Professional Documents

Culture Documents

DEL L&T Infrastructure Bond

Uploaded by

poly899Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DEL L&T Infrastructure Bond

Uploaded by

poly899Copyright:

Available Formats

Bond Review

October 12, 2010

Rating matrix L&T Infrastructure Finance Company Ltd

Rating : CARE AA+ by CARE

LAA+ by ICRA Long Term Infrastructure Bond 2010A Series

Instruments with rating of ‘CARE AA+’ by CARE are considered to

offer high safety for timely servicing of debt obligations. Such Bonds with tax benefits…

instruments carry very low credit risk. Instruments with a rating of

‘LAA+’ by ICRA indicate high credit quality and the rated

The L&T Infrastructure Finance Company Limited bonds are classified as

instruments carry low credit risk. “long term infrastructure bonds”. They are being issued in terms of

Issue Details Section 80CCF of the Income Tax Act wherein the amount to the extent

of Rs 20,000 per annum, paid or deposited as subscription to the bonds,

Issue opens October 15, 2010

shall be deducted in computing the taxable income of a resident

Issue closes November 2, 2010

individual or HUF. Therefore, an investment of Rs 20,000 in these bonds

Issue size (Rs crore) Rs 200 crores with an option to could save tax of Rs 6,180 in FY11 (assuming a marginal tax rate @

retain an oversubscription of up to 30.9%), implying a net investment of only Rs 13,820. Effective yield after

Rs 500 crores.

Tax adjustment to the investors, therefore, can be as high as: 17.2% for

Face Value Rs 1,000 /- per bond marginal tax rate @ 30.9%, 13.4% for marginal tax rate @ 20.6%, 10.2%

Minimum Application 5 bonds for marginal tax rate @ 10.3%.

Maturity / redemption 10 years * Issue details

Lock In period 5 years * The company plans to raise Rs 200 crores with an option to retain any

Buy Back Option At the end of 5 years and 7 years oversubscription of up to Rs 500 crores. The bonds have a face value of

from the date of allotment Rs 1,000 with 10 years maturity. There is a lock-in period of five years

Listing NSE

from the date of allotment. There is a buyback option after seven years

under Series 1 and Series 2 and after five years under Series 3 and Series

* From the date of allotment 4. Minimum subscription per application is five bonds. The bonds will be

listed on the National Stock Exchange (NSE). However, trading of the

Objects of the Issue

The funds raised through this issue will be utilised towards

bonds on the NSE can take place only after the expiry of the lock-in

“infrastructure lending” as defined by the RBI in the regulations period. Investors also have an option to hold the bonds in physical form.

issued by it from time to time, after meeting the expenditures of, and Interest paid will be taxable in the hands of the investor.

related to, the Issue. Exhibit 1: Interest rates under different series

Series 1 2 3 4

Face Value Rs.1000 Rs.1000 Rs.1000 Rs.1000

Interest payment Annual Cumulative Annual Cumulative

Interest Rate 7.75% 7.75% 7.50% 7.50%

Time to Maturity 10 Years 10 Years 10 Years 10 Years

Buyback Facility Yes Yes Yes Yes

Time To Buy Back 7 Years 7 Years 5 Years 5 Years

Fact sheet Source: Prospectus – L&T Infrastructure Finance ltd., ICICIdirect.com Research *under the cumulative option

Pre-Issue (as on Post-Issue interest will be compounded annually

June 2010) (Rs Cr.)

(Rs Cr.) Conclusion

Total Debt 3400 4100 To encourage investment into the infrastructure sector, a tax deduction

for investment up to Rs 20,000 p.a. in long-term infrastructure bonds by

Share holders Fund 1062 1062

individuals was introduced under Section 80CCF in the Finance Bill 2010.

Debt to Equity 3.20 3.86** This is in addition to the deduction of Rs 1 lakh p.a. available under

** assuming subscription of Rs 700 Cr. from the proposed Section 80C. The bond therefore offers an additional option to save tax.

Issue in the secured debt category as on June 30, 2010. The Tax benefit also increases the effective rate of returns on the bond.

actual debt-equity ratio post the Issue would depend on the

actual position of debt and equity on the Date of Allotment.

