Professional Documents

Culture Documents

7 Secrets Guaranteed To

Uploaded by

api-22175131Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Secrets Guaranteed To

Uploaded by

api-22175131Copyright:

Available Formats

7 Secrets Guaranteed To

Boost Your Credit Score

_ 2006-2007, Bruce D. Liu

This Digital Publication Courtesy:

PrimeMax Marketing Group

3416 Hidden Valley Drive

Plano, TX 75074

http://www.insiderguidetocreditrepair.com/

“NOW - You CAN Get Rid Of Your Credit Worries If You Follow

This Simple, Proven, Step-By-Step Guide …

Discover How You Can Quickly And Easily Get Rid Of Your Bad

Credit Guaranteed To Smash Your Debts FOREVER In Next 90 Days

... With Little or No Money - Even When Your Credit Situation

Seems Hopeless!”

Check out at my web site for details:

http://www.insiderguidetocreditrepair.com/index.html

_ PrimeMax Marketing Group All Rights Reserved Page 1

Disclaimer

While all attempts have been made to verify information

provided in this publication, neither the author nor

the publisher assumes any responsibility for errors,

omissions or contradictory interpretation of the

subject matter herein.

This publication is not intended to be used as a source

of legal advice. The purchaser or reader of this

publication assumes responsibility for the use of these

materials and information. The reader is strongly

encouraged to seek professional counsel before taking

any action.

The information presented in this publication is

intended as a general guide to assist you in improving

your credit rating. As different consumers have

different credit histories, results from employing the

information in this publication may vary.

_ PrimeMax Marketing Group All Rights Reserved Page 2

Thank you for requesting this free report - "7 Secrets

Guaranteed To Boost Your Credit Score!"

Let me start out this free report by sharing one important yet

quite simple principle: "Everything the *professionals* could do

for you, you can do it BETTER for yourself with LESS cost!"

It's not hard to do if you know how to do it and do it RIGHT and

EFFECTIVELY.

The problem is that most of people who are suffering financial

difficulty have little knowledge about how to find out what's

wrong with their credit rating and how to fix and rebuild it if

it's bad.

And even worse don't know about the federal laws and how to use

these laws to protect themselves against the credit bureaus, the

creditors and even the collect agencies.

That is one of the reasons I wrote a simple, and step-by-step

credit repair home study course to help people like you to get

rid of your credit problem and regain your financial future.

I hope that through this special report you will begin to see

just a few of the tips available from my ebook.

Once again, thanks for stopping by my web site.

Now, let's get started …

_ PrimeMax Marketing Group All Rights Reserved Page 3

================================================

7 Secrets Guaranteed To

Boost Your Credit Score

By Bruce D. Liu

================================================

Credit is used every day by millions of Americans, yet most do

not have the clear idea how the credit system really works. Most

people only know that they can pull out a plastic credit card

and buy something that they don't have the cash to pay for.

Credit is more than just a plastic card you use to buy things—it

is your financial trustworthiness. How much is it worth to you

to have good credit?

The answer is simple. Good credit in our society is virtually

“priceless”. If your credit is not good or even damaged, you

will be severely handicapped in almost any financial endeavor

you wish to accomplish.

Good credit means no late payments history, no collections, no

charge-off, no bankruptcies, and no public record. The better

your credit, the more willing companies and people will be to

lend you money, issue you a credit card, rent a house or

apartment to you, hire you, or provide services to you on

favorable terms.

However, bad credit, once established, can be difficult to

escape. It usually results from making late payments or

borrowing too much money, even court judgments, collections, or

bankruptcies.

When you apply for a credit card, personal loan, or any other

type of credit, the lender must decide if you are a good credit

risk. Creditors do this by checking your credit report to see

_ PrimeMax Marketing Group All Rights Reserved Page 4

how you've paid debts in the past.

A poor repayment history will not help you. A bad credit history

can haunt you for a long time—seven years or more.

Creditors usually consider a number of factors in deciding

whether to grant credit, most creditors rely heavily on your

credit history. Some creditors are reluctant to grant credit to

consumers-who have not established a "track record" with other

creditors first.

In addition, many creditors will not extend credit to consumers

with a history of delinquent payments, repossession, judgments,

or bankruptcy.

