Professional Documents

Culture Documents

' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/Ê

Uploaded by

Arpit Maheshwari0 ratings0% found this document useful (0 votes)

12 views8 pagesOriginal Title

arpit1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views8 pages' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/Ê

Uploaded by

Arpit MaheshwariCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

.

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

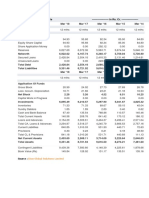

SOFTECH SOLUTIONS PVT.LTD ( Rupees in Lacs )

P R O J E C T A T A G L A N C E

C O S T O F P R O J E C T M E A N S O F F I N A N C E

Existing Proposed Total Existing Proposed Total

Land and Site Development 1.11 1.00 2.11 Equity Share Capital 55.00 35.00 90.00

Buildings 3.56 20.00 23.56 Equity Share Premium 4.40 4.60 9.00

Plant and Machineries 107.50 192.00 299.50 Other Type Share Capital

Motor Vehicles 3.89 3.00 6.89 Reserves & Surplus 20.17 20.17

Computers, Printers, etc 6.03 3.26 9.29 Cash Subsidy 5.00 5.00

Technical Know-how Fees Internal Cash Accruals 5.49 5.49

Franchise & Other Deposits Long/Medium Term Borrowings 52.34 160.00 212.34

Investments 3.00 3.00 Equated Installment Loans

Preliminary& Pre-operative Exp 4.00 4.00 Debentures / Bonds

Provision for Contingencies 6.00 6.00 Unsecured Loans/Deposits 38.00 30.00 68.00

Margin Money - Working Capital 44.82 10.90 55.72

T O T A L .................... 169.91 240.16 410.07 T O T A L ................... 169.91 240.16 410.07

--Annualised- Book Debt NAV ---- Dividend ----- - Retained Earnings - Payout Proba- P/E Yield Price/

Year EPS CEPS Value ble Mkt Book

Per Share Per Share Total Per Share Total Price (No.of Value

Rs. Rs. Rs. Rs. Rs. % Rs. Amt. % Rs. Amt. % Rs. times) %

2002-03 0.28 9.20 14.08 28.20 56.83 100.00 0.28 2.51

2003-04 3.92 10.68 16.99 23.46 57.24 10.00 1.00 9.00 74.48 2.92 26.27 25.52 4.31 1.10 23.20 0.25

2004-05 6.70 11.83 22.49 18.72 61.33 12.00 1.20 10.80 82.09 5.50 49.49 17.91 8.04 1.20 14.93 0.36

2005-06 7.63 11.54 28.73 13.98 62.82 14.00 1.40 12.60 81.66 6.23 56.11 18.34 9.92 1.30 14.11 0.35

2006-07 8.22 11.20 35.35 9.41 64.87 16.00 1.60 14.40 80.54 6.62 59.60 19.46 11.51 1.40 13.90 0.33

2007-08 8.56 10.84 42.11 6.00 68.22 18.00 1.80 16.20 78.96 6.76 60.81 21.04 12.84 1.50 14.02 0.30

---- D S C R ----- Debt / Equity TOL / Return -------- PROFITABILITY RATIOS ---------- Assets Current Lease

Year Indiv- Cumu. Over- -Deposits as- Net on Net GPM PBIDT PBT PAT Net P/V Turn- i Ratio Rental

-idual -all Debt Equity Worth Worth Contri- Ratio over

(RON) -bution Ratio

(Number of times) (No.of times) % % % % % % % Rs.

Initial 2.26 1.10

2006-07 2.09 2.09 2.00 0.97 3.19 1.98 12.39 21.54 0.63 0.41 143.06 22.37 1.17 1.33

2007-08 1.90 1.99 1.38 0.68 2.50 23.06 17.28 21.70 7.29 4.74 165.72 22.21 1.40 1.51

2008-09 2.17 2.05 0.83 0.41 1.84 29.78 19.92 21.64 10.89 7.08 188.06 22.05 1.49 1.65

2009-10 2.24 2.09 2.24 0.49 0.22 1.27 26.58 20.87 21.09 12.35 8.03 187.91 22.03 1.46 1.86

