Professional Documents

Culture Documents

Eskimo Pie Case Study

Eskimo Pie Case Study

Uploaded by

zeeshansheikh7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eskimo Pie Case Study

Eskimo Pie Case Study

Uploaded by

zeeshansheikh7Copyright:

Available Formats

Eskimo Pie Corporation

Background and Issues

Eskimo pie sells ice-cream and related food products

--earns revenues primarily through licensing, not a big manufacturer

--key assets are brand name recognition

--fragmented industry is consolidating, recent entry by large food cos.

Why was Reynolds selling Eskimo?

Why did Eskimo management prefer the IPO to the Nestle offer?

What criteria should Reynolds use in deciding between selling Eskimo to another

firm versus taking Eskimo public in an IPO?

Valuing Eskimo Pie

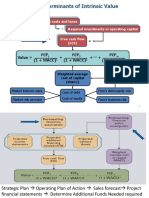

To value Eskimo we need the following:

(1) An estimate of rWACC

(2) An estimate of expected cash flows in 1991

(3) An estimate of the growth rate of future cash flows

Step 1: Estimating WACC

(A) Estimate unlevered: Use equity betas of stock in table 8, unlever them using the

formula from chapter 12: equity = [1 + (1-TC)Debt/Equity]unlevered

Ben & Jerrys

Dreyers

Empire of Carolina

Steves Ice Cream

Hershey Foods

Tootsie Roll

equity

1.2

1.4

.3

2.5

1.0

1.0

unlevered

1.18

1.33

0.14

2.37

0.96

1.00

Average unlevered = 1.162, use this as our estimate.

Estimating WACC (continued)

(B)

Estimate equity at the target D/E ratio

What would Eskimos target capital structure be after IPO?

equity = unlevered = 1.162

(C)

Identify rf

Use 10 year bond yield from exhibit 9: 7.42%

(D)

Identify the market risk premium rM-rf

Use 7.43% given in the problem.

(E)

Use the CAPM to estimate requity

requity = 7.42 + (1.162) x (7.43) = 16.05%

Under the unlevered target capital structure, rWACC = requity = 16.05%

Step 2. Expected cash flows

Lets estimate year-end 1991 after-tax cash flows since the Exhibit 6 forecasts

seem too low.

Net income

Plus current interest expense less taxes (.6 x 67,000)

Plus: depreciation

Less: interest income from $13 mil. Cash

[$13 mil. paid out in the transaction

Lost interest: $13mil. x (1-.4) x 4.56%]

Less: capital expenditures

change in working capital

Total Expected Cash Flow at end of 1991

$4,000,000

40,200

$1,352,000

-$355,680

-$1,000,000

0

$4,036,520

Working capital changes

Working capital excluding cash has decreased over the period 1987 to 1991, even

though sales have increased.

1987

1988

1989

1990

Working capital

9,342

11,107

10,830

11,735

Cash

5,550

8,109

10,723

13,191

Working capital less cash

3,792

2,998

107

-1,456

Eskimo Pie is a marketing and licensing firm, not a manufacturer.

Would be reasonable to exclude working capital changes from cash flow

estimation.

Step 2. Expected cash flows

Lets estimate year-end 1991 after-tax cash flows since the Exhibit 6 forecasts

seem too low.

Net income

Plus current interest expense less taxes (.6 x 67,000)

Plus: depreciation

Less: interest income from $13 mil. Cash

[$13 mil. paid out in the transaction

Lost interest: $13mil. x (1-.4) x 4.56%]

Less: capital expenditures

change in working capital

Total Expected Cash Flow at end of 1991

$4,000,000

40,200

$1,352,000

-$355,680

-$1,000,000

0

$4,036,520

Step 3. Estimating a growth rate in future cash flows

Eskimo Pie grows substantially in 1991, which made IPO a potential alternative.

