Professional Documents

Culture Documents

Sintex Industries LTD 111010

Uploaded by

mailwithvaibhav9675Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sintex Industries LTD 111010

Uploaded by

mailwithvaibhav9675Copyright:

Available Formats

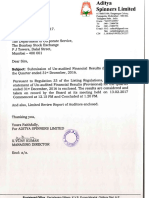

SINTEX INDUSTRIES LIMITED

REGD. OFFICE :- Kalol (N. GUJARAT) - 382 721. Web Site : www.sintex.in

UN-AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED SEPTEMBER 30, 2010 SEGMENT WISE REVENUE, RESULTS AND CAPITAL EMPLOYED FOR THE QUARTER ENDED SEPTEMBER 30, 2010

( ` in Lacs) (` in Lacs)

Standalone - Parent Company Consolidated Standalone - Parent Company Consolidated

Sr. Particulars 3 Months Corresponding 3 Year to date Year to date Previous 3 Months Corresponding 3 Year to date Year to date Previous Sr. Particulars 3 Months Corresponding 3 Year to date Year to date Previous 3 Months Corresponding 3 Year to date Year to date Previous

No. ended months ended in figures for current figures for previous Accounting ended months ended in figures for current figures for previous Accounting No. ended months ended in figures for current figures for previous Accounting ended months ended in figures for current figures for previous Accounting

9/30/2010 the Previous Year period ended year ended Year ended 9/30/2010 the Previous Year period ended year ended Year ended 9/30/2010 the Previous Year period ended year ended Year ended 9/30/2010 the Previous Year period ended year ended Year ended

9/30/2009 9/30/2010 9/30/2009 3/31/2010 9/30/2009 9/30/2010 9/30/2009 3/31/2010 9/30/2009 9/30/2010 9/30/2009 3/31/2010 9/30/2009 9/30/2010 9/30/2009 3/31/2010

(Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Audited)

1 (a) Net Sales / Income from Operations 49542.70 41366.82 101463.22 76775.34 201055.49 92061.55 71123.02 182858.08 136292.73 328164.12 1 Segment Revenue

(b) Other Operating Income 76.66 141.54 135.37 217.23 460.05 244.66 416.48 512.44 1486.67 3753.10

a) Textile 9481.73 7618.01 19350.07 15210.78 34631.04 9481.73 7618.01 19350.07 15210.78 34631.04

Total Income (a) + (b) 49619.36 41508.36 101598.59 76992.57 201515.54 92306.21 71539.50 183370.52 137779.40 331917.22 b) Plastics 40137.63 33890.35 82248.52 61781.79 166884.50 82824.48 63921.49 164020.45 122568.62 297286.18

2 Expenditure c) Un allocated 2840.02 585.21 4974.18 4278.26 9230.77 2718.31 483.60 4740.76 4072.18 8783.83

(a) (Increase) / Decrease in Stock in Trade and work-in

progress (1460.81) (143.01) (2054.52) (1301.92) 1396.40 (177.35) 583.76 (2175.98) (935.26) 2751.85

(b) Consumption of Raw Material 30012.73 23154.19 63457.92 44584.26 127167.76 45340.78 32869.30 91050.83 63920.29 169455.65 Total 52459.38 42093.57 106572.77 81270.83 210746.31 95024.52 72023.10 188111.28 141851.58 340701.05

(c) Purchase of traded goods 0.00 0.00 0.00 0.00 121.28 4267.67 1570.12 10738.03 3757.60 7641.51

(d) Employees cost 2316.44 2135.76 4557.82 4210.07 8524.34 10775.60 9470.38 22520.77 20140.85 43889.31 Less: Inter Segment Revenue - - - - - -

(e) Depreciation 2181.17 2202.89 4325.23 4364.52 8403.46 3571.48 3718.76 7204.85 7380.93 14445.67 Net Sales / Income From Operations 52459.38 42093.57 106572.77 81270.83 210746.31 95024.52 72023.10 188111.28 141851.58 340701.05

(f) Other expenditure 7193.11 6684.04 14991.00 14690.16 25853.30 14942.42 13993.00 30341.66 29103.79 54376.13

