Professional Documents

Culture Documents

Summary

Uploaded by

ankitkharkiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary

Uploaded by

ankitkharkiaCopyright:

Available Formats

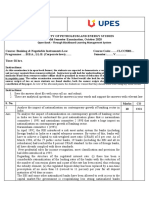

Executive Summary

For Working Capital Mangament calculations, there were formation of 2

Committees namely T andon Committee and Chore Committee. The Tandon

Committee came up with three methods of computation of working capital out of

which only the 2nd Method was accepted after the criticism by Chore Committtee.

In the following report details of the process and details of both the committees

have been discussed.

Working Capital Management

A managerial accounting strategy focusing on maintaining efficient levels of both

components of working capital, current assets and current liabilities, in respect to

each other. Working capital management ensures a company has sufficient cash

flow in order to meet its short-term debt obligations and operating expenses.

Tandon Committee

Like many other activities of the banks, method and quantum of short-term

finance that can be granted to a corporate was mandated by the Reserve Bank

of India till 1994. This control was exercised on the lines suggested by the

recommendations of a study group headed by Shri Prakash Tandon.

The study group headed by Shri Prakash Tandon, the then Chairman of

Punjab National Bank, was constituted by the RBI in July 1974 with eminent

personalities drawn from leading banks, financial institutions and a wide

cross-section of the Industry with a view to study the entire gamut of Bank's

finance for working capital and suggest ways for optimum utilisation of Bank

credit. This was the first elaborate attempt by the central bank to organise the

Bank credit. The report of this group is widely known as Tandon Committee

report. Most banks in India even today continue to look at the needs of the

corporates in the light of methodology recommended by the Group.

As per the recommendations of Tandon Committee, the corporates should be

discouraged from accumulating too much of stocks of current assets and

should move towards very lean inventories and receivable levels. The

committee even suggested the maximum levels of Raw Material, Stock-in-

process and Finished Goods which a corporate operating in an industry

should be allowed to accumulate.These levels were termed as inventory and

receivable norms. Depending on the size of credit required, the funding of

these current assets (working capital needs) of the corporates could be met by

one of the following methods:

First Method of Lending:

Banks can work out the working capital gap, i.e. total current

assets less current liabilities other than bank borrowings (called

Maximum Permissible Bank Finance or MPBF) and finance a

maximum of 75 per cent of the gap; the balance to come out of

long-term funds, i.e., owned funds and term borrowings. This

approach was considered suitable only for very small borrowers

i.e. where the requirements of credit were less than Rs.10 lacs.

Second Method of Lending:

Under this method, it was thought that the borrower should

provide for a minimum of 25% of total current assets out of long-

term funds i.e., owned funds plus term borrowings. A certain

level of credit for purchases and other current liabilities will be

available to fund the build up of current assets and the bank will

provide the balance (MPBF). Consequently, total current

liabilities inclusive of bank borrowings could not exceed 75% of

current assets. RBI stipulated that the working capital needs of

all borrowers enjoying fund based credit facilities of more than

Rs. 10 lacs should be appraised (calculated) under this method.

Third Method of Lending: Under this method, the borrower's

contribution from long term funds will be to the extent of the

entire CORE CURRENT ASSETS, which has been defined by

the Study Group as representing the absolute minimum level of

raw materials, process stock, finished goods and stores which are

in the pipeline to ensure continuity of production and a minimum

of 25% of the balance current assets should be financed out of

the long term funds plus term borrowings.

(This method was not accepted for implementation and hence is

of only academic interest).

