Professional Documents

Culture Documents

K-A-K Accruals & Prepayments Questions

Uploaded by

Umer FarooqCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

K-A-K Accruals & Prepayments Questions

Uploaded by

Umer FarooqCopyright:

Available Formats

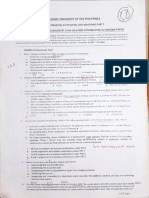

1. Leddley owns two properties which it rents to tenants.

In the year ended 31 December 20X6, it received

$280,000 in respect of property 1 and $160,000 in respect of property 2. Balances on the rental accounts were

as follows:

31 December 20X6 31 December 20X5

Property 1 13,400 Dr 12,300 Cr

Property 2 6,700 Cr 5,400 Dr

What amount should be credited to the income statement for the year ended 31 December 20X6 in respect of

rental income?

a) $453,600

b) $440,200

c) $465,900

d) $475,600

2. Troy, a property company, received cash totalling $838,600 from tenants during the year ended 31 December

20X6.

Figures for rent in advance and in arrears at the beginning and end of the year were:

31 December 31 December

20X5 20X6

$ $

Rent received in advance 102,600 88,700

Rent in arrears (all subsequently received) 42,300 48,400

What amount should appear in the company's income statement for the year ended 31 December 20X6 for

rental income?

a) $818,600

b) $738,000

c) $939,200

d) $858,600

3. Details of Bartlett's insurance policy are shown below:

Premium for year ended 31 March 20X6 paid April 20X5 $10,800

Premium for year ending 31 March 20X7 paid April 20X6 $12,000

What figures should be included in the company's financial statements for the year ended 30 June 20X6?

Income statement Statement of financial

$ position

$

a) 11,100 9,000 prepayment

b) 11,700 9,000 prepayment

c) 11,100 9,000 accrual

d) 11,700 9,000 accrual

4. Vine sublets part of its office accommodation.

The rent is received quarterly in advance on 1 January, 1 April, 1 July and 1 October. The annual rent has been

$24,000 for some years, but it was increased to $30,000 from 1 July 20X5.

umer farooq | k-a-k

Accruals &

Prepayments

What amounts for rent should appear in the company's financial statements for the year ended 31 January

20X6?

Income statement Statement of financial position

a) $27,500 $5,000 in accrued income

b) $27,000 $2,500 in accrued income

c) $27,000 $2,500 in prepaid income

d) $27,500 $5,000 in prepaid income

5. At 1 September, the motor expenses account showed 4 months' insurance prepaid of $80 and petrol accrued

of $95. During September, the outstanding petrol bill is paid, plus further bills of $245. At 30 September there

is a further outstanding petrol bill of $120.

The amount to be shown in the income statement for motor expenses for September is:

a) $385

b) $415

c) $445

d) $460

6. On 1 May 20X0, A pays a rent bill of $1,800 for the period to 30 April 20X1. What is the charge to the income

statement and the entry in the statement of financial position for the year ended 30 November 20X0?

a) $1,050 charge to income statement and prepayment of $750 in the statement of financial position

b) $ 1,050 charge to income statement and accrual of $750 in the statement of financial position

c) $1,800 charge to income statement and no entry in the statement of financial position

d) $750 charge to income statement and prepayment of $1,050 in the statement of financial position

7. The electricity account for the year ended 30 June 20X3 was as follows:

$

Opening balance for electricity accrued at 1 July 20X2 300

Payments made during the year:

1 August 20X2 for three months to 31 July 20X2 600

1 November 20X2 for three months to 31 October 20X2 720

1 February 20X3 for three months to 31 January 20X3 900

30 June 20X3 for three months to 30 April 20X3 840

Which of the following is the appropriate entry for electricity?

Accrued at June 20X3 Charged to income statement, year ended 30

June 20X3

a) $ Nil $3,060

b) $460 $3,320

c) $560 $3,320

d) $560 $3,420

8. The annual insurance premium for S for the period 1 July 20X3 to 30 June 20X4 is $13,200, which is 10% more

than the previous year. Insurance premiums are paid on 1 July.