2010-11 2.31 2.13 0.27 0.08 0.91 23.26 21.41 20.42 13.30 8.64 187.93 22.04 1.42 2.14

2011-12 3.18 2.24 0.14 0.68 20.32 21.64 19.64 13.84 9.00 187.94 22.04 1.35 2.71

IRR PAYBACK FACR

3 Internal Rate of Return .. ( In %age )0 %

- Cash BEP (% of Installed Capacity) 23.76 % Payback Period of the Project is ......... 3 Years & 7.98 Months

- Total BEP (% of Installed Capacity) 43.42 % Fixed Assets Coverage Ratio ... ( No. of times )......... 1.64

========================================================================================================================================

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

SOFTECH SOLUTIONS PVT.LTD

STATEMENT SHOWING COST OF PROJECT

AND MEANS OF FINANCE ( Rupees in Lacs )

Particulars Existing Proposed Total

C O S T O F P R O J E C T

Land and Site Development

Factory Land 1.11 1.00 2.11

Buildings

Factory Building 3.56 20.00 23.56

Plant and Machineries

Imported Machineries 15.00 15.00

Indigenious Machineries 90.42 164.00 254.42

Tools,Jigs & Fixtures 2.34 2.00 4.34

Laboratory Equipments 4.32 3.00 7.32

Electrification , etc 5.55 4.00 9.55

Installation, Erection, etc 4.87 4.00 8.87

Investments 3.00 3.00

Motor Vehicles 3.89 3.00 6.89

Computers, Printers, etc 1.76 1.75 3.51

Furniture & Fixtures 2.64 0.66 3.30

Other Misc. Assets 1.63 0.85 2.48

Preliminary & Pre-Operative Exp. 4.00 4.00

Provision for Contingencies 6.00 6.00

Total Capital Cost of Project 125.09 229.26 354.35

Margin Money for Working Capital 44.82 10.90 55.72

Total Cost of Project 169.91 240.16 410.07

SOFTCARE SOFTWARE SERVICES P LTD

STATEMENT SHOWING COST OF PROJECT

AND MEANS OF FINANCE ( Rupees in Lacs )

Particulars Existing Proposed Total

M E A N S O F F I N A N C E

Adjust DIFFERENCE between COP & MOF 0.07 0.07

Equity Share Capital

PROMOTERS 50.00 30.00 80.00

SHARMA GROUP 3.00 3.00 6.00

OZA GROUP 2.00 2.00 4.00

Total Equity Share Capital 55.00 35.00 90.00

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

Equity Share Premium

PROMOTERS 4.00 4.00 8.00

SHARMA GROUP 0.40 0.20 0.60

OZA GROUP 0.40 0.40

Total Equity Share Premium 4.40 4.60 9.00

Other Reserves & Surplus 20.17 20.17

Long/Medium Term Borrowings

TERM LOAN FROM BOB 41.34 41.34

NEW TL FROM BOB 100.00 100.00

TERM LOAN FROM GSFC 11.00 11.00

NEW TERM LOAN FROM GSFC 60.00 60.00

Total Long/Medium Term Borrowings 52.34 160.00 212.34

Unsecured Loans/Deposits

PROMOTERS GROUP DEPOSITS 32.00 22.00 54.00

SHARMA GROUP DEPOSITS 6.00 8.00 14.00

Total Unsecured Loans/Deposits 38.00 30.00 68.00

Cash Subsidy 5.00 5.00

Internal Cash Accruals 5.49 5.49

Total Means of Finance 169.91 240.16 410.07

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

SOFTECH SOLUTIONS PVT.LTD

STATEMENT SHOWING PROFITABILITY AND NET CASH ACCRUALS ( Rupees in Lacs )

Particulars Operating Years

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12

Revenue / Income / Realisation

Gross Domestic Sales Realisation 413.61 500.51 572.44 575.45 575.45 575.45

Less : Excise Duty / Levies 3.05 3.69 4.22 4.25 4.25 4.25

Net Domestic Sales Realisation 410.56 496.82 568.22 571.20 571.20 571.20

Export Sales Realisation 204.70 247.72 283.32 284.80 284.80 284.80

Misc. Income 12.79 14.92 17.06 17.06 17.06 17.06

Export Benefits 3.07 3.72 4.25 4.27 4.27 4.27

Total Revenue / Income / Realisation 631.12 763.18 872.85 877.33 877.33 877.33

Expenses/Cost of Products/Services/Items

Raw Material Cost

Imported 151.43 172.57 197.13 196.45 196.45 196.45

Indigenous 303.52 345.91 395.13 393.76 393.76 393.76

Total Nett Consumption/Usage 454.95 518.48 592.26 590.21 590.21 590.21

Other Material Cost 13.65 15.55 17.77 17.71 17.71 17.71

Packing Material Cost 9.86 11.24 12.84 12.79 12.79 12.79

Sub Total of Net Consumption/Usage 478.46 545.27 622.87 620.71 620.71 620.71

Consumables,Stores,etc 9.86 11.24 12.84 12.79 12.79 12.79

Employees Expenses 9.48 11.37 13.64 16.37 19.65 23.58

Power/Electricity Expenses 5.20 6.07 6.93 6.93 6.93 6.93

Depreciation 79.89 60.41 45.75 34.71 26.39 20.12

Repairs & Maintenance Exp. 3.00 3.15 3.31 3.47 3.65 3.83

Other Mfg. Expenses 3.50 3.68 3.86 4.05 4.25 4.47

Total Cost of Manufacture 589.39 641.19 709.20 699.03 694.37 692.43

Add : Opening Stock - W.I.P. 13.88 16.21 18.52 18.61 18.72

Less: Closing Stock - W.I.P. 13.88 16.21 18.52 18.61 18.72 18.84

Net Cost of Output / Services 575.51 638.86 706.88 698.94 694.27 692.31

Add : Opening Stock-Finished Goods 20.65 24.96 28.59 28.87 29.03

Less: Closing Stock-Finished Goods 20.65 24.96 28.59 28.87 29.03 29.22

Cost of Output of Good/Services Sold 554.86 634.55 703.26 698.66 694.10 692.12

Gross Profit 76.26 128.63 169.59 178.67 183.23 185.21

Administration Expenses 8.44 9.21 10.09 11.09 12.24 13.57

P. & P. Exp. W/Off 0.40 0.40 0.40 0.40 0.40 0.40

Financial Charges

Long/Medium Term Borrowings 27.81 23.15 17.81 12.46 7.13 2.30

Unsecured Loans/Deposits 1.34 1.13 0.82 0.51 0.26 0.10

On Working Capital Borrowings 19.65 22.65 27.15 27.15 27.15 27.15

Total Financial Charges 48.80 46.93 45.78 40.12 34.54 29.55

Selling Expenses 14.76 17.83 20.56 21.35 22.20 23.21

Total Cost of Sales 627.26 708.92 780.09 771.62 763.48 758.85

Net Profit Before Taxes 3.86 54.26 92.76 105.71 113.85 118.48

Tax on Profit 1.35 18.99 32.47 37.00 39.85 41.47

Net Profit After Taxes 2.51 35.27 60.29 68.71 74.00 77.01

Depreciation Added Back 79.89 60.41 45.75 34.71 26.39 20.12

P. & P. Exp. W/Off Added Back 0.40 0.40 0.40 0.40 0.40 0.40

Net Cash Accruals 82.80 96.08 106.44 103.82 100.79 97.53

------------------------------------------------------------------------------------------

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

SOFTECH SOLUTIONS PVT.LTD

STATEMENT SHOWING IMPORTANT FINANCIAL RATIOS - I ( Rupees in Lacs )

P a r t i c u l a r s Operating Years

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12

Profit Percentages to Net Sales

Gross Profit 76.26 128.63 169.59 178.67 183.23 185.21

% Of G.P. to Net Sales 12.39% 17.28% 19.92% 20.87% 21.41% 21.64%

Net Profit Before Taxes 3.86 54.26 92.76 105.71 113.85 118.48

% of N.P.B.T. To Net Sales 0.63% 7.29% 10.89% 12.35% 13.30% 13.84%

Net Profit After Taxes 2.51 35.27 60.29 68.71 74.00 77.01

% of N.P.A.T. To Net Sales 0.41% 4.74% 7.08% 8.03% 8.64% 9.00%

Debt Service Coverage Ratio

Funds Available to Service Debts

Net Profit After Taxes 2.51 35.27 60.29 68.71 74.00 77.01

Depreciation Charges 79.89 60.41 45.75 34.71 26.39 20.12

P.& P. Exp. Written Off 0.40 0.40 0.40 0.40 0.40 0.40

Interest on Long/Medium Term B 27.81 23.15 17.81 12.46 7.13 2.30

T o t a l 110.61 119.23 124.25 116.28 107.92 99.83

Debt Service Obligations

Repayment of Long/Medium Term 25.01 39.56 39.56 39.56 39.55 29.10

Interest on Long/Medium Term B 27.81 23.15 17.81 12.46 7.13 2.30

T o t a l 52.82 62.71 57.37 52.02 46.68 31.40

Parameters Initial

Equity Capital 90.00 90.00 90.00 90.00 90.00 90.00 90.00

Cash Subsidy 5.00 5.00 5.00 5.00 5.00 5.00 5.00

Other Reserves & Surplus 29.17 31.68 57.95 107.44 163.55 223.15 283.96

Unsecured Loans/Deposits 68.00 66.50 63.40 60.30 57.20 55.60 54.00

Long/Medium Term Borrowi 212.34 187.33 147.77 108.21 68.65 29.10

Total Liabilities 531.22 535.18 574.86 588.04 606.74 637.12

DEBT EQUITY RATIO considering

i.e.Total Term Liability/NetWorth

Total Outside Liability/Net Worth 3.19 2.50 1.84 1.27 0.91 0.68

Assets Turnover Ratio-No.of Times 1.17 1.40 1.49 1.46 1.42 1.35

Number of Shares of 10.00 each 900000 900000 900000 900000 900000 900000

Earnings Per Share(EPS) In Rupees 0.28 3.92 6.70 7.63 8.22 8.56

Cash EPS In Rupees 9.20 10.68 11.83 11.54 11.20 10.84

Dividend Per Share(DPS) In Rupees 0.00 1.00 1.20 1.40 1.60 1.80

Payout Ratio (%Age) 0.00 25.52 17.91 18.34 19.46 21.04

Retained Earnings(Per Share)In Rs 0.28 2.92 5.50 6.23 6.62 6.76

Retained Earnings (%Age) 100.00 74.48 82.09 81.66 80.54 78.96

Book Value Per Share In Rupees 14.08 16.99 22.49 28.73 35.35 42.11

Debt Per Share In Rupees 28.20 23.46 18.72 13.98 9.41 6.00

Probable Market Price/Share In Rs 0.00 4.31 8.04 9.92 11.51 12.84

Price / Book Value - No.of Times 0.00 0.25 0.36 0.35 0.33 0.30

Price Earnings Ratio- No.of Times 0.00 1.10 1.20 1.30 1.40 1.50

Yield (%Age) 0.00 23.20 14.93 14.11 13.90 14.02

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

SOFTECH SOLUTIONS PVT.LTD

STATEMENT SHOWING PROJECTED BALANCE SHEETS ( Rupees in Lacs )

