Professional Documents

Culture Documents

Real Estate Glossary

Uploaded by

powerfishCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Real Estate Glossary

Uploaded by

powerfishCopyright:

Available Formats

Real Estate Glossary

Addendum - Something added. A list or other material added to a document, letter, contractural

agreement, escrow instructions, etc. (See also: Amendment)

Amendment - A change, either to correct an error or to alter a part of an agreement without

changing the principal idea or essence.

Appraisal - An opinion of value based upon factual analysis. Legally, an estimation of value by

two disinterested persons of suitable qualifications.

Annual Percentage Ratge (A.P.R.) - The yearly interest percentage of a loan, as expressed by the

actual rate of interest paid. For example: 6% add-on interest would be more than 6% simple interest, even

though both would say 6%. The A.P.R. is disclosed as a requirement of federal truth in lending statutes.

Assumption of Mortgage - Agreement by a buyer to assume the liability under an existing note

secured by a mortgage or deed of trust. The lender usually must approve the new debtor in order to

release the existing debtor (usually the seller) from liability.

Beneficiary - (1) One for whose benefit a trust is created. (2) In states in which deeds of trust are

commonly used instead of mortgages, the lender (mortgagee) is called the beneficiary.

Close of Escrow - The date that title passes from seller to buyer and documents are recorded.

CC&R's - Covenants, Conditions, and Restrictions. A term used to describe the restrictive

limitations which may be placed on a property.

Chain of Title - The chronological order of conveyance of a parcel of land from the original

owner (usually the government) to the present owner.

Cloud of Title - An invalid encumbrance on real property, which, if valid, would affect the rights

of the owner. The cloud may be removed by quitclaim deed, or, if necessary, by court action.

Comparable Sales - Sales of properties used as comparisons to determine the value of a specific

property.

Conveyance - Transfer of title to a property. Includes most instruments by which an interest in

real estate is created, mortgaged or assigned.

Counter-Offer - An offer (instead of acceptance) in response to an offer. For example: A offers

to buy B's house for X dollars. B, in response, offers to sell to A at a higher price. B's offer to A is a

counter offer.

Deed - Actually, any one of many conveyance or financing instruments, but generally a

conveyancing instrument given to pass fee title to property upon sale.

Deed of Trust - An instrument used in many states in place of a mortgage. Property is transferred

to a trustee by the borrower (trustor), in favor of the lender (beneficiary), and reconveyed upon payment in

full.

Disclosure - To make something known. All disclosures should in writing when dealing with real

estate interests and real property.

Source of this article is the site of The Dream Home Company

Discount Points - The amount paid to increase the yield. Discount points are up-front interest

charges to reduce the interest reate on the loan over the term of the loan. Each point equals one percent of

the face value of the loan.

Due on Sale Clause - An acceleration clause that required full payment of a mortgage or deed of

trust balance when the secured property changes ownership.

Earnest Money - Money given by the buyer with an offer to purchase. Shows good faith.

Easement - A right created by grant, reservation, agreement, prescription, or necessary

implication, which one has in the land of another. It is either for the benefit of the land (appurtenant),

such as the right to cross A to get to B, or "in gross", such as a public utility easement.

Escrow - Delivery of a deed by a Grantor to a third party for delivery to the Grantee upon the

happening of a contingent event. Modernly, in some states, all instruments necessary to the sale

(including funds) are delivered to a neutral third party with instructions as to their use.

Fair Market Value - Price that probably would be negotiated between a willing seller and a

willing buyer in a reasonable time. Usually arrived at by the comparable sales in the area.

Hazard Insurance - Real Estate insurance protecting against loss caused by fire, some natural

causes, vandalism, etc., depending upon the terms of the policy.

Homeowners Association - An association of people who own real property in a given area,

formed for the purpose of improving or maintaining the quality of the area. Also an association formed by

the builder of condominiums or planned developments, and required by the statute in some states. The

builder's participation as well as the duties of the association are controlled by statute.

Homestead Exemption - Every person the age of 18 or over, married or single, who resides

within Arizona, is entitled to a homestead. A.R.S. 33-1101(A). This homestead is an exemption that

precludes most creditors from reaching the first $100,000 of equity in a person's residence. The

homestead exemption does not apply to a consensual lien, such as a mortgage or deed of trust. A.R.S. 33-

1103. Homeowners do not need to take any action to assert the homestead because the exemption attaches

by operation of law. A.R.S. 33-1102. The homestead also attaches automatically to a person's interest in

identifiable cash proceeds from the voluntary or involuntary sale of the homestead property. Each person

or married couple may hold only one homestead. A.R.S. 33-1101 (B). Therefore, if a person has more

than one property, a creditor may require the person to designate which property is protected by the

homestead exemption. A.R.S. 33-1102 (A)

Impounds - Account held by lender for payment of taxes, insurance and other periodic debts

against real property required to protect their security.

Lien - An encumbrance against a property for the repayment of a debt. Examples include

judgements, taxes, mortgages and deeds of trust.

Mortgage - The instrument by which real estate is pledged as security for the repayment of a loan.

Source of this article is the site of The Dream Home Company

Mortgage Insurance - Insurance written by an independent mortgage insurance company

protecting the mortgage lender against loss incurred by a mortgage default, thus enabling the lender a

higher percentage of the sales price.

PITI - Payment that combines the principal, interest, taxes and insurance.

Power of Attorney - An authority by which one person (principal) enables another (attorney in

fact) to act for him.

Public Report - A report given to prospective purchasers in a new subdivision, stating the

conditions of the area and development (cost of common facilities, utility providers, availability of

schools, proximity to airports and freeways, etc.) issued by the Department of Real Estate.

