Professional Documents

Culture Documents

Micro Credit

Uploaded by

Will Kirkwood0 ratings0% found this document useful (0 votes)

28 views1 pageMicrocredit provides small loans to poor individuals for entrepreneurship opportunities. These individuals lack traditional collateral or credit histories needed to access standard loans. Microcredit began in Bangladesh with the Grameen Bank, successfully allowing extremely impoverished people to generate income and build wealth. It has gained increasing credibility in mainstream finance as microcredit borrowers are recognized as pre-bankable clients, with many large organizations now considering microcredit projects.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMicrocredit provides small loans to poor individuals for entrepreneurship opportunities. These individuals lack traditional collateral or credit histories needed to access standard loans. Microcredit began in Bangladesh with the Grameen Bank, successfully allowing extremely impoverished people to generate income and build wealth. It has gained increasing credibility in mainstream finance as microcredit borrowers are recognized as pre-bankable clients, with many large organizations now considering microcredit projects.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pageMicro Credit

Uploaded by

Will KirkwoodMicrocredit provides small loans to poor individuals for entrepreneurship opportunities. These individuals lack traditional collateral or credit histories needed to access standard loans. Microcredit began in Bangladesh with the Grameen Bank, successfully allowing extremely impoverished people to generate income and build wealth. It has gained increasing credibility in mainstream finance as microcredit borrowers are recognized as pre-bankable clients, with many large organizations now considering microcredit projects.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Microcredit

From Wikipedia, the free encyclopedia that anyone can edit

Jump to: navigation, search

This article may require cleanup to meet Wikipedia's quality standards. Please

improve this article if you can. (August 2008)

This article is specific to small loans. For financial services to the poor, see

Microfinance. For small payments, see Micropayment.

Microcredit is the extension of very small loans (microloans) to those in poverty designed to

spur entrepreneurship. These individuals lack collateral, steady employment and a verifiable

credit history and therefore cannot meet even the most minimal qualifications to gain access to

traditional credit. Microcredit is a part of microfinance, which is the provision of a wider range

of financial services to the very poor.

Microcredit is a financial innovation that is generally considered to have originated with the

Grameen Bank in Bangladesh.[1] In that country, it has successfully enabled extremely

impoverished people to engage in self-employment projects that allow them to generate an

income and, in many cases, begin to build wealth and exit poverty.[citation needed] Due to the success

of microcredit, many in the traditional banking industry have begun to realize that these

microcredit borrowers should more correctly be categorized as pre-bankable; thus, microcredit is

increasingly gaining credibility[citation needed] in the mainstream finance industry, and many

traditional large finance organizations are contemplating microcredit projects as a source of

future growth, even though almost everyone in larger development organizations discounted the

likelihood of success of microcredit when it was begun. The United Nations declared 2005 the

International Year of Microcredit.

You might also like

- The Definition of MicrofinanceDocument6 pagesThe Definition of MicrofinanceAyush BhavsarNo ratings yet

- Report On Micro FinanceDocument55 pagesReport On Micro FinanceSudeepti TanejaNo ratings yet

- Microfinance Chapter 1Document27 pagesMicrofinance Chapter 1Prakash KumarNo ratings yet

- A Study On Micro Finance Manpreet MbaDocument79 pagesA Study On Micro Finance Manpreet MbakaurmanNo ratings yet

- A Project Report On Micro Finance in IndiaDocument80 pagesA Project Report On Micro Finance in Indiaashok_kumar45125100% (1)

- The Functional Microfinance Bank: Strategies for SurvivalFrom EverandThe Functional Microfinance Bank: Strategies for SurvivalNo ratings yet

- Confessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorFrom EverandConfessions of a Microfinance Heretic: How Microlending Lost Its Way and Betrayed the PoorRating: 3.5 out of 5 stars3.5/5 (5)

- MicrofinanceDocument58 pagesMicrofinanceSamuel Davis100% (1)

- MicrocreditDocument2 pagesMicrocreditAliul HassanNo ratings yet

- FIP 3Qtr2013Document8 pagesFIP 3Qtr2013Karol Mikhail Ra NakpilNo ratings yet

- Concept of Micro CreditDocument16 pagesConcept of Micro CreditSyed Wahidur RahmanNo ratings yet

- Explain Why Microcredit Has LittleDocument10 pagesExplain Why Microcredit Has LittleWajiha KhalidNo ratings yet

- Grameen Bank: Introduction To Micro CreditDocument6 pagesGrameen Bank: Introduction To Micro CreditAzharul Islam RobinNo ratings yet

- History: Microcredit Is The Extension of Very SmallDocument5 pagesHistory: Microcredit Is The Extension of Very SmallDhira DaDaNo ratings yet

- Role of Indian Microfinance Institutions in Financial InclusionsDocument7 pagesRole of Indian Microfinance Institutions in Financial InclusionsIJRASETPublicationsNo ratings yet

- Micro FinanceDocument30 pagesMicro FinanceSakshi BhaskarNo ratings yet

- Microfinance - IntroductionDocument7 pagesMicrofinance - Introductionbeena antuNo ratings yet

- Microfinance: Chapter - IIIDocument53 pagesMicrofinance: Chapter - IIIbhagatvarunNo ratings yet

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Document63 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarNo ratings yet

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Document55 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarNo ratings yet

- Rishu Eco ProjectDocument31 pagesRishu Eco ProjectAnkit ChauhanNo ratings yet

- MF Briefing Doc EnglishDocument8 pagesMF Briefing Doc EnglishButterfly DiaryNo ratings yet

- Minhaz Microcredit Term PaperDocument24 pagesMinhaz Microcredit Term PaperShafayet JamilNo ratings yet

- Micro Finance Ans Compilation For Mid 2Document19 pagesMicro Finance Ans Compilation For Mid 2Saddam RonyNo ratings yet

- Mfi PDFDocument53 pagesMfi PDFrakehsNo ratings yet

- Difference Between Microfinance and MicrocreditDocument3 pagesDifference Between Microfinance and MicrocreditShantkumar IBMRNo ratings yet

- Bank JobDocument33 pagesBank JobShafayet JamilNo ratings yet

- Notes On MicrofinanceDocument8 pagesNotes On MicrofinanceMapuia Lal Pachuau100% (2)

- Case Study On MicrofinanceDocument18 pagesCase Study On MicrofinanceTusharika RajpalNo ratings yet

- Micro Finance IBR PaperDocument26 pagesMicro Finance IBR PaperMeena AharamNo ratings yet

- Assignment 3Document6 pagesAssignment 312345No ratings yet

- A Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationDocument10 pagesA Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationjyotivermaNo ratings yet

- Current Trends and Challenges of Micro Finance in IndiaDocument10 pagesCurrent Trends and Challenges of Micro Finance in IndiaAkila TharunNo ratings yet

- MicrofinanceDocument77 pagesMicrofinancePramish SubediNo ratings yet

- Micro Finance in IndiaDocument24 pagesMicro Finance in IndiaSanjeet SinghNo ratings yet

- Empowering Women Through MicrofinancingDocument81 pagesEmpowering Women Through MicrofinancingSuraj DubeyNo ratings yet

- 05 Chapter-1 PDFDocument52 pages05 Chapter-1 PDFRohitNo ratings yet

- Issues and Challenges of Micro Finance Institutions in KarnatakaDocument4 pagesIssues and Challenges of Micro Finance Institutions in KarnatakaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- CH Allen EgsDocument5 pagesCH Allen EgsY N S Y SNo ratings yet

- MICRPFINANCE IN INDIA WordDocument14 pagesMICRPFINANCE IN INDIA WordA08 Ratika KambleNo ratings yet

- ECODEVDocument2 pagesECODEVEena Viamae PinpinNo ratings yet

- Financial Management of Microfinance Companies in IndiaDocument6 pagesFinancial Management of Microfinance Companies in IndiaIJRASETPublicationsNo ratings yet

- Group#1 - MicrofinancersDocument14 pagesGroup#1 - MicrofinancersBianca MedrandaNo ratings yet

- Black BookDocument21 pagesBlack BookShaikh Muskaan100% (2)

- Microfinance ReportDocument68 pagesMicrofinance ReportrohanNo ratings yet

- Fulltext01 PDFDocument43 pagesFulltext01 PDFHira RajpootNo ratings yet

- Rishu Eco ProjectDocument36 pagesRishu Eco ProjectAnkit ChauhanNo ratings yet

- Edited MicrofinanceDocument59 pagesEdited Microfinancedarthvader005No ratings yet

- Lecture - 02 Micro Credit & NGOs To Alleviate PovertyDocument25 pagesLecture - 02 Micro Credit & NGOs To Alleviate PovertyRaef AhmedNo ratings yet

- Micro Finance AssDocument24 pagesMicro Finance Assanuradha9787No ratings yet

- MicrofinanceDocument6 pagesMicrofinancethisismeamit20103094No ratings yet

- Group 9 - EE - Role of Microfinance - CompressedDocument31 pagesGroup 9 - EE - Role of Microfinance - CompressedSwati PorwalNo ratings yet

- Nobel Prize Winner Muhammad Yunus: The Key To Super-HappinessDocument1 pageNobel Prize Winner Muhammad Yunus: The Key To Super-Happinessthieff14No ratings yet

- ME - Course Content - Nov 2023Document89 pagesME - Course Content - Nov 2023HMS 786No ratings yet

- MicroDocument28 pagesMicro1k12No ratings yet

- Introduction To Micro FinanceDocument32 pagesIntroduction To Micro Financerahulsogani123No ratings yet

- Introductory MicrofinanceDocument65 pagesIntroductory MicrofinancerachelkagomboraNo ratings yet

- First and ForemostDocument7 pagesFirst and ForemostZakeyo Dala ChabingaNo ratings yet

- MICROFINANCEDocument35 pagesMICROFINANCEChinmayee ParhiNo ratings yet

- A Billion Bootstraps: Microcredit, Barefoot Banking, and The Business Solution for Ending PovertyFrom EverandA Billion Bootstraps: Microcredit, Barefoot Banking, and The Business Solution for Ending PovertyRating: 4 out of 5 stars4/5 (8)

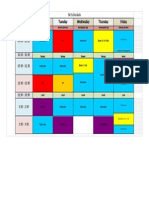

- 5K Class Schedule 14-15Document1 page5K Class Schedule 14-15Will KirkwoodNo ratings yet

- 5K Class Schedule 14-15Document1 page5K Class Schedule 14-15Will KirkwoodNo ratings yet

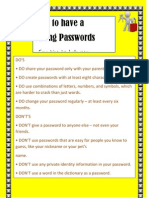

- How To Have A Strong Passwords: Few Tips To Help YouDocument1 pageHow To Have A Strong Passwords: Few Tips To Help YouWill KirkwoodNo ratings yet

- Sec ParentsDocument6 pagesSec ParentsWill KirkwoodNo ratings yet

- Edition 4 2 September 2011Document3 pagesEdition 4 2 September 2011Will KirkwoodNo ratings yet

- NIST News 11 AugustDocument2 pagesNIST News 11 AugustWill KirkwoodNo ratings yet

- 16 September 2011Document3 pages16 September 2011Will KirkwoodNo ratings yet

- 8 September 2011Document4 pages8 September 2011Will KirkwoodNo ratings yet

- 19 August 2011Document3 pages19 August 2011Will KirkwoodNo ratings yet

- PYP Exhibition InviteDocument1 pagePYP Exhibition InviteWill KirkwoodNo ratings yet

- NIST News Edition 2. 19 August 2011Document3 pagesNIST News Edition 2. 19 August 2011Will KirkwoodNo ratings yet

- Taxes: Think For Your Self, Then Ask An Adult, Then Do Some Research On The Internet Then Nswer These QuestionsDocument1 pageTaxes: Think For Your Self, Then Ask An Adult, Then Do Some Research On The Internet Then Nswer These QuestionsWill KirkwoodNo ratings yet

- Handout Confidence StrategiesDocument1 pageHandout Confidence StrategiesWill KirkwoodNo ratings yet

- Role of Ict in The Pyp DraftDocument8 pagesRole of Ict in The Pyp DraftWill Kirkwood100% (1)

- Handout Activities Self Esteem SessionDocument1 pageHandout Activities Self Esteem SessionWill KirkwoodNo ratings yet

- International Monetary Fund: Notes in Point FormDocument2 pagesInternational Monetary Fund: Notes in Point FormWill KirkwoodNo ratings yet

- Thursday 2 December, 2010 Presented by The Counsellors at NISTDocument42 pagesThursday 2 December, 2010 Presented by The Counsellors at NISTWill KirkwoodNo ratings yet

- WL Tag Victoria Ping PingDocument1 pageWL Tag Victoria Ping PingWill KirkwoodNo ratings yet

- Yr 2 School Closure DayDocument3 pagesYr 2 School Closure DayWill KirkwoodNo ratings yet

- KWL Fair TradeDocument2 pagesKWL Fair TradeWill KirkwoodNo ratings yet

- Staff Meetings January-JuneDocument2 pagesStaff Meetings January-JuneWill Kirkwood100% (2)

- Left Out: Think AboutDocument7 pagesLeft Out: Think AboutWill KirkwoodNo ratings yet

- Summer Program 2009 Updated May 15thDocument13 pagesSummer Program 2009 Updated May 15thWill KirkwoodNo ratings yet

- Discovery Streaming SetupDocument1 pageDiscovery Streaming SetupWill KirkwoodNo ratings yet

- Assessment Dates To RememberDocument1 pageAssessment Dates To RememberWill KirkwoodNo ratings yet