L i a b i l i t i e s Operating Years

2006-07 2007-08 2008-09 2009-10 2010-11 2011-12

Adjust Difference between COP & MOF 0.07 0.07 0.07 0.07 0.07 0.07

Equity Share Capital 90.00 90.00 90.00 90.00 90.00 90.00

Equity Share Premium 9.00 9.00 9.00 9.00 9.00 9.00

Surplus of Previous Year 20.17 22.68 48.95 98.44 154.55 214.15

Add : Net Profit After Taxes 2.51 35.27 60.29 68.71 74.00 77.01

Less : Dividend / Drawings 9.00 10.80 12.60 14.40 16.20

Surplus at the End of the Year 22.68 48.95 98.44 154.55 214.15 274.96

Cash Subsidy 5.00 5.00 5.00 5.00 5.00 5.00

Long/Medium Term Borrowings

Existing-TERM LOAN FROM BOB 33.07 24.80 16.53 8.26

Existing-TERM LOAN FROM GSFC 8.80 6.60 4.40 2.20

Proposed-NEW TL FROM BOB 90.91 72.73 54.55 36.37 18.19

Proposed-NEW TERM LOAN FROM GSFC 54.55 43.64 32.73 21.82 10.91

Unsecured Loans/Deposits

Existing-PROMOTERS GROUP DEPOSITS 32.00 32.00 32.00 32.00 32.00 32.00

Existing-SHARMA GROUP DEPOSITS 4.50 3.00 1.50

Proposed-PROMOTERS GROUP DEPOSITS 22.00 22.00 22.00 22.00 22.00 22.00

Proposed-SHARMA GROUP DEPOSITS 8.00 6.40 4.80 3.20 1.60

Bank Borrowing for Working Capital 131.00 151.00 181.00 181.00 181.00 181.00

Current Liabilities

Sundry Creditors 19.71 20.06 22.91 22.64 22.89 23.16

Other Current Liabilities

Total Current Liabilities 19.71 20.06 22.91 22.64 22.89 23.16

Total of Liabilities 531.22 535.18 574.86 588.04 606.74 637.12

A S S E T S

Fixed Assets

Gross Block 341.35 341.35 341.35 341.35 341.35 341.35

Less : Depreciation to Date 79.89 140.30 186.05 220.76 247.15 267.27

Net Block 261.46 201.05 155.30 120.59 94.20 74.08

Investments 3.00 3.00 3.00 3.00 3.00 3.00

Current Assets

Stocks on Hand 116.74 134.86 154.13 154.13 154.40 154.71

Receivable (Incl. Exports) 85.99 104.06 119.02 119.64 119.64 119.64

Other Current Assets 3.63 4.21 4.79 5.20 5.68 6.22

Cash and Bank Balances 50.80 78.80 129.82 177.08 221.82 271.87

Total Current Assets 257.16 321.93 407.76 456.05 501.54 552.44

Other Non Current Assets 6.00 6.00 6.00 6.00 6.00 6.00

Total of Assets 531.22 535.18 574.86 588.04 606.74 637.12

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

SOFTECH SOLUTIONS PVT.LTD

STATEMENT SHOWING ASSESSMENT OF WORKING CAPITAL REQUIREMENT ( Rupees in Lacs )

Particulars Stk.Prd./Term Cr. O p e r a t i n g Y e a r s

1st 2nd & 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12

Year Onwards

Stocks on Hand CURRENT ASSETS

Raw Material Cost

Imported 2.00 2.00 25.24 28.76 32.86 32.74 32.74 32.74

Indigenous 2.00 2.00 50.59 57.65 65.86 65.63 65.63 65.63

Other Material Cost 2.00 2.00 2.28 2.59 2.96 2.95 2.95 2.95

Packing Material Cos 2.00 2.00 1.64 1.87 2.14 2.13 2.13 2.13

Consumables,Stores,e 3.00 3.00 2.47 2.81 3.21 3.20 3.20 3.20

Work-in-Progress 10.00 10.00 13.88 16.21 18.52 18.61 18.72 18.84

Finished Goods 0.50 0.50 20.65 24.96 28.59 28.87 29.03 29.22

Receivables - Domestic

Book Debts 2.00 2.00 56.07 67.85 77.60 78.01 78.01 78.01

Receivables (Exports) 1.00 1.00 17.06 20.64 23.61 23.73 23.73 23.73

Current Expenses 1.00 1.00 3.70 4.28 4.87 5.27 5.74 6.30

Other Current Assets

Cash & Bank Balance - At Year End 50.80 78.80 129.82 177.08 221.82 271.87

Gross Working Capital-Total C/Assets 257.23 322.00 407.83 456.12 501.60 552.52

Sundry Creditors CURRENT LIABILITIES

Raw Material Cost

Other Material Cost 1.00 1.00 1.33 1.32 1.51 1.48 1.48 1.48

Packing Material Cos 1.00 1.00 0.96 0.96 1.09 1.07 1.07 1.07

Consumables,Stores,e 1.00 1.00 0.82 0.94 1.07 1.07 1.07 1.07

Current Expenses 0.50 0.50 1.85 2.14 2.43 2.64 2.87 3.15

Other Current Liabilities

Instalments Due Within next 12 Months

on Long / Medium Term Borrowings 42.66 42.66 42.66 41.15 30.70

Total Current Liabilities 62.37 62.72 65.57 63.79 53.59 23.16

Net Working Capital(Tot.CA - Tot.CL) 194.86 259.28 342.26 392.33 448.02 529.35

Maximum Permissible Finance-Method I 182.40 231.61 294.59 331.04 364.97 402.95

As Per Tandon Com. Norms -Method II 177.48 226.60 288.87 325.39 359.25 397.16

Permissible Finance - Drawing Power

Imported - ( 75.00% DP) 18.93 21.57 24.64 24.56 24.56 24.56

Indigenous - ( 75.00% DP) 23.19 28.53 32.59 32.82 32.81 32.81

Other Material Cost - ( 75.00% DP) 0.38 0.62 0.71 0.74 0.74 0.74

Packing Material Cost- ( 75.00% DP) 0.27 0.45 0.51 0.53 0.53 0.53

Consumables,Stores,et- ( 75.00% DP) 1.03 1.17 1.34 1.33 1.33 1.33

Work in Process - ( 65.00% DP) 9.02 10.54 12.04 12.10 12.17 12.25

Finished Goods - ( 70.00% DP) 14.46 17.47 20.01 20.21 20.32 20.45

Book Debts - ( 75.00% DP) 42.05 50.89 58.20 58.51 58.51 58.51

Total Bank Finance(Asper DP Method) 134.33 161.50 184.64 185.58 185.75 185.96

Total Bank Finance(Turnover Method) 123.66 149.65 171.15 172.05 172.05 172.05

Bank Finance:As Given Amt/Rounded to 131.00 151.00 181.00 181.00 181.00 181.00

Margin Money : ( At Commencement ) 55.72 72.14 74.10

Margin Money : (incl.Cash/Bank Bal) 106.52 150.94 203.92 252.48 297.72 348.35

% of Margin Money to Net Wkg.Capital 44.85% 49.99% 52.98% 58.25% 62.19% 65.81%

Current Ratio ( C/R ) 1.33 1.51 1.65 1.86 2.14 2.71

6oteo uth the oemo versoo o|

Io||x Prc PDf 6d|tcr

Jo remove ths ootce, vst:

uuu.pdfedtng.com

You might also like

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- L.1021 - Extended Producer Responsibility - Guidelines For Sustainable E-Waste ManagementDocument44 pagesL.1021 - Extended Producer Responsibility - Guidelines For Sustainable E-Waste Managementmariiusssica2008No ratings yet

- Limited Partnership AgreementDocument22 pagesLimited Partnership AgreementJobi Bryant100% (1)

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Using A Commercial Process For Simple JusticeDocument4 pagesUsing A Commercial Process For Simple JusticeTruth Press MediaNo ratings yet

- Project Report Solar PanelDocument56 pagesProject Report Solar PanelArnab Biswas0% (2)

- LT Shipbuilding BrochureDocument13 pagesLT Shipbuilding BrochureSrinivasan RajenderanNo ratings yet

- CFO MagazineDocument84 pagesCFO MagazinehenrydeeNo ratings yet

- PET Bottle Recycling Project Report AnalysisDocument52 pagesPET Bottle Recycling Project Report AnalysisMadhuri IyNo ratings yet

- Arbitration Role Playing ScriptDocument18 pagesArbitration Role Playing ScriptClimz Aether100% (1)

- DC Migration Case StudiesDocument3 pagesDC Migration Case StudiesSalman SaluNo ratings yet

- Production of Pearl Caustic Soda-653343 PDFDocument62 pagesProduction of Pearl Caustic Soda-653343 PDFhardajhbfNo ratings yet

- Tabangao Shell Refinery Employees Association v. Pilipinas Shell Petroleum CorporationDocument26 pagesTabangao Shell Refinery Employees Association v. Pilipinas Shell Petroleum CorporationAnnie Herrera-LimNo ratings yet

- Klasifikasi Akurasi EstimasiDocument4 pagesKlasifikasi Akurasi EstimasiAdwina DesyandriNo ratings yet

- Ch01 David AakerDocument30 pagesCh01 David Aakerpankhil_maru75% (4)

- Fin ReportDocument8 pagesFin ReportMayank SarafNo ratings yet

- Ply Wood BusinessDocument58 pagesPly Wood BusinessCB YadavNo ratings yet

- Profitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundDocument7 pagesProfitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundJatin AroraNo ratings yet

- Al Fajar Ply Board Factory OrgDocument22 pagesAl Fajar Ply Board Factory OrgFINAC GROUPNo ratings yet

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathNo ratings yet

- Birla CableDocument4 pagesBirla Cablejanam shahNo ratings yet

- Sample ValuationDocument18 pagesSample Valuationprasha99No ratings yet

- Project Report ON Sharma Pickles: Vishal Sharma Mba (Finance) Section B 19MBAJ0200Document9 pagesProject Report ON Sharma Pickles: Vishal Sharma Mba (Finance) Section B 19MBAJ0200Sushil PrajapatNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Balance Sheet of Hero Honda MotorsDocument2 pagesBalance Sheet of Hero Honda MotorsMehul ShuklaNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- Tom & Jerry Café resturants project reportDocument25 pagesTom & Jerry Café resturants project reportShivam AgrawalNo ratings yet

- DPR Shuttering MixerDocument17 pagesDPR Shuttering MixersyedNo ratings yet

- Pdfanddoc 834944 PDFDocument78 pagesPdfanddoc 834944 PDFAshish RanjangaonkarNo ratings yet

- Sbi Banlce SheetDocument1 pageSbi Banlce SheetANIKET VISHWANATH KURANENo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Five Year Balance Sheet and Profit & Loss Data for CompanyDocument20 pagesFive Year Balance Sheet and Profit & Loss Data for Companytanuj_mohantyNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Ratio Analysis 2023Document25 pagesRatio Analysis 2023mishantlilareNo ratings yet

- Extraction of Curcumin From TurmericDocument81 pagesExtraction of Curcumin From Turmericmaheshkale999No ratings yet

- SultanaDocument12 pagesSultanaMAHAVEER SOLUTIONNo ratings yet

- Advanced Financial ManagementDocument5 pagesAdvanced Financial ManagementAkshay KapoorNo ratings yet

- Final ProjectionsDocument6 pagesFinal ProjectionsMohit JainNo ratings yet

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- Report On ZomatoDocument10 pagesReport On ZomatoNikhil ParidaNo ratings yet

- Cma Data 2Document16 pagesCma Data 2rubhakarNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Beer PlantDocument80 pagesBeer Planttewelde gebrewahdNo ratings yet

- Redco Textiles LimitedDocument18 pagesRedco Textiles LimitedUmer FarooqNo ratings yet

- Worldscope Full Company Report Acc LimitedDocument20 pagesWorldscope Full Company Report Acc LimitedAnkit LunawatNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisSEHWAG MATHAVANNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Case 3Document6 pagesCase 3Dipali SinghNo ratings yet

- Cma-Data RajeshwarDocument16 pagesCma-Data RajeshwarVIRAT SAXENANo ratings yet

- Balance Sheet PDFDocument1 pageBalance Sheet PDFMikhil Pranay SinghNo ratings yet

- Balance SheetDocument1 pageBalance SheetMikhil Pranay SinghNo ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- Balance Sheet of Indiabulls - in Rs. Cr.Document3 pagesBalance Sheet of Indiabulls - in Rs. Cr.MubeenNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Financial Projections (Part 3)Document7 pagesFinancial Projections (Part 3)Mohit JainNo ratings yet

- Market ResearchDocument22 pagesMarket ResearchBABU ANo ratings yet

- ABB India Standalone Balance SheetDocument2 pagesABB India Standalone Balance SheetAbhay Kumar SinghNo ratings yet

- Project Financial DashboardDocument23 pagesProject Financial DashboardSteve UkohaNo ratings yet

- Wire Nail: WWW - Entrepreneurindia.coDocument69 pagesWire Nail: WWW - Entrepreneurindia.coAnonymous Y2J3QRfdNo ratings yet

- Name Enrollment Number Project On Section Submitted To DateDocument14 pagesName Enrollment Number Project On Section Submitted To DateL1588AshishNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Key Financial Ratios of HCL TechnologiesDocument9 pagesKey Financial Ratios of HCL TechnologiesshirleyNo ratings yet

- Production and Processing of Turpentine Oil-39247Document61 pagesProduction and Processing of Turpentine Oil-39247RoshanNo ratings yet

- uPVC Profiles For Doors and Windows: WWW - Entrepreneurindia.coDocument50 pagesuPVC Profiles For Doors and Windows: WWW - Entrepreneurindia.coSathish JayaprakashNo ratings yet

- Previous Years: Bajaj Auto - in Rs. Cr.Document10 pagesPrevious Years: Bajaj Auto - in Rs. Cr.maddikaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsPreethaNo ratings yet

- RP Infra Cma ReportDocument12 pagesRP Infra Cma ReportJitendra NikhareNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- Nucor CaseDocument33 pagesNucor CasedrankitamayekarNo ratings yet

- Sl. No. Course Name of The Subject Total Marks Mid. Sem. Exam Sem. End Exam Teaching Hours CreditsDocument5 pagesSl. No. Course Name of The Subject Total Marks Mid. Sem. Exam Sem. End Exam Teaching Hours CreditsAnonymous 3yqNzCxtTzNo ratings yet

- KUAP Pandipieri Constitution (2011)Document15 pagesKUAP Pandipieri Constitution (2011)Kenya Urban Apostolate Programmes, Pandipieri100% (2)

- Thai-North Rubber Industry Co. LTDDocument195 pagesThai-North Rubber Industry Co. LTDChutinard Kunmaneelert100% (1)

- Managing Director Technology Services in Boston MA Resume Michael AnthonyDocument3 pagesManaging Director Technology Services in Boston MA Resume Michael AnthonyMichaelAnthony2No ratings yet

- Business Organization and Systems Bba I Semester IDocument65 pagesBusiness Organization and Systems Bba I Semester Idevika7575No ratings yet

- Shity PaperDocument2 pagesShity PaperCarina MerceaNo ratings yet

- Prospectus 2013 MT Kenya University KINGDOMDocument34 pagesProspectus 2013 MT Kenya University KINGDOMJennifer WelchNo ratings yet

- Assignment - MQC708Document16 pagesAssignment - MQC708Eng Abdulkadir MahamedNo ratings yet

- 1b. Sustainment Unit Capability PE - Available Sustainment Units (v1)Document2 pages1b. Sustainment Unit Capability PE - Available Sustainment Units (v1)Steve RichardsNo ratings yet

- R12 Trading CommunityDocument6 pagesR12 Trading Communitymani@pfizerNo ratings yet

- Budget RIZZA PIZZA - Luan GonzagaDocument15 pagesBudget RIZZA PIZZA - Luan GonzagaLuan Allama GonzagaNo ratings yet

- A Stakeholder Based Approach To Public Value (ECEG 2013)Document11 pagesA Stakeholder Based Approach To Public Value (ECEG 2013)Walter CastelnovoNo ratings yet

- Practice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossDocument7 pagesPractice 8: Business Combinations and Impairment Exercise 7.12 Impairment Loss For A CGU, Reversal of Impairment LossJingwen YangNo ratings yet

- Project Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The StudyDocument10 pagesProject Report SCOPE OF Brand Image of Shampoos As A Person Objectives of The Studyxyz abcNo ratings yet

- Elaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Document15 pagesElaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- 183601fb151b9f5741a7fe66505ccc3dDocument35 pages183601fb151b9f5741a7fe66505ccc3dLeonardo BritoNo ratings yet

- Amalgamation ChecklistDocument101 pagesAmalgamation ChecklistSabeena KhanNo ratings yet

- Service Crew- Dining Crew- CashierDocument22 pagesService Crew- Dining Crew- CashierThatha CabatoNo ratings yet

- TMEICDocument2 pagesTMEICGunjan KhutNo ratings yet