(g) Total 40242.64 34033.87 85277.45 66547.09 171466.54 78720.60 62205.32 159680.16 123368.20 292560.12 2 Segment Result

3 Profit from Operations before other Income,Interest (Profit before tax and interest from each

& Exceptional Items (1-2) 9376.72 7474.49 16321.14 10445.48 30049.00 13585.61 9334.18 23690.36 14411.20 39357.10 segment)

4 Other Income 2840.02 585.21 4974.18 4278.26 9230.77 2718.31 483.60 4740.76 4072.18 8783.83

5 Profit before Interest & Exceptional Items (3+4) 12216.74 8059.70 21295.32 14723.74 39279.77 16303.92 9817.78 28431.12 18483.38 48140.93 a) Textile 1287.25 289.53 2428.67 969.95 2579.63 1287.25 289.53 2428.67 969.95 2579.63

6 Interest 2129.65 1188.51 4031.32 1970.38 5131.75 2657.67 1570.47 5143.22 2987.08 7307.80 b) Plastics 9629.79 7439.73 17326.08 11950.66 29308.93 13838.68 9299.43 24695.30 15916.39 38617.04

7 Profit after Interest but before Exceptional Items (5-6) 10087.09 6871.19 17264.00 12753.36 34148.02 13646.25 8247.31 23287.90 15496.30 40833.13 c) Un allocated 1299.70 330.44 1540.57 1803.13 7391.21 1177.99 228.82 1307.15 1597.04 6944.26

8 Exceptional items - - - - - - - - - -

9 Profit from Ordinary Activites before tax (7+8) 10087.09 6871.19 17264.00 12753.36 34148.02 13646.25 8247.31 23287.90 15496.30 40833.13 Total 12216.74 8059.70 21295.32 14723.74 39279.77 16303.92 9817.78 28431.12 18483.38 48140.93

10 Tax expense 2744.29 2171.74 4110.44 3231.75 6777.76 3629.90 2420.88 5365.50 3559.58 7721.00

11 Net profit from Ordinary Activities after tax (9-10) 7342.80 4699.45 13153.56 9521.61 27370.26 10016.35 5826.43 17922.40 11936.72 33112.13 Less :(i) Interest 2129.65 1188.51 4031.32 1970.38 5131.75 2657.67 1570.47 5143.22 2987.08 7307.80

12 Extraordinary items (Net of tax) - - - - - - (ii) Other Unallocable Expenditure - - - - - -

12A Minority Interest in Net Profit of Subsidiary - - - - - 5.20 103.60 26.37 155.01 212.26 net off

13 Net Profit (11-12-12A) 7342.80 4699.45 13153.56 9521.61 27370.26 10011.15 5722.83 17896.03 11781.71 32899.87 (iii) Unallocable Income - - - - - -

14 Paid - up equity share capital (Face

value of ` 2 each) 2709.91 2709.91 2709.91 2709.91 2709.91 2709.91 2709.91 2709.91 2709.91 2709.91 Total Profit before Tax 10087.09 6871.19 17264.00 12753.36 34148.02 13646.25 8247.31 23287.90 15496.30 40833.13

15 Reserves excluding Revaluation Reserve - - - - 185501.80 - - - - 191977.17 3 Capital Employed

16 Debenture Redemption Reserve 1139.67 1139.67

Earning Per Share (not annualised) (Face

17 value of ` 2 each) (Segment Assets - Segment Liabilities) :

Before Extraordinary items

- Basic 5.42 3.47 9.71 7.03 20.20 7.39 4.22 13.21 8.70 24.28 a) Textile 76585.37 73529.24 76585.37 73529.24 74273.56 76585.37 73529.24 76585.37 73529.24 74273.56

- Diluted 5.42 3.47 9.71 7.03 20.20 7.39 4.22 13.21 8.70 24.28 b) Plastics 118927.53 98297.43 118927.53 98297.43 101511.13 237825.32 202966.45 237825.32 202966.45 210046.34

After Extraordinary items c) Un allocated 118140.68 84917.46 118140.68 84917.46 104219.93 36366.29 20767.02 36366.29 20767.02 39443.58

