Professional Documents

Culture Documents

CF-Cost of Capital

Uploaded by

Noor PervezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CF-Cost of Capital

Uploaded by

Noor PervezCopyright:

Available Formats

Corporate Finance

Cost of Capital

Q.1:The capital structure of Rock Ltd.as at 1st January, 2015 is as follows:

Rs.in million

Issue ordinary shares (Rs.50 shares) 500

6% debentures 700

11% bank term loan 500

The ordinary shares have a current market price of Rs.200 each. The dividend for 2014 has just been paid.

Dividend per share in the five preceding years was as follows:

Year Dividend

2010 Rs.6.8

2011 Rs.7.2

2012 Rs.8.8

2013 Rs.9.6

2014 Rs.10.4

Dividends are paid once a year and are expected to grow in future at the same annual rate as they have

since 2010.The preferred stock has a market price of Rs.90.Redemption will be at par in four years time.

The company pays corporation tax at a rate of 30%.

Required:

Estimate the cost of capital of Rock Ltd.

Q.2: The summarized statement of financial position of D Ltd.at June 30, 2009 was as follows:

Assets Rs. ‘000’

Noncurrent assets 15,350

Current assets 5,900

Total assets 21,250

Equity and liabilities

Ordinary shares (Rs.10) 2,000

7% Preference shares (Rs.10) 1,000

Share premium 1,100

Retained earnings 6,550

Total equity 10,650

Long term liabilities: 5% debentures 8,000

Current liabilities 2,600

Total equity & liabilities 21,250

The current price of the ordinary shares is Rs.54 ex-dividend. The dividend of Rs.4 is payable during the

next few days. The expected rate of the dividend is 9% per annum. The current price of the preference

shares is Rs.7.7 and the dividend has recently been paid. The debenture interest has also been paid

recently and the debentures are currently trading at Rs.80 per Rs.100 nominal. Corporate tax is at the rate

of 30%.

Required:

Calculate the entity’s WACC, using the respective market values as weighting factors.

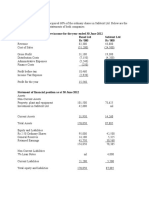

Q.3: ThefollowingfigureshavebeenextractedfromthemostrecentaccountsofCrescentLtd.:

StatementofFinancialPosi

tionason31stDecember20

11

Assets Rs.’000’ Liabilitiesandowner’sequity Rs.’000’

Currentassets 6,850 Currentliabilities 3,500

Investments 1,650 7%TFCs 6,600

Fixedassets 20,500 10,100

Shareholders’equity:

600,000

ordinaryshares(Rs.10 6,000

Retainedearnings 12,900

18,900

Total 29,000 Total 29,000

Summary of five (05)yearsprofitsanddividendsfortheyearended31stDecember:

Rs.’000’

2007 2008 2009 2010 2011

Profit afterinterest 3,582 4,308 4,000 3,846 4,492

Less 35%tax 1,254 1,508 1,400 1,346 1,572

Profit aftertax 2,328 2,800 2,600 2,500 2,920

Lessdividends 1,240 1,360 1,480 1,480 1,620

Addedtoretainedearnings 1,088 1,440 1,120 1,020 1,300

The current (1st January 2012) market value of Crescent Ltd.’s ordinary

share(cumdividend) is Rs.32.70 per share. An annual dividend of Rs.1,620,000 is

due forpaymentshortly. The 7% TFCs are redeemable at par at maturity after ten

years.

Theircurrentmarketvalueis75%ofrecordedvalue.Annualinteresthasjustbeenpaidont

heTFCs.There have been no issues or redemptions of ordinary shares and

debentures duringthepast fiveyears.

Required:

Calculate the WACC (weighted average cost of capital) for appraising

newinvestmentopportunitiesassumingnochangeinthetaxrateduringthelastfiveyears.

