Professional Documents

Culture Documents

Comparative Ratio Analysis: (For Fy:07-08) : Taking Rcom As A Base Company

Uploaded by

Arnav Gupta0 ratings0% found this document useful (0 votes)

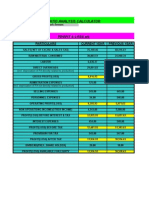

17 views3 pagesCOMPARATIVE RATIO ANALYSIS: (FOR FY:07-08) RATIOS AS AT 31.03.08 CURRENT RATIO (QUICK RATIO) FINANCIAL SLACK OVERALL EFFICIENCY FIXED ASSET TURNOVER DEBT-EQUITY RATIO deb-asset ratio GROSS PROFIT RATIO BHARTI AIRTEL 0. 0.452 0.0165 0.06 TIMES

Original Description:

Original Title

Ratios

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCOMPARATIVE RATIO ANALYSIS: (FOR FY:07-08) RATIOS AS AT 31.03.08 CURRENT RATIO (QUICK RATIO) FINANCIAL SLACK OVERALL EFFICIENCY FIXED ASSET TURNOVER DEBT-EQUITY RATIO deb-asset ratio GROSS PROFIT RATIO BHARTI AIRTEL 0. 0.452 0.0165 0.06 TIMES

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesComparative Ratio Analysis: (For Fy:07-08) : Taking Rcom As A Base Company

Uploaded by

Arnav GuptaCOMPARATIVE RATIO ANALYSIS: (FOR FY:07-08) RATIOS AS AT 31.03.08 CURRENT RATIO (QUICK RATIO) FINANCIAL SLACK OVERALL EFFICIENCY FIXED ASSET TURNOVER DEBT-EQUITY RATIO deb-asset ratio GROSS PROFIT RATIO BHARTI AIRTEL 0. 0.452 0.0165 0.06 TIMES

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

RATIOS BHARTI AIRTEL TATA RCOM(RELIANCE

AS AT 31.03.08 TELESERVICES(MAHARASTRA COMMUNICATION)

) LTD.

CURRENT RATIO 0.46 0.448 1.4

QUICK RATIO 0.452 0.446 1.3

FINANCIAL SLACK 0.0165 0.010 0.005

OVERALL EFFICIENCY 0.06 TIMES 0.334 TIMES 0.29 TIMES

FIXED ASSET 0.045 TIMES 0.571 TIMES 0.55 TIMES

TURNOVER

CURRENT ASSET 0.29 TIMES 3.74 TIMES 1.2TIMES

TURNOVER

WORKING CAPITAL -0.23 TIMES -3.04 TIMES 4.1 TIMES

EFFICIENCY

INVENTORY 16.68 TIMES 769 TIMES 89 TIMES

TURNOVER

DEBT-EQUITY RATIO 0.031 1.108 0.92

DEBT-ASSET RATIO 0.03 0.525 0.47

GROSS PROFIT RATIO 739.4% 7.34% 36.47%

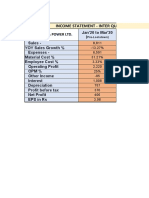

COMPARATIVE RATIO ANALYSIS: (FOR FY:07-08)

TAKING RCOM AS A BASE COMPANY

RATIO RCOM TATA BHARTI AIRTEL

TELESERVICES(MAHARASTRA)

AS AT 31.03.08 (RELIANCE LTD.

COMMUNICATION)

CURRENT RATIO 100 32 32.85

QUICK RATIO 100 34.3 34.7

FINANCIAL 100 200 330

SLACK

OVERALL 100 115 20

EFFICIENCY

FIXED ASSET 100 103 8.1

TURNOVER

CURRENT ASSET 100 311 24

TURNOVER

WORKING 100 -2.5 -5.6

CAPITAL

EFFICIENCY

INVENTORY 100 864 18.74

TURNOVER

DEBT-EQUITY 100 120 3.3

RATIO

DEBT-ASSET 100 111 6.3

RATIO

GROSS PROFIT 100 20.1 2027

RATIO

You might also like

- Dajjal Islamic Urdu BookDocument20 pagesDajjal Islamic Urdu Bookiqbal_islam92% (25)

- Mariwasa Manufacturing Corporation (Aguillas Arambulo Mammuad-Gonzales)Document19 pagesMariwasa Manufacturing Corporation (Aguillas Arambulo Mammuad-Gonzales)anefalarNo ratings yet

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Rice Mill - Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Document50 pagesRice Mill - Detailed Project Report - 9t Per Hour - For Finance, Subsidy & Project Related Support Contact - 9861458008Radha Krishna Sahoo100% (2)

- MARIWASA - Credit Analysis 3Document25 pagesMARIWASA - Credit Analysis 3Redf Benitez50% (2)

- CGTMSEDocument21 pagesCGTMSEakashNo ratings yet

- Manchestar CaseDocument3 pagesManchestar CaseArnav Gupta100% (1)

- Chunnel Project SolutionDocument2 pagesChunnel Project SolutionArnav GuptaNo ratings yet

- Checking of Loading Order: Fujairah Murban +/-5% 5.0% - 5.0%Document14 pagesChecking of Loading Order: Fujairah Murban +/-5% 5.0% - 5.0%shishir kumar100% (1)

- Internet of ThingsDocument16 pagesInternet of ThingsArnav GuptaNo ratings yet

- Vikas Bhola Family: Portfolio Performance Report - Aggregated ViewDocument15 pagesVikas Bhola Family: Portfolio Performance Report - Aggregated ViewVikas BholaNo ratings yet

- Hero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersDocument35 pagesHero Honda Motors Limited: Company Profile Mission Statement Board of Directors PromotersCharan KowtikwarNo ratings yet

- Assessment of Working Capital Requirements Form - IDocument11 pagesAssessment of Working Capital Requirements Form - IAyush SharmaNo ratings yet

- 33 - Jasmeet - A & A Orgochem Pvt. Ltd.Document9 pages33 - Jasmeet - A & A Orgochem Pvt. Ltd.rajat_singlaNo ratings yet

- Pcs NewsletterDocument4 pagesPcs NewsletterBrandon CampbellNo ratings yet

- CasesDocument74 pagesCasesPollsNo ratings yet

- Corporate FinanceDocument8 pagesCorporate FinanceamitNo ratings yet

- We LL Co MeDocument24 pagesWe LL Co MeShibly Qureshi TamimNo ratings yet

- Sescom Info Solutions FzeDocument14 pagesSescom Info Solutions FzeSESCOM INFO SOLUTIONS FZENo ratings yet

- Project Report of Financial ManagementDocument13 pagesProject Report of Financial ManagementAhmad RazaNo ratings yet

- 25 - Ratio Analysis Calculator - VviDocument14 pages25 - Ratio Analysis Calculator - VviRadhesh Bhoot100% (3)

- GL Bs - 2c1p - NPTR - 2021Document1 pageGL Bs - 2c1p - NPTR - 2021PERNIAGAAN ZAINUDINNo ratings yet

- Amwatch: Stock Focus of The DayDocument4 pagesAmwatch: Stock Focus of The DayBrian StanleyNo ratings yet

- Current Ratio Current Assets/Current Liabilities Current Liabilities (%)Document9 pagesCurrent Ratio Current Assets/Current Liabilities Current Liabilities (%)Prem KumarNo ratings yet

- Hela Bojuna - Comparative StatementDocument27 pagesHela Bojuna - Comparative StatementNadeeshani MunasingheNo ratings yet

- ' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/ÊDocument8 pages' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/ÊArpit MaheshwariNo ratings yet

- Balance SheetDocument1 pageBalance SheetNajihahNo ratings yet

- Cma - Taal HotelDocument9 pagesCma - Taal HotelPiyush BansalNo ratings yet

- Comparison - Ratios - Tyre - DistributionDocument15 pagesComparison - Ratios - Tyre - DistributionParehjuiNo ratings yet

- M/s Omega Nutraceuticals: (Rs. in Lacs) S.No. Items Total A: Cost of ProjectDocument4 pagesM/s Omega Nutraceuticals: (Rs. in Lacs) S.No. Items Total A: Cost of Projectpankajca0210No ratings yet

- Elite Investment Advisory Services Equity Derivative Daily Reports - 20 NovDocument4 pagesElite Investment Advisory Services Equity Derivative Daily Reports - 20 NovElite Investment Advisory ServicesNo ratings yet

- Corporate Compliance and Financial Profile of WAY ONNET GROUP PTE LTD (199605877H)Document6 pagesCorporate Compliance and Financial Profile of WAY ONNET GROUP PTE LTD (199605877H)qinyuanzhouNo ratings yet

- Nama: Firda Arfianti NIM: 2301949596 Kelas: LB53 Revenue CycleDocument17 pagesNama: Firda Arfianti NIM: 2301949596 Kelas: LB53 Revenue CycleFirdaNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Itc Limited Technical AnalysisDocument27 pagesItc Limited Technical AnalysisrajdeeplahaNo ratings yet

- Traveller Balance SheetDocument4 pagesTraveller Balance SheetMathi Mahi JayanthNo ratings yet