- Basic 5.42 3.47 9.71 7.03 20.20 7.39 4.22 13.21 8.70 24.28

- Diluted 5.42 3.47 9.71 7.03 20.20 7.39 4.22 13.21 8.70 24.28 Total 313653.58 256744.13 313653.58 256744.13 280004.62 350776.98 297262.71 350776.98 297262.71 323763.48

18 Debt Equity Ratio 1.20 1.31 1.14 Notes:

19 Debt Service Coverage Ratio 3.02 3.07 4.22 1 The Company is organised into two main business segments, namely:

20 Interest Service Coverage Ratio 5.28 7.47 7.65 Textile - Fabric and Yarn

21 Public Shareholding Plastic - Water Tanks, Doors, Windows, Prefab, Sections, BT Shelter, Custom Moulding etc.

- Number of Shares 90395238 95345238 90395238 95345238 95280238 90395238 95345238 90395238 95345238 95280238 Segments have been identified and reported taking into account the nature of products and services, the differing risks

- Percentage of Shareholding 66.23% 69.85% 66.23% 69.85% 69.80% 66.23% 69.85% 66.23% 69.85% 69.80% and returns, the organisation structure and the internal financial reporting systems.

22 Promoters and promoter group 2 Segment revenue in each of the above business segment primarily includes sales, service charges, rent, profit on sale of

Shareholding Fixed Assets (net), Miscellaneous Sales and export incentive.

a) Pledged /Encumbered 3 Figures for the previous year/quarter have been regrouped /rearranged, wherever necessary.

- Number of shares 24400000 10336670 24400000 10336670 10336670 24400000 10336670 24400000 10336670 10336670 Statement of Assets and Liabilites (` in Lacs)

- Percentage of shares (as a % of the total Standalone - Parent Company Consolidated

Half Year Ended Septmber 30 Half Year Ended Septmber 30

Shareholding of promoter and promoter group) 52.93% 25.12% 52.93% 25.12% 25.08% 52.93% 25.12% 52.93% 25.12% 25.08% Particulars (Unaudited) (Unaudited)

- Percentage of shares (as a % of the total 2010 2009 2010 2009

share capital of the Company) 17.88% 7.57% 17.88% 7.57% 7.57% 17.88% 7.57% 17.88% 7.57% 7.57%

b) Non - encumbered Shareholder's Funds :

- Number of shares 21700195 30813525 21700195 30813525 30878525 21700195 30813525 21700195 30813525 30878525 (a) Capital 2709.91 2709.91 2709.91 2709.91

- Percentage of shares (as a % of the total (b) Reserves and Surplus 198146.99 170097.80 215444.88 180320.28

Shareholding of promoter and promoter group) 47.07% 74.88% 47.07% 74.88% 74.92% 47.07% 74.88% 47.07% 74.88% 74.92% Minority Interest 1432.24 1895.02

- Percentage of shares (as a % of the total Loan Funds 240756.44 226701.84 267515.31 268911.58

share capital of the Company) 15.89% 22.58% 15.89% 22.58% 22.63% 15.89% 22.58% 15.89% 22.58% 22.63% Deferred Tax Liability / (Assets) (Net) 16005.04 13859.79 17269.56 14986.12

TOTAL 457618.38 413369.34 504371.90 468822.91

Notes: Fixed Assets 162329.09 147492.78 218436.14 203000.36

1 The above Standalone and Consolidated Unaudited Financial Results were reviewed by the Audit Committee and approved by the Board of Directors in their respective meetings held on October 11, 2010. Goodwil on consolidation 26020.52 26925.47

2 The Statutory Auditors have carried out a limited review of the Standalone Financial Results for the quarter ended September 30, 2010. Investments 110665.98 81410.66 40193.90 26053.73

3 Formule for computation of ratio are as follow- Current Assets, Loans And Advances

Debt Equity Ratio – Total debt / (Paid up Equity capital + Reserve and Surplus) (a) Inventories 19625.62 21851.63 39939.29 41568.77

Debt Service Coverage Ratio - Earning before Interest on term loan and debentures and Tax / (Interest on term loan and debentures + Principal repayment during the Period/ year) (b) Sundry Debtors 77949.00 60860.72 122694.10 91362.96

