Professional Documents

Culture Documents

FCE EBDT Bridge 2010 YTD

Uploaded by

Norman OderOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FCE EBDT Bridge 2010 YTD

Uploaded by

Norman OderCopyright:

Available Formats

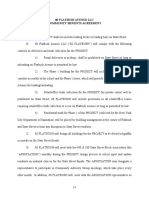

EBDT Bridge EBDT Increase

2010 October YTD vs. 2009 October YTD

Variances are pre-tax in millions with taxes shown separately EBDT Decrease

275.0 3.5 3.8

3.3 5.3

8.4 Nets 7.3

Segment

8.0

265.0 was up

$49.5 11.4

8.9 million

11.0

255.0 Corporate

Land was up

Segment $16.4

18.2 was down

18.1 million

11.4

245.0 $9.5

million

235.0 Combined Commercial and Residential 266.7

Segments were down $5.1 million

18.2

21.5

225.0

31.4

1.8

215.0

222.7 11.3

205.0

Land operations

Tax credit income

NOI on mature portfolio

Other

mature portfolio

Military Housing

Project write-offs

Property sales

New property openings

extinguishment of debt

extinguishment of debt

Gain on disposition of

Nets operations

Corporate interest

severance costs

extinguishment of debt

Corporate activities

2009 October YTD

Taxes

2010 October YTD

Interest on

partial interests

Reduced

Gain on early

Gain on early

Gain on early

.

This graph reflects earnings before depreciation, amortization and deferred taxes ("EBDT") a non‐GAAP measure. For a more thorough discussion of the Company's use of EBDT and a

reconciliation of EBDT to net earnings (loss), the most comparable financial measure calculated in accordance with GAAP, please see pages 22 ‐ 23 and 26 ‐ 27 of the Supplemental

Package for the Nine Months Ended October 31, 2010, located on the Company's website under SEC Filings.

You might also like

- Atlantic Yards FEIS Chapter 12 Traffic ParkingDocument94 pagesAtlantic Yards FEIS Chapter 12 Traffic ParkingNorman OderNo ratings yet

- Pacific Park Conservancy BylawsDocument21 pagesPacific Park Conservancy BylawsNorman OderNo ratings yet

- Woodland Case ALJ Decision, Part of SLA Defense To Second SuitDocument112 pagesWoodland Case ALJ Decision, Part of SLA Defense To Second SuitNorman OderNo ratings yet

- SLA Cancellation Order WoodlandDocument2 pagesSLA Cancellation Order WoodlandNorman OderNo ratings yet

- 648 Pacific Street Firehouse Appraisal Atlantic YardsDocument53 pages648 Pacific Street Firehouse Appraisal Atlantic YardsNorman OderNo ratings yet

- Pacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsDocument26 pagesPacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsNorman OderNo ratings yet

- Block 1118 Lot 6 Appraisal Atlantic YardsDocument14 pagesBlock 1118 Lot 6 Appraisal Atlantic YardsNorman OderNo ratings yet

- State Funding Agreement Atlantic Yards Phase 1 RemediesDocument2 pagesState Funding Agreement Atlantic Yards Phase 1 RemediesNorman OderNo ratings yet

- NYC HDC Board Minutes B3Document17 pagesNYC HDC Board Minutes B3Norman OderNo ratings yet

- Atlantic Yards/Pacific Park Brooklyn Construction Alert 10.28.19 + 11.4.19Document2 pagesAtlantic Yards/Pacific Park Brooklyn Construction Alert 10.28.19 + 11.4.19Norman OderNo ratings yet

- Atlantic Yards/Pacific Park Brooklyn Construction Alert 10/14/19 & 10/21/19Document2 pagesAtlantic Yards/Pacific Park Brooklyn Construction Alert 10/14/19 & 10/21/19Norman OderNo ratings yet

- Development Agreement Penalties For DelayDocument9 pagesDevelopment Agreement Penalties For DelayNorman OderNo ratings yet

- BrooklynSpeaks Slideshow Oct. 3, 2019Document30 pagesBrooklynSpeaks Slideshow Oct. 3, 2019Norman OderNo ratings yet