One approach: Estimate average annual growth in sales

1988

1989

1990

1991

(36,695-30,769)/(30,769)

(46,709-36,695)/(36,695)

(47,198-46,709)/(46,709)

(61,000-47,198)/(47,198)

Average sales growth

= 19.25%

= 27.29%

= 1.05%

= 29.24%

19.21%

Question: Is this a reasonable estimate of expected cash flow growth?

Has past 4-year period been special will growth slow down?

Other approaches to estimate growth

1. Past growth in net income

2. Past growth in operating income

3. Past growth in cash flows

Problem: These numbers are more variable, particularly for years with income or

cash flows close to zero.

Bringing in more information

What are analysts saying about future industry prospects?

What does Goldman-Sachs project? (forward looking estimates)

Expected 1992 growth in sales

Expected 1993 growth in sales

Average

4.54%

1.24%

2.89%

Expected 1992 growth in net income

Expected 1993 growth in net income

Average

10.44%

6.23%

8.34%

Net income more closely tracks changes in cash flow

Since growth is slowing down, lets use 6.23% for a constant growth rate.

4. Putting it all together

V = [Expected 1991 cash flow x (1+growth rate)] / [r growth rate]

V = [($4,036,520) x (1 + .0623)] / [.1605 - .0623]

V (or E) = 43,665,939

Should Reynolds sell to Nestle or do the IPO?

Nestle offer - $61 million cash

IPO proceeds

Cash from stock sale

Special dividend payment of

Total

$43,665,939

$15,000,000

$58,665,939

Looks like Nestle offer is slightly better.

Some Issues:

Results very sensitive to assumptions about growth rates - If more optimistic

since Goldman Sachs projection does not reflect the recent development.

Use 8.34% (the average growth rate) Total proceeds would be $71,720,697.

Other methods of valuing stocks? How about other firms in the same industry?

Comparable public firm multiples

There would be some multiples that could be used to check our estimates.

Equity-to-net income Total value-to-sales

Average of other firms

22.8

1.6

Estimate for Eskimo Pie

3.7

61

Implied value

84.4

97.6

The value of Eskimo Pie would range from about $84 to $98 million (excluding

the excess cash) our estimate seems to be undervalued.

Additional issues: Need to convince that IPO is feasible.

You might also like

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- What Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Document7 pagesWhat Is Your Estimate of The Value of Eskimo Pie Corporation As A Stand-Alone Company?Ya-ting YangNo ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- The Question That Need To Be Answered: What Should Be The Price of The IPO?Document3 pagesThe Question That Need To Be Answered: What Should Be The Price of The IPO?Bebila Singh50% (2)

- Sealed Air Case StudyDocument8 pagesSealed Air Case StudyDo Ngoc Chau100% (4)

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Friendly Cards CaseDocument3 pagesFriendly Cards CaseJeff Farley50% (2)

- Eskimo Pie FileDocument15 pagesEskimo Pie FilesuwimolJNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Ferrari Case StudyDocument2 pagesFerrari Case StudyjamesngNo ratings yet

- Ameritrade Case ConsolidatedDocument5 pagesAmeritrade Case Consolidatedyvasisht3100% (1)

- Eskimo PieDocument30 pagesEskimo PieMing Yang100% (1)

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerNo ratings yet

- Popsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Document18 pagesPopsicle Unilever 7.6% Klondike Empire of Carolin 5.4% Eskimo Pie Eskimo Pie 5.3% Snickers Mars 4.8% Weight Watchers H.J. Heinz 4.3%Irakli SaliaNo ratings yet

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73No ratings yet

- Interco CaseDocument12 pagesInterco CaseRyan LamNo ratings yet

- MCI Communications CorporationDocument6 pagesMCI Communications Corporationnipun9143No ratings yet

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- Eskimo Pie CaseDocument19 pagesEskimo Pie Casedese88No ratings yet

- FINA 5470 - Case 3 - Eskimo PieDocument7 pagesFINA 5470 - Case 3 - Eskimo PieYifan ChenNo ratings yet

- Linear Technology Payout Policy Case 3Document4 pagesLinear Technology Payout Policy Case 3Amrinder SinghNo ratings yet