What is the income statement charge for insurance for the year ended 31 December 20X3?

a) $11,800

b) $12,540

c) $12,600

d) $13,200

umer farooq | k-a-k

Accruals &

Prepayments

9. Farthing's year-end is 30 September. On 1 January 20X6 the organisation took out a loan of $100,000 with

annual interest of 12%. The interest is payable in equal installments on the first day of April, July, October and

January in arrears.

How much should be charged to the income statement account for the year ended 30 September 20X6, and how

much should be accrued on the statement of financial position?

Income statement Statement of financial position

a) $12,000 $3,000

b) $9,000 $3,000

c) $9,000 Nil

d) $6,000 $3,000

10. On the first day of Month 1, a business had prepaid insurance of $10,000. On the first day of Month 8, it paid,

in full, the annual insurance invoice of $36,000, to cover the following year.

The amount charged in the income statement and the amount shown in the statement of financial position at

the year-end is:

Income statement Balance carried forward

$ $

a) 5,000 24,000

b) 22,000 23,000

c) 25,000 21,000

d) 36,000 15,000

11. Which of the following statements is not true

a) Accruals decrease profit

b) Accrued income decrease profit

c) A prepayment is an asset

umer farooq | k-a-k

Accruals &

Prepayments

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- F5 FinalDocument18 pagesF5 FinalPrashant PandeyNo ratings yet

- FIA Maintaining Financial Records FA2 BPP Learning Media BPP Learning MediaDocument10 pagesFIA Maintaining Financial Records FA2 BPP Learning Media BPP Learning Mediamamoona ehsanNo ratings yet

- ACCA F3 CH#10: Accruals and Prepayments NotesDocument26 pagesACCA F3 CH#10: Accruals and Prepayments NotesMuhammad AzamNo ratings yet

- F2MA Test 3 From ACCA Sep 2020 QuestionDocument15 pagesF2MA Test 3 From ACCA Sep 2020 QuestionthetNo ratings yet

- ACCA F2 Management Accounting Course Companion, BPP Publishing - 2Document42 pagesACCA F2 Management Accounting Course Companion, BPP Publishing - 2humanity firstNo ratings yet

- Examiner's Report - FA2 PDFDocument40 pagesExaminer's Report - FA2 PDFSuy YanghearNo ratings yet

- Diploma in Accountancy Programme December 2019 Examination Qa PDFDocument217 pagesDiploma in Accountancy Programme December 2019 Examination Qa PDFethelNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- F9 Progress Test 2: Key Financial Calculations for Machine ProjectsDocument3 pagesF9 Progress Test 2: Key Financial Calculations for Machine ProjectsCoc GamingNo ratings yet

- ACCA F5 Linear Programming RevisionDocument4 pagesACCA F5 Linear Programming RevisionZoe ChimNo ratings yet

- Transunion NewDocument8 pagesTransunion NewCaleb HolleyNo ratings yet

- Financial Accounting I: Accruals, Prepayments, Adjustments & Financial StatementsDocument4 pagesFinancial Accounting I: Accruals, Prepayments, Adjustments & Financial Statements小仙女哈哈哈No ratings yet

- FA2 Accruals and PrepaymentsDocument4 pagesFA2 Accruals and Prepaymentsamna zamanNo ratings yet

- Financial Accounting Exam for Diploma in Accountancy StudentsDocument223 pagesFinancial Accounting Exam for Diploma in Accountancy StudentsethelNo ratings yet

- Chapter 18 ACCA F3Document6 pagesChapter 18 ACCA F3sikshaNo ratings yet

- Ma2 Mock ExamDocument13 pagesMa2 Mock Examsaad shahidNo ratings yet

- Chapter 4 - Principles of Double EntryDocument30 pagesChapter 4 - Principles of Double EntryMas Ayu100% (1)

- Fma Past Papers 1Document23 pagesFma Past Papers 1Fatuma Coco BuddaflyNo ratings yet

- FA2 S20-A21 Examiner's ReportDocument6 pagesFA2 S20-A21 Examiner's ReportAreeb AhmadNo ratings yet

- F2 Past Paper - Question06-2002Document8 pagesF2 Past Paper - Question06-2002ArsalanACCANo ratings yet

- 01 Accruals and Prepayments TestDocument13 pages01 Accruals and Prepayments TestThomas Kong Ying Li100% (1)