With these 7 secrets your credit rating will be improved

dramatically.

=======================================================

Secret #1: Know What Your Current FICO® Credit Score Is

=======================================================

A credit score, simply to say, is a rating tool used by a lender

or another financial company to determine whether you qualify

for a particular credit card, loan, or financial service. Think

of credit scoring as a point system based on your credit

history, designed to help predict how likely you are to repay a

loan or make payments on time.

Your credit score is an excellent guide to help you better

understanding your financial health. The creditors use credit

score to determine whether to grant credit or extend credit to

you.

Credit score ranges from 300 to 850, but the majority of scores

fall within the 600s and 700s.

Statistics show general US population FICO Scores range as

follows:

Above 780 - 15%

740-780 - 20%

_ PrimeMax Marketing Group All Rights Reserved Page 5

690 to 740 - 25%

620 to 690 - 20%

Below 620 - 20%

Higher credit scores indicate a lower credit risk, which usually

means lower your cost or easier to borrow more money.

Alternatively, a poor credit score usually mean you can only

qualify a higher interest rate and higher fees than those

offered to applicants with good credit records. So, knowing

your score can be crucial, especially when you apply for a loan.

Everyone with a credit record also has a credit score.

Different lenders may use different scoring systems, so your

score may vary significantly from one source to another.

FICO is registered trademark for Fair Isaac and Company, or Fair

Isaac for short. Fair Isaac is a company who constructs credit

score tools for lenders who use them to evaluate the credit of

their customers and prospects.

_FICO credit scores are among the most well known credit scores.

Find out more about FICO, check out Fair Isaac web site

http://www.fico.com/

But there are certainly other competitors of Fair Isaac who also

construct credit scores. Additionally all three of the national

credit bureaus construct their own credit scores.

FICO credit scores have become well known to consumers over the

last several years because they are often used in mortgage

transactions. It is used by over 70% of the nation's creditors

to make financial decisions about consumers.

Your FICO credit score is calculated by a mathematical equation

that evaluates many types of information found in your credit

files.

_ PrimeMax Marketing Group All Rights Reserved Page 6

Many different facts affect your credit scores, but most are

based on the following, such as:

Your payment history

Your length of credit history

The number and type of accounts you have

The amount you owed

Late payments

Collection actions

The credit inquiries

The new accounts recently opened

Age of your accounts

Your public record and other information

Your score can change whenever your credit report changes. As

your data changes at the credit bureaus, so will any new score

based on your credit report.

So your credit score from a month ago is probably not the same

score that a lender gets from the credit bureau today. But your

score probably won't change a lot from one month to the next.

A bankruptcy, late payments, or debt collections or a court

judgment can significantly low your score fast, while improving

your score takes time.

It is one of the most influential factors in deciding whether to

grant you credit, so that's why it's a good idea to check your

score 6-12 months before applying for a big loan, so you have

time to take action if needed.

If you are actively working on improving your credit score,

you'd want to check it quarterly or even monthly to review

changes.

You can get your own credit score by calling:

_ PrimeMax Marketing Group All Rights Reserved Page 7

Experian 1-888-322-5583

TransUnion 1-866-SCORE-TU or 1-866-726-7388

Equifax 1-877-SCORE-11 or 1-877-726-7311

To improve your credit score, concentrate on the accuracy of

report, paying your bills on time, paying down outstanding

balances, paying bill more than minimum required and not taking

on new debt.

==============================================================

Secret #2: Check On Your Credit Report Periodically

==============================================================

A credit report is a summary of your financial reliability—for

the most part, your history of paying debts and other bills.

Your credit reports can have a significant impact on your life

because they are wildly used in so many decision-making

processes that affect daily life, such as application for a

loan, a credit card, a car, a college loan, or sometimes even

for a job or insurance.

Many people never or rarely look at their credit report until

they apply for a loan or they have been denied a loan or other

request based on information in their reports.

It is important to know what your credit report says about you.

Your credit report is important because people may make

decisions on you based solely on your credit report.

Credit report is designed to provide information about your

credit history to business and organizations, such as banks,

department stores, credit card companies, mortgage companies,

etc.

