Professional Documents

Culture Documents

Tax Bracket List (WorkingCopy)

Uploaded by

Riyan Anggraeni0 ratings0% found this document useful (0 votes)

11 views2 pagesThe document outlines the personal income tax rates in Indonesia for 2013. It provides the annual nontaxable income amounts that can be deducted from gross income to calculate taxable income for taxpayers, spouses, up to three children, and working spouses. It then lists the progressive tax rates applied to annual taxable income brackets of 0-50 million, 50-250 million, 250-500 million, and 500 million and above at tax rates of 5%, 15%, 25%, and 30% respectively.

Original Description:

tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the personal income tax rates in Indonesia for 2013. It provides the annual nontaxable income amounts that can be deducted from gross income to calculate taxable income for taxpayers, spouses, up to three children, and working spouses. It then lists the progressive tax rates applied to annual taxable income brackets of 0-50 million, 50-250 million, 250-500 million, and 500 million and above at tax rates of 5%, 15%, 25%, and 30% respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesTax Bracket List (WorkingCopy)

Uploaded by

Riyan AnggraeniThe document outlines the personal income tax rates in Indonesia for 2013. It provides the annual nontaxable income amounts that can be deducted from gross income to calculate taxable income for taxpayers, spouses, up to three children, and working spouses. It then lists the progressive tax rates applied to annual taxable income brackets of 0-50 million, 50-250 million, 250-500 million, and 500 million and above at tax rates of 5%, 15%, 25%, and 30% respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Indonesian Personal Tax Income Rate 2013

Below is the list of the Annual Nontaxable Income, which is

deductible from gross income, to calculate the taxable income:

Annual Non-taxable

income

Taxpayer

Spouse

Each children (max 3)

Working Spouse (combined

incomes of Taxpayers)

Yearly

IDR

24,300,000.IDR

2,025,000.IDR

2,025,000.IDR

24,300,000.-

Monthly

IDR

2,025,000.IDR

168,750.IDR

168,750.IDR

2,025,000.-

Below is the progressive rate to calculate the tax payable on

taxable income:

Annual Taxable

Income

0 50,000,000

50,000,001

250,000,000

250,000,001

500,000,000

500,000,001 and above

Rate%

5%

15%

25%

30%

Persentase Pajak Penghasilan Pribadi Indonesia 2013

Daftar Pendapatan Tidak Kena Pajak Setahun di bawah ini

digunakan untuk memotong penghasilan gross dalam

perhitungan pajak penghasilan:

Pendapatan Tidak Kena

Pajak Setahun

Wajib Pajak

Pasangan

Anak (maks 3)

Pasangan yang bekerja

(penghasilan gabungan wajib

pajak)

Tahunan

IDR

24.300.000,IDR

2.025.000,IDR

2.025.000,IDR

24.300.000,-

Bulanan

IDR

2.025.000,IDR

168.750,IDR

168.750,IDR

2.025.000,-

Persentase progresif untuk menghitung pajak penghasilan atas

pendapatan kena pajak:

Pendapatan Kena Pajak

Setahun

% Pajak

0 50.000.000

50.000.001

250.000.000

250.000.001

500.000.000

500.000.001 and above

5%

15%

25%

30%

You might also like

- Annual Gross IncomeDocument4 pagesAnnual Gross IncomeMarilyn Perez OlañoNo ratings yet

- MATH PROJECT TOPIC 2 (Income Tax)Document7 pagesMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNo ratings yet

- Payroll TaxesDocument2 pagesPayroll Taxesforevapure_bar88162No ratings yet

- How To Calculate Income TaxDocument4 pagesHow To Calculate Income TaxreemaNo ratings yet

- Income Tax Slabs & Rates For Assessment Year 2013-14Document37 pagesIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNo ratings yet

- India Income Tax Slabs 2013Document1 pageIndia Income Tax Slabs 2013nkprasathNo ratings yet

- Tax Saving GuideDocument36 pagesTax Saving GuideSamantha JNo ratings yet

- Unit I .II TAXDocument42 pagesUnit I .II TAXArpit MadaanNo ratings yet

- How To Calculate Ur Income TaxDocument3 pagesHow To Calculate Ur Income TaxrazeemshipNo ratings yet

- Tds SALARY FOR A.Y. 2011-12Document59 pagesTds SALARY FOR A.Y. 2011-12Pragnesh ShahNo ratings yet

- How Does It Work?: Train Law Vs Nirc What Is NIRC?Document7 pagesHow Does It Work?: Train Law Vs Nirc What Is NIRC?Bryant R. CanasaNo ratings yet