Exhibit 2: Effective yield with tax benefits u/s 80CCF assuming Rs 20000 is invested in bonds

Financial data Tax Rates (%) Effective Investment* Series 1 (%) Series 2 (%) Series 3 (%) Series 4 (%)

Total Assets (31st March 2010) Rs 4249Cr. Effective Yield on Maturity (with Tax Benefit)

GNPA (31st March 2010) Rs 79 Cr. 30.9 13820 13.58 11.81 13.25 11.55

st 20.6 15880 11.29 10.26 11.00 10.01

NNPA (31 March 2010) Rs 71 Cr.

10.3 17940 9.38 8.93 9.11 8.67

Equity capital Rs 683 Cr.

Effective Yield on Buy Back (with Tax Benefit)

Face value (Equity Shares) Rs 10 30.9 13820 15.23 13.59 17.20 15.75

20.6 15880 12.31 11.36 13.42 12.58

Analyst’s name 10.3 17940 9.86 9.44 10.23 9.86

Sachin Jain

sachin.ja@icicisecurities.com

Source: ICICIdirect.com Research *Effective Investment = Rs. 20000*(1- Tax rate)

Sheetal Ashar

sheetal.ashar@icicisecurities.com

ICICIdirect.com | Equity Research

Company Background

L&T Infrastructure Finance Company Limited (LTIFCL) is a wholly owned

subsidiary of L&T Finance Holdings Ltd., which is a wholly owned

subsidiary of Larsen and Toubro Limited. LTIFCL is a systemically

important non deposit taking NBFC and classified as an Infrastructure

Finance Company (IFC), focused on financing of infrastructure projects

covering the power, roads, telecommunications, oil & gas and ports

sectors in India. LTIFCL provides infrastructure financing solutions

through a mix of debt, sub–debt, quasi-equity and equity participation. It

also offers project advisory and loan syndication services.

Company financials

In FY10, total assets of LTIFCL grew by 77% and stood at Rs 4,249 crores

as on March 31, 2010 from Rs 2,397 crores as on March 31, 2009.

The company achieved a growth rate of 88% in its loans and advances to

Rs 4,255 crores while Net Interest Income grew 57% to Rs 199 crores

during the same period. Net Interest Margin stood at 4.7% in FY10, which

we believe, will come under slight pressure with rising rates, going

forward. However, infrastructure status should help guard against a sharp

rise in cost of funds.

In FY10, the company has achieved a PAT growth of 46%. LTIFCL has

delivered a RoA of 3.28% and RoE of 13.5% in FY10. The same is

expected to improve. Leverage continues to be low at 4.2x as on March

31, 2010 providing cushion to future growth. Net non performing assets

(NNPA) stood at 1.66%.

The net worth of the company stood at Rs. 1,013 crores as on March 31,

2010.

Exhibit 3: Financial summary

Year to March FY10 FY09

Disbursements (Rs. Crore) 3796 1424

Loans (Rs. Crore) 4288 2266

Net Interest Income (Rs. Crore) 199 127

NIM (%) 4.7 5.4

Net Profit ( Rs. Crore) 111 77

GNPA (%) 1.8 0.0

NNPA (%) 1.7 0.0

RoNA (%) 3.3 3.5

RoE (%) 13.5 13.0

Source: Company, ICICIdirect.com Research

Key Risk and Concerns relating to the Bonds

§ In India, the corporate bond market is not developed and liquidity

of the bonds on the exchange after the stipulated lock in period

remains a concern. However, buy back option provides investors

an option to redeem the bonds at end of 7 years under Series 1 &

Series 2 and at end of 5 years under Series 3 and Series 4.

§ Fixed income instruments always carry interest rate risk. Increase

in market interest rates will have a negative impact on the price of

the bonds.

§ Any adverse development in future may affect the credit rating of

the bond thereby having negative impact on price of the bonds.

