Professional Documents

Culture Documents

Obama Tax Plan: Impact On Alaska

Uploaded by

The Heritage FoundationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Obama Tax Plan: Impact On Alaska

Uploaded by

The Heritage FoundationCopyright:

Available Formats

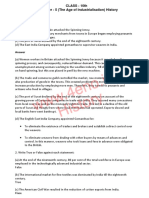

THE EFFECTS OF THE OBAMA TAX PLAN

Alaska

President Obama’s tax plan would allow portions TOTAL EMPLOYMENT

of the 2001 and 2003 tax cuts to expire, resulting in Annual Change in Jobs

steep tax hikes beginning in January 2011 for small

2011 2015 2020

businesses and those earning $250,000 or more. 0

The tax hikes would significantly affect the economy

–250

in Alaska, most notably in the number of jobs and

change in personal income. –500

Among the results, from 2011 to 2020, the state –750

of Alaska would: –1,000

• Lose, on average, 1,598 jobs annually.

• Lose, per household, $5,638 in total disposable –1,250

personal income.

–1,500

• See total individual income taxes increase by

$1,173 million. –1,750

–2,000

Source: Heritage Foundation calculations based on the IHS Global

Insight U.S. macroeconomic model, and data from the U.S. Census –2,250

Bureau and U.S. Department of Labor, Bureau of Labor Statistics.

–2,018

REAL DISPOSABLE INCOME TOTAL INDIVIDUAL INCOME TAXES

Annual Change per Household Annual Change in Millions of Dollars

$145.5

2011 2015 2020

$0 $160

–$75

$140

–$150

$120

–$225

$100

–$300

–$375 $80

–$450

$60

–$525

$40

–$600

$20

–$675

–$750 $0

2011 2015 2020

–$713.64

Chart AK • Obama Tax Plan by State heritage.org

THE EFFECTS OF THE OBAMA TAX PLAN

Change in Employment in Alaska

Average Annual Change in Total

Employment, 2011 to 2020, by

Congressional District

Jobs Lost: 800–1,399

Jobs Lost: 1,400–1,599

Jobs Lost: 1,600–1,799

Jobs Lost: 1,800–2,320

State: 1,598 jobs lost annually on average

Source: Heritage Foundation calculations based on the IHS Global Insight U.S. macroeconomic model, and data from the U.S. Census Bureau and U.S.

Department of Labor, Bureau of Labor Statistics.

Map AK • Obama Tax Plan by State heritage.org

You might also like

- Mandate For Leadership Policy RecommendationsDocument19 pagesMandate For Leadership Policy RecommendationsThe Heritage Foundation77% (31)

- Secret Service Affidavit For Seizure of Bednar FundsDocument12 pagesSecret Service Affidavit For Seizure of Bednar FundsThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength SpaceDocument11 pages2018 Index of Military Strength SpaceThe Heritage FoundationNo ratings yet

- Requests For Admission From Kirkland and EllisDocument6 pagesRequests For Admission From Kirkland and EllisThe Heritage FoundationNo ratings yet

- 2018 Index of Military Strength Naval DomainDocument15 pages2018 Index of Military Strength Naval DomainThe Heritage Foundation100% (2)

- Operational Performance Measurement: Further Analysis of Productivity and SalesDocument201 pagesOperational Performance Measurement: Further Analysis of Productivity and SalesFernando III Perez0% (1)

- 2018 Index of Military Strength CyberDocument16 pages2018 Index of Military Strength CyberThe Heritage Foundation100% (2)

- Job Order Costing Lecture NotesDocument6 pagesJob Order Costing Lecture NotesRenz LorenzNo ratings yet

- Schooling in Capitalist America-Bowles and Gintis 1-60 PDFDocument68 pagesSchooling in Capitalist America-Bowles and Gintis 1-60 PDFJosé R.100% (3)

- Feenstra Econ SM - Chap05 PDFDocument10 pagesFeenstra Econ SM - Chap05 PDFV GeghamyanNo ratings yet

