Professional Documents

Culture Documents

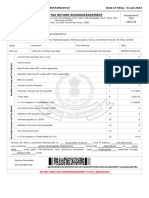

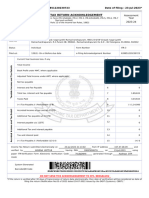

Mail Completed Form SC1120-T To:: Tentative Corporation Tax Return and Conditional Extension SC1120-T

Uploaded by

oscomeats0 ratings0% found this document useful (0 votes)

10 views1 pageMail completed Form SC1120-T to: SC Department of Revenue Corporation Columbia, SC 29214-0006 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE TENTATIVE CORPORATION TAX RETURN AND CONDITIONAL EXTENSION SC CORPORATE FILE # INCOME ACCT PERIOD END (MM-YY) 21137004-1 57-0972998 FEIN Corporate Name and address..

Original Description:

Original Title

0005154b_09c_0

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMail completed Form SC1120-T to: SC Department of Revenue Corporation Columbia, SC 29214-0006 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE TENTATIVE CORPORATION TAX RETURN AND CONDITIONAL EXTENSION SC CORPORATE FILE # INCOME ACCT PERIOD END (MM-YY) 21137004-1 57-0972998 FEIN Corporate Name and address..

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageMail Completed Form SC1120-T To:: Tentative Corporation Tax Return and Conditional Extension SC1120-T

Uploaded by

oscomeatsMail completed Form SC1120-T to: SC Department of Revenue Corporation Columbia, SC 29214-0006 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE TENTATIVE CORPORATION TAX RETURN AND CONDITIONAL EXTENSION SC CORPORATE FILE # INCOME ACCT PERIOD END (MM-YY) 21137004-1 57-0972998 FEIN Corporate Name and address..

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

1030

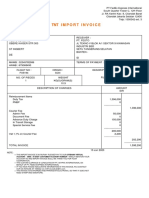

Mail completed Form SC1120-T to:

SC Department of Revenue

Corporation

Columbia, SC 29214-0006

SCCZ0301 11/23/09

1030 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

TENTATIVE CORPORATION TAX RETURN SC1120-T

(Rev 4/9/09)

AND CONDITIONAL EXTENSION 3096

SC CORPORATE FILE # INCOME ACCT PERIOD END (MM-YY)

1 Tentative Tax Based

21137004-1 12-09 on Net Income . . . . . . . . . . . . . 0 .00

57-0972998 2 LESS: Estimated

FEIN Tax Payments . . . . . . . . . . . . . . 0 .00

Corporate Name and Address

3 Tentative Tax Due . . . . . . . . G 0 .00

ORANGEBURG SAUSAGE CO INC 14-0804

597 HIGH STREET

4 Total Capital and Paid in Surplus

ORANGEBURG SC 29115 0. x .001 plus

$15.00 but not less

than $25.00 Tentative

Foreign Not USA License Fee ............. G 25 .00

Tax EXEMPT 14-0401

Consolidated Return (Attach a schedule listing each member.)

Bank or S & L

QSSS Election (Attach a schedule listing each member.)

Utility or Electric Cooperative 5 Balance Remitted ........ G 25 .00

Signature Date

30961031 211370041 570972998 1209 00000000000 00000002500 1

You might also like

- Michael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa ArimaDocument2 pagesMichael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa Arimamichael neddNo ratings yet

- HTTP Localhost 81 Trinidad BillDate20200401 Invoices MTH BILL.16378001.20200401.31047330Document2 pagesHTTP Localhost 81 Trinidad BillDate20200401 Invoices MTH BILL.16378001.20200401.31047330adeshradhaykissoonNo ratings yet

- WHT PlotDocument1 pageWHT Plotsaeed abbasiNo ratings yet

- 2015 Property Tax Statement: Due Date Total DueDocument1 page2015 Property Tax Statement: Due Date Total DueDeron BrownNo ratings yet

- E Tax 20200504201259Document3 pagesE Tax 20200504201259monitganatra100% (1)

- Ivt BS 2021Document53 pagesIvt BS 2021Sujan TripathiNo ratings yet

- Acorns Securities LLC 5300 California Avenue IRVINE, CA 92617Document12 pagesAcorns Securities LLC 5300 California Avenue IRVINE, CA 92617Nicole AndersonNo ratings yet

- Karam SINGH 2223Document2 pagesKaram SINGH 2223sattowal 89No ratings yet

- General Journal - Adjusting Entries December, 31 2017 (In RP.)Document12 pagesGeneral Journal - Adjusting Entries December, 31 2017 (In RP.)Zahra Nur FajriyahNo ratings yet

- Jawaban Sesi 3 Ujikom Pt. BoombasstikDocument12 pagesJawaban Sesi 3 Ujikom Pt. BoombasstikNada Nadya100% (1)

- Salary Bill For Gazzetted Government ServantsDocument2 pagesSalary Bill For Gazzetted Government ServantsMuhammad Ramzan BurfatNo ratings yet

- 1111Document2 pages1111Karan JangidNo ratings yet

- COI AY 22-23 Narinder BhatiaDocument4 pagesCOI AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- Amazon 1Document1 pageAmazon 1kimikorollinsNo ratings yet

- View FileDocument2 pagesView FileTakashi HamiltonNo ratings yet

- Huntington StatementDocument3 pagesHuntington Statementchde795No ratings yet

- COI Narinder Bhatia 22-23Document5 pagesCOI Narinder Bhatia 22-23Ashwani KumarNo ratings yet

- State Mobile Ward Status Preparedate Email-Id: Computation Total IncomeDocument4 pagesState Mobile Ward Status Preparedate Email-Id: Computation Total IncomejayminNo ratings yet

- Fund Cluster 3 (151 Pawcz) December 2022Document40 pagesFund Cluster 3 (151 Pawcz) December 2022Brian KamskyNo ratings yet

- UntitledDocument3 pagesUntitledNisar AliNo ratings yet

- Keshab Kaukhik Dutta ITDocument23 pagesKeshab Kaukhik Dutta ITAnup SahaNo ratings yet

- Onett Computation SheetDocument1 pageOnett Computation SheetBreahziel ParillaNo ratings yet

- Attachment UnlockedDocument3 pagesAttachment Unlockedmbhalani1207No ratings yet

- HH1 Ooo 002410910000 R 4325 DFF4846621Document1 pageHH1 Ooo 002410910000 R 4325 DFF4846621Trevor NelsonNo ratings yet

- 2019 1099-Consol Morgan Stanley 5948 KentDocument10 pages2019 1099-Consol Morgan Stanley 5948 Kentesteysi775No ratings yet

- Karam Singh 2122Document2 pagesKaram Singh 2122sattowal 89No ratings yet

- Ali Hassan CC PDFDocument1 pageAli Hassan CC PDFAdv Ali Akbar Adv Ali AkbarNo ratings yet

- PDF 990595730310723Document1 pagePDF 990595730310723RaviNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- MyfileDocument1 pageMyfileanon-302065No ratings yet

- Full & Final Pay Calculation: 368507 Nabata, Esathena BalderamaDocument4 pagesFull & Final Pay Calculation: 368507 Nabata, Esathena BalderamaËsatheńā ŃabaťāNo ratings yet

- JABEEN TAJ COIMBATORE EB - CompressedDocument1 pageJABEEN TAJ COIMBATORE EB - Compressedgoldentraders2574No ratings yet

- BV 005 LedgerDocument2 pagesBV 005 Ledgeramit singhNo ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Account SummaryDocument1 pageAccount SummaryVenkata BharathNo ratings yet

- Bill DetailDocument1 pageBill DetailKaliaperumal ParamanNo ratings yet

- Inv44138 PDFDocument1 pageInv44138 PDFusmanNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- AcknowledgementDocument1 pageAcknowledgementaditya_kavangalNo ratings yet

- SC87360692006Document2 pagesSC87360692006Michael BrownNo ratings yet

- 1702Q SGC - 2nd QTR 2019 FOR EMAILDocument31 pages1702Q SGC - 2nd QTR 2019 FOR EMAILJaylou BobisNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- LESCO - Online Customer Bill PrintingDocument2 pagesLESCO - Online Customer Bill PrintingusmanNo ratings yet

- Shree Khatu - Comp - Ay - 2021-22Document4 pagesShree Khatu - Comp - Ay - 2021-22Soumya SwainNo ratings yet

- Tax Invoice: Your Bill DetailsDocument2 pagesTax Invoice: Your Bill DetailsSiqiniseko Hadebe100% (1)

- SYARIKAT SESCO BERHAD (200401034422) : Electricity InvoiceDocument1 pageSYARIKAT SESCO BERHAD (200401034422) : Electricity InvoiceNur Aminah IntanNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)muhammad kamranNo ratings yet

- TD Statement Mar To AprrDocument4 pagesTD Statement Mar To Aprrslimple Smiles100% (2)

- CombinepdfDocument5 pagesCombinepdfirwan sianturiNo ratings yet

- TD Bank Penn Motor Sales Inc Apr-MayDocument3 pagesTD Bank Penn Motor Sales Inc Apr-Mayyusuf FajarNo ratings yet

