Professional Documents

Culture Documents

Key Financial Ratios of HCL Technologies

Uploaded by

shirleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Key Financial Ratios of HCL Technologies

Uploaded by

shirleyCopyright:

Available Formats

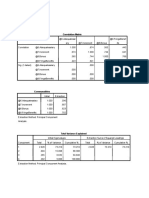

KEY FINANCIAL RATIOS MAR 19 MAR 18 MAR 17 MAR 16 JUN 15

OF HCL

TECHNOLOGIES (in Rs.

Cr.)

PER SHARE RATIOS

Basic EPS (Rs.) 59.69 52.54 48.18 33.52 45.17

Diluted EPS (Rs.) 59.66 52.50 48.13 33.43 44.91

Cash EPS (Rs.) 69.82 59.39 51.59 35.42 47.27

Book Value 224.64 198.29 182.27 152.41 138.02

[ExclRevalReserve]/Share

(Rs.)

Book Value 224.64 198.29 182.27 152.41 138.02

[InclRevalReserve]/Share

(Rs.)

Dividend / Share(Rs.) 8.00 12.00 24.00 16.00 30.00

Revenue from 191.97 158.80 135.56 95.25 122.00

Operations/Share (Rs.)

PBDIT/Share (Rs.) 82.83 72.24 61.82 43.28 57.32

PBIT/Share (Rs.) 73.41 65.81 58.46 41.32 55.19

PBT/Share (Rs.) 73.29 65.65 58.08 40.99 54.75

Net Profit/Share (Rs.) 60.41 52.96 48.23 33.46 45.13

PROFITABILITY RATIOS

PBDIT Margin (%) 43.14 45.48 45.59 45.43 46.98

PBIT Margin (%) 38.24 41.44 43.12 43.37 45.23

PBT Margin (%) 38.17 41.34 42.84 43.03 44.88

Net Profit Margin (%) 31.46 33.35 35.57 35.12 36.99

Return on Networth / Equity 26.88 26.70 26.46 21.95 32.70

(%)

Return on Capital Employed 32.00 32.52 31.49 21.37 31.86

(%)

Return on Assets (%) 21.85 22.43 21.23 17.74 25.47

Total Debt/Equity (X) 0.00 0.00 0.00 0.00 0.00

Asset Turnover Ratio (%) 69.44 67.25 59.67 50.52 68.84

LIQUIDITY RATIOS

Current Ratio (X) 2.93 3.29 3.06 3.91 3.23

Quick Ratio (X) 2.93 3.28 3.05 3.88 3.22

Inventory Turnover Ratio (X) 1,445.11 551.83 214.64 104.50 205.06

Dividend Payout Ratio (NP) 13.42 22.98 49.26 57.16 37.59

(%)

Dividend Payout Ratio (CP) 11.61 20.49 46.06 53.99 35.89

(%)

Earnings Retention Ratio 86.58 77.02 50.74 42.84 62.41

(%)

Cash Earnings Retention 88.39 79.51 53.94 46.01 64.11

Ratio (%)

VALUATION RATIOS

Enterprise Value (Cr.) 141,183.0 132,468.5 116,478.6 106,192.9 120,697.4

0 0 3 5 4

EV/Net Operating Revenue 5.43 6.00 6.03 7.90 7.04

(X)

EV/EBITDA (X) 12.58 13.19 13.22 17.40 14.98

MarketCap/Net Operating 5.67 6.11 6.44 8.55 7.55

Revenue (X)

Retention Ratios (%) 86.57 77.01 50.73 42.83 62.40

Price/BV (X) 4.84 4.89 4.79 5.34 6.67

Price/Net Operating 5.67 6.11 6.44 8.55 7.55

Revenue

Earnings Yield 0.06 0.05 0.06 0.04 0.05

PROFIT & LOSS ACCOUNT OF MAR 19 MAR 18 MAR 17 MAR 16 JUN 15

HCL TECHNOLOGIES (in Rs.

Cr.)