Interest Service Coverage Ratio - Earning before Interest and Tax/(Interest) (c) Cash and Bank balances 64306.65 82677.70 72060.50 88074.15

4 There were no Investors' complaints pending as on July 1, 2010. Complaints received and disposed off during the quarter were 1 (one) each and no Investors' complaints were lying unresolved as on September 30, 2010. (d) Loans and Advances 82130.92 84450.50 81983.01 83412.12

5 Figures for the previous year/quarter have been regrouped /rearranged, wherever necessary. Less: Current Liabilities and Provisions

For SINTEX INDUSTRIES LIMITED (a) Liabilites 31581.69 36180.32 63518.76 57138.42

(b) Provisions 27807.19 29202.80 33436.80 34444.70

Miscellaneous Expenditure (not

written off or adjusted) 0.00 8.47 0.00 8.47

( DINESH B. PATEL)

Date : October 11, 2010 CHAIRMAN Profit and Loss - - - -

Place : Ahmedabad TOTAL 457618.38 413369.34 504371.90 468822.91

E-mail for Investors: share@sintex.co.in

You might also like

- Thermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014Document1 pageThermax Limited: Standalone Audited Financial Results For The Quarter Ended September 30, 2014kartiknamburiNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Kush Industries Limited: (Formerly Known As SNS Textiles Limited)Document9 pagesKush Industries Limited: (Formerly Known As SNS Textiles Limited)Rama KumarNo ratings yet

- Ref: NBC/S/4.5 & 4.5 (A) /2018/: Date: 12.11.2018Document5 pagesRef: NBC/S/4.5 & 4.5 (A) /2018/: Date: 12.11.2018Sanjay GuptaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- PDF ShoppersDocument43 pagesPDF ShoppersVikrant KarhadkarNo ratings yet

- Q3 2009 UTV Software Communications Financials Uploaded by MediaNamaDocument1 pageQ3 2009 UTV Software Communications Financials Uploaded by MediaNamamixedbagNo ratings yet

- Resubmission of Revised Segment Results For December 31, 2016 (Result)Document4 pagesResubmission of Revised Segment Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Sgro LK TW Iii 2016Document116 pagesSgro LK TW Iii 2016Lc WisdamNo ratings yet

- Fajarbaru Builder Group BHDDocument5 pagesFajarbaru Builder Group BHDShungchau WongNo ratings yet

- Larsen & ToubroDocument10 pagesLarsen & Toubropragadeesh jayaramanNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Shivangi Digant Shah: Encl: A/aDocument6 pagesShivangi Digant Shah: Encl: A/asaransh pugaliaNo ratings yet

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- (Company Registration Number: 201012504K) Third Quarter and Nine Months 2010 Financial StatementsDocument16 pages(Company Registration Number: 201012504K) Third Quarter and Nine Months 2010 Financial StatementsLiying KwongNo ratings yet

- SCCO LKT Per 31 Des 2021Document79 pagesSCCO LKT Per 31 Des 2021Reza Pratama NugrahaNo ratings yet

- FY20 Q2 ResultsDocument14 pagesFY20 Q2 ResultsarhagarNo ratings yet

- BM Results 10112020Document13 pagesBM Results 10112020emailtodeepNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 500 1000 Imo Result 20230215Document12 pages500 1000 Imo Result 20230215Contra Value BetsNo ratings yet

- Laporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFDocument143 pagesLaporan Keuangan PT Elang Mahkota Teknologi TBK 30 PDFRAHUL YADATAMANo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Vitrox q22010Document12 pagesVitrox q22010Dennis AngNo ratings yet

- Netflix Quarter 1 2020 Financial StatementDocument5 pagesNetflix Quarter 1 2020 Financial StatementAlexNo ratings yet

- Fy 2021 Financial Plan (In Thousand Pesos) : BED No. 1Document2 pagesFy 2021 Financial Plan (In Thousand Pesos) : BED No. 1Helen Joy Grijaldo JueleNo ratings yet