- Meadows Speaker ResolutionDocument2 pagesMeadows Speaker ResolutionFreedomWorksPolicyNo ratings yet

- Do's & Don'Ts by Principal Employer - Engaging Contract LabourDocument6 pagesDo's & Don'Ts by Principal Employer - Engaging Contract Labourrgsr2008No ratings yet

- Solution Macroeconomics For Chapter 23 - 3th Editon - Mankiw - Measuring A Nation's IncomeDocument6 pagesSolution Macroeconomics For Chapter 23 - 3th Editon - Mankiw - Measuring A Nation's IncomeQuý Trần100% (8)

- San Miguel Union vs. Bersamira DigestDocument2 pagesSan Miguel Union vs. Bersamira DigestMichelle Montenegro - Araujo100% (1)

- Chap1-3 StudyGuideDocument19 pagesChap1-3 StudyGuideAmanda ThurstonNo ratings yet

- Labor Code - Cacho BookDocument6 pagesLabor Code - Cacho BookKarl CabarlesNo ratings yet

- Obama Tax Plan: Impact On DCDocument2 pagesObama Tax Plan: Impact On DCThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VermontDocument2 pagesObama Tax Plan: VermontThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WyomingDocument2 pagesObama Tax Plan: WyomingThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North DakotaDocument2 pagesObama Tax Plan: North DakotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Rhode IslandDocument2 pagesObama Tax Plan: Rhode IslandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KentuckyDocument2 pagesObama Tax Plan: KentuckyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OklahomaDocument2 pagesObama Tax Plan: OklahomaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MississippiDocument2 pagesObama Tax Plan: MississippiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: KansasDocument2 pagesObama Tax Plan: KansasThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NevadaDocument2 pagesObama Tax Plan: NevadaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WashingtonDocument2 pagesObama Tax Plan: WashingtonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On IdahoDocument2 pagesObama Tax Plan: Impact On IdahoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: NebraskaDocument2 pagesObama Tax Plan: NebraskaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: OregonDocument2 pagesObama Tax Plan: OregonThe Heritage FoundationNo ratings yet

- Obama Tax Plan: Impact On HawaiiDocument2 pagesObama Tax Plan: Impact On HawaiiThe Heritage FoundationNo ratings yet

- Obama Tax Plan: TennesseeDocument2 pagesObama Tax Plan: TennesseeThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MontanaDocument2 pagesObama Tax Plan: MontanaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MaineDocument2 pagesObama Tax Plan: MaineThe Heritage FoundationNo ratings yet

- Obama Tax Plan: LouisianaDocument2 pagesObama Tax Plan: LouisianaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: North CarolinaDocument2 pagesObama Tax Plan: North CarolinaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MarylandDocument2 pagesObama Tax Plan: MarylandThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New MexicoDocument2 pagesObama Tax Plan: New MexicoThe Heritage FoundationNo ratings yet

- Obama Tax Plan: WisconsinDocument2 pagesObama Tax Plan: WisconsinThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MinnesotaDocument2 pagesObama Tax Plan: MinnesotaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MissouriDocument2 pagesObama Tax Plan: MissouriThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New JerseyDocument2 pagesObama Tax Plan: New JerseyThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MichiganDocument2 pagesObama Tax Plan: MichiganThe Heritage FoundationNo ratings yet

- Obama Tax Plan: MassachusettsDocument2 pagesObama Tax Plan: MassachusettsThe Heritage FoundationNo ratings yet

- Obama Tax Plan: VirginiaDocument2 pagesObama Tax Plan: VirginiaThe Heritage FoundationNo ratings yet

- Obama Tax Plan: New YorkDocument2 pagesObama Tax Plan: New YorkThe Heritage FoundationNo ratings yet

- Obama Tax Plan: PennsylvaniaDocument2 pagesObama Tax Plan: PennsylvaniaThe Heritage FoundationNo ratings yet