- Payment of Tax, PAYE and Employment IncomeDocument20 pagesPayment of Tax, PAYE and Employment IncomeRavihara D.G.KNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- Income Tax Calculation IndiaDocument2 pagesIncome Tax Calculation Indiajustinmark99No ratings yet

- TDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Document5 pagesTDS Calculation Sheet in Excel and Slabs For FY 2017-18 and AY 2018-19Nishit MarvaniaNo ratings yet

- Tax Deducted at SourceDocument5 pagesTax Deducted at SourceRajinder KaurNo ratings yet

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterreNo ratings yet

- Tax FinalDocument21 pagesTax Finalshweta_narkhede01No ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- 2010 - Easy - Guide For Foreigner's Year-End Tax SettlementDocument94 pages2010 - Easy - Guide For Foreigner's Year-End Tax Settlement안수현No ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- Definition of Income TaxDocument14 pagesDefinition of Income Taxms_ssachinNo ratings yet

- Pengaruh Perkembangan UMKM Dan Kepatuhan Wajib Pajak Terhadap Penerimaan Pajak Di IndonesiaDocument25 pagesPengaruh Perkembangan UMKM Dan Kepatuhan Wajib Pajak Terhadap Penerimaan Pajak Di IndonesiaMutia AzzahraNo ratings yet

- BudgetDocument21 pagesBudgetshweta_narkhede01No ratings yet

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Tax InformationDocument14 pagesTax InformationSravan Kumar KoorapatiNo ratings yet

- A Critical Analysis of The Union Budget 2021Document4 pagesA Critical Analysis of The Union Budget 2021Jamila MustafaNo ratings yet

- Taxable Income RahulDocument18 pagesTaxable Income RahulRahul ParitNo ratings yet

- TDS On SalaryDocument5 pagesTDS On SalaryAato AatoNo ratings yet

- Taxation Foreign IncomeDocument6 pagesTaxation Foreign IncomerotiNo ratings yet

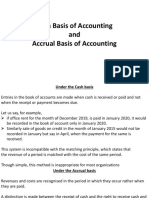

- Basis of AccountingDocument5 pagesBasis of AccountingAarush GuptaNo ratings yet

- 2021 Gr12 Maths Literacy WKBKDocument20 pages2021 Gr12 Maths Literacy WKBKtinashe chirukaNo ratings yet

- BudgetDocument13 pagesBudgetSayan Dutta RoyNo ratings yet

- YA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateDocument1 pageYA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateteotayNo ratings yet

- Income Tax EXPLAINATIONDocument11 pagesIncome Tax EXPLAINATIONVishwas AgarwalNo ratings yet

- Income Tax All Particulars 2013-14Document72 pagesIncome Tax All Particulars 2013-14kvsgssNo ratings yet

- Taxation System in BangladeshDocument4 pagesTaxation System in BangladeshRony RahmanNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- TdsDocument4 pagesTdsAdityaNo ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- Deduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009Document70 pagesDeduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009rhldxmNo ratings yet

- White Paper: Ministry of Finance, Trade and Economic PlanningDocument16 pagesWhite Paper: Ministry of Finance, Trade and Economic PlanningBonar StepanusNo ratings yet

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- IT Chart 2012-13Document2 pagesIT Chart 2012-13Srinivasan Guha Priyan IyengarNo ratings yet

- Individual Income TaxDocument2 pagesIndividual Income TaxpojjaneeNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Understanding The Salary Deductions On Your PayslipDocument10 pagesUnderstanding The Salary Deductions On Your PayslipChristianNo ratings yet

- CBDT Circular How To Calculate Tds On Salary For FY 1213Document64 pagesCBDT Circular How To Calculate Tds On Salary For FY 1213skybluehemaNo ratings yet

- IT Circular 2011-12Document56 pagesIT Circular 2011-12Narasimha SastryNo ratings yet

- Indian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountDocument23 pagesIndian Income Tax Calculator: Double Click The IT Calculator - IT Will Automatically Calculate The Taxable AmountshankarinsideNo ratings yet

- The Employment Tax Incentive - CalculationsDocument4 pagesThe Employment Tax Incentive - CalculationsmusvibaNo ratings yet

- Malaysia: Taxation of International ExecutivesDocument23 pagesMalaysia: Taxation of International ExecutivesPeng LimNo ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Tax Benefit For Savings and InvestmentDocument7 pagesTax Benefit For Savings and InvestmentShruti b ahujaNo ratings yet

- E-Filing of Income Tax ReturnDocument61 pagesE-Filing of Income Tax ReturnSilvi Khurana100% (2)

- Some Terms in Income Tax ClarifiedDocument9 pagesSome Terms in Income Tax ClarifiedAnonymous ATg0gvcf9No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet