Professional Documents

Culture Documents

International Financial Accounting Standards (IFRS)

Uploaded by

reetutrOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Financial Accounting Standards (IFRS)

Uploaded by

reetutrCopyright:

Available Formats

International Financial Accounting Standards ( IFRS )

On 22 January 2010, the Ministry of Corporate Affairs (MCA) issued a press release setting out

the roadmap for International Financial Reporting Standards (IFRS) convergence in India. The

roadmap requires IFRS to be made applicable in a phased manner. This is an historic step that

will elevate Indian entities and their finance and accounting professionals to much greater

heights. The publication of the roadmap was eagerly awaited by those who have been saying

that the convergence to IFRS in India is a matter of when and how” and not “if.”

Challenges faced by companies in IFRS implementation

- IFRS is itself a moving target with changes being done continually

- There are not many trained resources for IFRS

- Also IFRS training in an organization will be huge task

- Not many people are aware and have understanding of IFRS

It is better for the corporate to start as early as possible the implementation of IFRS and come

up with IFRS roadmap because Government is not looking forward to extend the date of 2011.

Ultimately the onus will be on management to comply with the requirement and the auditors

will only have to comment on whether the management has properly compiled with or not.

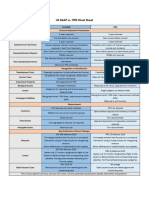

Some of the differences between IFRS & Indian GAAP are as follows :

Subject IFRS Indian GAAP

Depreciation Allocated on a systematic Depreciation is provided based on

basis to each accounting the useful lives of assets or the

period over the useful life minimum rates prescribed by the

of the asset. Indian Companies Act, whichever is

higher. Asset lives are not prescribed

by the Companies Act, but can be

derived from the depreciation rates.

Leasehold Land Disclosed as prepaid Disclosed as a part of fixed assets.

assets and accounting

treatment is similar to

operating leases.

Changes in Restate comparatives and Include effect in the income

accounting prior-year opening statement of the period in which the

policies retained earnings. change is made except as specified in

certain standards where the change

resulting from adoption of the

standard has to be adjusted against

opening retained earnings.

Fringe benefits Included as part of related Disclosed as a separate item after

tax expense (fringe benefit) profit before tax on the face of the

which gives rise to income statement.

incurrence of the tax.

Convertible debt Account for convertible Convertible debt is recognised as a

debt on split basis, liability based on legal form without

allocating proceeds any split.

between equity and debt

Functional Currency of primary Does not define functional currency.

currency economic environment in

which entity operates.

You might also like

- Afm 1Document20 pagesAfm 1antrikshaagrawalNo ratings yet

- Differences between US GAAP, Indian GAAP & IFRSDocument7 pagesDifferences between US GAAP, Indian GAAP & IFRSrajdeeppawarNo ratings yet

- Collated Comparison of Indian GAAP, US GAAP and IFRSDocument7 pagesCollated Comparison of Indian GAAP, US GAAP and IFRSfenildivyaNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- IFRS Assignment 4Document3 pagesIFRS Assignment 4Sandeep BodduNo ratings yet

- Usgaap, Igaap & IfrsDocument7 pagesUsgaap, Igaap & IfrsdhangarsachinNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- National Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPDocument10 pagesNational Exchange Actors Association (NEAA) : Difference Between IFRS & US GAAPEshetieNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- 28 Diff Bet Usgaap Igaap IfrsDocument7 pages28 Diff Bet Usgaap Igaap IfrsRohit BeniwalNo ratings yet

- IFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesDocument47 pagesIFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesEshetieNo ratings yet

- Dabur Notes To Consolidated Financial Statements PDFDocument67 pagesDabur Notes To Consolidated Financial Statements PDFRupasinghNo ratings yet

- Introduction To IFRSDocument33 pagesIntroduction To IFRSmikirichaNo ratings yet

- IFRS Study Notes-Day 2Document46 pagesIFRS Study Notes-Day 2Obisike EmeziNo ratings yet

- Shareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSDocument15 pagesShareholder Value & Global Reporting. Reconciliation of Indian GAAP Financial Statements With US/International GAAPSvdforeNo ratings yet

- Other accounting cash flows topicsDocument4 pagesOther accounting cash flows topicsDrpranav SaraswatNo ratings yet

- Us Gaap Ifrs Cash FlowsDocument4 pagesUs Gaap Ifrs Cash FlowsNawaz KhanNo ratings yet

- Overview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPDocument16 pagesOverview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPvcsekhar_caNo ratings yet

- Difference Between International Financial Reporting Standard's (IFRS's) AND Generally Accepted Accounting Principles (GAAP'S)Document3 pagesDifference Between International Financial Reporting Standard's (IFRS's) AND Generally Accepted Accounting Principles (GAAP'S)jaydeep5008No ratings yet

- U.S. GAAP vs. IFRS: Business Combinations: Prepared byDocument5 pagesU.S. GAAP vs. IFRS: Business Combinations: Prepared bygabiNo ratings yet

- IRFS Notes Part 4Document31 pagesIRFS Notes Part 4Deandre DreyerNo ratings yet

- Cuadro Comparativoestados FinancierosDocument8 pagesCuadro Comparativoestados FinancierosLaura Juliana Aponte LizarazoNo ratings yet

- Module 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesModule 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Unit - 1joint Stock Companies (Ind As) ThoryDocument5 pagesUnit - 1joint Stock Companies (Ind As) ThoryTtttNo ratings yet

- Ifrs - An Overview: International Financial Reporting StandardsDocument19 pagesIfrs - An Overview: International Financial Reporting Standardskitta880% (2)

- DIFFERENCES Between FASB and The Indonesian Conceptual FrameworkDocument17 pagesDIFFERENCES Between FASB and The Indonesian Conceptual FrameworkBella TjendriawanNo ratings yet

- SBRIFRSForSMEs TutorSlidesDocument29 pagesSBRIFRSForSMEs TutorSlidesDipesh MagratiNo ratings yet

- EY Step Up To Ind AsDocument35 pagesEY Step Up To Ind AsRakeshkargwalNo ratings yet

- Overview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPDocument16 pagesOverview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPreenuramanNo ratings yet

- 2022 K-IFRS Webina ConferenceDocument48 pages2022 K-IFRS Webina ConferenceSewon OhNo ratings yet

- Australian GAAP Vs IFRSDocument25 pagesAustralian GAAP Vs IFRSMichael ZhangNo ratings yet

- Ifrs VS Us GaapDocument1 pageIfrs VS Us GaapPratidina Aji WidodoNo ratings yet

- US GAAP Vs IFRSDocument1 pageUS GAAP Vs IFRSreg.comp2000No ratings yet

- Retained Earnings PDFDocument9 pagesRetained Earnings PDFDehradun MootNo ratings yet

- Differences between IFRS, US GAAP and Indian GAAPDocument4 pagesDifferences between IFRS, US GAAP and Indian GAAPshinesanjuNo ratings yet

- Solution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeDocument19 pagesSolution Manual For South Western Federal Taxation 2020 Corporations Partnerships Estates and Trusts 43rd Edition William A RaabeCourtneyCollinsntwex100% (40)

- Diff. Bet. U.S Gaap & Ind. GaapDocument3 pagesDiff. Bet. U.S Gaap & Ind. GaapjhonyrishabhNo ratings yet

- Joint Arrangements A New Approach To An Age-Old Business IssueDocument23 pagesJoint Arrangements A New Approach To An Age-Old Business IssuedarraNo ratings yet

- IRFS Notes Part 5Document107 pagesIRFS Notes Part 5Deandre DreyerNo ratings yet

- KEY DIFFERENCES BETWEEN IFRS AND INDIAN GAAPDocument20 pagesKEY DIFFERENCES BETWEEN IFRS AND INDIAN GAAPGaurav JainNo ratings yet

- Indonesian Conceptual Framework VS Conceptual Framework by FasbDocument6 pagesIndonesian Conceptual Framework VS Conceptual Framework by FasbBella TjendriawanNo ratings yet

- Acquisition of Subsidiaries: Relevant Guidance Acquisition MethodDocument18 pagesAcquisition of Subsidiaries: Relevant Guidance Acquisition MethodKyle MariéNo ratings yet

- Ifrs 22 Aug 09 - VC - 4Document32 pagesIfrs 22 Aug 09 - VC - 4Darshan ToreNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- Difference BTW As IFRS and INDDocument5 pagesDifference BTW As IFRS and INDrahul jambagiNo ratings yet

- Ifrs 1 First Time Adoption of Ifrss: BackgroundDocument3 pagesIfrs 1 First Time Adoption of Ifrss: Backgroundmusic niNo ratings yet

- Accounting Conventions: Understanding Key PrinciplesDocument17 pagesAccounting Conventions: Understanding Key Principlesjerrylove069No ratings yet

- Chap 13 - Income From BusinessDocument14 pagesChap 13 - Income From BusinessMuhammad Saad UmarNo ratings yet

- Gaap Ifrs Comp-432Document5 pagesGaap Ifrs Comp-432Shayla ClayNo ratings yet

- IFRS On Banking SectorDocument6 pagesIFRS On Banking SectorSiddhi MirnaalNo ratings yet

- TITLE Differences Between Ind AS and IAS/IFRSDocument2 pagesTITLE Differences Between Ind AS and IAS/IFRSaarti bhangadiyaNo ratings yet

- Business Combinations & Consolidated Financial StatementsDocument16 pagesBusiness Combinations & Consolidated Financial Statementsisaac2008100% (1)