- 4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFDocument3 pages4) Vid 005-dcf - Discounted-Cash-Flow-Model PDFAkshit SoniNo ratings yet

- Abrar Engro Excel SheetDocument4 pagesAbrar Engro Excel SheetManahil FayyazNo ratings yet

- Daily - March 29-30, 2011Document1 pageDaily - March 29-30, 2011JC CalaycayNo ratings yet

- Synergy Accounts FinalDocument14 pagesSynergy Accounts FinalYasser AyazNo ratings yet

- Financial Statement For Quiz 3 PDFDocument4 pagesFinancial Statement For Quiz 3 PDFJiaXinLimNo ratings yet

- Unbiased DiceDocument18 pagesUnbiased DiceMadhusudan PartaniNo ratings yet

- Income Statement - Inter Quarter Comparison: Jan'20 To Mar'20 (Sales - ExpensesDocument12 pagesIncome Statement - Inter Quarter Comparison: Jan'20 To Mar'20 (Sales - ExpensesMadhuram SharmaNo ratings yet

- Investment AvenueDocument6 pagesInvestment AvenueObaid KhanNo ratings yet

- Calculating CRAR & Capital Adequacy Ratio: Prof.b.p.mishra XimbDocument21 pagesCalculating CRAR & Capital Adequacy Ratio: Prof.b.p.mishra XimbSudhansuSekharNo ratings yet

- CyientDLMAnchor Allocation IntimationDocument3 pagesCyientDLMAnchor Allocation IntimationSaurav Kumar SinghNo ratings yet

- 23-06-0075-01A JTI FCIE Comfort Room Rebovation Works Rev. 01 (6-30-23)Document3 pages23-06-0075-01A JTI FCIE Comfort Room Rebovation Works Rev. 01 (6-30-23)Marvin Jay CastardoNo ratings yet

- Rtts Safety Joint: The Reliable Solution For Contingency String RecoveryDocument2 pagesRtts Safety Joint: The Reliable Solution For Contingency String RecoveryrezaNo ratings yet

- Scriptwise Cummulative Report For Equity Segment Between 01-Apr-2006 and 31-Mar-2007Document1 pageScriptwise Cummulative Report For Equity Segment Between 01-Apr-2006 and 31-Mar-2007api-3730755No ratings yet

- Asignacioninicial 2010Document1 pageAsignacioninicial 2010cnegovecNo ratings yet

- Assignment 4Document6 pagesAssignment 4Sudan KhadgiNo ratings yet

- ICICI Prudential Life InsuranceDocument3 pagesICICI Prudential Life InsuranceArjun BhatnagarNo ratings yet

- I190378914 1Document6 pagesI190378914 1Appie KoekangeNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- COA FAR No 1 1stQtr2017Document10 pagesCOA FAR No 1 1stQtr2017James SusukiNo ratings yet

- Recommended CAT 8CM32C - SparepartsDocument27 pagesRecommended CAT 8CM32C - SparepartsFergiKalesaranNo ratings yet

- Rabihah Enterprise: FarhanaDocument3 pagesRabihah Enterprise: FarhanaSaiful IzuanNo ratings yet

- Pint Date :10/01/2010Document1 pagePint Date :10/01/2010rongonNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- Genting Malaysia Berhad 110220Document51 pagesGenting Malaysia Berhad 110220BT GOHNo ratings yet

- A Comparitive Analysis of Working Capital ofDocument19 pagesA Comparitive Analysis of Working Capital ofManasvi MehtaNo ratings yet

- Financial Management Strategy-MBA-731: Work-SheetDocument8 pagesFinancial Management Strategy-MBA-731: Work-SheetEyuael SolomonNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Wedding RegistryDocument2 pagesWedding RegistryArnav GuptaNo ratings yet

- 10 Year Government Bond DataDocument2 pages10 Year Government Bond DataArnav GuptaNo ratings yet

- Risk Management ReviewDocument1 pageRisk Management ReviewArnav GuptaNo ratings yet

- Etno Internet of ThingsDocument9 pagesEtno Internet of ThingsArnav GuptaNo ratings yet

- Summary of HPS Case StudyDocument1 pageSummary of HPS Case StudyArnav GuptaNo ratings yet

- BRM AssignmentDocument7 pagesBRM AssignmentArnav GuptaNo ratings yet

- Internet of ThingsDocument16 pagesInternet of ThingsArnav GuptaNo ratings yet

- Final Intership Report 12FN-001Document64 pagesFinal Intership Report 12FN-001Arnav GuptaNo ratings yet

- ASDF FormatDocument4 pagesASDF Formatanshuj11No ratings yet