ratings yet

- Form 22DDocument2 pagesForm 22DtolfypaulNo ratings yet

- Foam 28 For NocDocument2 pagesFoam 28 For NocTata Power Delhi Distribution BillNo ratings yet

- Rto 28Document2 pagesRto 28Ashish GulatiNo ratings yet

- RTO Form28 PDFDocument3 pagesRTO Form28 PDFWelkin SkyNo ratings yet

- Modele Acte D'engagementDocument1 pageModele Acte D'engagementAachari BrahimNo ratings yet

- Form 20 (See Rule 47 and Rule 53A) Application For Registration or Temporary Registration of A Motor VehicleDocument4 pagesForm 20 (See Rule 47 and Rule 53A) Application For Registration or Temporary Registration of A Motor VehiclePrashant KakamariNo ratings yet

- UntitledDocument2 pagesUntitledMichelle LeeNo ratings yet

- Form 31Document2 pagesForm 31Jimit ShahNo ratings yet

- Form 25 PDFDocument2 pagesForm 25 PDFKing RyuNo ratings yet

- Form 20Document4 pagesForm 20Rohit JainNo ratings yet

- Form Form20ReportDocument2 pagesForm Form20Reportsatish pandeyNo ratings yet

- Annexture From Motor Vehicles and Transport Management ActDocument12 pagesAnnexture From Motor Vehicles and Transport Management ActgigibisaNo ratings yet

- Form 8 Application For The Addition of A New Class of Vehicle To A Driving LicenceDocument1 pageForm 8 Application For The Addition of A New Class of Vehicle To A Driving LicenceMd SerajNo ratings yet

- Enclosed With The Form (A) Original RC Book (B) Original Insurance Policy (C) Original Driving License (D) PUCDocument2 pagesEnclosed With The Form (A) Original RC Book (B) Original Insurance Policy (C) Original Driving License (D) PUCVijay Kumar reddyNo ratings yet

- Form 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitDocument2 pagesForm 47 (See Rules 83 (2) and 87 (2) ) Authorisation For Tourist Permit or National PermitSomnath DanNo ratings yet

- Form 29 (See Rule 55 (1) ) Notice of Transfer of Ownership of A Motor VehicleDocument4 pagesForm 29 (See Rule 55 (1) ) Notice of Transfer of Ownership of A Motor Vehiclejagjit singhNo ratings yet

- Form 28: Form of Application For "No Objection Certificate" and Grant of CertificateDocument3 pagesForm 28: Form of Application For "No Objection Certificate" and Grant of CertificateKumar TarunNo ratings yet

- Form 28 GHNDocument1 pageForm 28 GHNGhanshyam SinghNo ratings yet

- Form 9 Form of Application For The Renewal of Driving (See Rule 18 (1) )Document3 pagesForm 9 Form of Application For The Renewal of Driving (See Rule 18 (1) )Imran ShaikhNo ratings yet

- Entree Foods P.O Box 4457-00200 Nairobi, KenyaDocument6 pagesEntree Foods P.O Box 4457-00200 Nairobi, KenyaEazi X AnzigareNo ratings yet

- Form 26Document1 pageForm 26only for Civil serventsNo ratings yet

- Standard Tender Document For Provision of Motor and Alternator Rewinding Services Off Grid Power StationDocument80 pagesStandard Tender Document For Provision of Motor and Alternator Rewinding Services Off Grid Power StationrenimoNo ratings yet

- Perimeter Wall 4 Sec 4 BQ Combined PDFDocument65 pagesPerimeter Wall 4 Sec 4 BQ Combined PDFNeil AngNo ratings yet

- Vehicular Networking: Automotive Applications and BeyondFrom EverandVehicular Networking: Automotive Applications and BeyondMarc EmmelmannNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Pricing Communication Networks: Economics, Technology and ModellingFrom EverandPricing Communication Networks: Economics, Technology and ModellingNo ratings yet

- Zero To One-Book Review (By Divya Anand)Document27 pagesZero To One-Book Review (By Divya Anand)DEEPALI ANANDNo ratings yet

- 2 Rites A8Document1,104 pages2 Rites A8occultistpowersNo ratings yet

- Capital Budgeting Numericals and CasesDocument5 pagesCapital Budgeting Numericals and CasesAnkur ShuklaNo ratings yet

- ManagementDocument8 pagesManagementskgrover5524No ratings yet

- Sol. Man. - Chapter 11 - Investments - Additional ConceptsDocument10 pagesSol. Man. - Chapter 11 - Investments - Additional ConceptsKaisser Niel Mari FormentoNo ratings yet

- Environment Analysis: Marikina Polytechnic CollegeDocument32 pagesEnvironment Analysis: Marikina Polytechnic CollegeAnne MoralesNo ratings yet

- Ricardo Theory of Land Rent ModelDocument4 pagesRicardo Theory of Land Rent ModelnyapnyapokeNo ratings yet

- Lila Cumberland Ism Declaration of CompanyDocument5 pagesLila Cumberland Ism Declaration of CompanyGeorge Forster0% (1)

- Using Gamification To Build A Passionate and Quality-Driven Software Development TeamDocument10 pagesUsing Gamification To Build A Passionate and Quality-Driven Software Development TeamCognizantNo ratings yet

- Director of SQA or VP of SQADocument3 pagesDirector of SQA or VP of SQAapi-77785956No ratings yet

- Gagan Singh Pal STRDocument63 pagesGagan Singh Pal STRABHISHEK GUPTANo ratings yet

- Mana w9Document3 pagesMana w9Anh VuNo ratings yet

- Pricelist 2021 KLATENDocument23 pagesPricelist 2021 KLATENbayu setio ajiNo ratings yet

- Income and ExpenditureDocument128 pagesIncome and Expenditurejoannejose2011No ratings yet

- 36 Sprint Training - Unnati +Document30 pages36 Sprint Training - Unnati +Somesh KumarNo ratings yet

- HippoDocument1 pageHippoAndreNo ratings yet

- Environmental and Natural Resource Economics 10th Edition Tietenberg Solutions ManualDocument26 pagesEnvironmental and Natural Resource Economics 10th Edition Tietenberg Solutions ManualMatthewCurryeaqy100% (57)

- Solutions Chapter 18Document12 pagesSolutions Chapter 18Richard Leicheston100% (5)

- Notification AAICLAS Security Screener PostsDocument12 pagesNotification AAICLAS Security Screener Postssanjeev kumarNo ratings yet

- Form & RulesDocument7 pagesForm & RulesChandni KumarNo ratings yet