Usually, your credit report contains the four basic types of

information:

_ Identifying Information

Compiled from credit applications you've filled out, this

information normally includes your name, Social Security

_ PrimeMax Marketing Group All Rights Reserved Page 8

number, current and previous addresses, telephone number,

birth date, and employer.

_ Credit History

The bulk of your credit report consists of details about

credit accounts that were opened in your name or that list

you as an authorized user (such as a spouse's credit card).

Account details, which are supplied by creditors with which

you have an account, include the date the account was

opened, the credit limit or amount of the loan, the payment

terms, the balance, and a history that shows whether or not

you've paid the account on time.

_ Inquiries

A credit report's inquiries section includes a listing of

all of creditors, insurance companies or other parties that

have requested your credit report, usually when considering

an application you submitted.

Every time a potential credit grantor looks at your credit

file, a credit inquiry appears on at least one of your

credit bureau reports. Inquiries typically can remain on

your credit report for two years.

_ Public Records

Matters of public record generally gathered from local

courthouses, including bankruptcy records, foreclosures,

tax liens, court-ordered payments, and late child-support

payments.

Derogatory information can generally remain on your credit

report for up to 7 years, except for bankruptcy information,

which may be reported for 10 years.

However, a credit report does not include information about your

checking or savings accounts, bankruptcies that are more than 10

years old, charged-off or debts placed for collection that are

more than 7 years old, gender, ethnicity, religion, political

_ PrimeMax Marketing Group All Rights Reserved Page 9

affiliation, medical history, or criminal records.

Credit information is weighted based upon its type and history.

The more current good or bad information, the more weight the

affect.

For example a very old 90 day late may be less weighted than a

very recent 30 day late.

The following is the type of data weighted for you credit score:

Past Payment Performance (35% - heaviest weight)

Amounts You Owen (30% - next heaviest)

Length of Your Credit History (15% - third weight)

Types of Credit In Use (10% - least weighted)

New Credit (10% - least weighted)

When you receive your credit report, you'll probably be

surprised to discover what is and isn't in your credit report

and that it may be quite incomplete, inaccurate and outdated.

You may also find out your credit report is not truly

comprehensive portrait of yourself.

You may not know it, but right NOW, this very moment, countless

pieces of information are transmitted, received, and stored

regarding your financial and credit history!

Unfortunately, NOT all of them are good for you! Some of them

maybe server enough to result in credit denial!

In fact, over 50% credit reports have derogatory items. It is

conservatively estimates that 45 millions of those people can

benefit from simple corrective strategies that they can use to

improve their credit scores.

So, that is why important that you should review your credit

reports from all three major credit bureaus frequently. Some

experts suggest review your credit record at least once a year.

It is also advisable to check your credit report whenever you

are applying for important loan, financing your new car or even

_ PrimeMax Marketing Group All Rights Reserved Page 10

apply for new job.

To get copies of your reports, contact the credit bureaus listed

below:

Equifax Information Service

P.O.Box 105851

Atlanta, GA 30348

1-800-685-1111

http://www.equifax.com

Experian

National Consumer Assistance Center

P.O.Box 2104

Allen, TX 75013

1-888-397-3742

http://www.experian.com

TransUnion

Consumer Disclosure Center

P.O.Box 390

Springfield, PA 19064-0390

1-800-916-8800

http://www.transunion.com or

http://www.tuc.com

Under The Fair and Accurate Credit Transactions Act (FACTA)

signed into Federal law in December 2003, you are entitled free

credit report from each of the 3 credit bureaus once every year.

You can get your free annual credit reports by calling

1-877-322-8228 or visit http://www.annualcreditreport.com/

If you want get more than one copy each year, then the cost of

your credit report ranges from $7 to $12, depending on what

state you are living in.

But, your credit score is not part of credit report, it can be

obtained for additional charge, normally from $6 to $13 from

each of 3 credit bureaus.

_ PrimeMax Marketing Group All Rights Reserved Page 11

================================================================

Secret #3: Catch And Correct Any Error In Your Report

================================================================

The first and most essential trick to improve your credit score

is to ensure the accuracy of each of your credit reports. Only

after you are certain of their accuracy should you begin

planning other steps to improve your credit score.

When receiving your credit report, you may find out the credit

report is NOT truly comprehensive portrait of yourself. So, it

is very important to read your credit report very carefully!

And try to identify any inaccurate, outdated, incomplete and

even negative information as possible as you can.

Following is the list of common problems you may found in your

credit report:

Information is mixed

Your name, your address, or your SSN is not corrected

Duplicate accounts show up

Information is inaccurate, incomplete or outdated

Account information does not relate to you

Unauthorized inquiries are listed, etc.

Under the Fair Credit Reporting Act (FCRA), you have the rights

to dispute the completeness and accuracy of information in your

credit files.

If you find information in your credit record that you believe

is inaccurate, correct them as soon as possible to minimize any

possible damage to your credit record.

By doing so, you need to complete the special investigation

request form that comes with your credit report. Follow all of

form's instructions.

You may also want to attach a letter to your completed form,

dated and signed by you, and along with copies of any

_ PrimeMax Marketing Group All Rights Reserved Page 12

documentation you have that helps prove the error in your credit

report.

The documentation might include copies of canceled checks, sales

receipts, account statements, or previous correspondence between

you and the creditor involved.

Attaching a letter to the investigation request form is always a

good idea if you don't think that the credit bureau's

investigation form gives you enough space to explain why you

think there is error in your report.

Keep a copy of your completed investigation request form,

letter, and backup documentation. They provide you with the

records of what you said and when you said it. Also, the date

on letter will let you know when you should have heard back from

the credit bureaus.

Once you have completed the investigation request form, mail it

to the address the form provided, along with your letter, and

copies of any documentation. Send it by certified mail with a

request for return a return receipt.

When you get the signed receipt back, file it with the rest of

your credit record information.

When writing your letter, be as succinct as possible. Explain

clearly what is wrong with your credit report and attach a copy

of the report to your letter. Highlight or circle each of the

problems you want to be corrected.

When a credit bureau receives a dispute, it must investigate and

record the current status of the disputed items within 30 days.

_ If the credit bureaus cannot verify a disputed item, it

must delete it.

_ If your report contains erroneous information, the credit

bureaus must correct it.

_ If an item you are disputing is incomplete, the credit

_ PrimeMax Marketing Group All Rights Reserved Page 13

bureaus must complete it.

For example, if your file showed that you were late in making

payments on accounts, but failed to show that you were no longer

delinquent, the credit-reporting agency must show that your

payments are now current.

If your file showed an account that belongs only to another

person, the credit bureau would have to delete it. Also, at your

request, the credit bureau must send a notice of correction to

any report recipient who has checked your file in the past six

months.

If an investigation does not resolve your dispute, the law

permits you to file a statement of up to 100 words to explain

your side of the story.

Credit bureaus' employees often are available to help you write

your statement. The credit bureaus must include this

explanation in your report each time it sends out.

Adding 100 words written statement to your credit file is just

the one of options, if you cannot resolve the dispute.

Certainly, other options are available for you, such as:

_ Finding new additional document support your case

_ Negotiating with the creditors who provides the information

_ Filing complaint in FTC

_ Mediation

_ Legal action against credit bureau

Which option you choose, it depends on how your credit repair

processing going.

Credit bureaus are permitted by law to report bankruptcies for

10 years and other negative information for 7 years.

Also, any negative information may be reported indefinitely for

use in the evaluation of your application for:

_ $50,000 or more in credit

_ PrimeMax Marketing Group All Rights Reserved Page 14

_A life insurance policy with a face amount of $50,000+

_ Consideration for a job paying $20,000 or more.

However, the accurate negative information in your report is

hard to be removed unless you have knowledge how to deal with

it.

==========================================================

Secret #4: Keep Total Balances As Low As Possible

==========================================================

Potential creditors will be concerned if there are indications

you already owe a lot of money on credit cards and other

obligations because additional debt could stretch your ability

to repay.

One way creditors evaluate whether to approve a loan or charge a

higher interest rate (which means higher risk) is to look at how

much you owe compared to your earning.

Creditors also consider how much of your credit card limit you

typically use.

If you max out your credit cards or otherwise keeping a high

balance in relation to your credit limit, a lender could

question your ability to make payments on additional debt.

Different lenders and credit scoring systems may use different

calculations when evaluating you. For example, some may include

your monthly payment in their debt-to-income ratio, and others

may not.

So, in general, try to keep your debt level as low as possible

you can. Here’re some tips:

Don't spend more than you can afford. While a credit card makes

it easy to buy something now and pay for it later, you can lose

track of how much you've spent by the time the bill arrives if

you're not careful.

And if you don't pay your bill in full, you'll probably have to

_ PrimeMax Marketing Group All Rights Reserved Page 15

pay finance charges on the unpaid balance. What's more, if you

continue to charge while carrying an outstanding balance, your

debt can snowball.

Be aware of carrying over your account balance from month to

month. Doing so can make it easy to run up a big balance that

you may be unable to pay.

Don't max out or charge near the limit on your credit card.

Also, if possible, try to pay off that credit card balance each

month.

If you cannot pay in full, my suggestion is carry over balance

NOT to exceed 30% of credit limits.

High outstanding debt may negatively affect your score, as you

have a greater chance of missing payments.

If you are having trouble making ends meet, contact your

creditors or see a legitimate credit counselor.

This won't improve your score immediately, but if you can begin

to manage your credit and pay on time, your score will get

better over time. And you won't lose points for seeing a credit

counselor.

Pay off debt rather than moving it around. The most effective

way to improve your score in this area is by paying down your

revolving credit. In fact, owing the same amount but having

fewer open accounts may lower your score.

Follow these strategies and you'll build a good credit history,

reduce debts and save on interest payments, too.

_ PrimeMax Marketing Group All Rights Reserved Page 16

==========================================================

Secret #5: Always Make All Of Your Payments On Time

And Pay More Than Minimum Required

============================================================

One of the biggest factors in the determination of your credit

score is your past payment history.

While one or two late payments on your mortgage, credit card or

other important obligations may not significantly damage your

credit record, if at all, making a habit of this an count

against you.

Consistently pay your bills on time each month as possible you

can. Because this indicates you're a responsible money manager

and likely to take your future commitments (such as a loan,

mortgage) seriously.

Be especially careful with payments in the months before you

apply for a loan, because lenders put more emphasis on your

recent payment history.

If having a trouble to pay off balance, at least, you should pay

more than minimum required. DON'T delay payment.

Delinquent payments or collections can have a major negative

impact on your score.

If forced to miss a payment, be sure to pay the following month.

Your past due accounts will be indicated on your credit reports.

If you have missed payments, get current and stay current. The

longer you pay your bills on time, the better your score.

Be aware that paying off a collection account, or closing an

account on which you previously missed a payment, will not

remove it from your credit report.

Your credit score will still consider this information, because

it reflects your past credit patterns.

You might like the idea of paying back only the minimum required

each month or even reducing your minimum payment.

But it isn't really good deals, especially if you can afford to

_ PrimeMax Marketing Group All Rights Reserved Page 17

pay off all or much of your credit card balance.

When you pay only the minimum on your credit card bill, you're

simply taking more time to pay off your debt.

That means more money in interest charges-- perhaps thousands of

dollars and a debt that takes 10 or 20 years longer to pay than

necessary.

If you don't make at least the minimum payment on your credit

card, your creditors will eventually report your account as past

due, and that's a bad mark on your credit history.

Not only that, but paying less than the minimum can result in

late fees and additional interest charges, which can add up

quickly.

Your credit card company also may begin to see you as more of a

risk and decide to substantially increase your interest rate.

So, pay more than the minimum to reduce interest charges and

improve you credit score.

===================================================

Secret #6: Don't Open Too Many Credit Cards

That You Don't Need

===================================================

You may not think twice about offers to "sign up today" for a

credit card to receive a percentage off your first purchase, get

a free T-shirt or to have no payments for six months.

Depending on your personal situation, these promotions may be

good deals.

But beware. If you open a number of credit accounts with

retailers just to get the discounts or freebies, these seemingly

harmless accounts may remain in your credit file and end up

costing you money when you get a loan or insurance the next

time.

If you have a stack of credit cards and department store cards,

even if you rarely use them or don't carry a balance on them,

each card represents money that you could borrow.

_ PrimeMax Marketing Group All Rights Reserved Page 18

A potential creditor will look at each card and its $10,000 or

$20,000 credit limit and say, "We don't know when or if you'll

access this amount, but if you do, that means you'll have less

money available to repay any new obligation".

The result could be that, if you apply for a mortgage, a car

loan or some other important loans, you may qualify for only a

smaller loan amount or perhaps face increased costs and fees or

your application is rejected

Also, when you apply to a bank for a credit card or a loan, the

creditor will look at the "inquiries" section of your credit

report to find out if you've recently applied for loans

elsewhere.

Several such inquiries on your credit report could indicate to a

lender that you may be having financial troubles or that you

could be on the border of getting too deeply in debt.

These inquiries remain on your credit report for 2 years and can

be a factor in your credit score.

So, don't own or apply for credit cards you really don't need.

Two or three general-purpose cards and a few cards issued by

stores or oil companies probably are enough for the average

family.

Cancel and cut up the rest. If necessary, transfer any balances

from these cards onto the few you plan to keep.

Also important: Notify the card issuer in writing that you want

the account closed at your request, and with no balance

remaining, and save a copy for your files.

This letter can be very valuable if, as it sometimes happens,

the account is inaccurately reported as still open and

available, or if it's shown as being closed by the card issuer,

which is considered a negative in the credit industry.

Note: Under some credit scoring systems, canceling credit cards

can lower your credit score, not raise it. For example,

_ PrimeMax Marketing Group All Rights Reserved Page 19

canceling cards you've owned for many years could lower your

credit score because those older cards can establish a long

history of responsible credit use.

Even so, I still generally favor the idea of canceling cards you

rarely or never use, for reasons already mentioned, plus others

(including the fact that you'll have fewer cards that can be

lost to a thief, and you are more likely to notice problems with

cards you use regularly).

As one possible strategy, review all the cards you have. Keep

only the cards you've had for a long time and handled well by

always paying on time.

======================================================

Secret #7: Using Exactly Same Name Every Time You Fill

Out Credit Applications

=======================================================

This may seem like a minor issue but it can be important in

terms of the accuracy of your credit report,

Credit bureaus obtain data from a variety of sources, not all of

which include a person's full name, Social Security number or

other identifying factors.

As a result, aspects of someone else's credit history perhaps

late payments, loan defaults or other serious problems could

be reported on your credit report and could reduce your credit

score.

Some situations are more likely than others to create mix-ups.

It's not uncommon for a child and a parent with the similar

names to show up on each other's credit report.

Always use your full legal name when opening a bank account or

applying for a loan or other benefit, such as a job or lease.

Never leave off a Junior, Senior or similar designation, and

never use a nickname. Or, at the very least, be consistent by

always using the same name when you fill out these kinds of

_ PrimeMax Marketing Group All Rights Reserved Page 20

applications or documents.

For example, if you have a middle name, use it consistently or

not at all; and always specify if you are a junior or a senior.

Following this advice doesn't guarantee that someone else's

credit history won't appear on your credit report, but it will

help reduce the potential for error in your credit file

================================================================

That wraps up your free report on "7 Secrets Guaranteed To Boost

Your Credit Score!" Simply by knowing and applying these 7

secrets you'll 99% raise your credit score significantly. I

hope you enjoyed it!

However, this report is only a tiny drop in the bucket compared

to what we have prepared for you to learn from our Home Buyer

Course. We help you improve your credit scores and help you

qualify for up to $25,000 in down payment assistance!

You simply have to complete one of our one day Home Buyers

Course in your area to qualify! It’s that easy. In this course

you will hear from professionals in the real estate field such

as Real Estate Agents, Home Inspectors, Closing Attorneys, and

Mortgage Brokers who will provide valuable insight to the

process of purchasing a home!

If you are interesting in learning more on how to

effectively remove bad marks on your credit reports, I suggest

you go to the site below and register for our next Home Buyers

Course in your area ASAP!

http://www.YouCanRaiseYourCreditScore.info

Take care ... and all the best to you!