- F7 notes 2Document4 pagesF7 notes 2Ahmed IqbalNo ratings yet

- Annual Report of IOCL 91Document1 pageAnnual Report of IOCL 91Nikunj ParmarNo ratings yet

- Business Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToDocument98 pagesBusiness Combination and Corporate Restructuring: After Studying This Chapter, You Would Be Able ToYUUSDHNo ratings yet

- IndAS 103 AmalgamationDocument98 pagesIndAS 103 AmalgamationadityaNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- Chapter 5 The Nineteenth Century Philippine Economy Society and The Chinese MestizosDocument27 pagesChapter 5 The Nineteenth Century Philippine Economy Society and The Chinese MestizosJuMakMat Mac50% (2)

- Seamless Marketo - Google Analytics Integration: Cheat SheetDocument7 pagesSeamless Marketo - Google Analytics Integration: Cheat SheetWill ChouNo ratings yet

- MY Price List With CSV SBDocument6 pagesMY Price List With CSV SBNini Syaheera Binti JasniNo ratings yet

- SALES FORECASTING TECHNIQUESDocument12 pagesSALES FORECASTING TECHNIQUESUjjwal MalhotraNo ratings yet

- User Guide Inquiry - Velocity V2 (English Version) - 090317Document10 pagesUser Guide Inquiry - Velocity V2 (English Version) - 090317herwongNo ratings yet

- HidadfrDocument55 pagesHidadfrArvind JSNo ratings yet

- Key Notes - Bankers Committee RetreatDocument3 pagesKey Notes - Bankers Committee RetreatLola OniNo ratings yet

- Budget Cycle Both LGU and National Government AgenciesDocument41 pagesBudget Cycle Both LGU and National Government AgenciesKrizzel Sandoval100% (1)

- Trademark Infringement SDocument6 pagesTrademark Infringement SJose Li ToNo ratings yet

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument18 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreAnirban Roy ChowdhuryNo ratings yet

- Data Science 101: An Introduction to Fundamentals, Use Cases, and the Data Science ProcessDocument23 pagesData Science 101: An Introduction to Fundamentals, Use Cases, and the Data Science ProcessVijay BhemalNo ratings yet

- 2023 Medical Sterilizer Promo DetailsDocument2 pages2023 Medical Sterilizer Promo DetailsVulcano JerezNo ratings yet

- BournvitaDocument39 pagesBournvitaSwapnil PandeyNo ratings yet

- Corporate Governance Models ExplainedDocument34 pagesCorporate Governance Models ExplainedAprajita Sharma0% (1)

- Integral X-500 Wall Basin Product SpecsDocument1 pageIntegral X-500 Wall Basin Product SpecsRudolfGerNo ratings yet

- Ogl 260 Module 5 Paper FubuDocument4 pagesOgl 260 Module 5 Paper Fubuapi-650422817No ratings yet

- Ces Report in BusinessDocument54 pagesCes Report in Businessnicole alcantaraNo ratings yet

- Marketing Report - J.Crew LudlowDocument9 pagesMarketing Report - J.Crew LudlowElizabethKyiNo ratings yet

- Statutory Audit ProgramDocument7 pagesStatutory Audit ProgramSuman Pyatha0% (1)

- Mode of Expression: Chabahar Port, IranDocument16 pagesMode of Expression: Chabahar Port, IranUmair MumtazNo ratings yet

- Acc Company ProfileDocument35 pagesAcc Company Profilesanyogitasawant5No ratings yet

- Rewards credit card statement detailsDocument3 pagesRewards credit card statement detailsVvNo ratings yet

- Conventional Milling Machine Into CNC MachineDocument18 pagesConventional Milling Machine Into CNC MachineEverAngelNo ratings yet

- Phonics Stage 1 PDFDocument50 pagesPhonics Stage 1 PDFMehwish Azmat83% (6)

- Measuring The Financial Effects of Mitigating Commodity Price Volatility in Supply ChainsDocument15 pagesMeasuring The Financial Effects of Mitigating Commodity Price Volatility in Supply ChainsLejandra MNo ratings yet

- Govt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDocument16 pagesGovt. of Andhra Pradesh (APTC Form - 47) : / Temporaray Head of Account DeductionsDr MaldannaNo ratings yet

- Book List PDFDocument4 pagesBook List PDFAnuragNo ratings yet

- Autocratic Leadership Style of Henry Ford 1.1. DefinitionDocument3 pagesAutocratic Leadership Style of Henry Ford 1.1. DefinitionThảo Ngọc100% (2)

- PWC Sharing Economy Report 2015 PDFDocument30 pagesPWC Sharing Economy Report 2015 PDFIván R. MinuttiNo ratings yet

- Job Description Design Engineer FresherDocument2 pagesJob Description Design Engineer Fresherpraveenraokh32No ratings yet