You might also like

- Rohit TestDocument9 pagesRohit TestRohitNo ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- 2 Finalnew Suggans Nov09Document16 pages2 Finalnew Suggans Nov09spchheda4996No ratings yet

- Adhish Sir'S Classes 1: Chapter - Cost of CapitalDocument8 pagesAdhish Sir'S Classes 1: Chapter - Cost of CapitaladhishcaNo ratings yet

- Unit 3 - CostOFCapital (LN.... )Document7 pagesUnit 3 - CostOFCapital (LN.... )mis gunNo ratings yet

- 1 Key Definitions 2 GAAP For Financial Instruments 3 IFRS 9: Recognition and Measurement 4 Objective Based Questions and AnswersDocument24 pages1 Key Definitions 2 GAAP For Financial Instruments 3 IFRS 9: Recognition and Measurement 4 Objective Based Questions and AnswersZahidNo ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BDocument15 pages7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraNo ratings yet

- Shareholder Value SumsDocument4 pagesShareholder Value Sumssimran.bhambri4No ratings yet

- Maximizing Firm Value Through Optimal Financing DecisionsDocument16 pagesMaximizing Firm Value Through Optimal Financing DecisionsTanmay AroraNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- Subject: Financial Management: Faculty: Dr. Sitangshu KhatuaDocument4 pagesSubject: Financial Management: Faculty: Dr. Sitangshu KhatuaMittal Kirti MukeshNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Unit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Document4 pagesUnit 4 - Mutual Fund and Bond Valuatio - Mutual Fund Problem 1: Rs. (In Lakhs)Paulomi LahaNo ratings yet

- WACC Handout #1: 8 Examples Calculating Weighted Average Cost of CapitalDocument5 pagesWACC Handout #1: 8 Examples Calculating Weighted Average Cost of CapitalMUHAMMAD SHAFINo ratings yet

- Ca Inter May 2023 ImpDocument23 pagesCa Inter May 2023 ImpAlok TiwariNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- Wa0035.Document5 pagesWa0035.Barack MikeNo ratings yet

- WACC puOgaACHywDocument3 pagesWACC puOgaACHywAravNo ratings yet

- Practice Problems On Long Term Financing and Cost of CapitalDocument8 pagesPractice Problems On Long Term Financing and Cost of CapitalDhairya ShahNo ratings yet

- Cost of Capital - PracticalDocument9 pagesCost of Capital - PracticalKhushi RaniNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Cost of Capital QuestionsDocument4 pagesCost of Capital QuestionsNDIFREKE UFOTNo ratings yet

- 01 s601 SFM - 2 PDFDocument4 pages01 s601 SFM - 2 PDFMuhammad Zahid FaridNo ratings yet

- Ak 2Document12 pagesAk 2nikenapNo ratings yet

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- IFRS Financial Reporting and Asset ImpairmentDocument10 pagesIFRS Financial Reporting and Asset ImpairmentNitin ChoudharyNo ratings yet

- KL Business Finance Nov Dec 2013Document2 pagesKL Business Finance Nov Dec 2013Towhidul IslamNo ratings yet

- FMC 2019Document3 pagesFMC 2019Shweta ShrivastavaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- Chapter 5 NumericalDocument4 pagesChapter 5 Numericalkapil DevkotaNo ratings yet

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet

- Corporate Financial ManagementDocument3 pagesCorporate Financial ManagementRamu KhandaleNo ratings yet

- Unilever Nepal's Financial Health CheckDocument4 pagesUnilever Nepal's Financial Health CheckKusum GopalNo ratings yet

- Mock Test - 2023Document3 pagesMock Test - 2023Phuoc TruongNo ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument115 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- BFD Merged Q Tahapopatia +923453086312Document96 pagesBFD Merged Q Tahapopatia +923453086312Abdul BasitNo ratings yet

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Cost of debtDocument2 pagesCost of debtbekalgagan29No ratings yet

- Cash and Credit ManagementDocument11 pagesCash and Credit Managementaoishic2025No ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Financial Management Project AnalysisDocument10 pagesFinancial Management Project AnalysisAlisha Shaw0% (1)

- ADVANCED ACCOUNTING 2BDocument4 pagesADVANCED ACCOUNTING 2BHarusiNo ratings yet

- COA Unit 4 Amalgamation ProblemsDocument7 pagesCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- ADVANCED ACCOUNTING 2DDocument5 pagesADVANCED ACCOUNTING 2DHarusiNo ratings yet

- Cfap 4 BFD Winter 2017Document4 pagesCfap 4 BFD Winter 2017Tanveer RazaNo ratings yet

- Week 02 Data Organizatiion and PresentaionDocument51 pagesWeek 02 Data Organizatiion and PresentaionNoor PervezNo ratings yet

- Lecture1 A Business StatisticsDocument15 pagesLecture1 A Business StatisticsNoor PervezNo ratings yet

- Lec 1 Nature of Managerial CommunicationDocument51 pagesLec 1 Nature of Managerial CommunicationNoor PervezNo ratings yet

