Professional Documents

Culture Documents

2015 Fall Exam M Syllabus PDF

2015 Fall Exam M Syllabus PDF

Uploaded by

marubberCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

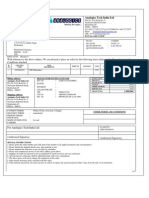

- Certificate of Marine Cargo Insurance: OriginalDocument3 pagesCertificate of Marine Cargo Insurance: OriginalMauricio Montaño MelgarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Gsa and The OverstandingDocument43 pagesGsa and The OverstandingJoshua Sygnal Gutierrez100% (13)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz 16Document6 pagesQuiz 16Richmon SantosNo ratings yet

- 07 Memory Aid Credit TransactionsDocument38 pages07 Memory Aid Credit Transactionsarrrrrrrrr100% (1)

- Compiled BarQs Insurance LawDocument54 pagesCompiled BarQs Insurance LawCelinka Chun100% (1)

- Offer Letter GurgoanDocument15 pagesOffer Letter GurgoandimpyNo ratings yet

- CSI201 Syllabus Fall2015Document6 pagesCSI201 Syllabus Fall2015lolNo ratings yet

- SolutDocument31 pagesSolutlolNo ratings yet

- Alpha Blondy Bio UkDocument2 pagesAlpha Blondy Bio UklolNo ratings yet

- Models For Financial Economics - July 2015: Normal Distribution Calculator Prometric Web SiteDocument3 pagesModels For Financial Economics - July 2015: Normal Distribution Calculator Prometric Web SitelolNo ratings yet

- Jacobian ConvolutionDocument23 pagesJacobian ConvolutionlolNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- PSL3 - Agriculture Schemes - Part 2Document16 pagesPSL3 - Agriculture Schemes - Part 2svmkishoreNo ratings yet

- Obligation RequestDocument8 pagesObligation RequestNoemi San AntonioNo ratings yet

- Limited Portability LawDocument2 pagesLimited Portability LawIvy PazNo ratings yet

- Questcor Pharmaceuticals, Inc.: Risks Associated With Our BusinessDocument120 pagesQuestcor Pharmaceuticals, Inc.: Risks Associated With Our BusinessHoney BansalNo ratings yet

- Comparison of Resposibilities Client and ContractorDocument3 pagesComparison of Resposibilities Client and ContractorNazirah NazeriNo ratings yet

- Mahindra and MahindraDocument27 pagesMahindra and MahindraAnisa_Rao33% (3)

- Armagas LTD V Mundogas (The Ocean Frost) (1985) UKHL 11 (22 May 1985)Document15 pagesArmagas LTD V Mundogas (The Ocean Frost) (1985) UKHL 11 (22 May 1985)Natalie DouglasNo ratings yet

- Conditions of Contract For Supply & Installation of Goods and Provision of ServicesDocument30 pagesConditions of Contract For Supply & Installation of Goods and Provision of ServicesAman ManiNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2021-01Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2021-01Fuzzy PandaNo ratings yet

- Form W-8BEN-E InstructionsDocument15 pagesForm W-8BEN-E InstructionsSteve ThompsonNo ratings yet

- AR02 Solutions To Cessioning Practice QuestionsDocument7 pagesAR02 Solutions To Cessioning Practice QuestionsGashawNo ratings yet

- Constantino vs. Asia Life Insurance CompanyDocument2 pagesConstantino vs. Asia Life Insurance CompanyAnne Ausente BerjaNo ratings yet

- Cat 86200516 PDFDocument58 pagesCat 86200516 PDFAnonymous TPVfFif6TONo ratings yet

- Po 609 AlphaDocument2 pagesPo 609 AlphapavanNo ratings yet

- DRAFT - Revised Philippine Rules On SeaFreight ForwardingDocument14 pagesDRAFT - Revised Philippine Rules On SeaFreight ForwardingPortCalls100% (1)

- Ic s01 Fire and Loss of Profitt Insurance - FinalDocument59 pagesIc s01 Fire and Loss of Profitt Insurance - FinalRanjithNo ratings yet