12 mths 12 mths 12 mths 9 mths 12 mths

INCOME

REVENUE FROM 60,427.0 50,569.0 47,568.0 31,135.9 36,701.2

OPERATIONS [GROSS] 0 0 0 4 2

Less: Excise/Sevice Tax/Other 0.00 0.00 0.00 0.00 0.00

Levies

REVENUE FROM 60,427.0 50,569.0 47,568.0 31,135.9 36,701.2

OPERATIONS [NET] 0 0 0 4 2

TOTAL OPERATING 60,427.0 50,569.0 47,568.0 31,135.9 36,701.2

REVENUES 0 0 0 4 2

Other Income 943.00 1,217.00 1,073.00 866.13 1,139.46

TOTAL REVENUE 61,370.0 51,786.0 48,641.0 32,002.0 37,840.6

0 0 0 7 8

EXPENSES

Cost Of Materials Consumed 0.00 0.00 0.00 0.00 0.00

Operating And Direct Expenses 9,760.00 8,620.00 8,666.00 0.00 0.00

Employee Benefit Expenses 29,283.0 24,729.0 22,866.0 15,203.2 17,726.4

0 0 0 5 3

Finance Costs 174.00 69.00 89.00 73.90 91.23

Depreciation And Amortisation 2,073.00 1,383.00 828.00 409.86 403.75

Expenses

Other Expenses 5,762.00 4,619.00 4,837.00 8,575.16 9,231.48

TOTAL EXPENSES 48,748.0 40,775.0 38,101.0 24,966.1 28,723.6

0 0 0 5 2

PROFIT/LOSS BEFORE 12,622.0 11,011.0 10,540.0 7,035.92 9,117.06

EXCEPTIONAL, 0 0 0

EXTRAORDINARY ITEMS AND

TAX

Exceptional Items 0.00 0.00 0.00 0.00 0.00

PROFIT/LOSS BEFORE TAX 12,622.0 11,011.0 10,540.0 7,035.92 9,117.06

0 0 0

TAX EXPENSES-CONTINUED

OPERATIONS

Current Tax 3,094.00 2,386.00 1,885.00 1,663.50 2,128.42

Less: MAT Credit Entitlement 0.00 0.00 0.00 0.00 311.95

Deferred Tax -592.00 -84.00 51.00 -224.50 -1.36

Other Direct Taxes 0.00 0.00 0.00 0.00 0.00

TOTAL TAX EXPENSES 2,502.00 2,302.00 1,936.00 1,439.00 1,815.11

PROFIT/LOSS AFTER TAX 10,120.0 8,709.00 8,604.00 5,596.92 7,301.95

AND BEFORE 0

EXTRAORDINARY ITEMS

PROFIT/LOSS FROM 10,120.0 8,709.00 8,604.00 5,596.92 7,301.95

CONTINUING OPERATIONS 0

PROFIT/LOSS FOR THE 10,120.0 8,709.00 8,604.00 5,596.92 7,301.95

PERIOD 0

Minority Interest 0.00 -1.00 0.00 0.75 -24.78

CONSOLIDATED 10,120.0 8,721.00 8,606.00 5,602.43 7,317.07

PROFIT/LOSS AFTER MI AND 0

ASSOCIATES

OTHER ADDITIONAL

INFORMATION

EARNINGS PER SHARE

Basic EPS (Rs.) 74.00 62.00 60.00 40.00 52.00

Diluted EPS (Rs.) 74.00 62.00 60.00 40.00 52.00

DIVIDEND AND DIVIDEND

PERCENTAGE

Equity Share Dividend 1,099.00 1,692.00 3,386.00 2,697.59 2,385.59

Tax On Dividend 222.00 340.00 683.00 0.00 439.27

BALANCE SHEET OF HCL MAR 19 MAR 18 MAR 17 MAR 16 JUN 15

TECHNOLOGIES (in Rs. Cr.)