You might also like

- Methods of LendingDocument1 pageMethods of LendingankitkharkiaNo ratings yet

- Methods of Short-Term LendingDocument2 pagesMethods of Short-Term LendingPradeep ShawNo ratings yet

- Methods of LendingDocument2 pagesMethods of Lendingmuditagarwal72No ratings yet

- Y First Method of LendingDocument2 pagesY First Method of LendingNisha MozaNo ratings yet

- MPBFDocument6 pagesMPBFhiteshgauranaNo ratings yet

- Methods of Lending Tandon CommiteeDocument2 pagesMethods of Lending Tandon CommiteeKinjal ThakkarNo ratings yet

- Methods of Lending - Tandon CommitteDocument2 pagesMethods of Lending - Tandon CommitteGeetika TharejaNo ratings yet

- Methods of LendingDocument2 pagesMethods of LendingilovesomeoneNo ratings yet

- Tandon Committe & Tarapore Committee SuggestionDocument6 pagesTandon Committe & Tarapore Committee SuggestionAmar SinhaNo ratings yet

- Tandon Committee's recommendations for bank lending normsDocument17 pagesTandon Committee's recommendations for bank lending normsGayathri TNo ratings yet

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaNo ratings yet

- Tandon Committee Recommendations on Corporate Working Capital NormsDocument2 pagesTandon Committee Recommendations on Corporate Working Capital NormsAnkita SharmaNo ratings yet

- Tandon & Chore CommitteeDocument2 pagesTandon & Chore CommitteeCfhunSaatNo ratings yet

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalPranav BhattNo ratings yet

- MPBFDocument3 pagesMPBFfriendshp_rockzNo ratings yet

- Maximum Permissible BankingDocument4 pagesMaximum Permissible BankingPrashant AroraNo ratings yet

- Abhi Tandon CommiteeDocument1 pageAbhi Tandon CommiteeAbhishek KumarNo ratings yet

- Tandon Committee Recommendations on Bank Credit NormsDocument6 pagesTandon Committee Recommendations on Bank Credit NormsSakthi Priyadharshini MNo ratings yet

- Teaching Note - Group 4Document20 pagesTeaching Note - Group 4SHASHANK JAINNo ratings yet

- Methods of LendingDocument4 pagesMethods of LendingGaurav GuptaNo ratings yet

- 10 - Chapter 4 PDFDocument17 pages10 - Chapter 4 PDFkartheek1989No ratings yet

- Credit Monitoring ArrangementDocument15 pagesCredit Monitoring ArrangementAbhi_IMK100% (1)

- Tandon Committee's Working Capital NormsDocument20 pagesTandon Committee's Working Capital NormsPrashant SharmaNo ratings yet

- Financing Working Capital by Banks: 6 Committees: 1. Dehejia Committee ReportDocument5 pagesFinancing Working Capital by Banks: 6 Committees: 1. Dehejia Committee ReportMurali DharanNo ratings yet

- Working Capital Finance GuidelinesDocument2 pagesWorking Capital Finance GuidelinesOngwang KonyakNo ratings yet

- INSTITUTE OF MANAGEMENT STUDIES, DAVV, INDORE CREDIT MANAGEMENT AND RETAIL BANKINGDocument4 pagesINSTITUTE OF MANAGEMENT STUDIES, DAVV, INDORE CREDIT MANAGEMENT AND RETAIL BANKINGSNo ratings yet

- Working Capital Assessment: by Prof. Divya GuptaDocument13 pagesWorking Capital Assessment: by Prof. Divya GuptaArun SinghNo ratings yet

- Working capital requirements and assessment methodsDocument100 pagesWorking capital requirements and assessment methodsperkin kothariNo ratings yet

- RBI's Credit Monitoring Arrangement and Tandon Committee recommendationsDocument4 pagesRBI's Credit Monitoring Arrangement and Tandon Committee recommendationsAbhi_IMK100% (1)

- Tandon Committee On Follow-Up of Bank CreditDocument1 pageTandon Committee On Follow-Up of Bank CreditFaiz KhanNo ratings yet

- CAF Individual Assignment - Vedantam Gupta - 20152095Document4 pagesCAF Individual Assignment - Vedantam Gupta - 20152095Vedantam GuptaNo ratings yet

- Impact of nationalisation on Indian banking sectorDocument4 pagesImpact of nationalisation on Indian banking sectorAryan DevNo ratings yet

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- Working Capital Finance-Recommendations of Various Committees.Document33 pagesWorking Capital Finance-Recommendations of Various Committees.Ranaque JahanNo ratings yet

- SFM AssignmentDocument6 pagesSFM Assignmentjohn doeNo ratings yet

- Credit Appraisla and Analysis ReportDocument7 pagesCredit Appraisla and Analysis ReportharryNo ratings yet

- Tandon Committee PresentationDocument13 pagesTandon Committee PresentationNitharshini Kannan0% (1)

- Chapter 12 - Business Financing Including Venture Capital FDocument28 pagesChapter 12 - Business Financing Including Venture Capital FjtpmlNo ratings yet

- WCM PSBDocument41 pagesWCM PSBVISHAKHA BHALERAONo ratings yet

- New Trends in Financing Working Capital by BanksDocument9 pagesNew Trends in Financing Working Capital by BanksAparna Karuvallil100% (1)

- Corporate Banking: 11/04/21 Om All Rights Reserved. 1Document180 pagesCorporate Banking: 11/04/21 Om All Rights Reserved. 1Pravah ShuklaNo ratings yet

- Working Capital RequirementDocument6 pagesWorking Capital RequirementChaitanya PandayNo ratings yet

- Autoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirDocument2 pagesAutoparts India Pvt. LTD, Standalone. With An Aim To Learn How Wonjin Manage TheirVimal MorkelNo ratings yet

- Chapter-Iii Review of LiteratureDocument41 pagesChapter-Iii Review of LiteratureAnonymous FUvuOyuTNo ratings yet

- Commercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanyDocument32 pagesCommercial Banking Management: Working Capital Requirement and Financing For Manufacturing CompanySHASHANK JAINNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementSulthan AlaudeenNo ratings yet

- Fund based working capital assessment with MPBF methodDocument28 pagesFund based working capital assessment with MPBF methodAbinash BiswalNo ratings yet

- Short Term LoansDocument4 pagesShort Term LoansHarsh MehtaNo ratings yet

- Asset Liability Management HDFC SynopsisDocument12 pagesAsset Liability Management HDFC Synopsismramu1715No ratings yet

- A Project Report HDFC BANKDocument48 pagesA Project Report HDFC BANKVikas SinghNo ratings yet

- HDFC Bank CAMELS Analysis and DuPont ModelDocument31 pagesHDFC Bank CAMELS Analysis and DuPont Modelasifbhaiyat33% (3)

- Corporate Debt RestructuringDocument5 pagesCorporate Debt RestructuringKumar AbhishekNo ratings yet

- Corporate Debt Restructuring: Presented By: Jasnidhi Kaur Ankit Jain Nupur PalDocument27 pagesCorporate Debt Restructuring: Presented By: Jasnidhi Kaur Ankit Jain Nupur PaljassifussiNo ratings yet

- GarnisheeDocument4 pagesGarnisheeShivangi SharmaNo ratings yet

- MBA Semester-4 MF0007 - Treasury Management Assignment Set-2Document3 pagesMBA Semester-4 MF0007 - Treasury Management Assignment Set-2jaswantmauryaNo ratings yet

- Research Paper On Npa ManagementDocument8 pagesResearch Paper On Npa Managementd1fytyt1man3100% (1)

- Strengthening Partnerships: Accountability Mechanism Annual Report 2014From EverandStrengthening Partnerships: Accountability Mechanism Annual Report 2014No ratings yet

- SummaryDocument3 pagesSummaryankitkharkiaNo ratings yet

- Long CondorDocument4 pagesLong CondorankitkharkiaNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsankitkharkiaNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsankitkharkiaNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsankitkharkiaNo ratings yet

- 0 Par Value 1000 1 Coupon 8% 2 Years To Maturity 3 3 Payment Frequency 2 4 Value of Bond 961.63 5 6Document2 pages0 Par Value 1000 1 Coupon 8% 2 Years To Maturity 3 3 Payment Frequency 2 4 Value of Bond 961.63 5 6ankitkharkiaNo ratings yet

- Bahar E Shariat EngDocument85 pagesBahar E Shariat EngSajid YusufNo ratings yet