Dee Nott

Connect Realty.com

910-494-2480

_ PrimeMax Marketing Group All Rights Reserved Page 21

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CIF 01 - Account Opening Form For EFS ProgrammeDocument5 pagesCIF 01 - Account Opening Form For EFS ProgrammeMutalib KasimNo ratings yet

- 4-CONSUMER CREDIT (PART 1) (Introduction To Consumer Credit)Document31 pages4-CONSUMER CREDIT (PART 1) (Introduction To Consumer Credit)Nur DinieNo ratings yet

- Credit Repair Secrets ExposedDocument69 pagesCredit Repair Secrets ExposedJulian Williams©™86% (14)

- Instant Credit RepairDocument53 pagesInstant Credit RepairMenjetu98% (58)

- Business Credit Made EasyDocument68 pagesBusiness Credit Made Easylabeledagenius100% (24)

- WPS-256306334 PaaletDocument6 pagesWPS-256306334 Paaletzyanbarnes652No ratings yet

- Cred Risk (07-9 Alternate)Document61 pagesCred Risk (07-9 Alternate)Farrukh JunaidNo ratings yet

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- AB Wakala Application Forms R3.Document1 pageAB Wakala Application Forms R3.SL EntertainmentNo ratings yet

- The First Fintech Bank Arrival - VSolodkiy - Sep-2017Document252 pagesThe First Fintech Bank Arrival - VSolodkiy - Sep-2017humdil100% (3)

- FTC Disclosure ExampleDocument12 pagesFTC Disclosure ExampleReden Oriola100% (1)

- Credit Repair ContractDocument19 pagesCredit Repair ContractMarko PerićNo ratings yet

- 2016 Credit Policy Manual III EditedDocument99 pages2016 Credit Policy Manual III EditedBattogtokh AzjargalNo ratings yet

- Passportcopy 4389960 DOCSDocument8 pagesPassportcopy 4389960 DOCSlisaNo ratings yet

- Credit Scoring Systems HandbookDocument79 pagesCredit Scoring Systems HandbookNegovan CodinNo ratings yet

- Credit Scoring Literature ReviewDocument5 pagesCredit Scoring Literature Reviewafdtovmhb100% (2)

- Application Form. City Bank PDFDocument5 pagesApplication Form. City Bank PDFRumah Titian Ashraful Rohaniah100% (1)

- Jargon Buster Fact SheetDocument9 pagesJargon Buster Fact Sheettedi wediNo ratings yet

- Slide - Chapter 5 - Managing Liquidity - Open Credit PDFDocument11 pagesSlide - Chapter 5 - Managing Liquidity - Open Credit PDFNgọc Phan Thị BíchNo ratings yet

- FIP 3Qtr2013Document8 pagesFIP 3Qtr2013Karol Mikhail Ra NakpilNo ratings yet

- PESTEL AnalysisDocument2 pagesPESTEL AnalysisworldontopNo ratings yet

- Regulatory Bulletin July 2021Document16 pagesRegulatory Bulletin July 2021Tariq MahmoodNo ratings yet

- Notice of Action Taken and Statement of Reasons: Advance AmericaDocument2 pagesNotice of Action Taken and Statement of Reasons: Advance AmericaMichael CalvinNo ratings yet

- Credit Guarantee Corporation Malaysia Berhad Steering SME Development in MalaysiaDocument16 pagesCredit Guarantee Corporation Malaysia Berhad Steering SME Development in MalaysiaLi Jean TanNo ratings yet

- Background Release Form - Offer DocumentDocument9 pagesBackground Release Form - Offer DocumentLatasha wilson100% (1)

- Business Partner For SAP FSCMDocument172 pagesBusiness Partner For SAP FSCMYinka FaluaNo ratings yet

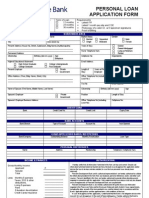

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormDomingo RamilNo ratings yet

- Credit BookDocument115 pagesCredit Bookapi-26366579100% (2)

- EDRDocument (1) CZIALCITADocument16 pagesEDRDocument (1) CZIALCITAHydee AggabaoNo ratings yet

- Redit Epair IT: AC T F F Y C PDocument28 pagesRedit Epair IT: AC T F F Y C PWill Crawford0% (1)