12 mths 12 mths 12 mths 9 mths 12 mths

EQUITIES AND LIABILITIES

SHAREHOLDER'S FUNDS

Equity Share Capital 271.00 278.00 285.00 282.08 281.20

TOTAL SHARE CAPITAL 271.00 278.00 285.00 282.08 281.20

Reserves and Surplus 41,095.0 36,108.0 32,664.0 27,108.6 23,943.1

0 0 0 9 9

TOTAL RESERVES AND 41,095.0 36,108.0 32,664.0 27,108.6 23,943.1

SURPLUS 0 0 0 9 9

TOTAL SHAREHOLDERS 41,366.0 36,386.0 32,949.0 27,390.7 24,224.3

FUNDS 0 0 0 7 9

Minority Interest 103.00 0.00 173.00 210.66 82.11

NON-CURRENT LIABILITIES

Long Term Borrowings 2,977.00 338.00 383.00 737.40 167.89

Deferred Tax Liabilities [Net] 226.00 34.00 0.00 0.00 0.00

Other Long Term Liabilities 783.00 458.00 226.00 576.28 614.57

Long Term Provisions 821.00 700.00 696.00 597.04 210.64

TOTAL NON-CURRENT 4,807.00 1,530.00 1,305.00 1,910.72 993.10

LIABILITIES

CURRENT LIABILITIES

Short Term Borrowings 724.00 42.00 55.00 214.44 355.48

Trade Payables 1,305.00 918.00 801.00 703.47 625.41

Other Current Liabilities 9,684.00 8,617.00 10,006.0 8,574.99 7,230.62

0

Short Term Provisions 586.00 530.00 473.00 335.55 1,733.54

TOTAL CURRENT LIABILITIES 12,299.0 10,107.0 11,335.0 9,828.45 9,945.05

0 0 0

TOTAL CAPITAL AND 58,575.0 48,023.0 45,762.0 39,340.6 35,244.6

LIABILITIES 0 0 0 0 7

ASSETS

NON-CURRENT ASSETS

Tangible Assets 5,293.00 4,560.00 3,998.00 3,595.38 3,403.69

Intangible Assets 8,534.00 7,394.00 4,733.00 345.39 4,871.58

Capital Work-In-Progress 235.00 320.00 448.00 610.90 551.52

FIXED ASSETS 14,062.0 12,274.0 9,179.00 4,551.67 8,826.79

0 0

Non-Current Investments 85.00 303.00 160.00 161.91 106.81

Deferred Tax Assets [Net] 2,455.00 1,837.00 1,652.00 1,811.09 789.71

Long Term Loans And Advances 355.00 235.00 0.00 15.00 1,442.19

Other Non-Current Assets 2,835.00 2,017.00 1,804.00 2,043.91 1,032.37

TOTAL NON-CURRENT 28,853.0 23,465.0 19,299.0 14,358.9 12,197.8

ASSETS 0 0 0 0 7

CURRENT ASSETS

Current Investments 2,220.00 2,357.00 1,146.00 536.47 762.58

Inventories 91.00 172.00 276.00 264.48 157.61

Trade Receivables 11,706.0 9,639.00 8,301.00 7,721.14 6,538.69

0

Cash And Cash Equivalents 7,872.00 4,018.00 9,044.00 9,334.60 9,786.23

Short Term Loans And Advances 1,312.00 3,410.00 2,521.00 2,050.02 2,188.84

OtherCurrentAssets 6,521.00 4,962.00 5,175.00 5,074.99 3,612.85

TOTAL CURRENT ASSETS 29,722.0 24,558.0 26,463.0 24,981.7 23,046.8

0 0 0 0 0

TOTAL ASSETS 58,575.0 48,023.0 45,762.0 39,340.6 35,244.6

0 0 0 0 7

OTHER ADDITIONAL

INFORMATION

CONTINGENT LIABILITIES,

COMMITMENTS

Contingent Liabilities 476.00 365.00 547.00 372.07 583.33

BONUS DETAILS

Bonus Equity Share Capital 211.34 216.80 222.26 222.26 222.26

NON-CURRENT INVESTMENTS

Non-Current Investments Quoted 0.00 260.00 0.00 0.00 0.00

Market Value

Non-Current Investments 85.00 43.00 34.00 161.91 106.81

Unquoted Book Value

CURRENT INVESTMENTS

Current Investments Quoted 1,226.00 0.00 0.00 0.00 0.00

Market Value

Current Investments Unquoted 1,079.00 2,357.00 1,146.00 0.00 762.58

Book Value

Source : Dion Global Solutions Limited

RESULTS OF HCL TECH

News

You might also like

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Deepak Nitrite - Industry Analysis and Recommendation to BuyDocument14 pagesDeepak Nitrite - Industry Analysis and Recommendation to BuySujay SinghviNo ratings yet

