Professional Documents

Culture Documents

Justice Teresita Leonardo-De Castro Cases (2008-2015) : Civil Law

Justice Teresita Leonardo-De Castro Cases (2008-2015) : Civil Law

Uploaded by

Harold B. LacabaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Justice Teresita Leonardo-De Castro Cases (2008-2015) : Civil Law

Justice Teresita Leonardo-De Castro Cases (2008-2015) : Civil Law

Uploaded by

Harold B. LacabaCopyright:

Available Formats

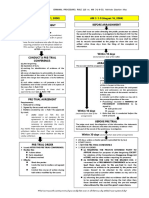

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

EFFECT AND APPLICATION OF LAWS

CARIDAD MAGKALAS vs. NATIONAL HOUSING AUTHORITY

G.R. No. 138823, September 17, 2008, J. Leonardo-De Castro

There is no irreconcilable conflict or repugnancy between Section 28 of R.A. No. 7279 and P.D.

No. 1315 and No. 1472, rather, they can be read together and harmonized to give effect to their

provision. It should be stressed that Section 28 of R.A. No. 7279 does not totally and absolutely prohibit

eviction and demolition without a judicial order as in fact it provides for exceptions. Pursuant to

established doctrine, the three (3) statutes should be construed in the light of the objective to be

achieved and the evil or mischief to be suppressed by the said laws, and they should be given such

construction as will advance the object, suppress the mischief and secure the benefits intended. It is

worthy to note that the three laws (P.D. No. 1315, P.D. No. 1472 and R.A. No. 7279) have a common

objective to address the housing problems of the country by establishing a comprehensive urban

development and housing program for the homeless. For this reason, the need to harmonize these laws

all the more becomes imperative.

Facts:

Petitioner Caridad Magkalas is one of the informal settlers in Bagong Barrio, Caloocan City,

whose lot was expropriated by virtue of P.D. No. 1315 and following the subdivision project devised

by Respondent NHA, as statutory administrator, the lot occupied by Magkalas was included in the

open space requirement or area center. Magkalas along with two other claimants appealed this

decision designating their lots as part of the area center. The NHA, however, denied their appeal

and afterwards sent a Notice of Lot Assignment to Magkalas recognizing the latter as a censused

owner of a structure with TAG No. 0063-04 which was identified for relocation.

Eventually, Petitioner Magkalas filed a complaint for damages with prayer for TRO/writ of

preliminary injunction against NHA. The RTC of Caloocan dismissed the complaint and ordered

NHA to proceed with the demolition of Magkalas structure. In the meantime, the two other

claimants affected by the area center acceded to their transfer to the allocated lots within the same

subdivision project.

Magkalas is now before the Court asserting that while Presidential Decree Nos. 1315 and

1472 authorized the NHA to eject without the necessity of a judicial order all squatter colonies in

government resettlement projects, R.A. No. 7279 discouraged such eviction and demolition without

court order. She further claims that R.A. No. 7279, being the later law, impliedly repealed the

preceding laws following the legal axiom that when a later law is passed with provisions contrary to

the former law, an implied repeal of the former law takes effect.

Issue:

Whether or not R.A. 7279 impliedly repealed P.D. 1472 and P.D. 1315.

Ruling:

Petitioner Magkalas cites Section 28 of R.A. No. 7279 which provides: Eviction or demolition

as a practice shall be discouraged. Eviction or demolition, however, may be allowed under the

following situations:

Page 1 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

a)

b)

c)

When persons or entities occupy danger areas such as esteros, railroad tracks,

garbage dumps, riverbanks, shorelines, waterways and other public places such as

sidewalks, roads, parks and playgrounds;

When government infrastructure projects with available funding are about to be

implemented; or

When there is a court order for eviction and demolition.

Magkalas asserts that this afore-quoted provision is inconsistent with Section 1 of P.D. No.

1315 and Section 2 of P.D. No. 1472, which state as follows:

Sec. 1 (P.D. No. 1315) xxx. The National Housing Authority hereinafter referred to as the

Authority is designated administrator for the national government and is authorized to immediately

take possession, control and disposition of the expropriated properties with the power of demolition of

their improvements. xxx

Sec. 2 (P.D. No. 1315) xxx. The National Housing Authority shall have the power to

summarily eject, without the necessity of judicial order, any and all squatters colonies on government

resettlement projects, as well as any illegal occupants in any homelot, apartment or dwelling unit

owned or administered by it. xxx.

From a careful reading of the foregoing provisions, the Court holds that R.A. No. 7279 does

not necessarily repeal P.D. No. 1315 and P.D. No. 1472 as it does not contain any provision which

categorically and expressly repeals the provisions of P.D. No. 1315 and P.D. No. 1472. Neither could

there be an implied repeal. It is a well-settled rule of statutory construction that repeals by

implication are not favored. The rationale behind the rule is explained as follows:

Repeal of laws should be made clear and expressed. Repeals by implication are not favoured

as laws are presumed to be passed with deliberation and full knowledge of all laws existing on the

subject. Such repeals are not favored for a law cannot be deemed repealed unless it is clearly manifest

that the legislature so intended it. The failure to add a specific repealing clause indicates that the

intent was not to repeal any existing law, unless an irreconcilable inconsistency and repugnancy exist

in the terms of the new and old laws.

The Court finds that there is no irreconcilable conflict or repugnancy between Section 28 of

R.A. No. 7279 and P.D. No. 1315 and No. 1472, rather, they can be read together and harmonized to

give effect to their provision. It should be stressed that Section 28 of R.A. No. 7279 does not totally

and absolutely prohibit eviction and demolition without a judicial order as in fact it provides for

exceptions. Pursuant to established doctrine, the three (3) statutes should be construed in the light

of the objective to be achieved and the evil or mischief to be suppressed by the said laws, and they

should be given such construction as will advance the object, suppress the mischief and secure the

benefits intended. It is worthy to note that the three laws (P.D. No. 1315, P.D. No. 1472 and R.A. No.

7279) have a common objective to address the housing problems of the country by establishing a

comprehensive urban development and housing program for the homeless. For this reason, the

need to harmonize these laws all the more becomes imperative.

Page 2 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

CONFLICT OF LAWS

BANK OF THE PHILIPPINE ISLANDS SECURITIES CORPORATION vs. EDGARDO V. GUEVARA

G.R. No. 167052, March 11, 2015, J. Leonardo-De Castro

In an action for enforcement of foreign judgment, the Court has limited review over the

decision rendered by the foreign tribunal. The Philippine courts cannot pass upon the merits of the

case pursuant to the incorporation clause of the Constitution, unless there is proof of want of

jurisdiction, want of notice to the party, collusion, fraud, or clear mistake of law or fact.

Facts:

Philsec Investment Corporation (PHILSEC) is a domestic stock brokerage firm and BPI

International Finance Limited (BPI-IFL) (previously called AIFL), both formerly owned by Ayala

Corp but was subsequently bought by BPI. PHILSEC was a member of the Makati Stock Exchange

and the rules of the said organization required that a stockbroker maintain an amount of security

equal to at least 50% of a clients outstanding debt.

Guevara was the President of PHILSEC and one of his obligations was to resolve the

outstanding loans of a certain Ventura O. Ducat (Ducat), which the latter obtained separately from

PHILSEC and AIFL. Although Ducat constituted a pledge of his stock portfolio valued at

approximately US$1.4 million, Ducats loans already amounted to US$3.1 million. Because the

security for Ducats debts fell below the 50% requirement of the Makati Stock Exchange, the trading

privileges of PHILSEC was in peril of being suspended.

Ducat proposed to settle his debts by an exchange of assets and offered his property in

Harris County Texas in the US in partnership with 1488 Inc., a US-based corporation. It was

accepted by Ayala Corp through Enrique Zobel, its CEO. Before the reaching finality of the

agreement, Zobel had the property appraised by sending an employee. The employee of Ayala

communicated to Zobel his estimate which was US$2.9 million. However, Guevara was also tasked

by Ayala Corp to have the property appraised and according to William Craig, the former owner of

the property, the fair market value of the land was US$3,365,000.

An agreement was then perfected where ATHONA, which was also owned by Ayala Corp,

should buy the property for US$2,807,209.02 from 1488, the part of the purchase price of which

(US$2.5million) was loaned from Philsec and AIFL and shall execute a promissory note for the

balance. Also in the agreement was that upon receipt of US$2.5million, 1488 shall fully pay the

obligations of Ducat in Philsec and AIFL and shall become the new owner of Ducats pledged stock

portfolio.

After acquiring the Harris County property, ATHONA had difficulty selling the same. As a

result, ATHONA failed to pay its promissory note for the balance of the purchase price property,

and PHILSEC and AIFL refused to release the remainder of Ducats stock portfolio, claiming that

they were defrauded into believing that the said property had a fair market value higher than it

actually

had.

1488 instituted a suit against PHILSEC, AIFL, and ATHONA for (a) misrepresenting that an

active market existed for two shares of stock included in Ducats portfolio when, in fact, said shares

were to be withdrawn from the trading list; (b) conversion of the stock portfolio; (c) fraud, as

Page 3 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

ATHONA had never intended to abide by the provisions of its promissory note when they signed it;

and (d) acting in concert as a common enterprise or in the alternative, that ATHONA was the alter

ego of PHILSEC and AIFL.

PHILSEC, AIFL, and ATHONA filed counterclaims against 1488, Inc., Daic, Craig, Ducat, and

Guevara, for the recovery of damages and excess payment or, in the alternative, the rescission of the

sale of the property, alleging fraud, negligence, and conspiracy on the part of counter-defendants

who knew or should have known that the value of said property was less than the appraisal value

assigned to it by Craig.

The U.S. District Court dropped Guevara as counter-defendant for lack of evidence to

support the allegations against him. The Court concluded that the counterclaims against Edgardo V.

Guevara are frivolous and brought against him simply to humiliate and embarrass him and ordered

Philsec (aka BPI) and AIFL to pay Guevara $49,450 as reasonable punishment. BPI appealed to the

US Court of Appeals which affirmed the decision of the district court.

Guevara then filed with the RTC an action for the enforcement of foreign judgment which

was opposed by BPI on the grounds that it was rendered upon a clear mistake of law or fact and/or

in violation of its right to due process. The RTC acted in favor of Guevara which was affirmed by the

CA. In its Motion for Reconsideration, BPI asked that the case be re-raffled which was granted by

the CA. It was denied for the second time in another division of the CA. Hence, the present petition.

Issue:

Whether or not the trial court erred in not passing upon the merits of the case on the

ground of clear mistake of law or fact and in violation of due process

Ruling:

No. The Court finds the Petition bereft of merit.

In Mijares v. Raada, the Court extensively discussed the underlying principles for the

recognition and enforcement of foreign judgments in Philippine jurisdiction:

There is no obligatory rule derived from treaties or conventions that requires the

Philippines to recognize foreign judgments, or allow a procedure for the

enforcement thereof. However, generally accepted principles of international law,

by virtue of the incorporation clause of the Constitution, form part of the laws of the

land even if they do not derive from treaty obligations. The classical formulation in

international law sees those customary rules accepted as binding result from the

combination two elements: the established, widespread, and consistent practice on

the part of States; and a psychological element known as the opinion juris sive

necessitates (opinion as to law or necessity). Implicit in the latter element is a belief

that the practice in question is rendered obligatory by the existence of a rule of law

requiring it.

Aside from the widespread practice, it is indubitable that the procedure for recognition and

enforcement is embodied in the rules of law, whether statutory or jurisprudential, adopted in

various foreign jurisdictions. In the Philippines, this is evidenced primarily by Section 48, Rule 39

Page 4 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

of the Rules of Court which has existed in its current form since the early 1900s. Certainly, the

Philippine legal system has long ago accepted into its jurisprudence and procedural rules the

viability of an action for enforcement of foreign judgment, as well as the requisites for such valid

enforcement, as derived from internationally accepted doctrines. Again, there may be distinctions

as to the rules adopted by each particular state, but they all prescind from the premise that there is

a rule of law obliging states to allow for, however generally, the recognition and enforcement of a

foreign judgment. The bare principle, to our mind, has attained the status of opinio juris in

international practice.

This is a significant proposition, as it acknowledges that the procedure and requisites

outlined in Section 48, Rule 39 derive their efficacy not merely from the procedural rule, but by

virtue of the incorporation clause of the Constitution. Rules of procedure are promulgated by the

Supreme Court, and could very well be abrogated or revised by the high court itself. Yet the

Supreme Court is obliged, as are all State components, to obey the laws of the land, including

generally accepted principles of international law which form part thereof, such as those ensuring

the qualified recognition and enforcement of foreign judgments. (Citations omitted.)

An action for the enforcement of a foreign judgment or final order in this jurisdiction is

governed by Rule 39, Section 48 of the Rules of Court, which provides:

SEC. 48. Effect of foreign judgments or final orders. The effect of a judgment or final

order of a tribunal of a foreign country, having jurisdiction to render the judgment

or final order is as follows:

(a) In case of a judgment or final order upon a specific thing, the judgment or final

order is conclusive upon the title to the thing; and

(b) In case of a judgment or final order against a person, the judgment or final order

is presumptive evidence of a right as between the parties and their successors in

interest by a subsequent title.

In either case, the judgment or final order may be repelled by evidence of a want of

jurisdiction, want of notice to the party, collusion, fraud, or clear mistake of law or

fact.

As stated in Section 48, Rule 39, the actionable issues are generally restricted to a review of

jurisdiction of the foreign court, the service of personal notice, collusion, fraud, or mistake of fact or

law. The limitations on review [are] in consonance with a strong and pervasive policy in all legal

systems to limit repetitive litigation on claims and issues. Otherwise known as the policy of

preclusion, it seeks to protect party expectations resulting from previous litigation, to safeguard

against the harassment of defendants, to insure that the task of courts not be increased by neverending litigation of the same disputes, and in a larger sense to promote what Lord Coke in

the Ferrers Case of 1599 stated to be the goal of all law: rest and quietness. If every judgment of a

foreign court were reviewable on the merits, the plaintiff would be forced back on his/her original

cause of action, rendering immaterial the previously concluded litigation. (Emphases supplied,

citations omitted.)

As the foregoing jurisprudence had established, recognition and enforcement of a foreign

judgment or final order requires only proof of fact of the said judgment or final order. In an

Page 5 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

action in personam, as in the case at bar, the foreign judgment or final order enjoys the disputable

presumption of validity. It is the party attacking the foreign judgment or final order that is tasked

with the burden of overcoming its presumptive validity. A foreign judgment or final order may only

be repelled on grounds external to its merits, particularly, want of jurisdiction, want of notice to the

party, collusion, fraud, or clear mistake of law or fact.

Contrary to the claims of BPI, both the RTC and the Court of Appeals carefully considered

the allegations, arguments, and evidence presented by petitioner to repel the Order dated March

13, 1990 of the U.S. District Court in Civil Action No. H-86-440. Worthy of reproducing herein are

the following portions of the RTC judgment:

[Petitioners] contention that the judgment sought to be enforced herein is violative

of its right to due process and contrary to public policy because the Houston Court

relied upon Exhibit 91 (which is [petitioner BPI Securities] Exh. 1 in this case) and

the US Court disregarded the evidence on record in the Houston Action is

unavailing. Whether or not said Exhibit 91 (petitioners Exh. 1) is inadmissible or

is not entitled to any weight is a question which should have been addressed to the

US of Court of Appeals by [petitioner]. To ask a Philippine court to pass upon the

admissibility or weight of Exh. 91 is violative of our public policy not to substitute

our judgment for that of a competent court of another jurisdiction.

Certainly, under these circumstances, the claim of violation of due process cannot be

sustained since [petitioner] was given reasonable opportunity to present its side

before the imposition of sanctions.

The Court is unmoved by petitioners allegations of denial of due process because of its U.S.

counsels exorbitant fees and negligence. As aptly pointed out by respondent in his Memorandum:

On the specific claim that petitioner has been denied legal representation in the

United States in view of the exorbitant legal fees of US counsel, petitioner is now

estopped from asserting that the costs of litigation resulted in a denial of due

process because it was petitioner which impleaded Guevara. If petitioner cannot

prosecute a case to its final stages, then it should not have filed a counterclaim

against Guevara in the first place. Moreover, there is no showing that petitioner

could not find a less expensive counsel. Surely, petitioner could have secured the

services of another counsel whose fees were more affordable.

Moreover, petitioner is bound by the negligence of its counsel. The declarations of the

Court in Gotesco Properties, Inc. v. Moral is applicable to petitioner:

The general rule is that a client is bound by the acts, even mistakes, of his counsel in

the realm of procedural technique. The basis is the tenet that an act performed by

counsel within the scope of a general or implied authority is regarded as an act of

the client. While the application of this general rule certainly depends upon the

surrounding circumstances of a given case, there are exceptions recognized by this

Court: (1) where reckless or gross negligence of counsel deprives the client of due

process of law; (2) when its application will result in outright deprivation of the

clients liberty or property; or (3) where the interests of justice so require.

Page 6 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

The present case does not fall under the said exceptions. In Amil v. Court of Appeals,the

Court held that to fall within the exceptional circumstance relied upon x x x, it must be shown that

the negligence of counsel must be so gross that the client is deprived of his day in court. Thus,

where a party was given the opportunity to defend [its] interests in due course, [it] cannot be said

to have been denied due process of law, for this opportunity to be heard is the very essence of due

process. To properly claim gross negligence on the part of the counsel, the petitioner must show

that the counsel was guilty of nothing short of a clear abandonment of the clients cause. (Citations

omitted.)

HUMAN RELATIONS

UNJUST ENRICHMENT

R.V. SANTOS COMPANY, INC. vs. BELLE CORPORATION,

G.R. Nos. 159561-62, October 3, 2012, J. Leonardo-De Castro

Expounding on this provision in a recent case, we have held that the principle of unjust

enrichment essentially contemplates payment when there is no duty to pay, and the person who

receives the payment has no right to receive it.

In light of the overpayment, it seems specious for petitioner to claim that it has suffered

damages from respondents refusal to pay its Progress Billing, which had been proven to be excessive

and inaccurate. Bearing in mind the law and jurisprudence on unjust enrichment, we hold that

petitioner is indeed liable to return what it had received beyond the actual value of the work it had

done for respondent.

Facts:

Petitioner R.V Santos Company, Inc and Respondent Belle Corporation entered into a

Construction Contract. As stipulated therein, petitioner undertook to construct a detailed

underground electrical network for respondents Tagaytay Woodlands Condominium Project

located in Tagaytay City. Under said contract, respondent advanced to petitioner fifty percent

(50%) of the contract price. The project was supposed to be completed and ready for operation

within 180 calendar days from receipt by petitioner of the notice to commence from respondent,

provided that all civil related works necessary for the execution of the project works were in place.

However, the project was allegedly not completed within the stipulated time frame. Subsequently,

respondent placed additional work orders with petitioner.

Petitioner submitted its Progress Billing to respondent claiming 53.3% accomplishment of

the project. After deducting 50% of the Progress Billing on the main project, the total amount billed

by petitioner was P5,347,608.03. Purportedly relying on petitioners representations, respondents

project engineer recommended approval of the Progress Billing. Subsequently, however,

respondent reputedly made its own assessment of the work accomplished by petitioner and

determined that it was only worth P 4,676,724.64. Respondent supposedly relayed its findings to

petitioner. The parties representatives met and during that meeting petitioner allegedly advised

Belle that it will not return to the site until the outstanding balance due to it is paid.

Page 7 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Respondent engaged the services of an assessor, R.A. Mojica and Partners (R.A. Mojica), to

determine the value of the work done by petitoner. After it conducted an electrical works audit, R.A.

`Mojica reported to respondent that the work accomplished by petitioner on the main project only

amounted to P4,868,443.59 and not P7,159,216.05 as billed by petitioner.

Thus, relying on the arbitration clause in the Construction Contract, Belle brought the

matter before the CIAC and prayed that petitioner be directed to (a) reimburse Belle the amount of

P 4,940,108.15, and (b) pay Belle the amount of P 2,200,000.00 as liquidated damages CIAC held

that respondent indeed made an overpayment to petitoner. The Court of Appeals issued a Decision

dismissing the petitions and affirming the CIAC Decision.

Issue:

1. Whether or not respondent Belles approval of the Progress Billing is final and binding and

may no longer be withdrawn.

2. Whether or not Respondent Belle should be made liable to RVSCI for damages

Ruling:

Court finds no merit in the Petition.

1. No, it can be withdrawn.

After careful consideration of the contentions of the parties, we agree with the CIACs

finding, as affirmed by the Court of Appeals, that the owners approval of progress billing is merely

provisional. This much can be gleaned from Article VI, Section 6.2(c) of the Construction Contract

which states that "[t]he acceptance of work from time to time for the purpose of making progress

payment shall not be considered as final acceptance of the work under the Contract." There can be

no other interpretation of the said provision but that progress billings are but preliminary

estimates of the value of the periodic accomplishments of the contractor. Otherwise, there would be

no need to include Article VI, Section 6.2(c) in the Contract since final acceptance of the contractors

work would come as a matter of course if progress billings were, as RVSCI contends, final and

binding upon the owner. On the contrary, progress billings and final acceptance of the work were

clearly still subject to review by the owner.

Moreover, we see no reason to disturb the CIAC ruling that the foregoing contractual

provision is consistent with industry practice, as can be deduced from Articles 22.02, 22.04 and

22.09 of CIAP Document 102. Based on these provisions, it is readily apparent that, whether in the

case of progress billings or of turn-over of completed work, the owner has the right to verify the

contractors actual work accomplishment prior to payment.

In all, we approve the CIACs pronouncement that "[t]he owner is, therefore, not estopped

from questioning a prior evaluation of the percentage of accomplishment of the contractor and to

downgrade such accomplishment after re-evaluation. It is the right of every owner to re-evaluate or

re-measure the work of its contractor during the progress of the work."

2. No, Respondents Belle cannot be held liable to petitioner for damages.

Page 8 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

It is apropos to state here that the rationale underlying the owners right to seek an

evaluation of the contractors work is the right to pay only the true value of the work as may be

reasonably determined under the circumstances.

This is consistent with the law against unjust enrichment under Article 22 of the Civil Code

which states that "every person who through an act of performance by another, or any other means,

acquires or comes into possession of something at the expense of the latter without just or legal

ground, shall return the same to him." Expounding on this provision in a recent case, we have held

that "the principle of unjust enrichment essentially contemplates payment when there is no duty to

pay, and the person who receives the payment has no right to receive it."

In the case at bar, we uphold the CIACs factual finding that the value of the total work

accomplished by RVSCI on the main project was P4,868,443.59 while the cost of the additional

work amounted to P1,768,000.00 plus P22,442.27, for a total of P6,658,885.86. On the other hand,

Belle had made payments in the total amount of P11,598,994.44.36 It is thus undeniable that RVSCI

had received payments from Belle in excess of the value of its work accomplishment.

In light of this overpayment, it seems specious for RVSCI to claim that it has suffered

damages from Belles refusal to pay its Progress Billing, which had been proven to be excessive and

inaccurate. Bearing in mind the law and jurisprudence on unjust enrichment, we hold that RVSCI is

indeed liable to return what it had received beyond the actual value of the work it had done for

Belle.

On a related note, this Court cannot grant RVSCIs claim for the value of materials and

equipment allegedly left at the site. As observed by the CIAC, this particular claim was not included

in the Terms of Reference and, hence, could not be litigated upon or proved during the CIAC

proceedings.

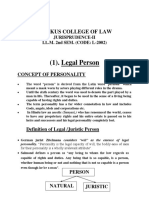

PERSONS

PSYCHOLOGICAL INCAPACITY

MARIETTA C. AZCUETA vs. REPUBLIC OF THE PHILIPPINES AND THE COURT OF APPEALS

G.R. No. 180668, May 26, 2009, J. Leonardo- De Castro

There is no requirement that the defendant/respondent spouse should be personally examined

by a physician or psychologist as a condition sine qua non for the declaration of nullity of marriage

based on psychological incapacity.

Facts:

Petitioner Marietta C. Azcueta and Rodolfo Azcueta met in 1993. Less than two months after

their first meeting, they got married. At the time of their marriage, petitioner was 23 years old

while respondent was 28. They separated in 1997 after four years of marriage. They have no

children. On March 2, 2002, Marietta filed with the Regional Trial Court of Antipolo City, Branch 72,

a petition for declaration of absolute nullity of marriage. In her petition and during her testimony,

Marietta claimed that her husband Rodolfo was psychologically incapacitated to comply with the

essential obligations of marriage. According to her, Rodolfo was emotionally immature,

Page 9 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

irresponsible and continually failed to adapt himself to married life and perform the essential

responsibilities and duties of a husband. Rodolfo never bothered to look for a job; every time

Rodolfo would get drunk he became physically violent towards her. Their sexual relationship was

also unsatisfactory. He did not even want to have a child yet because he claimed he was not ready.

In the course of the trial, petitioner presented Dr. Cecilia Villegas, a psychiatrist. She testified that

based on the information gathered from petitioner, she found that Rodolfo showed that he was

psychologically incapacitated to perform his marital duties and responsibilities. Dr. Villegas

concluded that he was suffering from Dependent Personality Disorder associated with severe

inadequacy related to masculine strivings. Based on Mariettas evidence, the RTC rendered a

Decision dated October 25, 2004, declaring the marriage between petitioner and Rodolfo as null

and void ab initio. The Solicitor General appealed the RTC Decision objecting that (a) the psychiatric

report of Dr. Villegas was based solely on the information provided by petitioner and was not based

on an examination of Rodolfo; and (b) there was no showing that the alleged psychological defects

were present at the inception of marriage or that such defects were grave, permanent and

incurable. The CA reversed the RTC and essentially ruled that petitioner failed to sufficiently prove

the psychological incapacity of Rodolfo hence, this petition.

Issue:

Whether or not the totality of the evidence presented is adequate to sustain a finding that

Rodolfo is psychologically incapacitated to comply with his essential marital obligations.

Ruling:

Yes, they are.

In Republic of the Philippines v. Court of Appeals and Molina stringent guidelines in the

interpretation and application of Article 36 of the Family Code, to wit: (1) The burden of proof to

show the nullity of the marriage belongs to the plaintiff. Any doubt should be resolved in favor of

the existence and continuation of the marriage and against its dissolution and nullity. (2) The root

cause of the psychological incapacity must be: (a) medically or clinically identified, (b) alleged in

the complaint, (c) sufficiently proven by experts and (d) clearly explained in the decision. Article 36

of the Family Code requires that the incapacity must be psychological. The evidence must convince

the court that the parties, or one of them, was mentally or psychically ill to such an extent that the

person could not have known the obligations he was assuming, or knowing them, could not have

given valid assumption thereof. (3) The incapacity must be proven to be existing at the time of the

celebration of the marriage. The manifestation of the illness need not be perceivable at such time,

but the illness itself must have attached at such moment, or prior thereto. (4) Such incapacity must

also be shown to be medically or clinically permanent or incurable. Furthermore, such incapacity

must be relevant to the assumption of marriage obligations. (5) Such illness must be grave enough

to bring about the disability of the party to assume the essential obligations of marriage. The illness

must be shown as downright incapacity or inability, not a refusal, neglect or difficulty, much less ill

will. (6) The essential marital obligations must be those embraced by Articles 68 up to 71 of the

Family Code as regards the husband and wife as well as Articles 220, 221 and 225 of the same Code

in regard to parents and their children. (7) Interpretations given by the National Appellate

Matrimonial Tribunal of the Catholic Church in the Philippines, while not controlling or decisive,

should be given great respect by our courts.

After a thorough review of the records of the case, it was found that there was sufficient

Page 10 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

compliance with Molina to warrant the annulment of the parties marriage. More importantly and

contrary to the Solicitor Generals contention, there is no requirement that the

defendant/respondent spouse should be personally examined by a physician or psychologist as a

condition sine qua non for the declaration of nullity of marriage based on psychological incapacity.

What matters is whether the totality of evidence presented is adequate to sustain a finding of

psychological incapacity.

JOSE REYNALDO B. OCHOSA vs. BONA J. ALANO and REPUBLIC OF THE PHILIPPINES

G.R. No. 167459, January 26, 2011, J. Leonardo-De Castro

Article 36 of the Family Code is not to be confused with a divorce law that cuts the marital

bond at the time the causes therefore manifest themselves. It refers to a serious psychological illness

afflicting a party even before the celebration of the marriage. It is a malady so grave and so

permanent as to deprive one of awareness of the duties and responsibilities of the matrimonial bond

one is about to assume. Judicial precedents regarding the evidentiary requirements in psychological

incapacity cases that must be applied.

Facts:

It appears that Jose met Bona in August 1973 when he was a young lieutenant in the AFP

while the latter was a seventeen-year-old first year college drop-out. They had a whirlwind

romance that culminated into sexual intimacy and eventual marriage on 27 October 1973 before

the Honorable Judge Cesar S. Principe in Basilan. The couple did not acquire any property. Neither

did they incur any debts. Their union produced no offspring. In 1976, however, they found an

abandoned and neglected one-year-old baby girl whom they later registered as their daughter,

naming her Ramona Celeste Alano Ochosa.

During their marriage, Jose was often assigned to various parts of the Philippine archipelago

as an officer in the AFP. Bona did not cohabit with him in his posts, preferring to stay in her

hometown of Basilan. Neither did Bona visit him in his areas of assignment, except in one (1)

occasion when Bona stayed with him for four (4) days.

It appears that Bona was an unfaithful spouse. Even at the onset of their marriage when Jose

was assigned in various parts of the country, she had illicit relations with other men. Bona

apparently did not change her ways when they lived together at Fort Bonifacio; she entertained

male visitors in her bedroom whenever Jose was out of their living quarters. On one occasion, Bona

was caught by Demetrio Bajet y Lita, a security aide, having sex with Joses driver, Corporal Gagarin.

Rumors of Bonas sexual infidelity circulated in the military community. When Jose could no longer

bear these rumors, he got a military pass from his jail warden and confronted Bona.

During their confrontation, Bona admitted her relationship with Corporal Gagarin who also

made a similar admission to Jose. Jose drove Bona away from their living quarters. Bona left with

Ramona and went to Basilan. In 1994, Ramona left Bona and came to live with Jose. It is Jose who is

currently supporting the needs of Ramona.

Jose filed a Petition for Declaration of Nullity of Marriage, seeking to nullify his marriage to

Bona on the ground of the latters psychological incapacity to fulfill the essential obligations of

marriage.

Page 11 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Trial on the merits of the case ensued. Petitioner along with his two military aides,

Gertrudes Himpayan Padernal and Demetrio Bajet y Lita, testified about Bonas marital infidelity

during the marriage. The fourth and final witness was Elizabeth E. Rondain, a psychiatrist, who

testified that after conducting several tests, she reached the conclusion that respondent was

suffering from histrionic personality disorder.

According to Rondain, Bonas psychological disorder was traceable to her family history,

having for a father a gambler and a womanizer and a mother who was a battered wife. There was

no possibility of a cure since respondent does not have an insight of what is happening to her and

refused to acknowledge the reality.

The trial court granted the petition and nullified the parties marriage. The Court of Appeals

reversed and set aside the trial court Decision. Jose filed a Motion for Reconsideration but this was

denied by the Court of Appeals. Hence, this Petition.

Issue:

Whether or not Bona should be deemed psychologically incapacitated to comply with the

essential marital obligations.

Ruling:

The petition is without merit.

In the landmark case of Santos v. Court of Appeals, we observed that psychological

incapacity must be characterized by (a) gravity, (b) juridical antecedence, and (c) incurability. The

incapacity must be grave or serious such that the party would be incapable of carrying out the

ordinary duties required in marriage; it must be rooted in the history of the party antedating the

marriage, although the overt manifestations may emerge only after marriage; and it must be

incurable or, even if it were otherwise, the cure would be beyond the means of the party involved.

We are sufficiently convinced, after a careful perusal of the evidence presented in this case,

that Bona had been, on several occasions with several other men, sexually disloyal to her spouse,

Jose. Likewise, we are persuaded that Bona had indeed abandoned Jose. However, we cannot apply

the same conviction to Joses thesis that the totality of Bonas acts constituted psychological

incapacity as determined by Article 36 of the Family Code. There is inadequate credible evidence

that her defects were already present at the inception of, or prior to, the marriage. In other words,

her alleged psychological incapacity did not satisfy the jurisprudential requisite of juridical

antecedence.

Dr. Rondains testimony and psychiatric evaluation report do not provide evidentiary

support to cure the doubtful veracity of Joses one-sided assertion. Even if we take into account the

psychiatrists conclusion that Bona harbors a Histrionic Personality Disorder that existed prior to

her marriage with Jose and this mental condition purportedly made her helplessly prone to

promiscuity and sexual infidelity, the same cannot be taken as credible proof of antecedence since

the method by which such an inference was reached leaves much to be desired in terms of meeting

the standard of evidence required in determining psychological incapacity.

Verily, Dr. Rondain evaluated Bonas psychological condition indirectly from the

information gathered solely from Jose and his witnesses. This factual circumstance evokes the

Page 12 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

possibility that the information fed to the psychiatrist is tainted with bias for Joses cause, in the

absence of sufficient corroboration.

Even if we give the benefit of the doubt to the testimonies at issue since the trial court judge

had found them to be credible enough after personally witnessing Jose and the witnesses testify in

court, we cannot lower the evidentiary benchmark with regard to information on Bonas premarital history which is crucial to the issue of antecedence in this case because we have only the

word of Jose to rely on. In fact, Bonas dysfunctional family portrait which brought about her

Histrionic Personality Disorder as painted by Dr. Rondain was based solely on the assumed truthful

knowledge of Jose, the spouse who has the most to gain if his wife is found to be indeed

psychologically incapacitated. No other witness testified to Bonas family history or her behavior

prior to or at the beginning of the marriage. Both Mrs. Padernal and Corporal Bajet came to know

Bona only during their employment in petitioners household during the marriage. It is undisputed

that Jose and Bona were married in 1973 while Mrs. Padernal and Corporal Bajet started to live

with petitioners family only in 1980 and 1986, respectively.

We have previously held that, in employing a rigid and stringent level of evidentiary

scrutiny to cases like this, we do not suggest that a personal examination of the party alleged to be

psychologically incapacitated is mandatory; jurisprudence holds that this type of examination is not

a mandatory requirement. While such examination is desirable, we recognize that it may not be

practical in all instances given the oftentimes estranged relations between the parties. For a

determination though of a partys complete personality profile, information coming from persons

with personal knowledge of the juridical antecedents may be helpful. This is an approach in the

application of Article 36 that allows flexibility, at the same time that it avoids, if not totally

obliterate, the credibility gaps spawned by supposedly expert opinion based entirely on doubtful

sources of information.

However, we have also ruled in past decisions that to make conclusions and generalizations

on a spouses psychological condition based on the information fed by only one side, similar to what

we have pointed out in the case at bar, is, to the Courts mind, not different from admitting hearsay

evidence as proof of the truthfulness of the content of such evidence.

It is apparent from the above-cited testimonies that Bona, contrary to Joses assertion, had

no manifest desire to abandon Jose at the beginning of their marriage and was, in fact, living with

him for the most part of their relationship from 1973 up to the time when Jose drove her away from

their conjugal home in 1988. On the contrary, the record shows that it was Jose who was constantly

away from Bona by reason of his military duties and his later incarceration. A reasonable

explanation for Bonas refusal to accompany Jose in his military assignments in other parts of

Mindanao may be simply that those locations were known conflict areas in the seventies. Any doubt

as to Bonas desire to live with Jose would later be erased by the fact that Bona lived with Jose in

their conjugal home in Fort Bonifacio during the following decade.

In view of the foregoing, the badges of Bonas alleged psychological incapacity, i.e., her

sexual infidelity and abandonment, can only be convincingly traced to the period of time after her

marriage to Jose and not to the inception of the said marriage.

We have stressed time and again that Article 36 of the Family Code is not to be confused

with a divorce law that cuts the marital bond at the time the causes therefore manifest

themselves. It refers to a serious psychological illness afflicting a party even before the celebration

Page 13 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

of the marriage. It is a malady so grave and so permanent as to deprive one of awareness of the

duties and responsibilities of the matrimonial bond one is about to assume. These marital

obligations are those provided under Articles 68 to 71, 220, 221 and 225 of the Family Code.

While we are not insensitive to petitioners suffering in view of the truly appalling and

shocking behavior of his wife, still, we are bound by judicial precedents regarding the evidentiary

requirements in psychological incapacity cases that must be applied to the present case.

PROPERTY RELATIONS OF THE SPOUSES (FAMILY CODE)

HEIRS OF DOMINGO HERNANDEZ, SR., namely: SERGIA V. HERNANDEZ (Surviving Spouse),

DOMINGO V. HERNANDEZ, JR., and MARIA LEONORA WILMA HERNANDEZ vs. PLARIDEL

MINGOA, SR., DOLORES CAMISURA, MELANIE MINGOA, AND QUEZON CITY REGISTER OF

DEEDS

G.R. No. 146548, December 18 2009, J. Leonardo-De Castro

When the sale is made before the effectivity of the Family Code, the applicable law is the Civil

Code. Article 173 of the Civil Code provides that the disposition of conjugal property without the wife's

consent is not void but merely voidable.

Facts:

In 1994, a complaint was filed by heirs of Domingo Hernandez, Sr., namely, spouse Sergia

Hernandez and their surviving children Domingo, Jr. and Maria Leonora Wilma, asking for (a) the

annulment and/or declaration of nullity of TCT No. 290121 including all its derivative titles, the

Irrevocable Special Power of Attorney (SPA) in favor of Dolores Camisura, the SPA in favor of

Plaridel Mingoa, Sr., and the Deed of Absolute Sale of Real Estate executed by Plaridel Mingoa, Sr. in

favor of Melanie Mingoa for being products of forgery and falsification; and (b) the reconveyance

and/or issuance to them the certificate of title covering the subject property.

In 1958, Domingo Hernandez, Sr. and his spouse were awarded a piece of real property by

the Philippine Homesite and Housing Corporation (PHHC) by way of salary deduction. In 1963,

having paid in full the entire amount of P6,888.96, a Deed of Absolute Sale of the property was

executed by the PHHC in their favor. Title issued in their name bears an annotation of the retention

period of the property by the awardee (restriction of any unauthorized sale to third persons within

a certain period). Tax payments due on the property were religiously paid as evidenced by receipts

under the Hernandezs name.

Hernandez, Sr. died intestate in 1983 and it was only after his burial that his heirs found out

that the title was already cancelled a year before and in lieu thereof, TCT No. 290121 was issued to

the Melanie Mingoa. The petitioner heirs also allege that because of financial difficulties, they were

only able to file a complaint in 1995 after consulting with several lawyers.

According to respondents, Hernandez, Sr. was awarded by the PHHC the Right to Purchase

the property in question. However, the late Hernandez, Sr. failed to pay all the installments due on

the said property. Afraid that he would forfeit his, Hernandez, Sr. sold to Dolores Camisura his

rights for the sum of P6,500.00 in 1963, through a deed of transfer of rights. Simultaneous to this,

Hernandez, Sr. and his spouse executed an irrevocable special power of attorney, appointing

Page 14 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Dolores Camisura as their attorney-in-fact with express power to sign, execute and acknowledge

any contract of disposition, alienation and conveyance of her right over the aforesaid parcel of land.

This SPA was executed for the purpose of securing her right to transfer the property to a third

person considering that there was a prohibition to dispose of the property by the original

purchaser within one year from full payment.

In 1964, Dolores Camisura sold her right over the said property to Plaridel Mingoa for

P7,000.00. Camisura then executed a similar irrevocable power of attorney and a deed of sale of

right in a residential land and improvements therein in favor of Plaridel Mingoa. Plaridel Mingoa

took possession of the said property and began paying all the installments due on the property to

PHHC. In 1978, Plaridel Mingoa sold to his eldest child, Melanie Mingoa, the property in question

for P18,000.00.It is further claimed that since 1966 until 1982, Plaridel Mingoa religiously paid all

the taxes due on the said property; and that from 1983 up to the present, Melanie Mingoa paid all

the property taxes due thereon aside from having actual possession of the said property.

The trial court ruled in favor of the heirs, declaring the titles and documents null and void.

On appeal, such ruling was reversed and set aside.

Issue:

(1) Whether there was a valid alienation involving the subject property; and

(2) Whether the action impugning the validity of such alienation has prescribed and/or was

barred by laches.

Ruling:

(1) Yes, the sale was voidable and thus, valid until annulled.

The Deed of Transfer of Rights, executed by Hernandez, Sr. in Camisuras favor, expressly

states that the former, in consideration of the amount of P6,500.00, transfers his rights over the

subject property to the latter. Notably, such deed was simultaneously executed with the SPA in

1963. The Court concluded that the SPA executed was, in reality, an alienation involving the subject

property.

The consent of Hernandez, Sr. to the contract is undisputed, thus, the sale of his share in the

conjugal property was valid. With regard to the consent of his wife, the trial court found that it was

lacking because said wifes signature on the SPA was falsified. Notably, even the appellate court

observed that the forgery was so blatant as to be remarkably noticeable to the naked eye of an

ordinary person. The Court affirmed both lower courts' findings regarding the forgery.

However, the wifes lack of consent to the sale did not render the transfer of her share

invalid. Petitioners contend that such lack of consent rendered the SPAs and the deed of sale

fictitious, hence null and void in accordance with Article 1409 of the Civil Code. Petitioners likewise

contend that an action for the declaration of the non-existence of a contract under Article 1410

does not prescribe.

The Court held that Articles 1409 and 1410 are not applicable to the matter. Said property

was awarded in 1958. The assailed SPAs were executed in 1963 and 1964. Title in the name of

Page 15 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Domingo Hernandez, Sr. covering the subject property was issued in 1966. The sale of the property

to Melanie Mingoa and the issuance of a new title in her name happened in 1978. Since all these

events occurred before the Family Code took effect in 1988, the provisions of the New Civil Code

govern these transactions.

In Sps. Alfredo v. Sps. Borras, it was held that when the sale is made before the effectivity of

the Family Code, the applicable law is the Civil Code. Article 173 of the Civil Code provides that the

disposition of conjugal property without the wife's consent is not void but merely voidable.

As provided in Art. 173, the wife may, during the marriage, and within ten years from the

transaction questioned, ask the courts for the annulment of any contract of the husband entered

into without her consent, when such consent is required, or any act or contract of the husband

which tends to defraud her or impair her interest in the conjugal partnership property. Should the

wife fail to exercise this right, she or her heirs, after the dissolution of the marriage, may demand

the value of property fraudulently alienated by the husband.

(2) Yes, it has already prescribed and already barred by laches.

The right of action of the petitioners accrued in 1963. Petitioners filed the action for

reconveyance in 1995. Even if we were to consider that their right of action arose when they

learned of the cancellation and issuance of new title in 1993, still, 12 years have lapsed since such

discovery, and they filed the petition beyond the period allowed by law. Moreover, when

petitioners filed the complaint, the conjugal partnership of property had already been terminated

by virtue of the Hernandez Sr.s death. Clearly, petitioners action has prescribed.

Under Art. 173, an action for the annulment of any contract entered into by the husband

without the wifes consent must be filed (1) during the marriage; and (2) within 10 years from the

transaction questioned. Where any one of these two conditions is lacking, the action will be

considered as having been filed out of time.

Petitioners action has likewise become stale, as it is barred by laches. Laches means the

failure or neglect for an unreasonable and unexplained length of time to do that which, by

observance of due diligence, could or should have been done earlier. It is negligence or omission to

assert a right within a reasonable time, warranting the presumption that the party entitled to assert

his right either has abandoned or declined to assert it. Laches thus operates as a bar in equity.

Petitioners' unreasonably long period of inaction in asserting their purported rights over

the subject property weighs heavily against them. As correctly ruled by the Court of Appeals, there

existed a period of 17 years during which time Hernandez, Sr. never even questioned the

respondents possession of the property; also there was another interval of 12 years after

discovering the cancellation of their title before the Heirs of Hernandez instituted an action for

reconveyance.

The fact that Mingoas were able to take actual possession of the subject property for such a

long period without any form of cognizable protest from Hernandez, Sr. and the petitioners strongly

calls for the application of the doctrine of laches.

PROPERTY

Page 16 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

OWNERSHIP

SPS. AMBROSIO DECALENG (substituted by his heirs) and JULIA "WANAY" DECALENG vs.

BISHOP OF THE MISSIONARY DISTRICT OF THE PHILIPPINE ISLANDS OF PROTESTANT

EPISCOPAL CHURCH IN THE UNITED STATES OF AMERICA, otherwise known as THE

PHILIPPINE EPISCOPAL CHURCH

G.R. No. 171209, June 27, 2012, J. Leonardo-De Castro

A Torrens title cannot be attacked collaterally, and the issue on its validity can be raised only

in an action expressly instituted for that purpose. A collateral attack is made when, in another action

to obtain a different relief, the certificate of title is assailed as an incident in said action. Spouses

Decaleng only sought the dismissal of the complaint of PEC-EDNP plus the grant of their counterclaim

for the payment of moral damages, exemplary damages, litigation expenses, and attorneys fees. They

conspicuously did not pray for the annulment or cancellation of Certificate of Title No. 1. Evidently, the

Spouses Decalengs attack on the validity, as well as the existence of Certificate of Title No. 1 is only

incidental to their defense against the accion publiciana and accion reinvindicatoria instituted by

PEC-EDNP, hence, merely collateral.

Facts:

The Bishop of the Missionary District of the Philippine Islands of the Protestant Episcopal

Church in the United States of America, otherwise known as the Philippine Episcopal Church (PEC),

is a religious corporation duly organized and registered under the laws of the Republic of the

Philippines. One of its dioceses is the Episcopal Diocese of Northern Philippines (EDNP).

On, PEC-EDNP filed before the Regional Trial Court a Complaint for Accion Reinvindicatoria

and Accion Publiciana against Ambrosio Decaleng and Fabian Lopez (Lopez). PEC-EDNP alleged

that it is the owner of two parcels of land in the Municipality of Sagada, located in areas of as Kengeka and Ken-gedeng. According to PEC-EDNP, the Ken-geka property is covered by Certificate of

Title No. 1 of the Register of Deeds of Mountain Province, issued on 1915, in the name of U.S.

Episcopal Church. PEC-EDNP asserted that the U.S. Episcopal Church donated the Ken-geka

property, among other real properties, to the PEC by virtue of a Deed of Donation executed on 1974.

Around the second quarter of 1989, Ambrosio Decaleng entered and cultivated a portion of about

1,635 square meters of the Ken-geka property despite the protestations of PEC-EDNP

representatives.

When it comes to the Ken-gedeng property, PEC-EDNP averred that it and its predecessorsin-interest occupied the Ken-gedeng property openly, adversely, continuously, and notoriously in

en concepto de dueo since the American Missionaries arrived in the Mountain Province in 1901.

PEC-EDNP and its predecessors-in-interest have introduced valuable improvements on the Kengedeng property through the years. During the first quarter of 1987, Ambrosio Decaleng illegally

and forcibly entered two portions of the Ken-gedeng property. Ambrosio Decaleng made matters

worse by selling Portion 2 of the Ken-gedeng property to Fabian Lopez.

Ambrosio Decaleng and Lopez filed their Answer alleging that Certificate of Title No. 1 was

inaccurate and depicted a parcel of land much bigger than that generally believed to be owned by

PEC-EDNP and that the properties occupied by Ambrosio Decaleng were outside the properties of

PEC-EDNP. They then moved for the dismissal of the complaint against them.

Page 17 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Issue:

Whether or not PEC- EDNP is the rightful owner of the subject lands.

Ruling:

Yes.

An accion reinvindicatoria is an action to recover ownership over real property. Article 434

of the New Civil Code provides that to successfully maintain an action to recover the ownership of a

real property, the person who claims a better right to it must prove two things: first, the identity of

the land claimed by describing the location, area, and boundaries thereof; and second, his title

thereto. The Court finds that PEC-EDNP was able to successfully prove both requisites by

preponderance of evidence, both documentary and testimonial. The identity of the properties over

which PEC-EDNP asserts ownership is well-established. The Ken-geka property is covered by

Certificate of Title No. 1, while the Ken-gedeng property is identified as Lot 3 of Survey Plan PSU118424.

PEC-EDNP likewise proved its title to the Ken-geka and Ken-gedeng properties. The Kengeka property was registered in the name of the U.S. Episcopal Church under Certificate of Title No.

1. It was conveyed by the U.S. Episcopal Church to PEC through a Deed of Donation dated April 24,

1974. It was also declared by the U.S. Episcopal Church and PEC-EDNP for real property tax

purposes. Although not yet covered by any certificate of title, the Ken-gedeng property had been

occupied under claim of title (en concepto de dueo) by PEC-EDNP and its predecessor-in-interest,

the U.S. Episcopal Church, since the latters arrival in 1901. It was also declared by the U.S.

Episcopal Church and PEC-EDNP for real property tax purposes. PEC-EDNPs officers, priests, and

employees, as well as the Sagada residents testified as to actual possession by PEC-EDNP of the

Ken-geka and Ken-gedeng properties by the introduction of improvements such as permanent

buildings, pine trees, fruit trees, and vegetable gardens thereon.

Finally, Spouses Decalengs contention that Certificate of Title No. 1 does not exist

constitutes a collateral attack of Certificate of Title No. 1. It must be noted that a Torrens title

cannot be attacked collaterally, and the issue on its validity can be raised only in an action expressly

instituted for that purpose. A collateral attack is made when, in another action to obtain a different

relief, the certificate of title is assailed as an incident in said action. In this case, the original

complaint filed by PEC-EDNP before the RTC is for accion publiciana and accion reinvindicatoria

(for recovery of possession and ownership) of the Ken-geka and Ken-gedeng properties. In said

complaint, PEC-EDNP alleged ownership of the Ken-geka property as evidenced by Certificate of

Title No. 1. In their defense, the spouses Decaleng raised issues as to the validity of Certificate of

Title No. 1 (by asserting in their Answer that Certificate of Title No. 1 covered an area much larger

than that actually owned by PEC-EDNP), and as to the existence of Certificate of Title No. 1 (by

presenting Mountain Province Register of Deeds Dailay-Papas certification that Certificate of Title

No. 1 does not appear in the record of registered titles). Nevertheless, the spouses Decaleng only

sought the dismissal of the complaint of PEC-EDNP, plus the grant of their counterclaim for the

payment of moral damages, exemplary damages, litigation expenses, and attorneys fees; and they

conspicuously did not pray for the annulment or cancellation of Certificate of Title No. 1. Evidently,

the spouses Decalengs attack on the validity, as well as the existence of Certificate of Title No. 1 is

Page 18 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

only incidental to their defense against the accion publiciana and accion reinvindicatoria instituted

by PEC-EDNP, hence, merely collateral.

ACCESSION

MARIA TORBELA, represented by her heirs, EULOGIO TOSINO, et al. vs. SPOUSES ANDRES T.

ROSARIO, et al.

G.R. No. 140528, December 7, 2011, J. Leonardo-De Castro

The accessory follows the principal. The right of accession is recognized under Article 440 of

the Civil Code which states that the ownership of property gives the right by accession to everything

which is produced thereby, or which is incorporated or attached thereto, either naturally or

artificially.

Facts:

The Torbela sibling inherited the title to the subject property (Lot No. 356-A) from their

parents, the Torbela spouses, who, in turn, acquired the same from the first registered owner of the

lot, Valeriano. Later, the Torbela siblings executed a Deed of Absolute Quitclaim on December 12,

1964 in which they transferred and conveyed Lot No. 356-A to Dr. Rosario for the consideration of

P9.00.

However, the Torbela siblings claimed that they only executed the Deed as an

accommodation so that Dr. Rosario could have Lot No. 356-A registered in his name and use said

property to secure a loan from DBP, the proceeds of which would be used for building a hospital on

Lot No. 356-A. On December 16, 1964, TCT No. 52751, covering Lot No. 356-A, was already issued

in Dr. Rosarios name.

On December 28, 1964, Dr. Rosario executed his own Deed of Absolute Quitclaim, in which

he expressly acknowledged that he only borrowed Lot No. 356-A and was transferring and

conveying the same back to the Torbela siblings for the consideration of P1.00.

On February 21, 1965, Dr. Rosarios loan in the amount of P70,200.00, secured by a

mortgage on Lot No. 356-A, was approved by DBP. Soon thereafter, construction of a hospital

building started on Lot No. 356-A. In the meantime, Dr. Rosario acquired another loan from the

Philippine National Bank (PNB) sometime in 1979-1981.

On December 8, 1981, Dr. Rosario and his wife, Duque-Rosario (spouses Rosario), acquired

a loan from Banco Filipino Savings and Mortgage Bank (Banco Filipino). To secure said loan, the

spouses Rosario again constituted mortgages on Lot No. 356-A among others.

On February 13, 1986, the Torbela siblings filed before the Regional Trial Court (RTC) of

Urdaneta, Pangasinan, a Complaint for recovery of ownership and possession of Lot No. 356-A, plus

damages, against the spouses Rosario. The spouses Rosario afterwards failed to pay their loan from

Banco Filipino. Banco Filipino extrajudicially foreclosed the mortgage on Lot No. 356-A and a

Certificate of Sale in favor of Banco Filipino was later issued.

On December 9, 1987, the Torbela siblings filed before the RTC their Amended Complaint,

impleading Banco Filipino as additional defendant.

Page 19 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

Issue:

Should the Torbela siblings submit an accounting of the rents of the improvements on Lot

No. 356-A which they had received and to turn over any balance thereof to Dr. Rosario?

Ruling:

Yes, the rules on accession shall govern the improvements on Lot No. 356-A and the rents

thereof.

The accessory follows the principal. The right of accession is recognized under Article 440

of the Civil Code which states that the ownership of property gives the right by accession to

everything which is produced thereby, or which is incorporated or attached thereto, either

naturally or artificially.

There is no question that Dr. Rosario is the builder of the improvements on Lot No. 356-A.

The Torbela siblings themselves alleged that they allowed Dr. Rosario to register Lot No.

356-A in his name so he could obtain a loan from DBP, using said parcel of land as security; and

with the proceeds of the loan, Dr. Rosario had a building constructed on Lot No. 356-A, initially used

as a hospital, and then later for other commercial purposes. Dr. Rosario supervised the construction

of the building, which began in 1965; fully liquidated the loan from DBP; and maintained and

administered the building, as well as collected the rental income therefrom, until the Torbela

siblings instituted Civil Case No. U-4359 before the RTC on February 13, 1986.

When it comes to the improvements on Lot No. 356-A, both the Torbela siblings (as

landowners) and Dr. Rosario (as builder) are deemed in bad faith. The Torbela siblings were aware

of the construction of a building by Dr. Rosario on Lot No. 356-A, while Dr. Rosario proceeded with

the said construction despite his knowledge that Lot No. 356-A belonged to the Torbela siblings.

This is the case contemplated under Article 453 of the Civil Code, which reads:

ART. 453. If there was bad faith, not only on the part of the person who built, planted or sowed

on the land of another, but also on the part of the owner of such land, the rights of one and the other

shall be the same as though both had acted in good faith.

It is understood that there is bad faith on the part of the landowner whenever the act was done

with his knowledge and without opposition on his part.

When both the landowner and the builder are in good faith, the following rules govern:

Whatever is built, planted, or sown on the land of another, and the improvements or repairs

made thereon, belong to the owner of the land. Where, however, the planter, builder, or sower has

acted in good faith, a conflict of rights arises between the owners and it becomes necessary to

protect the owner of the improvements without causing injustice to the owner of the land. In view

of the impracticability of creating what Manresa calls a state of "forced co-ownership," the law has

provided a just and equitable solution by giving the owner of the land the option to acquire the

Page 20 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

improvements after payment of the proper indemnity or to oblige the builder or planter to pay for

the land and the sower to pay the proper rent. It is the owner of the land who is allowed to exercise

the option because his right is older and because, by the principle of accession, he is entitled to the

ownership of the accessory thing.

The landowner has to make a choice between appropriating the building by paying the

proper indemnity or obliging the builder to pay the price of the land. But even as the option lies

with the landowner, the grant to him, nevertheless, is preclusive. He must choose one. He cannot,

for instance, compel the owner of the building to remove the building from the land without first

exercising either option. It is only if the owner chooses to sell his land, and the builder or planter

fails to purchase it where its value is not more than the value of the improvements, that the owner

may remove the improvements from the land. The owner is entitled to such remotion only when,

after having chosen to sell his land, the other party fails to pay for the same.

This case then must be remanded to the RTC for the determination of matters necessary for

the proper application of Article 448, in relation to Article 546, of the Civil Code. Such matters

include the option that the Torbela siblings will choose; the amount of indemnity that they will pay

if they decide to appropriate the improvements on Lot No. 356-A; the value of Lot No. 356-A if they

prefer to sell it to Dr. Rosario; or the reasonable rent if they opt to sell Lot No. 356-A to Dr. Rosario

but the value of the land is considerably more than the improvements. The determination made by

the Court of Appeals in its Decision dated June 29, 1999 that the current value of Lot No. 356-A is

P1,200,000.00 is not supported by any evidence on record.

Should the Torbela siblings choose to appropriate the improvements on Lot No. 356-A, the

following ruling of the Court in Pecson v. Court of Appeals is relevant in the determination of the

amount of indemnity under Article 546 of the Civil Code:

Still following the rules of accession, civil fruits, such as rents, belong to the owner of the

building. Thus, Dr. Rosario has a right to the rents of the improvements on Lot No. 356-A and is

under no obligation to render an accounting of the same to anyone. In fact, it is the Torbela siblings

who are required to account for the rents they had collected from the lessees of the commercial

building and turn over any balance to Dr. Rosario. Dr. Rosarios right to the rents of the

improvements on Lot No. 356-A shall continue until the Torbela siblings have chosen their option

under Article 448 of the Civil Code. And in case the Torbela siblings decide to appropriate the

improvements, Dr. Rosario shall have the right to retain said improvements, as well as the rents

thereof, until the indemnity for the same has been paid

QUIETING OF TITLE

REPUBLIC OF THE PHILIPPINES vs. HON. MAMINDIARA P. MANGOTARA, in his capacity as

Presiding Judge of the Regional Trial Court, Branch 1, Iligan City, Lanao del Norte, and MARIA

CRISTINA FERTILIZER CORPORATION, and the PHILIPPINE NATIONAL BANK,

G.R. No. 170375, July 7, 2010, J. Leonardo-De Castro

Vidal filed an action for quieting of title with regard to the land she inherited from Francisco

Cacho. However, Teofilo opposed contended that there is no title to be disturbed in the first place. The

court ruled that this action indisputably an action for quieting of title, a special proceeding wherein

the court is precisely tasked to determine the rights of the parties as to a particular parcel of land, so

Page 21 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

that the complainant and those claiming under him/her may be forever free from any danger of

hostile claim.

Facts:

Demetria Vidal (Vidal) and AZIMUTH filed a Petition for Quieting of Title against Teofilo,

Atty. Cabildo, and the Register of Deeds of Iligan City. She averred that she is the daughter of

Francisco Cacho Vidal (Francisco) and Fidela Arellano Confesor. Francisco was the only child of Don

Dionisio Vidal and Doa Demetria. AZIMUTH, for its part, filed the Petition as Vidals successor-ininterest with respect to a 23-hectare portion of the subject parcels of land pursuant to the

Memorandum of Agreement dated April 2, 1998 and Deed of Conditional Conveyance dated August

13, 2004, which Vidal executed in favor of AZIMUTH. Teofilo opposed the Petition contending that

it stated no cause of action because there was no title being disturbed or in danger of being lost due

to the claim of a third party, and Vidal had neither legal nor beneficial ownership of the parcels of

land in question; that the matter and issues raised in the Petition had already been tried, heard, and

decided by the RTC of Iligan City and affirmed with finality by this Court in the 1997 Cacho case; and

that the Petition was barred by the Statute of Limitations and laches

Issue:

Whether or not the proper remedy is an action for quieting of title and not reconveyance

Ruling:

Yes, the proper remedy is an action for quieting of title

The action for reconveyance is based on Section 55 of Act No. 496, otherwise known as the

Land Registration Act, as amended, which states [t]hat in all cases of registration procured by fraud

the owner may pursue all his legal and equitable remedies against the parties to such fraud, without

prejudice, however, to the rights of any innocent holder for value of a certificate of title. The Court,

in Heirs of Eugenio Lopez, Sr. v. Enriquez, described an action for reconveyance as follows. An action

for reconveyance is an action in personam available to a person whose property has been

wrongfully registered under the Torrens system in anothers name. Although the decree is

recognized as incontrovertible and no longer open to review, the registered owner is not

necessarily held free from liens. As a remedy, an action for reconveyance is filed as an ordinary

action in the ordinary courts of justice and not with the land registration court. Reconveyance is

always available as long as the property has not passed to an innocent third person for value.

On the other hand, Article 476 of the Civil Code lays down the circumstances when a person

may institute an action for quieting of title. ART. 476. Whenever there is a cloud on title to real

property or any interest therein, by reason of any instrument, record, claim, encumbrance or

proceeding which is apparently valid or effective but is in truth and in fact invalid, ineffective,

voidable, or unenforceable, and may be prejudicial to said title, an action may be brought to remove

such cloud or to quiet the title. An action may also be brought to prevent a cloud from being cast

upon title to real property or any interest therein.

The Court pronounced in the Agapay and Yaptinchay cases that a declaration of heirship

cannot be made in an ordinary civil action such as an action for reconveyance, but must only be

made in a special proceeding, for it involves the establishment of a status or right. The appropriate

Page 22 of 159

Justice Teresita Leonardo-De Castro Cases (2008-2015) Civil Law

special proceeding would have been the settlement of the estate of the decedent. Nonetheless, an