Professional Documents

Culture Documents

Sock Market Performance in May

Uploaded by

John Paul GroomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sock Market Performance in May

Uploaded by

John Paul GroomCopyright:

Available Formats

Stock Market Performance in May

The stock market volatility in March, April and May, has provided for three of the four

most active months in terms of Real volume, as seen in Figure 1. The only month that has

surpassed these three has been October, 2009 when Rio de Janeiro was selected as the

venue for the 2016 Olympic Games.

Figure 1

Bovespa - Monthly Volumes

October '08 - May '10

200.00

150.00

R$ billions

100.00

50.00

0.00

De

Au

De

O

Fe

Ap

Ju

Fe

Ap

ct

ct

n-

g-

b-

b-

c-

c-

r-0

r-1

-0

-0

09

08

09

09

09

10

8

0

Source: BMF Bovespa

In terms of market participants in May, Figure 2 shows that the trend of foreign investors

being the most active sellers continues, with Financial Institutions being the only other

net seller in the market. The most active net buyers in May were corporations, perhaps

buying their own stocks for what they saw were bargain prices, to sell again in the future.

Other net buyers were Individuals and Institutional.

Figure 2

Stock Market Activity, May, 2010

$1,500,000

$1,000,000

$500,000

R$ '000's

$0

-$500,000 1

-$1,000,000

-$1,500,000

-$2,000,000

Foreigners Institutional Individuals Fin Inst Companies

Source: BMF Bovespa

The trend in stock market participants can be seen in Figure 3, with the decline from

37.9% of activity in July 2009, to 25.8% in March, but back up to 29.6% in May.

Institutional investors have taken over from foreign investors as being the largest

participants, with 34.3% in May. Individual investors seem to have lost some interest, as

their participation has slipped from highs of over 30% earlier in the year to 26.5% in

May. Corporate participants doubled their activity between April and May from 1.0% to

2.1%.

Figure 3

40.0% Stock Market Participants Oct 08 - Mai 10

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

O

Fe

Ap

Ju

Au

Fe

Ap

D

D

ct

ct

ec

ec

n-

b-

b-

r-0

g-

r-1

-0

-0

-

09

09

10

0

08

09

8

0

9

Individuals Institutional Foreigners Companies Fin Insts Other

Source BMF Bovespa

We note today that the Ibovespa closed above 63,000 points for the first time in June, and

was up a healthy 2.54%. We do not, however, see this as the start of a long term trend.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Secured Transactions Outline JDDocument176 pagesSecured Transactions Outline JDJesse Danoff92% (13)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Rich Vs PalomaDocument2 pagesRich Vs PalomaEderic ApaoNo ratings yet

- Kuroiler - NPV Financial Plan - Chick SalesDocument14 pagesKuroiler - NPV Financial Plan - Chick SalesYouth Environmental and Social Enterprises (YESE)0% (1)

- Chap 11 - Decision Making and Relevant Information (1) PrintDocument28 pagesChap 11 - Decision Making and Relevant Information (1) PrintranjithaNo ratings yet

- PhilPaSS PrimerDocument22 pagesPhilPaSS PrimerCoolbuster.NetNo ratings yet

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- Early MayDocument1 pageEarly MayJohn Paul GroomNo ratings yet

- The Stock Market FallsDocument2 pagesThe Stock Market FallsJohn Paul GroomNo ratings yet

- The Brazilian Balance of PaymentsDocument2 pagesThe Brazilian Balance of PaymentsJohn Paul GroomNo ratings yet

- The Stock Market in AprilDocument3 pagesThe Stock Market in AprilJohn Paul GroomNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- A Primer - Part 1Document4 pagesA Primer - Part 1John Paul GroomNo ratings yet

- Pac 2Document2 pagesPac 2John Paul GroomNo ratings yet

- Stock Market Parts Feb 10Document2 pagesStock Market Parts Feb 10John Paul GroomNo ratings yet

- Its Well To Remember That Risk EvaluationDocument2 pagesIts Well To Remember That Risk EvaluationJohn Paul GroomNo ratings yet

- Stock Market DevelopmentsDocument2 pagesStock Market DevelopmentsJohn Paul GroomNo ratings yet

- Compaign 2010Document2 pagesCompaign 2010John Paul GroomNo ratings yet

- SM - New YearDocument2 pagesSM - New YearJohn Paul GroomNo ratings yet

- Pas 1 - Presentation of Financial StatementsDocument30 pagesPas 1 - Presentation of Financial StatementsClint Baring Arranchado100% (1)

- Trial Balance (QUEEN TOYS)Document1 pageTrial Balance (QUEEN TOYS)Arum AnnisaNo ratings yet

- REVISED APPLICATION FOR GRANTs 2023-2024 (1) - 240201 - 064357Document7 pagesREVISED APPLICATION FOR GRANTs 2023-2024 (1) - 240201 - 064357ezekielolunga2017No ratings yet

- 5 TomCollier SPEE Annual Parameters SurveyDocument20 pages5 TomCollier SPEE Annual Parameters SurveymdshoppNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- Revisi: Exponential Moving Average (EMA)Document11 pagesRevisi: Exponential Moving Average (EMA)ktkalai selviNo ratings yet

- Online Lecutre 1Document21 pagesOnline Lecutre 1Dinar HassanNo ratings yet

- Circular No. 902Document10 pagesCircular No. 902jc cayananNo ratings yet

- Gross Working Capital Concept (2) Net Working Capital ConceptDocument3 pagesGross Working Capital Concept (2) Net Working Capital ConceptAiDLoNo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ana Fernanda Gonzales CaveroNo ratings yet

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- Prepared By, Ms. Ekta S Patel, I Year M.SC NursingDocument174 pagesPrepared By, Ms. Ekta S Patel, I Year M.SC Nursingjasleen kaurNo ratings yet

- TU Delft Risk Management Course SummaryDocument20 pagesTU Delft Risk Management Course SummarySimeon DishkovNo ratings yet

- ITC E-ChoupalDocument23 pagesITC E-ChoupalRick Ganguly100% (1)

- AnnuityDocument6 pagesAnnuitymasyatiNo ratings yet

- Tax Amnesty - Said. Redeem. RelievedDocument22 pagesTax Amnesty - Said. Redeem. RelievedANGELINA ANGELINANo ratings yet

- Al Anwar Ceramic Tiles Company SAOGDocument11 pagesAl Anwar Ceramic Tiles Company SAOGAnila AslamNo ratings yet

- British American TobaccoDocument121 pagesBritish American TobaccoShubro Barua100% (6)

- IFRS Vs US GAAPDocument5 pagesIFRS Vs US GAAPtibebu5420No ratings yet

- VPS Form SampleDocument7 pagesVPS Form SampleMuhammad ShariqNo ratings yet

- Case Study Health CareDocument6 pagesCase Study Health Caredavidboh100% (1)

- آليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Document20 pagesآليــــات تنشيـط وتطـوير بـورصة الجزائر (الأداء، المعوقات و الحلول)Sea BenNo ratings yet

- Share Buyback Most Important Question SolutionDocument3 pagesShare Buyback Most Important Question Solutionram reddyNo ratings yet

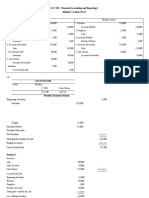

- ACC 101 - Financial Accounting and Reporting 1Document14 pagesACC 101 - Financial Accounting and Reporting 1Rc RocafortNo ratings yet

- Ratio Analysis On Hero HondaDocument20 pagesRatio Analysis On Hero Hondapraxy86No ratings yet