- Earnings Statement: Tamika S Jackson 373 S Canal Street APT K3 Canton, MS 39046Document1 pageEarnings Statement: Tamika S Jackson 373 S Canal Street APT K3 Canton, MS 39046tamika jacksonNo ratings yet

- Documents 0Document3 pagesDocuments 0rajindermechNo ratings yet

- Ajay Kapoor & CoDocument4 pagesAjay Kapoor & CoPratibha0% (1)

- Ace InvoiceDocument1 pageAce Invoiceagarwal.usNo ratings yet

- Parish Accounts Oh 201920Document4 pagesParish Accounts Oh 201920api-205664725No ratings yet

- Earnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590Document1 pageEarnings Statement: Zalena K Mcclenic 11 Sixth ST Westbury, Ny 11590mellishagrant11No ratings yet

- 3 Dec 2023Document1 page3 Dec 2023krishsaxena20No ratings yet

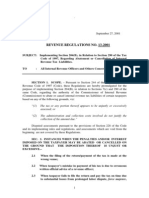

- Taxation (NIRC Sec 1-36Document11 pagesTaxation (NIRC Sec 1-36Angie Louh S. DiosoNo ratings yet

- 961028.CD FTH Brosura Pages 1 425Document5 pages961028.CD FTH Brosura Pages 1 425Luka VukicNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Milton BillDocument2 pagesMilton Billproperty bazarNo ratings yet

- INBUTAX AssignmentDocument2 pagesINBUTAX Assignmentstephensze14No ratings yet

- Other Percentage Taxes: Prof. Jeanefer Reyes CPA, MPADocument29 pagesOther Percentage Taxes: Prof. Jeanefer Reyes CPA, MPAmark anthony espirituNo ratings yet

- Indian Oil Corporation Limited: Supplier ConsigneeDocument1 pageIndian Oil Corporation Limited: Supplier ConsigneeMONTUPRONo ratings yet

- D. Jurisdiction Over Subject and ObjectsDocument2 pagesD. Jurisdiction Over Subject and Objectslorelei louiseNo ratings yet

- 64407059314019501Document82 pages64407059314019501Prabhat SharmaNo ratings yet

- Final TaxDocument33 pagesFinal TaxAlicia FelicianoNo ratings yet

- GST Module 1 Compiled PDFDocument285 pagesGST Module 1 Compiled PDFRahul DoshiNo ratings yet

- Problems On General Insurance Companies AccountsDocument4 pagesProblems On General Insurance Companies Accountsgowrirao496No ratings yet

- Acct11 1hwDocument3 pagesAcct11 1hwRonald James Siruno MonisNo ratings yet

- Commissioner and Internal Revenue, Petitioner. Fortune Tobacco Corporation, RespondentDocument3 pagesCommissioner and Internal Revenue, Petitioner. Fortune Tobacco Corporation, RespondentBeatta RamirezNo ratings yet

- Hot & Cold Assignment SolutionDocument10 pagesHot & Cold Assignment SolutionSabir AliNo ratings yet

- Lorena Kukovičić - TAXATIONDocument17 pagesLorena Kukovičić - TAXATIONlorenaNo ratings yet

- EconomicsDocument32 pagesEconomicsSahil BansalNo ratings yet

- Income Taxation Solution Manual 2019 Ed 2Document40 pagesIncome Taxation Solution Manual 2019 Ed 2Alexander DimaliposNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFAniket Ghosh0% (1)

- Tax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalDocument3 pagesTax Invoice: Product Description Qty Gross A Mount Discount Taxable V Alue Igst TotalANIL KUMARNo ratings yet

- Retainer Policy FY 22Document11 pagesRetainer Policy FY 22aanchal bansal bNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- A Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Document435 pagesA Practical Guide To GST - Adv. Sanjay Dwivedi (2017 Edition)Sanjay DwivediNo ratings yet

- Bir Form No. 2304Document2 pagesBir Form No. 2304mijareschabelita2No ratings yet

- CIR v. MirantDocument7 pagesCIR v. MirantPaul Joshua SubaNo ratings yet

- GST Invoice: Shubham Engineering Works - (2019-20)Document3 pagesGST Invoice: Shubham Engineering Works - (2019-20)vinodNo ratings yet

- Multi BillDocument4 pagesMulti BillghareebNo ratings yet

- Chapter - 5 Time & Value of SupplyDocument16 pagesChapter - 5 Time & Value of SupplyRaja BahlNo ratings yet

- Perk Valuation of Motor CarDocument18 pagesPerk Valuation of Motor CarcapkaggarwalNo ratings yet

- Suggested Answers in Taxation Law Bar Examinations 1994 2006 PDFDocument86 pagesSuggested Answers in Taxation Law Bar Examinations 1994 2006 PDFGregorio AustralNo ratings yet