- Presentation 1Document17 pagesPresentation 1Noor PervezNo ratings yet

- Lectorial 3 Conceptual ModellingDocument27 pagesLectorial 3 Conceptual ModellingNoor PervezNo ratings yet

- Slides For Workshop ThreeDocument7 pagesSlides For Workshop ThreeNoor PervezNo ratings yet

- Analysis of Financial Statements Course Notes Week 5Document10 pagesAnalysis of Financial Statements Course Notes Week 5Navin GolyanNo ratings yet

- CapitalisationDocument13 pagesCapitalisationHarish PatilNo ratings yet

- Chapter 13 Capital Structure and Leverage PDFDocument16 pagesChapter 13 Capital Structure and Leverage PDFbasit111No ratings yet

- Annual Report Project On Muthoot Finance LTDDocument39 pagesAnnual Report Project On Muthoot Finance LTDAnu ArjaNo ratings yet

- International Economics: Balance of Payments and DisequilibriumDocument8 pagesInternational Economics: Balance of Payments and DisequilibriumSai Kiran ReddyNo ratings yet

- Capital StructureDocument91 pagesCapital StructureyvNo ratings yet

- 130 - Capital MarketDocument236 pages130 - Capital MarketShikha Arora100% (2)

- Risk Appetite Statement 2023 ExternalDocument28 pagesRisk Appetite Statement 2023 Externalwajahat khanNo ratings yet

- Leverages NotesDocument9 pagesLeverages NotesAshwani ChouhanNo ratings yet

- Thesis On Debt FinancingDocument8 pagesThesis On Debt Financingheidimaestassaltlakecity100% (2)

- CH 14Document17 pagesCH 14rameshmbaNo ratings yet

- MAS - Cost of Capital 11pagesDocument11 pagesMAS - Cost of Capital 11pageskevinlim186100% (1)

- Why Businesses Need Finance SourcesDocument9 pagesWhy Businesses Need Finance SourcesMatthew GunawanNo ratings yet

- FM Additional NotesDocument62 pagesFM Additional NotesChristopher C ChekaNo ratings yet

- ICAI CA Questions and Answers on IND ASDocument176 pagesICAI CA Questions and Answers on IND ASMohan AddankiNo ratings yet

- 2023 Capital Markets OutlookDocument62 pages2023 Capital Markets OutlookBerenyiNo ratings yet

- Project Report On Capital StructureDocument96 pagesProject Report On Capital StructurePrince Satish Reddy50% (2)

- 1Q18 Prudential Debt Investor UpdateDocument41 pages1Q18 Prudential Debt Investor UpdateohwowNo ratings yet

- Tumelo Matjekane Finance 2009 RevisedDocument12 pagesTumelo Matjekane Finance 2009 RevisedMoatasemMadianNo ratings yet

- Annual Report 2014Document86 pagesAnnual Report 2014Баянмөнх МөнхбаярNo ratings yet

- Ch14 - Test Bank Ch14 - Test BankDocument79 pagesCh14 - Test Bank Ch14 - Test BankWag mong ikalatNo ratings yet

- Capital Market FmsDocument22 pagesCapital Market FmsPrateek ChawlaNo ratings yet

- 2018 (Jia, Pownall, - Zhao) Avoiding China - S Capital Market Evidence From Hong Kong-Listed Red-Chips and P-ChipsDocument25 pages2018 (Jia, Pownall, - Zhao) Avoiding China - S Capital Market Evidence From Hong Kong-Listed Red-Chips and P-ChipsPutri lianitaNo ratings yet

- Internship Report on Problems and Prospects of Brokerage Houses in BangladeshDocument34 pagesInternship Report on Problems and Prospects of Brokerage Houses in BangladeshNewaz ShovonNo ratings yet

- The Theoretical Aspect of Profit and Profitability AnalysisDocument8 pagesThe Theoretical Aspect of Profit and Profitability AnalysisAlison VelozNo ratings yet

- Project On Sun PharmaDocument77 pagesProject On Sun PharmaNivedha MNo ratings yet

- Satyajit 2Document30 pagesSatyajit 2Raihan WorldwideNo ratings yet

- Project ManagementDocument6 pagesProject ManagementEmuyeNo ratings yet

- Economic OrganizationDocument25 pagesEconomic OrganizationMyshel Apalla PrajesNo ratings yet

- Black Book HDFC SecuritiesDocument64 pagesBlack Book HDFC SecuritiesASHWIN KUZHIKATTUNo ratings yet