Professional Documents

Culture Documents

Cement Sector: ACPL Result Preview

Uploaded by

Muhammad Sarfraz AbbasiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cement Sector: ACPL Result Preview

Uploaded by

Muhammad Sarfraz AbbasiCopyright:

Available Formats

Analyst:

Muhammad Sarfraz Abbasi

sarfraz.abbasi@atlascapital.com.pk

(+92-21)-111-226-100 (Ext.403)

Morning Pulse Jan 25, 2010

Cement Sector: ACPL result

behind the decline, in fact it is attributed to sluggish

demand during the 1HFY11. During 1HFY11 cement

ACCUMULATE

industry has been struggling with the diminishing sales as

preview… 8.19% decline was seen in local dispatches whereas

Market Snapshot

Synopsis… export dispatches were also found 11.16% down against KSE 30 12069.39 -64.63 -0.53

last year. KSE 100 12370.59 -61.32 -0.49

Attock Cement Pakistan Limited (ACPL) is scheduled to

KSE ALL 8584.97 -41.19 -0.48

announced its financial results for 1HFY11 on Thursday,

Pakistan Research

27th January 2011 We expect company to post Profit Rising cost may hurt profitability …

After Tax (PAT) of PRs272.06m (EPS PRs3.14), posting a We expect cost of sales to record upsurge of 14.73% to

sharp decline of 56.39% against corresponding period PRs3.03bn against PRs2.64bn during the same period of

of the last year when company had recorded PAT of last year. This upsurge in cost of sale is mainly driven by Key Data

energy costs and rising tariffs. Floods in Australia have Market Cap(PRs bn) 5.12

PRs623.91m and EPS of PRs7.20 respectively. In our

busted coal supplies to the world while demand is on Shares Outstanding (m) 86.59

today’s report we will discuss expected performance of Bloomberg ACPL.PA

the company in 1HFY11 and future outlook. rise which has pushed up prices to US$128 per ton in

12M Avg. Volume (m) 0.095

December. However, we believe that impact of rising

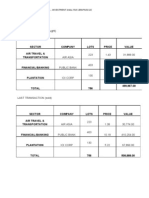

PRs(m) 1HFY10A 1HFY11E % Chg prices especially in the month of December would not

Revenue 3,731 3,609 -3% put a large impact on 1HFY11 profitability as company

COGS 2,642 3,031 15% holds 3 to 4 month coal inventories were bought at

lower rates. 12M ACPL relative performance vs KSE

Gross Profit 1,089 577 -47% 160%

ACPLL KSE-100

Distribution Costs 223 181 -19%

Lower expenses and financial charges may lend 135%

Administrative cost 86 90 4% support to bottom line… 110%

Other expenses 42 32 -22% We expect distribution cost and other expense to

85%

Other income 95 80 -15% record decline of 18.88% and 22.12% respectively. We

Operating profit 833 355 -57% believe that the company’s distribution cost has strong 60%

correlation with the sales and thus reduced sales are

Mar-10

Apr-10

Aug-10

Feb-10

May-10

Jun-10

Sep-10

Nov-10

Dec-10

Jan-10

Oct-10

Jan-11

Jul-10

Financial expenses 41 9 -78%

likely to lead to the lower distribution cost and other

Profit Before Tax 792 345 -56%

expenses. We also expect financial charges to see

Taxes 169 73 -56% substantial decline of 77.78% owing to repayment of

Profit After Tax 624 272 -56% debts.

EPS (PRs) 7.20 3.14 -56%

Source: Company accounts, Atlas Research Future Outlook and recommendation…

We are of the view that ACPL has an immense potential

Depressed demand leads to flimsy revenues… Atlas Capital Markets (Pvt.) Ltd

to increase its market share and profitability. However,

Top line of the company is expected to witness decline scale of the profitability will be forecasted once B-209, Park Towers, Clifton, Karachi

of 3.29% to PRs3.60bn against sales of PRs3.73bn in FY09. reconstruction activities pick up the pace. We expect Equity Research: Equity Sales:

The main reason behind this decline seems diminished construction activities to boost up in 3QCY11. Our DCF

Tel: 92 (21) 5376125 Tel: 92 (21) 5368261-8

Fax: 92 (21) 5376126 Fax: 92 (21) 5376122

dispatches as the company is expect to sell 844.89m based target price for scrip is PRs69 offering 16.73%

tons cement against 854.96m tons in the same period of Money Market: Corporate Finance:

upside potential. We recommend Accumulate stance. Tel: 92 (21) 5376128 Tel: 92 (21) 5824991

last year. Unlike last year retention prices is not the evil Fax: 92 (21) 5376129 Fax: 92 (21) 5376122

Financial Products Distribution:

Disclaimer: All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time

Tel: 92 (21) 5376125

of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Atlas Capital Markets (Pvt.)