Purchase Agreement - An agreement between a buyer and seller of real property, setting forth the

price and terms of the sale.

Quitclaim Deed - A deed operating as a release; intended to pass any title, interest, or claim which

the Grantor may have in the property , but not containing any warranty of a valid interest or title by the

Grantor.

Realtor - A designation given to a real estate broker or sales associate who is a member of a board

associated with the National Association of Realtors or with the National Association of Real Estate

Boards.

Recording - Filing documents affecting real property with the County Recorder as a matter of

public record.

Subdivision - The division of one parcel of land into smaller parcels (lots) created by filing a

subdivision plat with the governmental authority (city or county) and receiving approval from the

governmental authority.

Title - The evidence one has of right to possession of land.

Warranty Deed - A deed that conveys fee title to real property from the Grantor (usually the

Seller) to the Grantee (usually the buyer).

1031 Exchange - A tax deferred or 1031 exchange is a transactions involving the transfer of

investment or income property and the receipt of like-kind property which will be used as income or

investment property. When certain criteria are met, as set forth in section 1031 of the Internal Revenue

Code, the income taxes on any gain realized from the sale of the relinquished property are deferred.

Source of this article is the site of The Dream Home Company

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Winning From Within - SummaryDocument4 pagesWinning From Within - SummaryShraddha Surendra100% (3)

- 1 Rodney Britton v. Apple Inc. Job Descrimination, Sexual HarrassmentDocument8 pages1 Rodney Britton v. Apple Inc. Job Descrimination, Sexual HarrassmentJack PurcherNo ratings yet

- Granularity of GrowthDocument4 pagesGranularity of GrowthAlan TangNo ratings yet

- The Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelDocument178 pagesThe Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelShukwai ChristineNo ratings yet

- Why Study in USADocument4 pagesWhy Study in USALowlyLutfurNo ratings yet

- Gogo ProjectDocument39 pagesGogo ProjectLoyd J RexxNo ratings yet

- Utilitarianism Bentham: PPT 6 Hedonic Act UtilitarianismDocument9 pagesUtilitarianism Bentham: PPT 6 Hedonic Act UtilitarianismPepedNo ratings yet

- Uwamungu Et Al 2022 - Contaminacion de Suelos Por MicroplasticosDocument14 pagesUwamungu Et Al 2022 - Contaminacion de Suelos Por MicroplasticosXXUHAJNo ratings yet

- ReinsuranceDocument142 pagesReinsuranceabhishek pathakNo ratings yet

- Assignment LA 2 M6Document9 pagesAssignment LA 2 M6Desi ReskiNo ratings yet

- Cartographie Startups Françaises - RHDocument2 pagesCartographie Startups Françaises - RHSandraNo ratings yet

- Effectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonDocument109 pagesEffectiveness of The Automated Election System in The Philippines A Comparative Study in Barangay 1 Poblacion Malaybalay City BukidnonKent Wilson Orbase Andales100% (1)

- Japanese Erotic Fantasies: Sexual Imagery of The Edo PeriodDocument12 pagesJapanese Erotic Fantasies: Sexual Imagery of The Edo Periodcobeboss100% (4)

- Taller InglesDocument11 pagesTaller InglesMartín GonzálezNo ratings yet

- MODULE 7 - Voting SystemDocument19 pagesMODULE 7 - Voting SystemHanz PeñamanteNo ratings yet

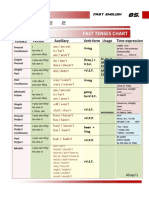

- Table 2: Fast Tenses ChartDocument5 pagesTable 2: Fast Tenses ChartAngel Julian HernandezNo ratings yet

- Infinivan Company Profile 11pageDocument11 pagesInfinivan Company Profile 11pagechristopher sunNo ratings yet

- Transportation Systems ManagementDocument9 pagesTransportation Systems ManagementSuresh100% (4)

- Gabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFDocument2 pagesGabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFatelierimkellerNo ratings yet

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityDocument15 pagesOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraNo ratings yet

- Full Download Health Psychology Theory Research and Practice 4th Edition Marks Test BankDocument35 pagesFull Download Health Psychology Theory Research and Practice 4th Edition Marks Test Bankquininemagdalen.np8y3100% (39)

- Asking Who Is On The TelephoneDocument5 pagesAsking Who Is On The TelephoneSyaiful BahriNo ratings yet

- 1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreDocument2 pages1 Summative Test in Empowerment Technology Name: - Date: - Year & Section: - ScoreShelene CathlynNo ratings yet

- Things Fall ApartDocument4 pagesThings Fall ApartJack ConnollyNo ratings yet

- Project Initiation & Pre-StudyDocument36 pagesProject Initiation & Pre-StudyTuấn Nam NguyễnNo ratings yet

- Public Provident Fund Card Ijariie17073Document5 pagesPublic Provident Fund Card Ijariie17073JISHAN ALAMNo ratings yet

- Contemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitDocument1 pageContemporary Worl Module 1-Act.1 (EAC) Bea Adeline O. ManlangitGab RabagoNo ratings yet

- CG Road EscortsDocument3 pagesCG Road EscortsNeha SharmaNo ratings yet

- RAN16.0 Optional Feature DescriptionDocument520 pagesRAN16.0 Optional Feature DescriptionNargiz JolNo ratings yet

- Romeo and Juliet: Unit Test Study GuideDocument8 pagesRomeo and Juliet: Unit Test Study GuideKate Ramey100% (7)