- BudgetChartBook 2022 1Document128 pagesBudgetChartBook 2022 1Team USANo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Spending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Document100 pagesSpending, Taxes, & Deficits: A Book of Charts: Brian Riedl Senior Fellow, Manhattan Institute October 2020Brian RiedlNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- Rate+Sheet+and+Examples 2Document3 pagesRate+Sheet+and+Examples 2mayordrillNo ratings yet

- Accounting in BusinessesDocument5 pagesAccounting in BusinessesNyesha GarbuttNo ratings yet

- 250 WDP MveDocument28 pages250 WDP MveMichael Van EssenNo ratings yet

- 2012 New Tax TableDocument1 page2012 New Tax TableHelen BennettNo ratings yet

- 02 - Cash Flow TemplateDocument2 pages02 - Cash Flow Templateprhipolito22No ratings yet

- Paystub 119316Document1 pagePaystub 119316marcelNo ratings yet

- Extract From 2013 Housing Needs AssessmentDocument8 pagesExtract From 2013 Housing Needs Assessment3x4 ArchitectureNo ratings yet

- Book KeepingDocument10 pagesBook Keepingakansha.associate.workNo ratings yet

- Profit & Loss For Kami's Clothing As at 2018Document3 pagesProfit & Loss For Kami's Clothing As at 2018Veer SinghNo ratings yet

- Kansas Farm Family Living ReportDocument3 pagesKansas Farm Family Living ReportKeri StrahlerNo ratings yet

- IIMK - FA - SectionB - Assignment 4Document4 pagesIIMK - FA - SectionB - Assignment 4Jay PatelNo ratings yet

- Fried TC Tacoma 10-06-14Document27 pagesFried TC Tacoma 10-06-14Brackett427No ratings yet

- Budget WorksheetDocument4 pagesBudget Worksheetsenuli WithanachchiNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- BSBFIM501 Profit and Loss Account.v1.0Document3 pagesBSBFIM501 Profit and Loss Account.v1.0AkashVermaNo ratings yet

- Juliamenesesworkshop10 1Document1 pageJuliamenesesworkshop10 1api-437960877No ratings yet

- Fahmi Gilang Madani - 120110170024 - Tugas AKLDocument6 pagesFahmi Gilang Madani - 120110170024 - Tugas AKLFahmi GilangNo ratings yet

- Did The Nation Overdose On Debt?: Economics GroupDocument8 pagesDid The Nation Overdose On Debt?: Economics Groupcliff_kuleNo ratings yet

- OK Budget Outlook - Oct09Document36 pagesOK Budget Outlook - Oct09sdesignNo ratings yet

- Income Statement: IVAN IZO Law OfficeDocument4 pagesIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNo ratings yet

- The Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020Document9 pagesThe Coronavirus's $20 Trillion Hit To Global Corporations: APRIL 6, 2020go joNo ratings yet

- 2018 Index of Military Strength JointDocument9 pages2018 Index of Military Strength JointThe Heritage FoundationNo ratings yet

- Declassified FISA Abuse Memo PDFDocument4 pagesDeclassified FISA Abuse Memo PDFThe Heritage Foundation100% (1)

- 2018 Index of Military Strength Land DomainDocument14 pages2018 Index of Military Strength Land DomainThe Heritage FoundationNo ratings yet

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- Smith, Weber Letter To Mnuchin Re Russia and Green GroupsDocument6 pagesSmith, Weber Letter To Mnuchin Re Russia and Green GroupsThe Heritage Foundation100% (3)

- 2018 Index of Military Strength Air Domain EssayDocument15 pages2018 Index of Military Strength Air Domain EssayThe Heritage FoundationNo ratings yet

- Comparing GOP Health Care BillsDocument1 pageComparing GOP Health Care BillsThe Heritage Foundation100% (1)

- 2015 Hudson NoticeDocument126 pages2015 Hudson NoticeThe Heritage FoundationNo ratings yet

- Motion To Dismiss in Bednar Forfeiture CaseDocument4 pagesMotion To Dismiss in Bednar Forfeiture CaseThe Heritage FoundationNo ratings yet

- McLellan CaseDocument13 pagesMcLellan CaseThe Heritage FoundationNo ratings yet