- HDFC P and LDocument1 pageHDFC P and Lragaveyndhar maniNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsJoydeep GoraiNo ratings yet

- Particulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDDocument4 pagesParticulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDMayank PatelNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Axis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKDocument2 pagesAxis Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNo ratings yet

- Tata Steel: PrintDocument1 pageTata Steel: PrintSEHWAG MATHAVANNo ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- Apollo Hospitals Enterprise LimitedDocument4 pagesApollo Hospitals Enterprise Limitedpaigesh1No ratings yet

- Financials of Canara BankDocument14 pagesFinancials of Canara BankSattwik rathNo ratings yet

- Data of BhartiDocument2 pagesData of BhartiAnkur MehtaNo ratings yet

- Cma-Data RajeshwarDocument16 pagesCma-Data RajeshwarVIRAT SAXENANo ratings yet

- Emu LinesDocument22 pagesEmu LinesRahul MehraNo ratings yet

- Cma-Data Rajeshwar-1-12Document12 pagesCma-Data Rajeshwar-1-12VIRAT SAXENANo ratings yet

- Profit and LossDocument2 pagesProfit and LossSourav RajeevNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- ITM MaricoDocument8 pagesITM MaricoAdarsh ChaudharyNo ratings yet

- Atest Quarterly/Halfyearly As On (Months) : %OI %OI %OIDocument4 pagesAtest Quarterly/Halfyearly As On (Months) : %OI %OI %OIManas AnandNo ratings yet

- Welspun India: PrintDocument2 pagesWelspun India: PrintSJNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Osr 2.1Document82 pagesOsr 2.1INFROLEDGENo ratings yet

- Arvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDDocument2 pagesArvind - Profit & Loss Account - Textiles - Denim - Profit & Loss Account of Arvind - BSE - 500101, NSE - ARVINDAjay CharlesNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Assignment of Accounting For ManagersDocument17 pagesAssignment of Accounting For ManagersGurneet KaurNo ratings yet

- Canara Bank Income Statement AnalysisDocument88 pagesCanara Bank Income Statement Analysissnithisha chandranNo ratings yet

- Financial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosDocument93 pagesFinancial Statements and Analysis: Income Statement Balance Sheet Cashflow Statement Financial RatiosAayushi ChandwaniNo ratings yet

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- (XI) Bibliography and AppendixDocument5 pages(XI) Bibliography and AppendixSwami Yog BirendraNo ratings yet

- Cma Data 2Document16 pagesCma Data 2rubhakarNo ratings yet

- MoneyDocument1 pageMoneySashi TamizhaNo ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsShyamlee KanojiaNo ratings yet

- UNITED SPIRITS LTD-SIrDocument39 pagesUNITED SPIRITS LTD-SIrnishantNo ratings yet

- Moneycontrol. P&L of Liberty ShoesDocument2 pagesMoneycontrol. P&L of Liberty ShoesSanket Bhondage100% (1)

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- Escort P&LDocument2 pagesEscort P&LSagar JainNo ratings yet

- Consolidated Profit CanarabankDocument1 pageConsolidated Profit CanarabankMadhav LuthraNo ratings yet

- Term Paper Sandeep Anurag GautamDocument13 pagesTerm Paper Sandeep Anurag GautamRohit JainNo ratings yet

- Reformulated Income Statement of Century Ply: Operating RevenueDocument2 pagesReformulated Income Statement of Century Ply: Operating RevenueBhoomika GuptaNo ratings yet

- Ruchi, Purvi & Anam (FM)Document7 pagesRuchi, Purvi & Anam (FM)045Purvi GeraNo ratings yet

- Income Latest: Financials (Standalone)Document3 pagesIncome Latest: Financials (Standalone)Vishwavijay ThakurNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Ratio Analysis TanyaDocument10 pagesRatio Analysis Tanyatanya chauhanNo ratings yet