Fax: 92 (21) 5376126

Limited accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All

information is provided without warranty and Atlas Capital Markets (Pvt.) Limited makes no representation of warranty of any kind as to the accuracy or Atlas Research is available on Bloomberg and

completeness of any information hereto contained. Thomson Financial

You might also like

- 08 Dec 2010Document1 page08 Dec 2010Muhammad Sarfraz AbbasiNo ratings yet

- Attock Cement Pakistan Limited (ACPL) 1Q/FY11 Financial Performance ReviewDocument1 pageAttock Cement Pakistan Limited (ACPL) 1Q/FY11 Financial Performance ReviewMuhammad Sarfraz AbbasiNo ratings yet

- 19 Aug 2010Document2 pages19 Aug 2010Muhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFBL - A Good BUYDocument1 pageFertilizer Sector: FFBL - A Good BUYMuhammad Sarfraz AbbasiNo ratings yet

- M01OCT09Document1 pageM01OCT09paranoidweaklingNo ratings yet

- Tata Motors Limited: ResearchDocument5 pagesTata Motors Limited: ResearchJustin KhanNo ratings yet

- 03 Jun 10Document2 pages03 Jun 10Muhammad Sarfraz AbbasiNo ratings yet

- Pakistan Weekly Update: Market Remains StagnantDocument9 pagesPakistan Weekly Update: Market Remains StagnantShujaat AhmadNo ratings yet

- Automobiles: Lockdown, RM Inflation Dent EarningsDocument8 pagesAutomobiles: Lockdown, RM Inflation Dent EarningsPrahladNo ratings yet

- Tu858 Ambuja Cements Limited 090302Document6 pagesTu858 Ambuja Cements Limited 090302Patel BhargavNo ratings yet

- Lumax Industries LimitedDocument11 pagesLumax Industries LimiteddarshanmadeNo ratings yet

- Barclays India Cement On The Road To Recovery Initiate On Ultratech and Grasim ADocument115 pagesBarclays India Cement On The Road To Recovery Initiate On Ultratech and Grasim AChirag shahNo ratings yet

- Pakistan Cement IndustryDocument57 pagesPakistan Cement Industrydurraizali100% (1)

- JK Lakshmi Cement LTDDocument12 pagesJK Lakshmi Cement LTDViju K GNo ratings yet

- TheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectDocument1 pageTheSun 2008-12-12 Page30 TNB Seeks Govt Help To Raise Financing For Bakun ProjectImpulsive collectorNo ratings yet

- January 30, 2009Document1 pageJanuary 30, 2009fad_jav100% (2)

- Watts & Bolts: A Monthly Round-Up of Key Data & ImplicationsDocument15 pagesWatts & Bolts: A Monthly Round-Up of Key Data & ImplicationsAshutosh GuptaNo ratings yet

- Daily News 2012 11 13Document5 pagesDaily News 2012 11 13te_gantengNo ratings yet

- GAIL - 3QFY23 - 31-01-2023 - SystematixDocument9 pagesGAIL - 3QFY23 - 31-01-2023 - SystematixvakilNo ratings yet

- Sector Update India Cement April 2018Document120 pagesSector Update India Cement April 2018Vivek PatidarNo ratings yet

- Suzlon IC 24aug23Document50 pagesSuzlon IC 24aug23Abhinav KumarNo ratings yet

- TheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bDocument1 pageTheSun 2009-04-09 Page16 Japan Set To Boost Stimulus To US$150bImpulsive collectorNo ratings yet

- A123 Systems, Inc.: AONE: $17.98 Hold AONE: Believe Promising Outlook With Growing Pains AheadDocument6 pagesA123 Systems, Inc.: AONE: $17.98 Hold AONE: Believe Promising Outlook With Growing Pains AheadRicksCabNo ratings yet

- Sector Report Yes BankDocument53 pagesSector Report Yes BankPriyalNo ratings yet

- TheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisDocument1 pageTheSun 2008-11-18 Page13 PTP Sees Opportunities Amid Glbal Financial CrisisImpulsive collectorNo ratings yet