- s100t ManualDocument225 pagess100t ManualtuanNo ratings yet

- Naib Tehsildar Previous Year Paper VINOD PUBLICATIONS PDFDocument8 pagesNaib Tehsildar Previous Year Paper VINOD PUBLICATIONS PDFShahnawaz Mustafa100% (1)

- Solutions For RefugeesDocument24 pagesSolutions For RefugeesjacquelineNo ratings yet

- Analyzing The Firm's Cash FlowDocument12 pagesAnalyzing The Firm's Cash FlowJohn Joseph CambaNo ratings yet

- Fulgado v. Court of AppealsDocument8 pagesFulgado v. Court of AppealsSei KawamotoNo ratings yet

- Lesson 30 Capitalism Vs SocialismDocument3 pagesLesson 30 Capitalism Vs Socialismjessicaraealt100% (1)

- Crime & Punishment Essay #3Document1 pageCrime & Punishment Essay #3SarahJMWNo ratings yet

- Cargill Philippines Inc. vs. Fernando Regala Trading Inc., GR 175404, Jan. 31 2011Document15 pagesCargill Philippines Inc. vs. Fernando Regala Trading Inc., GR 175404, Jan. 31 2011Christian AbenirNo ratings yet

- Aud Red SirugDocument12 pagesAud Red SirugRisaline CuaresmaNo ratings yet

- Triple Canopy Base InfoDocument5 pagesTriple Canopy Base InfojmusseryNo ratings yet

- BGB Unit 40 & 50Document7 pagesBGB Unit 40 & 50Julia LonerNo ratings yet

- Stresses Faced by WomenDocument3 pagesStresses Faced by WomenIOSRjournalNo ratings yet

- Perpetual vs. Periodic Inventory System Journal EntriesDocument12 pagesPerpetual vs. Periodic Inventory System Journal EntriesMutia SefriliaNo ratings yet

- Sannyasi and Fakir RebellionDocument17 pagesSannyasi and Fakir RebellionNityapriyaSrivastavaNo ratings yet

- Factura GuatemalaDocument1 pageFactura Guatemalazt3venNo ratings yet

- ANSYS Polyflow Tutorial GuideDocument416 pagesANSYS Polyflow Tutorial Guidewoongs73No ratings yet

- Nixon v Fitzgerald 1982 Supreme Court dissent favors qualified immunityDocument2 pagesNixon v Fitzgerald 1982 Supreme Court dissent favors qualified immunityNamu BwakaNo ratings yet

- Deloitte Title VII ViolationsDocument71 pagesDeloitte Title VII ViolationsDeloitte LawsuitNo ratings yet

- 14-5633 7100-10a6-GDocument23 pages14-5633 7100-10a6-GHabib AliNo ratings yet

- Goquiolay vs. Sycip - Real CaseDocument43 pagesGoquiolay vs. Sycip - Real CaseLeizl A. VillapandoNo ratings yet

- و البترولDocument50 pagesو البترولnimmodragomelo123No ratings yet

- Pakistan Donor ProfileDocument47 pagesPakistan Donor ProfileAtif Ahmad KhanNo ratings yet

- Rizal's Ideals Inspire NationalismDocument3 pagesRizal's Ideals Inspire Nationalismkarinaprisylla100% (1)

- Summer Internship ReportDocument47 pagesSummer Internship ReportBijal Mehta43% (7)

- United States v. Markeith Hart, 4th Cir. (2015)Document4 pagesUnited States v. Markeith Hart, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- The History of The Treman, Tremaine, Truman Family in AmericaDocument1,324 pagesThe History of The Treman, Tremaine, Truman Family in AmericaJakob AyresNo ratings yet

- Gen. Form No. 2 Expense Receipt TemplateDocument1 pageGen. Form No. 2 Expense Receipt TemplateYnnejesor ArugesNo ratings yet

- Calamba Medical Center VS NLRCDocument4 pagesCalamba Medical Center VS NLRCLucky P. RiveraNo ratings yet

- Property Management ManualDocument44 pagesProperty Management ManualChosnyid UmmaNo ratings yet