- Eskimo PieDocument7 pagesEskimo PieHeather KellerNo ratings yet

- Case 2 Eskimo Pie Corporation (Abridged)Document7 pagesCase 2 Eskimo Pie Corporation (Abridged)Irakli Salia100% (1)

- Debt Policy at Ust Inc Case StudyDocument7 pagesDebt Policy at Ust Inc Case StudyAnton Borisov100% (1)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- AmeriTrade Case StudyDocument3 pagesAmeriTrade Case StudyTracy PhanNo ratings yet

- Boeing 7E7 Case StudyDocument5 pagesBoeing 7E7 Case Studymrc2000100% (1)

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- Week 6 - The Flinder Valves and Controls Inc - AnswersDocument3 pagesWeek 6 - The Flinder Valves and Controls Inc - AnswersLucasNo ratings yet

- Cooper Industries - Group 5Document11 pagesCooper Industries - Group 5Rudro MukherjeeNo ratings yet

- 13 American Chemical Corporation - Group 13Document5 pages13 American Chemical Corporation - Group 13Anonymous MpSSPQi0% (1)

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuNo ratings yet

- Investment Banking Case AnalysisDocument3 pagesInvestment Banking Case AnalysisSunil VadhvaNo ratings yet

- Knoll Furniture CaseDocument5 pagesKnoll Furniture CaseIni EjideleNo ratings yet

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- BNYC and Mellons Merger, Grp-11, MACR-BDocument2 pagesBNYC and Mellons Merger, Grp-11, MACR-Balok_samal_250% (2)

- American Chemical CompanyDocument7 pagesAmerican Chemical Companycmarshall22340% (5)

- Lex Service PLCDocument3 pagesLex Service PLCMinu RoyNo ratings yet

- Eskimo PieDocument2 pagesEskimo Piechch91750% (2)

- Massey Questions 1-4Document4 pagesMassey Questions 1-4Samir IsmailNo ratings yet

- Sealed Air Co Case Study Queestions Why Did Sealed Air Undertake A LeveragDocument9 pagesSealed Air Co Case Study Queestions Why Did Sealed Air Undertake A Leveragvichenyu100% (1)

- Stone Container CorporationDocument5 pagesStone Container Corporationalice123h21No ratings yet

- American Chemical CorporationDocument5 pagesAmerican Chemical Corporationjlvaldesm100% (1)

- DuPont QuestionsDocument1 pageDuPont QuestionssandykakaNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Cooper Industries Case QuestionsDocument3 pagesCooper Industries Case QuestionsChip choiNo ratings yet

- American Chemical Corp (ACC) Case Study Executive SummaryDocument1 pageAmerican Chemical Corp (ACC) Case Study Executive SummaryNatasha SuddhiNo ratings yet

- Case 1 SolDocument22 pagesCase 1 Solstig2lufetNo ratings yet

- Coursehero 40252829Document2 pagesCoursehero 40252829Janice JingNo ratings yet

- Pressco Case MemoDocument7 pagesPressco Case Memotodenheim0% (3)

- Pressco Inc. Case StudyDocument19 pagesPressco Inc. Case StudyIrakli SaliaNo ratings yet

- Diamond Chemicals Case Study11 - FinalDocument20 pagesDiamond Chemicals Case Study11 - FinalJoao0% (1)

- Kohl's Equity ValuationDocument20 pagesKohl's Equity ValuationJaskaran JaiyaNo ratings yet

- Super ProjectDocument2 pagesSuper ProjectAnkit MehtaNo ratings yet

- Harris SeafoodsDocument2 pagesHarris SeafoodsNadia Iqbal100% (1)

- AMT - Pro FormaDocument8 pagesAMT - Pro FormaConorTimmins100% (1)

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- Lecture 28Document34 pagesLecture 28Riaz Baloch NotezaiNo ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Document33 pagesValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasNo ratings yet

- 2-4 2006 Dec ADocument13 pages2-4 2006 Dec AAjay Takiar50% (2)

- Depreciation Expense Cost - Salvage Value / Useful LifeDocument2 pagesDepreciation Expense Cost - Salvage Value / Useful LifeGarp BarrocaNo ratings yet

- Psychological Contract & Employee EngagementDocument14 pagesPsychological Contract & Employee Engagementswati_nageliamcimNo ratings yet

- Calculate Materiality: Assignment 2Document3 pagesCalculate Materiality: Assignment 2ge baijingNo ratings yet

- Assignment 2-Feb2023Document18 pagesAssignment 2-Feb2023NURUL HANISNo ratings yet

- Risk Assessment & RatingsESRM OfficerDocument2 pagesRisk Assessment & RatingsESRM OfficerBoyi EnebinelsonNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration Certificatet eshwarNo ratings yet

- FundAcc Exercise WorkbookDocument33 pagesFundAcc Exercise WorkbookJosef SamoranosNo ratings yet

- Module 4Document20 pagesModule 4Anonymous d3CGBMzNo ratings yet

- Quotation For Manpower Services: TermsDocument1 pageQuotation For Manpower Services: TermsAwadh GroupNo ratings yet

- Toa 1407 Non-Financial AssetsDocument15 pagesToa 1407 Non-Financial AssetsRodNo ratings yet

- Partnership Chapter 3-IncompleteDocument14 pagesPartnership Chapter 3-IncompleteJames DencerNo ratings yet

- ASMI-OSHMS-PR-11 - Communication and Consultation ProcedureDocument6 pagesASMI-OSHMS-PR-11 - Communication and Consultation ProcedureJHUPEL ABARIALNo ratings yet

- Retail Management Imp QuestionsDocument21 pagesRetail Management Imp QuestionsDinesh kumar JenaNo ratings yet

- Chapter 6 - The Finance Function and Finance InformationDocument63 pagesChapter 6 - The Finance Function and Finance Informationtrandinh2828No ratings yet

- Sense Introduction To Social EnterpreneurshipDocument36 pagesSense Introduction To Social EnterpreneurshipSk nabilaNo ratings yet

- Unilever - I Kadek Yushak W - 64905000038-3Document5 pagesUnilever - I Kadek Yushak W - 64905000038-3Kadek yushakNo ratings yet

- QTN No 213468Document4 pagesQTN No 213468ZakNo ratings yet

- Nilachol. A3 DeedDocument19 pagesNilachol. A3 DeedAl Mahmud HasanNo ratings yet

- Mac Financial RatiosDocument12 pagesMac Financial RatiosArooj IqbalNo ratings yet

- Ak Mentoring Day 2 Swing Trading: Starts at 7amDocument36 pagesAk Mentoring Day 2 Swing Trading: Starts at 7amAvadhesh Kumar SinghNo ratings yet

- Destination Management Plan SheffieldDocument26 pagesDestination Management Plan SheffieldbibiNo ratings yet

- Business English I Revision Crossword Puzzle - PDFDocument1 pageBusiness English I Revision Crossword Puzzle - PDFAna Rita FaustinoNo ratings yet

- BME2 Formales 3TM2 Activity1Document3 pagesBME2 Formales 3TM2 Activity1Karylle FormalesNo ratings yet

- Project UddyamDocument5 pagesProject Uddyamrutvi.khatri.20No ratings yet

- Aiib PresentationDocument12 pagesAiib PresentationGerry WienNo ratings yet

- Presentation 1Document8 pagesPresentation 1Chetan Sunil SonawaneNo ratings yet

- B2B Marketing - A South Asian Perspective, 11th EditionDocument2 pagesB2B Marketing - A South Asian Perspective, 11th Editionharika k100% (1)

- A Resource For The Teaching and Learning of EnglishDocument85 pagesA Resource For The Teaching and Learning of EnglishmsuksarnNo ratings yet

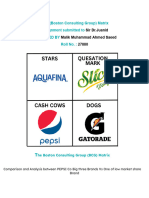

- BCG Assigment Rollno.27880Document4 pagesBCG Assigment Rollno.27880Ahmed SaeedNo ratings yet