- Community Benefits Agreement - 80 FlatbushDocument5 pagesCommunity Benefits Agreement - 80 FlatbushNorman OderNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Resume Chapter 4: TRANSACTIONAL PROCESSING AND INTERNAL CONTROL PROCESSDocument4 pagesResume Chapter 4: TRANSACTIONAL PROCESSING AND INTERNAL CONTROL PROCESSaryantiyessyNo ratings yet

- Chapter 6 - Test BankDocument64 pagesChapter 6 - Test Bankjuan80% (5)

- LHDNM-CTIM Tax Forum 2021Document2 pagesLHDNM-CTIM Tax Forum 2021Abdul Mukhriz Abdul RashidNo ratings yet

- Acc311 Solved QuizDocument10 pagesAcc311 Solved QuizalijaleesNo ratings yet

- Tugas Kelompok Audit ForensikDocument32 pagesTugas Kelompok Audit ForensikJacobus BenittoNo ratings yet

- Conceptual Framework and Accounting StandardsDocument2 pagesConceptual Framework and Accounting StandardsJoy KimNo ratings yet

- Aue4862 Test 4 2022 ScenarioDocument16 pagesAue4862 Test 4 2022 ScenarioNosipho NyathiNo ratings yet

- Timetablecat Acca December2012Document1 pageTimetablecat Acca December2012Guyana Sugar Corporation Inc.No ratings yet

- Accounting Information System: Wrai@kuptm - Edu.my©Document6 pagesAccounting Information System: Wrai@kuptm - Edu.my©natasha thaiNo ratings yet

- ABC Implementation Ethics Cma Adapted Applewood ElectronicDocument2 pagesABC Implementation Ethics Cma Adapted Applewood Electronictrilocksp SinghNo ratings yet

- JDocument3 pagesJGinger FoxNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Inventories and COGSDocument30 pagesInventories and COGSJekNo ratings yet

- VAHAN 4.0 (Online Appointment)Document1 pageVAHAN 4.0 (Online Appointment)Gaurav YadavNo ratings yet

- RTP Nov 2022Document139 pagesRTP Nov 2022abhichavan7722No ratings yet

- Assignment InstructionDocument3 pagesAssignment InstructionBongDanielNo ratings yet

- Auditing Test Bank Ch1Document37 pagesAuditing Test Bank Ch1Moti BekeleNo ratings yet

- Vijaya Diagnostic Centre Limited: Matters" On Page 128Document302 pagesVijaya Diagnostic Centre Limited: Matters" On Page 128Abhishek SharmaNo ratings yet

- 2015 Winter DatelineDocument24 pages2015 Winter DatelineindydentalsocietyNo ratings yet

- Hamlin PD Agency AuditDocument2 pagesHamlin PD Agency AuditreagandrNo ratings yet

- Universitas Gadjah Mada Organizational StructureDocument1 pageUniversitas Gadjah Mada Organizational StructureNurma DianiNo ratings yet

- Internal Audit and Corporate Governance in Local GovernmentDocument123 pagesInternal Audit and Corporate Governance in Local GovernmentAsh CastroNo ratings yet

- COPADocument167 pagesCOPANgoc Hong100% (1)

- Mooe Research-BibliograpyDocument14 pagesMooe Research-BibliograpyGraciella Fae PuyaoanNo ratings yet

- FilipinoDocument80 pagesFilipinoJolo NavajasNo ratings yet

- GCC Program Processes v4Document29 pagesGCC Program Processes v4apandeyNo ratings yet

- Access Letter Business Permit OA JENITA MAMBA 2018Document1 pageAccess Letter Business Permit OA JENITA MAMBA 2018Kervin GalangNo ratings yet

- REC Spec.Document128 pagesREC Spec.Sanjay RoutNo ratings yet

- Manatad - Corporate Governance - Analyzing Business IssuesDocument4 pagesManatad - Corporate Governance - Analyzing Business IssuesPring PringNo ratings yet

- Textiles Committee RulesDocument13 pagesTextiles Committee RulesSalil YadavNo ratings yet