- Aditya: ForgeDocument17 pagesAditya: ForgeanupNo ratings yet

- Indf LK TW Iii 2016Document180 pagesIndf LK TW Iii 2016TantriNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- BCG Q2FY22 ResultsDocument12 pagesBCG Q2FY22 ResultsSandyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 3Q - 2016 - CPGT - Citra Maharlika Nusantara Corpora TBK PDFDocument107 pages3Q - 2016 - CPGT - Citra Maharlika Nusantara Corpora TBK PDFYudhi MahendraNo ratings yet

- M.C DailyDocument1 pageM.C DailyEr Dnyaneshwar PatilNo ratings yet

- Res Oct08Document1 pageRes Oct08narayanan_rNo ratings yet

- Enrg LK TW Iii 2020Document130 pagesEnrg LK TW Iii 2020juliadiNo ratings yet

- Announces Q4 & FY16 Results & Results Press Release For The Period Ended March 31, 2016 (Result)Document4 pagesAnnounces Q4 & FY16 Results & Results Press Release For The Period Ended March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document15 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- General Accident PLC: Interim Financial Statements 30 June 2010Document9 pagesGeneral Accident PLC: Interim Financial Statements 30 June 2010saxobobNo ratings yet

- 07 August 2020: Nath Bio-Genes (1) LTDDocument4 pages07 August 2020: Nath Bio-Genes (1) LTDgirirajNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Q2FY22 ResultsDocument16 pagesQ2FY22 ResultsrohitnagrajNo ratings yet

- Revised Segment Results For December 31, 2016 (Company Update)Document4 pagesRevised Segment Results For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- ECSH 3Q 2009 Announcement 111109Document16 pagesECSH 3Q 2009 Announcement 111109WeR1 Consultants Pte LtdNo ratings yet

- Annexure 7 - Audited Financial Results For The Year Ended March 31 2011Document3 pagesAnnexure 7 - Audited Financial Results For The Year Ended March 31 2011PGurusNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Screenshot 2023-05-08 at 8.32.05 PMDocument22 pagesScreenshot 2023-05-08 at 8.32.05 PMSomnath DasNo ratings yet

- Industri Jamu Farmasi Sido Muncul 30 Sept 2021Document92 pagesIndustri Jamu Farmasi Sido Muncul 30 Sept 2021Amelia HumaizaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Indofood Sukses Makmur TBK - Billingual - 30 - Sep - 2018 PDFDocument180 pagesIndofood Sukses Makmur TBK - Billingual - 30 - Sep - 2018 PDFSsela selviaNo ratings yet

- KIIL Reesults Q3Document5 pagesKIIL Reesults Q3Abdul SamadNo ratings yet

- કુંભણ ગ્રામ પંચાયતના કામો માટે મંજુર થયેલ ગ્રાન્ટDocument22 pagesકુંભણ ગ્રામ પંચાયતના કામો માટે મંજુર થયેલ ગ્રાન્ટNitin KhodifadNo ratings yet

- Rent RelianceDocument2 pagesRent RelianceSharah Del Tabudlong TudeNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 08 Annual Report 08Document2 pages08 Annual Report 08Ken ChaichanavongNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- GHCL LimitedDocument1 pageGHCL LimitedsoumyasibaniNo ratings yet

- RP-Sanjiv Goenka Group: Growing LegaciesDocument10 pagesRP-Sanjiv Goenka Group: Growing Legaciessouvik dasguptaNo ratings yet

- Does The Budget Benefit You?Document1 pageDoes The Budget Benefit You?mailwithvaibhav9675No ratings yet

- Study SkillsDocument32 pagesStudy SkillsAmer Al-Fawakheery80% (5)

- Chapter 1 Basics of OOPDocument20 pagesChapter 1 Basics of OOPmailwithvaibhav9675No ratings yet

- MarginDocument1 pageMarginmailwithvaibhav9675No ratings yet

- Companies and Their SlogansDocument4 pagesCompanies and Their Slogansmailwithvaibhav9675No ratings yet

- Sintex Industries LTD 111010Document1 pageSintex Industries LTD 111010mailwithvaibhav9675No ratings yet

- Allahabad Address 1930Document7 pagesAllahabad Address 1930Abdul mutaal AsadNo ratings yet