- KPR Phase_1Document23 pagesKPR Phase_1Satyam1771No ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Lakshmi Machine Works: PrintDocument9 pagesLakshmi Machine Works: Printlaxmi joshiNo ratings yet

- Ara ReportDocument60 pagesAra Reportvineeth singhNo ratings yet

- FM Cce2Document7 pagesFM Cce2shrutiNo ratings yet

- cma-data (2)Document15 pagescma-data (2)anupNo ratings yet

- Appendix I: Financial Statement of Nestle India - in Rs. Cr.Document3 pagesAppendix I: Financial Statement of Nestle India - in Rs. Cr.XZJFUHNo ratings yet

- 34 - Neha Sabharwal - Panacea BiotechDocument10 pages34 - Neha Sabharwal - Panacea Biotechrajat_singlaNo ratings yet

- Raymond P&LDocument2 pagesRaymond P&LSJNo ratings yet

- ABB Balance SheetDocument6 pagesABB Balance SheetJyoti Prakash KhataiNo ratings yet

- Transport Logistics Profitability and Cost Efficiency Over TimeDocument13 pagesTransport Logistics Profitability and Cost Efficiency Over TimeAninda DuttaNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- Financial Performance of HCLDocument26 pagesFinancial Performance of HCLshirley100% (1)

- Venkateshan S: Internship: 1Document3 pagesVenkateshan S: Internship: 1shirleyNo ratings yet

- Project Report Submitted in Partial Fulfillment For The Requirement of The Degree ofDocument7 pagesProject Report Submitted in Partial Fulfillment For The Requirement of The Degree ofshirleyNo ratings yet

- Project MadhuDocument132 pagesProject MadhushirleyNo ratings yet

- PraneshDocument3 pagesPraneshshirleyNo ratings yet

- Project Report FormatDocument5 pagesProject Report Formatnaveenprabhakar100% (1)

- Factor Analysis Compensation Factor: Correlation MatrixDocument9 pagesFactor Analysis Compensation Factor: Correlation MatrixshirleyNo ratings yet

- Financial Performance of HCLDocument26 pagesFinancial Performance of HCLshirley100% (1)

- Data Flow DiagramDocument11 pagesData Flow DiagramshirleyNo ratings yet

- 4G TechnologyDocument4 pages4G TechnologyshirleyNo ratings yet

- The Constructive Cost ModelDocument4 pagesThe Constructive Cost ModelshirleyNo ratings yet

- Project SchedulingDocument5 pagesProject SchedulingshirleyNo ratings yet

- Data Flow DiagramDocument11 pagesData Flow DiagramshirleyNo ratings yet

- Book 8 Habit of WinningDocument12 pagesBook 8 Habit of WinningshirleyNo ratings yet

- Critical Problem SolvingDocument8 pagesCritical Problem SolvingshirleyNo ratings yet

- Robotic Check-Ups: Medical RobotsDocument1 pageRobotic Check-Ups: Medical RobotsshirleyNo ratings yet

- Occupancy Counting With Burst and Intermittent Signals in Smart BuildingsDocument12 pagesOccupancy Counting With Burst and Intermittent Signals in Smart BuildingsshirleyNo ratings yet

- Maggi Second Analysis 1Document21 pagesMaggi Second Analysis 1shirleyNo ratings yet

- KishoreDocument3 pagesKishoreshirleyNo ratings yet

- VanigamaniDocument2 pagesVanigamanishirleyNo ratings yet

- Action ResearchDocument8 pagesAction ResearchshirleyNo ratings yet

- Business Plan of APE Optical: April 23Document28 pagesBusiness Plan of APE Optical: April 23shirley100% (1)

- Rebels - in - Frills - A - Literature - Review - On 4Document93 pagesRebels - in - Frills - A - Literature - Review - On 4mariobogarinNo ratings yet

- Lab Skill Workbook - Applied Physics - Seph0009 07-12-2023Document87 pagesLab Skill Workbook - Applied Physics - Seph0009 07-12-2023rahulsaitalasilaNo ratings yet