ICICIdirect.com | Equity Research

Page 2

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

7th Floor, Akruti Centre Point,

MIDC Main Road, Marol Naka

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

Disclaimer

The report and information contained herein is strictly confidential and meant solely for the

selected recipient and may not be altered in any way, transmitted to, copied or distributed,

in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities Ltd (I-Sec). The author of the report does not hold

any investment in any of the companies mentioned in this report. I-Sec may be holding a

small number of shares/position in the above-referred companies as on date of release of

this report. This report is based on information obtained from public sources and sources

believed to be reliable, but no independent verification has been made nor is its accuracy

or completeness guaranteed. This report and information herein is solely for informational

purpose and may not be used or considered as an offer document or solicitation of offer to

buy or sell or subscribe for securities or other financial instruments. Nothing in this report

constitutes investment, legal, accounting and tax advice or a representation that any

investment or strategy is suitable or appropriate to your specific circumstances. The

securities discussed and opinions expressed in this report may not be suitable for all

investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This report may not be taken

in substitution for the exercise of independent judgment by any recipient. The recipient

should independently evaluate the investment risks. I-Sec and affiliates accept no liabilities

for any loss or damage of any kind arising out of the use of this report. Past performance is

not necessarily a guide to future performance. Actual results may differ materially from

those set forth in projections. I-Sec may have issued other reports that are inconsistent with

and reach different conclusion from the information presented in this report. This report is

not directed or intended for distribution to, or use by, any person or entity who is a citizen

or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which

would subject I-Sec and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this

document may come are required to inform themselves of and to observe such restriction.

ICICIdirect.com | Equity Research

Page 3

You might also like

- IDFCInfra BondDocument2 pagesIDFCInfra BondKrishna GsNo ratings yet

- Press Release: L&T Infrastructure Finance Company LimitedDocument4 pagesPress Release: L&T Infrastructure Finance Company Limitedjignesh_vaderaNo ratings yet

- Idfc Long Term Infrastructure BondsDocument2 pagesIdfc Long Term Infrastructure Bondsnaav_adnaavNo ratings yet

- LT Infrastructure Final Product NoteDocument1 pageLT Infrastructure Final Product NoteChandra Mohan SNo ratings yet

- IDFC BondDocument3 pagesIDFC BondKeisham BabitaNo ratings yet

- L&T Infrastructure Bonds 2011B SeriesDocument2 pagesL&T Infrastructure Bonds 2011B Seriespriya thackerNo ratings yet

- IDFC Bond FAQsDocument6 pagesIDFC Bond FAQsNatarajan AgoramNo ratings yet

- The IssueDocument8 pagesThe IssuessfinservNo ratings yet

- India Infrastructure Finance Company LTDDocument4 pagesIndia Infrastructure Finance Company LTDDinesh SenNo ratings yet

- Sovereign Gold Bond: August 2020Document7 pagesSovereign Gold Bond: August 2020Chintan SardaNo ratings yet

- FM AssignmentDocument5 pagesFM Assignmentrising dragonNo ratings yet

- Ifci Infrastructure BondsDocument5 pagesIfci Infrastructure BondsAnirudh SharmaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- About The Fund: High Quality Defined Maturity Exchange TradedDocument2 pagesAbout The Fund: High Quality Defined Maturity Exchange TradedJayaprakash MuthuvatNo ratings yet

- PortfolioDocument11 pagesPortfolioHARSHBHATTERNo ratings yet

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- Case Study - RamDocument5 pagesCase Study - RamswathyNo ratings yet

- CDs offer higher rates than savings for fixed-term depositsDocument11 pagesCDs offer higher rates than savings for fixed-term depositsyadavgunwalNo ratings yet

- Various Savings Instruments Issued by NBFCDocument2 pagesVarious Savings Instruments Issued by NBFCAbhishek JhaveriNo ratings yet

- Assignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingDocument4 pagesAssignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingAditi RawatNo ratings yet

- Srei Infrastructure Infrastructure Finance Limited Term SheetDocument3 pagesSrei Infrastructure Infrastructure Finance Limited Term Sheetamanjeet singhNo ratings yet

- Created by L&DDocument37 pagesCreated by L&Dharshita khadayteNo ratings yet

- Maximizing Firm Value Through Optimal Financing DecisionsDocument16 pagesMaximizing Firm Value Through Optimal Financing DecisionsTanmay AroraNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- 76920bos61942 1Document8 pages76920bos61942 1bhatjanardhan2000No ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- 04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services LimitedDocument3 pages04-Jan-2019 25-Jan-2019: Mahindra & Mahindra Financial Services Limitedkishore13No ratings yet