- Statement of Account: Mr. Sanjoy BhattacharjeeDocument6 pagesStatement of Account: Mr. Sanjoy BhattacharjeeMainak BhattacharjeeNo ratings yet

- Income From Salary-FinalDocument42 pagesIncome From Salary-FinalPrathibha TiwariNo ratings yet

- Philippine Health Care Providers Inc Vs CirDocument2 pagesPhilippine Health Care Providers Inc Vs CirGeralyn GabrielNo ratings yet

- Module 4 CasesDocument7 pagesModule 4 CasesShivam SinghNo ratings yet

- Annexure BDocument11 pagesAnnexure BSonu JainNo ratings yet

- Fidic ClauseDocument53 pagesFidic Clauseehtsham007No ratings yet

- The Commercial Documents Evidence Act, 1939Document4 pagesThe Commercial Documents Evidence Act, 1939Leo LukoseNo ratings yet

2015 Fall Exam M Syllabus PDF

2015 Fall Exam M Syllabus PDF

Uploaded by

marubberOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2015 Fall Exam M Syllabus PDF

2015 Fall Exam M Syllabus PDF

Uploaded by

marubberCopyright:

Available Formats

Models for Life Contingencies

FALL 2015

Important Exam Information:

Exam Registration

Candidates may register online or with an application.

Introductory Study Note

The Introductory Study Note has a complete listing of all readings as well

as sample exam questions and solutions, errata and other very important

information.

Past Exams

Past exams from 2000-2013 for prior (multiple-choice only) versions of

the exam are available on the SOA website along with recent

examinations.

Updates

Candidates should be sure to check the Updates page on the exam home

page periodically for additional corrections or notices.

Models for Life Contingencies

FALL 2015

1. Topic: Models for single and multiple lives (10-20%)

Learning Objectives

The Candidate will understand key concepts concerning tabular or parametric survival models and single or

multiple-life states.

Learning Outcomes

The Candidate will be able to:

a)

Explain and interpret the effects of transitioning between states, the survival models and their

interactions. Calculate and interpret standard probability functions including survival and mortality

probabilities, force of mortality, and complete and curtate expectation of life.

b) For models dealing with multiple lives and/or multiple states, explain the random variables associated

with the model; calculate and interpret marginal and conditional probabilities, and moments.

c)

Using the factors mentioned in Learning Outcomes 1a and 1b, construct and interpret survival models

for cohorts consisting of non-homogeneous populations, for example, smokers and non-smokers or

ultimate-and-select groups.

d) Describe the behavior of continuous-time and discrete-time Markov chain models, identify possible

transitions between states, and calculate and interpret the probability of being in a particular state and

transitioning between states.

e)

Apply to calculations involving these models appropriate approximation methods such as uniform

distribution of deaths, constant force, Woolhouse, and Euler.

2. Topic: Present Value Random Variables (10-20%)

Learning Objectives

The Candidate will be able to perform calculations on the present value random variables associated with

benefits and expenses for any of the models mentioned in the Learning Outcomes of Learning Objective 1.

Learning Outcomes

The Candidate will be able to:

a)

Calculate and interpret probabilities, means, percentiles and higher moments.

b) Calculate and interpret the effect of changes in underlying assumptions such as mortality and interest.

c)

Apply to calculations involving these random variables appropriate approximation methods such as

uniform distribution of deaths, constant force, Woolhouse and Euler.

Models for Life Contingencies

FALL 2015

3. Topic: Premium Calculation (20-40%)

Learning Objectives

The Candidate will be able to both calculate with and explain premium-calculation methodologies such as the

equivalence principle, the portfolio-premium principle, and premiums determined by specified profit objectives.

Learning Outcomes

The Candidate will be able to:

a)

Calculate and interpret probabilities, means, percentiles and higher moments of random variables

associated with these premiums, including loss-at-issue random variables.

b) Using any of the models mentioned in the Learning Outcomes of Learning Objective 1, calculate and

interpret the effect of changes in policy design and underlying assumptions such as changes in

mortality, benefits, expenses, interest and dividends.

c)

Perform the calculations mentioned in Learning Outcomes 3a and 3b for contracts associated with

specified contingent cash flows including

o

Non-interest-sensitive insurances;

Annuities;

Universal life insurances; and

Participating insurances.

d) Apply to calculations involving these premiums appropriate approximation methods such as uniform

distribution of deaths, constant force, Woolhouse and Euler

4. Topic: Reserves (20-40%)

Learning Objectives

The Candidate will understand reserves for insurances and annuities for models mentioned in the Learning

Outcomes of Learning Objectives 1 and 3.

Learning Outcomes

The Candidate will be able to:

a)

Calculate and interpret any of (i) several reserve types including benefits reserves, gross premium

reserves, expense reserves or any of (ii) several reserve methods such as Full Preliminary Term (FPT) or

modified reserves.

b) Calculate and interpret probabilities, means, percentiles and higher moments of random variables

associated with these reserves, including future-loss random variables.

c)

Calculate and interpret asset shares, expected profit, actual profit, gain, gain by source and period,

internal rate of return and other common profit measures.

d) Calculate and interpret the effect of policy modifications.

e)

Calculate and interpret contract account values, contract surrender values and profit measures on

universal life insurance contracts.

3

Models for Life Contingencies

FALL 2015

f)

Compare and contrast non-interest-sensitive and participating insurances with universal life

insurances.

g)

Calculate and interpret the effect of changes in policy design and underlying assumptions such as

changes in mortality, benefits, expenses, interest and dividends.

h) Apply to calculations involving these reserves appropriate approximation methods such as uniform

distribution of deaths, constant force, Woolhouse and Euler.

5. Topic: Pension Plans and Retirement Benefits (5-15%)

Learning Objectives

The Candidate will understand how the models mentioned in the Learning Outcomes of previous Learning

Objectives apply to pension plans and retirement benefits.

Learning Outcomes

The Candidate will be able to:

a)

Describe and compare defined benefit pension plans and defined contribution pension plans. Describe

and compare different types of defined benefit plans, including final average salary plans and career

average earning plans.

b) Identify and interpret the common states and decrements for pension plans, and the parametric and

tabular models, including Markov chain models, associated with these decrements.

c)

Apply the models mentioned in Learning Outcome 5b to the plans mentioned in Learning Outcome 5a

and calculate and interpret replacement ratios, benefits, and their expected values with adjustments

such as the actuarial reduction factor.

d) Calculate and interpret the effect of changes in underlying assumptions such as mortality, other

decrements and interest.

e)

Apply to calculations involving these plans and benefits appropriate approximation methods such as

uniform distribution of deaths, constant force, Woolhouse and Euler.

Resources

Actuarial Mathematics for Life Contingent Risks, 2nd Edition, 2013, Dickson, D., Hardy, M., Waters, H.,

Cambridge University Press. Exercises are considered part of the required readings.

o

Chapters 1-9

Chapter 10 (Except Section 10.7)

Chapter 11 (Except Section 11.5)

Chapters 12-13

Notation and Terminology Note

Exam MLC Tables

Note, the text and the Notation and Terminology Note will not be available with the examination booklet. A copy of the

Tables will be available.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Certificate of Marine Cargo Insurance: OriginalDocument3 pagesCertificate of Marine Cargo Insurance: OriginalMauricio Montaño MelgarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Gsa and The OverstandingDocument43 pagesGsa and The OverstandingJoshua Sygnal Gutierrez100% (13)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz 16Document6 pagesQuiz 16Richmon SantosNo ratings yet

- 07 Memory Aid Credit TransactionsDocument38 pages07 Memory Aid Credit Transactionsarrrrrrrrr100% (1)

- Compiled BarQs Insurance LawDocument54 pagesCompiled BarQs Insurance LawCelinka Chun100% (1)

- Offer Letter GurgoanDocument15 pagesOffer Letter GurgoandimpyNo ratings yet

- CSI201 Syllabus Fall2015Document6 pagesCSI201 Syllabus Fall2015lolNo ratings yet

- SolutDocument31 pagesSolutlolNo ratings yet

- Alpha Blondy Bio UkDocument2 pagesAlpha Blondy Bio UklolNo ratings yet

- Models For Financial Economics - July 2015: Normal Distribution Calculator Prometric Web SiteDocument3 pagesModels For Financial Economics - July 2015: Normal Distribution Calculator Prometric Web SitelolNo ratings yet

- Jacobian ConvolutionDocument23 pagesJacobian ConvolutionlolNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- PSL3 - Agriculture Schemes - Part 2Document16 pagesPSL3 - Agriculture Schemes - Part 2svmkishoreNo ratings yet

- Obligation RequestDocument8 pagesObligation RequestNoemi San AntonioNo ratings yet

- Limited Portability LawDocument2 pagesLimited Portability LawIvy PazNo ratings yet

- Questcor Pharmaceuticals, Inc.: Risks Associated With Our BusinessDocument120 pagesQuestcor Pharmaceuticals, Inc.: Risks Associated With Our BusinessHoney BansalNo ratings yet

- Comparison of Resposibilities Client and ContractorDocument3 pagesComparison of Resposibilities Client and ContractorNazirah NazeriNo ratings yet

- Mahindra and MahindraDocument27 pagesMahindra and MahindraAnisa_Rao33% (3)

- Armagas LTD V Mundogas (The Ocean Frost) (1985) UKHL 11 (22 May 1985)Document15 pagesArmagas LTD V Mundogas (The Ocean Frost) (1985) UKHL 11 (22 May 1985)Natalie DouglasNo ratings yet

- Conditions of Contract For Supply & Installation of Goods and Provision of ServicesDocument30 pagesConditions of Contract For Supply & Installation of Goods and Provision of ServicesAman ManiNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2021-01Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2021-01Fuzzy PandaNo ratings yet

- Form W-8BEN-E InstructionsDocument15 pagesForm W-8BEN-E InstructionsSteve ThompsonNo ratings yet

- AR02 Solutions To Cessioning Practice QuestionsDocument7 pagesAR02 Solutions To Cessioning Practice QuestionsGashawNo ratings yet

- Constantino vs. Asia Life Insurance CompanyDocument2 pagesConstantino vs. Asia Life Insurance CompanyAnne Ausente BerjaNo ratings yet

- Cat 86200516 PDFDocument58 pagesCat 86200516 PDFAnonymous TPVfFif6TONo ratings yet

- Po 609 AlphaDocument2 pagesPo 609 AlphapavanNo ratings yet

- DRAFT - Revised Philippine Rules On SeaFreight ForwardingDocument14 pagesDRAFT - Revised Philippine Rules On SeaFreight ForwardingPortCalls100% (1)

- Ic s01 Fire and Loss of Profitt Insurance - FinalDocument59 pagesIc s01 Fire and Loss of Profitt Insurance - FinalRanjithNo ratings yet

- Statement of Account: Mr. Sanjoy BhattacharjeeDocument6 pagesStatement of Account: Mr. Sanjoy BhattacharjeeMainak BhattacharjeeNo ratings yet

- Income From Salary-FinalDocument42 pagesIncome From Salary-FinalPrathibha TiwariNo ratings yet

- Philippine Health Care Providers Inc Vs CirDocument2 pagesPhilippine Health Care Providers Inc Vs CirGeralyn GabrielNo ratings yet

- Module 4 CasesDocument7 pagesModule 4 CasesShivam SinghNo ratings yet

- Annexure BDocument11 pagesAnnexure BSonu JainNo ratings yet

- Fidic ClauseDocument53 pagesFidic Clauseehtsham007No ratings yet

- The Commercial Documents Evidence Act, 1939Document4 pagesThe Commercial Documents Evidence Act, 1939Leo LukoseNo ratings yet