- Ak. Jain Dukki Torts - PDF - Tort - DamagesDocument361 pagesAk. Jain Dukki Torts - PDF - Tort - Damagesdagarp08No ratings yet

- UpgradeCAWI CWIDocument3 pagesUpgradeCAWI CWIERNESTO SALVADOR VALLE PELAEZNo ratings yet

- Assignment - The Universal Declaration of Human RightsDocument5 pagesAssignment - The Universal Declaration of Human RightsMarina PavlovaNo ratings yet

- Chapter 02 Courts and Alternative Dispute ResolutionDocument13 pagesChapter 02 Courts and Alternative Dispute ResolutionРустам ДандонитиллоNo ratings yet

- 01 Internal Auditing Technique Rev. 05 12 09 2018Document40 pages01 Internal Auditing Technique Rev. 05 12 09 2018Syed Maroof AliNo ratings yet

- BL-5-Negotiable Instruments ActDocument46 pagesBL-5-Negotiable Instruments ActAbhishekNo ratings yet

- Online Declaration Form 1516Document2 pagesOnline Declaration Form 1516AlcaNo ratings yet

- Credit MonitoringDocument20 pagesCredit MonitoringMdramjanaliNo ratings yet

- Vcs Floating-Ip - A10 CommunityDocument3 pagesVcs Floating-Ip - A10 Communitymoro2871990No ratings yet

- Hydrolics-Ch 4Document21 pagesHydrolics-Ch 4solxNo ratings yet

- Avantages Dis Advantages of Mutual FundsDocument3 pagesAvantages Dis Advantages of Mutual FundsJithendra Kumar MNo ratings yet

- Bids MinutesDocument2 pagesBids MinutesJeanette Canales RapadaNo ratings yet

- Sapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1Document84 pagesSapbpc NW 10.0 Dimension Data Load From Sap BW To Sap BPC v1lkmnmkl100% (1)

- About HDFC Bank: ProfileDocument8 pagesAbout HDFC Bank: ProfileGoyalRichuNo ratings yet

- Maharashtra Public Trust ActDocument72 pagesMaharashtra Public Trust ActCompostNo ratings yet

- Fam Law II - CompleteDocument103 pagesFam Law II - CompletesoumyaNo ratings yet

- Common Accounting Concepts and Principles: Going ConcernDocument3 pagesCommon Accounting Concepts and Principles: Going Concerncandlesticks20201No ratings yet

- WHO COVID-19 SITUATION REPORT FOR July 13, 2020Document16 pagesWHO COVID-19 SITUATION REPORT FOR July 13, 2020CityNewsTorontoNo ratings yet

- Vector Potential For A Particle On The Ring and Unitary Transform of The HamiltonianDocument8 pagesVector Potential For A Particle On The Ring and Unitary Transform of The HamiltonianShaharica BaluNo ratings yet

- United States v. Freddie Andaya, 4th Cir. (2015)Document3 pagesUnited States v. Freddie Andaya, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Analysis of NPADocument31 pagesAnalysis of NPApremlal1989No ratings yet

- Engineering Mechanics Syllabus - Fisrt BtechDocument2 pagesEngineering Mechanics Syllabus - Fisrt BtechfotickNo ratings yet

- Critical CriminologyDocument20 pagesCritical CriminologyJashan100% (1)

- 4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)Document172 pages4-String Cigar Box Guitar Chord Book (Brent Robitaille) (Z-Library)gregory berlemontNo ratings yet

- Partnership DeedDocument13 pagesPartnership DeedChintan NaikwadeNo ratings yet

- ACCTG 1 Week 4 - Recording Business TransactionsDocument17 pagesACCTG 1 Week 4 - Recording Business TransactionsReygie FabrigaNo ratings yet

- Miranda V AguirreDocument15 pagesMiranda V AguirrePam RamosNo ratings yet

- Document View PDFDocument4 pagesDocument View PDFCeberus233No ratings yet

- The Life'S and Works of Jose Rizal Rizal'S Life and The Philippines in The Nineteenth Century As Rizal'S ContextDocument6 pagesThe Life'S and Works of Jose Rizal Rizal'S Life and The Philippines in The Nineteenth Century As Rizal'S ContextVanessa Del RosarioNo ratings yet