- National Saving CenterDocument4 pagesNational Saving CenterMariyam TajamalNo ratings yet

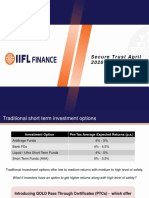

- Secure Trust April 2020 - PTC Series ADocument17 pagesSecure Trust April 2020 - PTC Series ARohan RautelaNo ratings yet

- CF-Cost of CapitalDocument3 pagesCF-Cost of CapitalNoor PervezNo ratings yet

- Principles of Financial Management Practice Qs (1)Document4 pagesPrinciples of Financial Management Practice Qs (1)22UG1-0372 WICKRAMAARACHCHI W.A.S.M.No ratings yet

- Mutual Fund Vs Corporate Fixed DepositeDocument8 pagesMutual Fund Vs Corporate Fixed Depositeabhijitsamanta1No ratings yet

- ICICI Lifelong Income Policy BenefitsDocument1 pageICICI Lifelong Income Policy BenefitsMayur NagdiveNo ratings yet

- Paper - 2: Strategic Financial Management Questions Sensitivity AnalysisDocument27 pagesPaper - 2: Strategic Financial Management Questions Sensitivity AnalysisRaul KarkyNo ratings yet

- Project 7 & 8-1Document21 pagesProject 7 & 8-1pn1285219No ratings yet

- Debentures 2024 SPCCDocument53 pagesDebentures 2024 SPCCdollpees01No ratings yet

- Loan Against Property for IndividualsDocument2 pagesLoan Against Property for IndividualsRohith RaoNo ratings yet

- KFD New07112023153153412 E28Document5 pagesKFD New07112023153153412 E28Mayur NagdiveNo ratings yet

- Venugopal Dhoot ProposalDocument4 pagesVenugopal Dhoot ProposalCNBCTV18 DigitalNo ratings yet

- Tax Planning With Reference To Managerial DecisionsDocument22 pagesTax Planning With Reference To Managerial DecisionsdharuvNo ratings yet

- Advance Financial Management AnswerDocument26 pagesAdvance Financial Management AnswerRavi Kumar RaiNo ratings yet

- Time Value of MoneyDocument54 pagesTime Value of MoneyNeetu Kumari 1 8 3 1 8No ratings yet

- Pinnacle Brochure 21oct09Document8 pagesPinnacle Brochure 21oct09neha-bothra-1107No ratings yet

- Practice SheetDocument2 pagesPractice Sheetishapnil 63No ratings yet

- BORROWING COST CALCULATIONSDocument4 pagesBORROWING COST CALCULATIONSKiran Kumar KBNo ratings yet

- Problems of Capital BudgetingDocument4 pagesProblems of Capital Budgetingm agarwalNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- TVMDocument3 pagesTVMswapnil6121986No ratings yet

- FinDocument47 pagesFinRayhanNo ratings yet

- Session 1 Handout ExDocument2 pagesSession 1 Handout ExasimmishraNo ratings yet

- Project 1Document43 pagesProject 1gowtham114411No ratings yet

- Edelweiss Tokio Life POS Saral Nivesh Plan SummaryDocument2 pagesEdelweiss Tokio Life POS Saral Nivesh Plan SummaryabilashvincentNo ratings yet

- IDFC Tax-Saving Bonds-VRK100-15102010Document4 pagesIDFC Tax-Saving Bonds-VRK100-15102010RamaKrishna Vadlamudi, CFANo ratings yet

- Project A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Document11 pagesProject A Project B Project C Project D Expected NPV (RS.) 60,000 80,000 70,000 90,000 Standard Deviation (RS.) 4,000 10,000 12,000 14,000Hari BabuNo ratings yet

- Exam Roll No. Financial Management ExamDocument2 pagesExam Roll No. Financial Management ExamRíshãbh JåíñNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- IPru Easy Retirement Leaflet PDFDocument6 pagesIPru Easy Retirement Leaflet PDFRameshNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet