Professional Documents

Culture Documents

Pereira Vs CA

Pereira Vs CA

Uploaded by

Kristine Lara Virata EspirituOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pereira Vs CA

Pereira Vs CA

Uploaded by

Kristine Lara Virata EspirituCopyright:

Available Formats

Pereira vs.

CA

Doctrine:

It has been repeatedly held that when a person dies without leaving pending

obligations to be paid, his heirs, whether of age or not, are not bound to submit the

property to a judicial administration, which is always long and costly, or to apply for

the appointment of an administrator by the Court. It has been uniformly held that in

such case the judicial administration and the appointment of an administrator are

superfluous and unnecessary proceedings.

Where partition is possible, either in or out of court, the estate should not be

burdened with an administration proceeding without good and compelling reasons.

Facts:

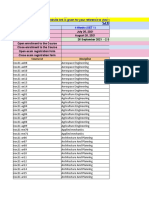

Andres Pereira, an employee of PAL, passed away at Bacoor, Cavite without a will. He

was survived by his legitimate spouse of ten months, Victoria Pereira (petitioner), and

his sister Rita Nagac (PR).

PR instituted before RTC of Bacoor, a special proceeding for the issuance of letters of

administration in her favor pertaining to the estate of the deceased.

In her verified petition, private respondent alleged the following: that she and Victoria

Bringas Pereira are the only surviving heirs of the deceased; that the deceased left no

will; that there are no creditors of the deceased; that the deceased left several

properties, namely: death benefits from the Philippine Air Lines (PAL), as well as

savings deposits, and a house and finally, that the petitioner had been working in

London as an auxiliary nurse and as such one-half of her salary forms part of the

estate of the deceased.

Petitioner filed her opposition and motion to dismiss the petition of private

respondent alleging that there exists no estate of the deceased for purposes of

administration and praying in the alternative, that if an estate does exist, the letters

of administration relating to the said estate be issued in her favor as the surviving

spouse.

RTC appointed PR as administratrix of the intestate estate upon a bond posted by her

in the amount of Pl,000.00. The trial court ordered her to take custody of all the real

and personal properties of the deceased and to file an inventory thereof within three

months after receipt of the order.

Issue:

W/N a judicial administration proceeding is necessary when the decedent dies

intestate without leaving any debts?

Held:

NO, it is not necessary. The general rule is that when a person dies leaving property,

the same should be judicially administered and the competent court should appoint a

qualified administrator, in the order established in Section 6, Rule 78, in case the

deceased left no will, or in case he had left one, should he fail to name an executor

therein. An exception to this rule is established in Section 1 of Rule

74. Under this exception, when all the heirs are of lawful age and there are

no debts due from the estate, they may agree in writing to partition the

property without instituting the judicial administration or applying for the

appointment of an administrator.

Section 1, Rule 74 of the Revised Rules of Court, however, does not preclude the heirs

from instituting administration proceedings, even if the estate has no debts or

obligations, if they do not desire to resort for good reasons to an ordinary action for

partition. While Section 1 allows the heirs to divide the estate among

themselves as they may see fit, or to resort to an ordinary action for

partition, the said provision does not compel them to do so if they have

good reasons to take a different course of action. It should be noted that

recourse to an administration proceeding even if the estate has no debts is

sanctioned only if the heirs have good reasons for not resorting to an action for

partition.

You might also like

- The Walt Disney Company!Document16 pagesThe Walt Disney Company!BeautifullbeeNo ratings yet

- SOP FinalDocument7 pagesSOP FinalsabaNo ratings yet

- ADMIN 44 - BAGATSING vs. COPDocument2 pagesADMIN 44 - BAGATSING vs. COPEr BurgosNo ratings yet

- In Re Francisco V CarreonDocument3 pagesIn Re Francisco V CarreonJohn YeungNo ratings yet

- Specpro DigestsDocument17 pagesSpecpro DigestsKristal Lee100% (2)

- Liwag v. Happy Glen LoopDocument3 pagesLiwag v. Happy Glen LoopEr Burgos0% (1)

- Macadangdang v. CADocument2 pagesMacadangdang v. CAEr Burgos100% (1)

- PowerWorld 13 ManualDocument1,376 pagesPowerWorld 13 ManualSorinRNo ratings yet

- A Project Report On: "A Marketing Strategy of PVC Pipes in Odisha"Document42 pagesA Project Report On: "A Marketing Strategy of PVC Pipes in Odisha"Gayatri Das80% (5)

- Municipal Council of San Pedro Laguna Vs Colegio de San JoseDocument1 pageMunicipal Council of San Pedro Laguna Vs Colegio de San JoseJennilene LoricoNo ratings yet

- Maintenance of Crushers: R S BaislaDocument52 pagesMaintenance of Crushers: R S BaislaRavindranath BheemisettyNo ratings yet

- RULE 75 To 77 DigestDocument4 pagesRULE 75 To 77 DigestDianaVillafuerteNo ratings yet

- Legal Writing - SampleDocument1 pageLegal Writing - SampleMarti Clarabal100% (1)

- People vs. Fabre EvidDocument2 pagesPeople vs. Fabre Evidjulandmic9100% (1)

- de Gala-Sison Vs Hon. Maddela (1975)Document2 pagesde Gala-Sison Vs Hon. Maddela (1975)Francis MasiglatNo ratings yet

- Biak Na Bato Mining Vs TancoDocument6 pagesBiak Na Bato Mining Vs Tancomichelle_calzada_1No ratings yet

- CD 3 - Rivera v. IAC, 182 SCRA 322Document2 pagesCD 3 - Rivera v. IAC, 182 SCRA 322KrizzaShayneRamosArqueroNo ratings yet

- II. K. 2. Briones v. MiguelDocument2 pagesII. K. 2. Briones v. MiguelEr BurgosNo ratings yet

- CHUA Vs Absolute Management CorpDocument3 pagesCHUA Vs Absolute Management CorpMsIc GabrielNo ratings yet

- Testate Estate of Petrona Francisco v. Proceso Francisco - PobeDocument2 pagesTestate Estate of Petrona Francisco v. Proceso Francisco - PobeDominique PobeNo ratings yet

- Sheker Vs Estate of ShekerDocument2 pagesSheker Vs Estate of ShekerLuke VelasquezNo ratings yet

- Duran v. DuranDocument5 pagesDuran v. Duranalexis_beaNo ratings yet

- 2nd Case DigestDocument4 pages2nd Case DigestKareen BaucanNo ratings yet

- Legal Technique Cases Digest Succession 2017 2018Document11 pagesLegal Technique Cases Digest Succession 2017 2018Ronellie Marie TinajaNo ratings yet

- Spec Pro Digests 3rd CompilationDocument12 pagesSpec Pro Digests 3rd CompilationKia FavorNo ratings yet

- Rule 74 - Cua Vs VargasDocument2 pagesRule 74 - Cua Vs VargasCharlotteNo ratings yet

- Ining v. VegaDocument3 pagesIning v. VegaEr Burgos100% (1)

- 08 - de Guzman v. de Guzman-CarilloDocument2 pages08 - de Guzman v. de Guzman-Carillocool_peach0% (1)

- State Investment House v. Court of Appeals 198 SCRA 390Document3 pagesState Investment House v. Court of Appeals 198 SCRA 390Er BurgosNo ratings yet

- De Leon Vs CA (Digested)Document2 pagesDe Leon Vs CA (Digested)Jonathan Uy0% (1)

- Testate Estate of The Deceased Carlos Gurrea y MonasterioDocument2 pagesTestate Estate of The Deceased Carlos Gurrea y Monasterioviva_33No ratings yet

- CIR v. San RoqueDocument2 pagesCIR v. San RoqueEr BurgosNo ratings yet

- 3.hilado vs. CADocument1 page3.hilado vs. CAAlayka A AnuddinNo ratings yet

- Rule 82 - Ocampo Vs Ocampo G.R. No. 187879Document3 pagesRule 82 - Ocampo Vs Ocampo G.R. No. 187879Perry YapNo ratings yet

- Spec Pro Mendoza Vs TehDocument3 pagesSpec Pro Mendoza Vs TehAprille S. AlviarneNo ratings yet

- 86 Gatmaitan Vs Medina PDFDocument2 pages86 Gatmaitan Vs Medina PDFLenvicElicerLesigues100% (1)

- Enervida vs. de La TorreDocument2 pagesEnervida vs. de La TorreEr BurgosNo ratings yet

- Group 2 August 17Document12 pagesGroup 2 August 17Colleen Fretzie Laguardia Navarro100% (1)

- Case Digest (Eusebio - Garcia)Document5 pagesCase Digest (Eusebio - Garcia)burn_iceNo ratings yet

- Jerez vs. Hon. NietesDocument2 pagesJerez vs. Hon. NietesJam ZaldivarNo ratings yet

- Avelino V CA DigestDocument1 pageAvelino V CA DigestPJ Hong100% (1)

- Rev Rem Case Digests Set 2 Cases 3 and 4Document3 pagesRev Rem Case Digests Set 2 Cases 3 and 4HNo ratings yet

- Afan vs. de GuzmanDocument2 pagesAfan vs. de GuzmanCarla EspinoNo ratings yet

- Corona Vs CADocument1 pageCorona Vs CAApril Gem BalucanagNo ratings yet

- Gabin vs. Melliza DGDocument1 pageGabin vs. Melliza DGKimberly RamosNo ratings yet

- Aldamiz V CFI MindoroDocument2 pagesAldamiz V CFI MindorobaabolsNo ratings yet

- Gatmaitan V MedinaDocument2 pagesGatmaitan V MedinaKarez MartinNo ratings yet

- Specpro Digests Rule 88-90Document18 pagesSpecpro Digests Rule 88-90Jan kristelNo ratings yet

- Utulo v. Vda de GarciaDocument1 pageUtulo v. Vda de GarciaZhanika Marie CarbonellNo ratings yet

- Gaza Et Al vs. LimDocument3 pagesGaza Et Al vs. LimGino Alejandro SisonNo ratings yet

- Renato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Document21 pagesRenato Diaz & Aurora Tumbol vs. Secretary of Finance DOCTRINE: The Law Imposes Value Added Tax (VAT) On "All Kinds of Services"Vicente Del Castillo IVNo ratings yet

- G.R. No. 110427Document1 pageG.R. No. 110427amado espejoNo ratings yet

- Dela Cruz vs. Judge BersamiraDocument3 pagesDela Cruz vs. Judge BersamiraElaine Aquino MaglaqueNo ratings yet

- Polido v. CADocument2 pagesPolido v. CAAbigayle RecioNo ratings yet

- Case Digest Legal FormsDocument52 pagesCase Digest Legal FormsChristine QuibodNo ratings yet

- Valarao V PascualDocument2 pagesValarao V PascualJohn YeungNo ratings yet

- 1 - People vs. LaugaDocument2 pages1 - People vs. LaugaRedd LapidNo ratings yet

- Pastor Jr. Vs CADocument4 pagesPastor Jr. Vs CACrisvon L. GazoNo ratings yet

- CD SEPC PRO Alaban Vs CaDocument9 pagesCD SEPC PRO Alaban Vs CaSunny TeaNo ratings yet

- QUASHA ANCHETA PEÑA V LCNDocument5 pagesQUASHA ANCHETA PEÑA V LCNRL N Deiparine100% (1)

- Phil Trust V Luzon SuretyDocument2 pagesPhil Trust V Luzon SuretyJudy Rivera100% (1)

- Docslide - Us - Hilado Vs CaDocument2 pagesDocslide - Us - Hilado Vs CaAirah Burgos CortesNo ratings yet

- PAHAMOTANG V PNBDocument2 pagesPAHAMOTANG V PNBMiguel CastricionesNo ratings yet

- Gatmaitan v. MedinaDocument2 pagesGatmaitan v. MedinaFritz Frances Danielle100% (1)

- NBNMBMDocument4 pagesNBNMBMMarlene TongsonNo ratings yet

- Pahamotang Vs PNB DigestDocument12 pagesPahamotang Vs PNB DigestAngelica AlonzoNo ratings yet

- Hofilena and Santos AdoptionDocument2 pagesHofilena and Santos AdoptionBerniceAnneAseñas-ElmacoNo ratings yet

- Fule Vs Fule 1924Document1 pageFule Vs Fule 1924Marie Loise MarasiganNo ratings yet

- Cases Batch 5 Evidence Case DigestDocument8 pagesCases Batch 5 Evidence Case DigestPfizer Chan BangisNo ratings yet

- Civil Law Review II Syllabus Textbook 2017 2019 and Leonen Dean Delson PDFDocument28 pagesCivil Law Review II Syllabus Textbook 2017 2019 and Leonen Dean Delson PDFCelyn PalacolNo ratings yet

- Extrajudicial Settlement by Agreement Between Heirs - PEREIRA v. CADocument2 pagesExtrajudicial Settlement by Agreement Between Heirs - PEREIRA v. CAChaelle GabatoNo ratings yet

- VICTORIA BRINGAS PEREIRA, Petitioner, vs. THE HONORABLE COURT OF APPEALS and RITA PEREIRA NAGAC, Respondents. G.R. No. L-81147 June 20, 1989Document2 pagesVICTORIA BRINGAS PEREIRA, Petitioner, vs. THE HONORABLE COURT OF APPEALS and RITA PEREIRA NAGAC, Respondents. G.R. No. L-81147 June 20, 1989lexxNo ratings yet

- 5-Pereira V CADocument2 pages5-Pereira V CAVictor LimNo ratings yet

- Equiable Banking v. IACDocument1 pageEquiable Banking v. IACEr BurgosNo ratings yet

- Asia Lighterage and Shipping v. CADocument1 pageAsia Lighterage and Shipping v. CAEr BurgosNo ratings yet

- North Cotabato v. GPPDocument1 pageNorth Cotabato v. GPPEr BurgosNo ratings yet

- Monsanto v. LimDocument1 pageMonsanto v. LimEr BurgosNo ratings yet

- CIR v. Gen FoodsDocument1 pageCIR v. Gen FoodsEr BurgosNo ratings yet

- Mangasaer v. UgayDocument1 pageMangasaer v. UgayEr BurgosNo ratings yet

- De Pedro V RomasanDocument2 pagesDe Pedro V RomasanEr BurgosNo ratings yet

- Javier v. LumontadDocument1 pageJavier v. LumontadEr BurgosNo ratings yet

- Marcos v. SandiganbayanDocument2 pagesMarcos v. SandiganbayanEr BurgosNo ratings yet

- Republic of The Philippines Regional Trial Court National Capital Judicial Region Makati City BRANCHDocument2 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region Makati City BRANCHEr BurgosNo ratings yet

- Wallace v. Pujalte 34 Phil 511Document2 pagesWallace v. Pujalte 34 Phil 511Er BurgosNo ratings yet

- 443 - Clemente vs. FMSDocument1 page443 - Clemente vs. FMSEr BurgosNo ratings yet

- TortsDocument21 pagesTortsEr BurgosNo ratings yet

- Part ListDocument30 pagesPart ListsaurabhNo ratings yet

- Brand Management Chapter 8Document47 pagesBrand Management Chapter 8Maula JuttNo ratings yet

- Gpon Hgu With 4-Port Gbe, 1200Mbps 802.11ac Wireless and 2-Port Fxs (1 X Usb)Document5 pagesGpon Hgu With 4-Port Gbe, 1200Mbps 802.11ac Wireless and 2-Port Fxs (1 X Usb)Amarsaikhan AmgalanNo ratings yet

- HART Communication Protocol: One. OverviewDocument52 pagesHART Communication Protocol: One. OverviewScada AutomationNo ratings yet

- Midterm ReviewerDocument19 pagesMidterm ReviewerDeseree De RamosNo ratings yet

- Annual Report MOFPI 16 17Document210 pagesAnnual Report MOFPI 16 17MikeNo ratings yet

- Advance Optima Uras 14 (001-050)Document50 pagesAdvance Optima Uras 14 (001-050)brunoNo ratings yet

- This Is My TwonDocument2 pagesThis Is My TwonMónicaNo ratings yet

- Real-Time Flooding Risk Evaluation For Ship-To-Ship Collisions Based On First PrinciplesDocument16 pagesReal-Time Flooding Risk Evaluation For Ship-To-Ship Collisions Based On First PrinciplesImam FirdausNo ratings yet

- Performance Management ProcessDocument8 pagesPerformance Management ProcessSD DNo ratings yet

- CSE-D LINKed IN FILEDocument32 pagesCSE-D LINKed IN FILEVISHAL R CS studentNo ratings yet

- Catalogo 2014 Sonatest TransductoresDocument5 pagesCatalogo 2014 Sonatest TransductoresErick OlavarriaNo ratings yet

- A Study On Brand Preference of Mobile PhoneDocument8 pagesA Study On Brand Preference of Mobile PhoneAshokNo ratings yet

- 201908021564741904-Missing Payroll Data PDFDocument120 pages201908021564741904-Missing Payroll Data PDFMuhammad SajedNo ratings yet

- Tentative Course List (July - Dec 2021)Document104 pagesTentative Course List (July - Dec 2021)Anil MamillapalliNo ratings yet

- A Short Course On Computer VirusesDocument178 pagesA Short Course On Computer Virusesnuit_blanche_1No ratings yet

- Smart Your Life For IotDocument14 pagesSmart Your Life For IotTomas GVNo ratings yet

- Kristine Grace Avelino Gabris BUSINESS MATH Q2 W3Document16 pagesKristine Grace Avelino Gabris BUSINESS MATH Q2 W3TOOTSY BOY AhyongNo ratings yet

- MCPDocument2 pagesMCPrbabar2000142No ratings yet

- Samsung PlanoDocument40 pagesSamsung PlanoGábor VécseyNo ratings yet

- EVENT BRIEF - SWOT AnalysisDocument4 pagesEVENT BRIEF - SWOT AnalysisDHLA SHS Teacher 6No ratings yet

- Critical Writing PAF3113Document7 pagesCritical Writing PAF3113Adlin SofiyaNo ratings yet

- Elements of Fashion: by Sunil TalekarDocument29 pagesElements of Fashion: by Sunil TalekarSunil TalekarNo ratings yet

- Position 1Document5 pagesPosition 1Pat G.No ratings yet

- Turkiye SuppliersDocument7 pagesTurkiye SuppliersIli AntoNo ratings yet