- Examiner's Report: MA2 Managing Costs & FinanceDocument3 pagesExaminer's Report: MA2 Managing Costs & FinanceLabeed AhmadNo ratings yet

- Acca ExercisesDocument10 pagesAcca ExercisesAmir AmirliNo ratings yet

- ACCACAT Paper T4 Accounting For Costs INT Topicwise Past PapersDocument40 pagesACCACAT Paper T4 Accounting For Costs INT Topicwise Past PapersGT Boss AvyLara50% (4)

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- F2 Past Paper - Question06-2005Document14 pagesF2 Past Paper - Question06-2005ArsalanACCANo ratings yet

- ACCA F3 Integrated Financial Accounting Course Companion, BPP PublishingDocument44 pagesACCA F3 Integrated Financial Accounting Course Companion, BPP Publishingsmy890No ratings yet

- FIA FFM Mock Exam Questions on Investment Appraisal, Inventory Management and Business FinanceDocument9 pagesFIA FFM Mock Exam Questions on Investment Appraisal, Inventory Management and Business Financetheizzatirosli100% (1)

- Control Accounts Q8 PDFDocument3 pagesControl Accounts Q8 PDFRyanNo ratings yet

- LR Questions PDFDocument10 pagesLR Questions PDFkumassa kenyaNo ratings yet

- ACCA F3 CH#10: Accruals and Prepayments Practice NotesDocument13 pagesACCA F3 CH#10: Accruals and Prepayments Practice NotesMuhammad AzamNo ratings yet

- F2 Past Paper - Ans06-2004Document10 pagesF2 Past Paper - Ans06-2004ArsalanACCANo ratings yet

- Fa2 Specimen j14 PDFDocument16 pagesFa2 Specimen j14 PDFShahiman MahdzirNo ratings yet

- Foundations in AccountancyDocument5 pagesFoundations in AccountancyAik MusafirNo ratings yet

- Pearson LCCI 2021 Examination TimetableDocument9 pagesPearson LCCI 2021 Examination TimetableKhin Zaw HtweNo ratings yet

- Fa2 Mock Test 2Document7 pagesFa2 Mock Test 2Sayed Zain ShahNo ratings yet

- ACCA F2 Revision Notes OpenTuition PDFDocument25 pagesACCA F2 Revision Notes OpenTuition PDFSaurabh KaushikNo ratings yet

- ACCA F5 Class NotesDocument177 pagesACCA F5 Class NotesAzeezNo ratings yet

- Past Paper IIDocument16 pagesPast Paper IIWasim OmarshahNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Extra MTQ Acca f2Document6 pagesExtra MTQ Acca f2siksha100% (1)

- Examiner's report on MA2 exam questionsDocument3 pagesExaminer's report on MA2 exam questionsAhmad Hafid Hanifah100% (1)

- Ma1 Examreport d12Document4 pagesMa1 Examreport d12Josh BissoonNo ratings yet

- Ch2 Control AccountsDocument21 pagesCh2 Control AccountsahmadNo ratings yet

- Incomplete Records - N4 22 PDFDocument57 pagesIncomplete Records - N4 22 PDFSay SopheakneathNo ratings yet

- F2 Past Paper - Question06-2007Document13 pagesF2 Past Paper - Question06-2007ArsalanACCA100% (1)

- 11 Accruals and PrepaymentsDocument1 page11 Accruals and PrepaymentsNadia AhmedNo ratings yet

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestNo ratings yet

- 3int - 2008 - Jun - Ans CAT T3Document6 pages3int - 2008 - Jun - Ans CAT T3asad19No ratings yet

- Control Accounts Reconciliation PractiseDocument2 pagesControl Accounts Reconciliation Practisendumiso100% (1)

- MA1 test chapter 03 costingDocument4 pagesMA1 test chapter 03 costingshahabNo ratings yet

- Accruals & Prepayment-1Document3 pagesAccruals & Prepayment-1Kopanang LeokanaNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- SharonDocument6 pagesSharonLucky LuckyNo ratings yet

- Intermediate Accounting QuizDocument15 pagesIntermediate Accounting QuizKennedy Malubay0% (1)

- EASY ROUND INCOME TAXESDocument13 pagesEASY ROUND INCOME TAXESCamila Mae AlduezaNo ratings yet