- Research Project On Capital PunishmentDocument6 pagesResearch Project On Capital PunishmentNitwit NoddyNo ratings yet

- Stock Market Course ContentDocument12 pagesStock Market Course ContentSrikanth SanipiniNo ratings yet

- Quiz Bowl QuestionsDocument8 pagesQuiz Bowl QuestionsKeenan Dave RivoNo ratings yet

- IMU 25,26 Oct 2014 (Other) ResultDocument2,582 pagesIMU 25,26 Oct 2014 (Other) ResultMuhammadFarhanShakee100% (1)

- Arctic Monkeys Do I Wanna KnowDocument4 pagesArctic Monkeys Do I Wanna KnowElliot LangfordNo ratings yet

- MAXsys 2510 Meterin FamilyDocument52 pagesMAXsys 2510 Meterin FamilyAbel NinaNo ratings yet

- Hatch-Slack PathwayDocument10 pagesHatch-Slack Pathwaychurail khanNo ratings yet

- Heliopolis Language Modern School Academic Year (2015-2016) Model Exam (9) 1st Prep (Unit 3) Aim High (A-Level)Document2 pagesHeliopolis Language Modern School Academic Year (2015-2016) Model Exam (9) 1st Prep (Unit 3) Aim High (A-Level)Yasser MohamedNo ratings yet

- Module 6 Questions and AnswersDocument10 pagesModule 6 Questions and AnswersProject InfoNo ratings yet

- Pink Illustrative Weather Quiz Game PresentationDocument28 pagesPink Illustrative Weather Quiz Game PresentationMark Laurenze MangaNo ratings yet

- Grade 6 Quarter 3 WHLP WEEK 4Document3 pagesGrade 6 Quarter 3 WHLP WEEK 4JaneDandanNo ratings yet

- ITC Gardenia LavendreriaDocument6 pagesITC Gardenia LavendreriaMuskan AgarwalNo ratings yet

- Dell M1000e Install Admin TroubleshootingDocument78 pagesDell M1000e Install Admin Troubleshootingsts100No ratings yet

- Effects of The Sugar RevolutionDocument9 pagesEffects of The Sugar RevolutionSusan BarriotNo ratings yet

- Data Center Cooling Solutions That Lower Costs With High Energy SavingsDocument5 pagesData Center Cooling Solutions That Lower Costs With High Energy Savingskhamsone pengmanivongNo ratings yet

- Forming Plurals of NounsDocument5 pagesForming Plurals of NounsCathy GalNo ratings yet

- MSDS TriacetinDocument4 pagesMSDS TriacetinshishirchemNo ratings yet

- Plattischemic Stroke Lesson PlanDocument18 pagesPlattischemic Stroke Lesson Planapi-216258123100% (3)

- Nuisance CandidateDocument5 pagesNuisance CandidateMalen AvanceñaNo ratings yet

- Step 5 - PragmaticsDocument7 pagesStep 5 - PragmaticsRomario García UrbinaNo ratings yet

- Detailed 200L Course OutlineDocument8 pagesDetailed 200L Course OutlineBoluwatife OloyedeNo ratings yet

- Business Studies Project: Made By: Rahil JainDocument29 pagesBusiness Studies Project: Made By: Rahil JainChirag KothariNo ratings yet

- A Study On Customer Satisfaction of TVS Apache RTR 160Document11 pagesA Study On Customer Satisfaction of TVS Apache RTR 160Manajit BhowmikNo ratings yet

- An Introduction To Insurance AccountingDocument86 pagesAn Introduction To Insurance AccountingTricia PrincipeNo ratings yet

- Compassionate Sciences - RedactedDocument184 pagesCompassionate Sciences - RedactedNew Jersey marijuana documentsNo ratings yet

- Vicarious LiabilityDocument12 pagesVicarious LiabilitySoap MacTavishNo ratings yet

- 7vk61 Catalog Sip E6Document18 pages7vk61 Catalog Sip E6Ganesh KCNo ratings yet

- Kyle Capodice Ecet Candidate ResumeDocument1 pageKyle Capodice Ecet Candidate Resumeapi-394690479No ratings yet