- Daleiden TX ComplaintDocument2 pagesDaleiden TX ComplaintThe Heritage FoundationNo ratings yet

- Merritt TX ComplaintDocument2 pagesMerritt TX ComplaintThe Heritage FoundationNo ratings yet

- Conservative Action Project MemoDocument7 pagesConservative Action Project MemoThe Heritage FoundationNo ratings yet

- Order-Straughn Gorman CaseDocument27 pagesOrder-Straughn Gorman CaseThe Heritage FoundationNo ratings yet

- Charles Clarke Forfeiture CaseDocument9 pagesCharles Clarke Forfeiture CaseThe Heritage FoundationNo ratings yet

- Respondents Motion To Reopen Contested Case RecordDocument17 pagesRespondents Motion To Reopen Contested Case RecordThe Heritage FoundationNo ratings yet

- History of PovertyDocument96 pagesHistory of PovertyHajra Aslam AfridiNo ratings yet

- Foundation Course: Paper 1: Organization & Management FundamentalsDocument5 pagesFoundation Course: Paper 1: Organization & Management FundamentalsRavi PrakashNo ratings yet

- Activity-Based CostingDocument20 pagesActivity-Based CostingamartyadasNo ratings yet

- 18 Markets - Factors - ProductionDocument44 pages18 Markets - Factors - ProductionKaran GandhiNo ratings yet

- Latihan Ujian MacroeconomicDocument70 pagesLatihan Ujian MacroeconomicSetiady MaruliNo ratings yet

- 2001 A Household Analysis of Huastec MayDocument13 pages2001 A Household Analysis of Huastec MayChad MinottNo ratings yet

- MSMEDocument8 pagesMSMEcoolvirgo2000No ratings yet

- Jackson E - Women and Sexuality - David Dabydeen - The Intended The Counting House and Our Lady of Demerara WomenDocument17 pagesJackson E - Women and Sexuality - David Dabydeen - The Intended The Counting House and Our Lady of Demerara WomenRiya NagendraNo ratings yet

- Lesson 7 External CompetitivenessDocument46 pagesLesson 7 External CompetitivenessZobaer AhmedNo ratings yet

- Tujuba Nagasa Gemechu Thesis After DefenseDocument82 pagesTujuba Nagasa Gemechu Thesis After DefenseTujuba Nagasa GemechuNo ratings yet

- Chapter 3 - Lecture SlidesDocument18 pagesChapter 3 - Lecture SlidesfirasNo ratings yet

- Some Economic Applications1Document25 pagesSome Economic Applications1kayesalingay3No ratings yet

- Quiz 509Document9 pagesQuiz 509Haris NoonNo ratings yet

- Research ProposalDocument3 pagesResearch ProposalHasan ArmoghanNo ratings yet

- The External Environment and Organizational Culture: Mcgraw-Hill/IrwinDocument40 pagesThe External Environment and Organizational Culture: Mcgraw-Hill/Irwinthiva30No ratings yet

- The Concept of Equilibrium' in The Goods & Services MarketDocument3 pagesThe Concept of Equilibrium' in The Goods & Services Marketgosaye desalegnNo ratings yet

- Economic Perspectives On CSRDocument34 pagesEconomic Perspectives On CSRPinkz JanabanNo ratings yet

- CLASS - 10th Chapter - 5 (The Age of Industrialisation) HistoryDocument3 pagesCLASS - 10th Chapter - 5 (The Age of Industrialisation) HistorybalaushaNo ratings yet

- Economics 101-Essay: by Victoria Luxford Student # 30322TDocument6 pagesEconomics 101-Essay: by Victoria Luxford Student # 30322TTori LuxfordNo ratings yet

- Chapter 1 - Business Objectives Resources and AccountabilityDocument14 pagesChapter 1 - Business Objectives Resources and AccountabilityNoush MehendiNo ratings yet

- PPTXDocument26 pagesPPTXmohsinziaNo ratings yet

- Role of Government On Compensation ManagementDocument12 pagesRole of Government On Compensation ManagementGift AnosiNo ratings yet