- AP 1st Monthly AssessmentDocument6 pagesAP 1st Monthly AssessmentCiena Mae Asas100% (1)

- Separate and Consolidated QuizDocument6 pagesSeparate and Consolidated QuizAllyssa Kassandra LucesNo ratings yet

- Lecture 5 - Ss Q1 Q2 Q3Document4 pagesLecture 5 - Ss Q1 Q2 Q3Esther FanNo ratings yet

- Audit of Shareholders Equity DiscussionsDocument5 pagesAudit of Shareholders Equity DiscussionsGwyneth TorrefloresNo ratings yet

- 1 Intro To Financial MGMT (Slides)Document22 pages1 Intro To Financial MGMT (Slides)Ju RaizahNo ratings yet

- ch2 Advanced AccountingDocument56 pagesch2 Advanced Accountingthescribd94No ratings yet

- Government Grants for Asset Costs and ExpensesDocument4 pagesGovernment Grants for Asset Costs and ExpensesLyka Nicole Dorado67% (3)

- Basel III Regulation CommerzbankDocument6 pagesBasel III Regulation CommerzbankUpnaPunjabNo ratings yet

- CMA ExamDocument34 pagesCMA Examtimmy457No ratings yet

- Chapter-06 - Financial Statement AnalysisDocument70 pagesChapter-06 - Financial Statement Analysispatricia modyNo ratings yet

- CFAS ReviewerDocument5 pagesCFAS ReviewerbanannannaNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- Journalizing and posting examples for accruals and deferralsDocument3 pagesJournalizing and posting examples for accruals and deferralsFantayNo ratings yet

- Outreach NetworksDocument3 pagesOutreach NetworksPaco Colín50% (2)

- Wealth Management AssignmentDocument2 pagesWealth Management AssignmentHimanshu BajajNo ratings yet

- Accounting Cycle WorksheetDocument11 pagesAccounting Cycle Worksheettarikuabdisa0No ratings yet

- BAC 211 Group AssDocument12 pagesBAC 211 Group AssStephan Mpundu (T4 enick)No ratings yet

- Polytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamDocument9 pagesPolytechnic University of the Philippines Advanced Financial Accounting and Reporting Part 2 Assessment ExamBazinga HidalgoNo ratings yet

- Corporate Finance Assignment PDFDocument13 pagesCorporate Finance Assignment PDFسنا عبداللهNo ratings yet

- Revised Conceptual Framework: Rsoriano/JmaglinaoDocument2 pagesRevised Conceptual Framework: Rsoriano/JmaglinaoMerliza JusayanNo ratings yet

- FIN-5823 - Financial Analysis ExampleDocument15 pagesFIN-5823 - Financial Analysis ExampleGPA FOURNo ratings yet

- Accounting Concepts and ConventionsDocument40 pagesAccounting Concepts and ConventionsAmrita TatiaNo ratings yet

- Prepare and Match ReciptsDocument15 pagesPrepare and Match Reciptstafese kuracheNo ratings yet

- Calamba Campus Chapter 4 Inventory ProblemsDocument6 pagesCalamba Campus Chapter 4 Inventory ProblemsJeanette Lampitoc100% (2)

- State Whether Each of The Following Statement Is True or FalseDocument7 pagesState Whether Each of The Following Statement Is True or FalseAnamika VatsaNo ratings yet

- Capital Budgeting NPV IrrDocument26 pagesCapital Budgeting NPV Irrkamarulz93_kzNo ratings yet

- Annual Report of IOCL 174Document1 pageAnnual Report of IOCL 174Nikunj ParmarNo ratings yet

- Shareholders' Equity ProblemsDocument18 pagesShareholders' Equity ProblemsDump DumpNo ratings yet

- 2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Document4 pages2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Mohsin Ali Shaikh vlogsNo ratings yet

- Private Equity and Venture CapitalDocument5 pagesPrivate Equity and Venture CapitalpraveenNo ratings yet

- Chapter 12 ExercisesDocument8 pagesChapter 12 ExercisesHanera KingsleyNo ratings yet

- Accounting GeniusDocument9 pagesAccounting Geniusryan angelica allanicNo ratings yet