- Initiating Coverage - Agritech Limited PakistanDocument9 pagesInitiating Coverage - Agritech Limited PakistanShahid AliNo ratings yet

- Company Research 20091014162453Document14 pagesCompany Research 20091014162453ranjith_999No ratings yet

- Ashok Leyland MergerDocument1 pageAshok Leyland Mergerramya patraNo ratings yet

- Networth Cement 10oct07Document10 pagesNetworth Cement 10oct07Megha PoteNo ratings yet

- 1 4 PortfolioDocument4 pages1 4 Portfolioezlin85No ratings yet

- Touseef Finance ReportDocument2 pagesTouseef Finance ReportHaseeb AliNo ratings yet

- Fertilizer Sector: FFBL Result PreviewDocument1 pageFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Work Program List SHEETDocument180 pagesWork Program List SHEETEngrDebashisMallickNo ratings yet

- Expecting Better Results in 2H20 As Production Issues Have AbatedDocument6 pagesExpecting Better Results in 2H20 As Production Issues Have AbatedJustin ChengNo ratings yet

- DieselGen Sector Report 270718-1532688620Document28 pagesDieselGen Sector Report 270718-1532688620Pringles JinglesNo ratings yet

- Thesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelDocument1 pageThesun 2009-04-20 Page14 Asian Carriers Shaken by Plunge in Premium TravelImpulsive collectorNo ratings yet

- SBI Small Cap Fund FactsheetDocument1 pageSBI Small Cap Fund FactsheetPalam PvrNo ratings yet

- 2020-09, Ambit Insights - Motherson SumiDocument34 pages2020-09, Ambit Insights - Motherson SumiKarthikNo ratings yet

- IJM Corporation: ResearchDocument4 pagesIJM Corporation: Researchjcw288No ratings yet

- Sembcorp Marine LTD: Expecting Tardy RecoveryDocument6 pagesSembcorp Marine LTD: Expecting Tardy RecoveryJohn TanNo ratings yet

- Logistics Management Article1Document4 pagesLogistics Management Article1Nago TriguerosNo ratings yet

- Tenaga Nasional Berhad - Higher 1H19 Electricity Surcharge - 181217Document6 pagesTenaga Nasional Berhad - Higher 1H19 Electricity Surcharge - 181217yoyo looNo ratings yet

- Motors+ India Bulls+ +17+06+09Document5 pagesMotors+ India Bulls+ +17+06+09venkatrao_gvNo ratings yet

- List of Existing Power Plants List of Existing Power Plants (Grid-Connected) As of June 2020Document4 pagesList of Existing Power Plants List of Existing Power Plants (Grid-Connected) As of June 2020Pedro GojoNo ratings yet

- VisayasDocument4 pagesVisayasAldrin Lloyd BaalanNo ratings yet

- Cement - Sector - IC - New Player, High Stakes - The Shake-Up IntensifiesDocument98 pagesCement - Sector - IC - New Player, High Stakes - The Shake-Up IntensifiesRohan ShahNo ratings yet

- Thesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewDocument1 pageThesun 2009-02-12 Page16 Ipps Against Power Purchase Pact ReviewImpulsive collectorNo ratings yet

- PSMC - in Dire Straits (AKD Daily, May 19, 2023)Document2 pagesPSMC - in Dire Straits (AKD Daily, May 19, 2023)muddasir1980No ratings yet

- Global Cement Presentation - 19 8 2020 PDFDocument24 pagesGlobal Cement Presentation - 19 8 2020 PDFAamir AzizNo ratings yet

- Pakistan Market Statistics - Apr13 2011Document1 pagePakistan Market Statistics - Apr13 2011Tughral HilalyNo ratings yet

- Suzlon Energy LTD: Still A Winding Road To Recovery: Downgrade To UWDocument11 pagesSuzlon Energy LTD: Still A Winding Road To Recovery: Downgrade To UWSubhasis RoyNo ratings yet

- Ashok Leyland: Preparing To Reap Fruits When The Recovery StartsDocument10 pagesAshok Leyland: Preparing To Reap Fruits When The Recovery StartsKiran KudtarkarNo ratings yet

- 28 Generation Cost April 2023Document1 page28 Generation Cost April 2023sinnyen.hengNo ratings yet

- ACST - Small But MightyDocument6 pagesACST - Small But MightyErma Putri FitriawatiNo ratings yet

- Amreli Steels LTD: Price Performance Belies Fundamentals Reiterate BUY!Document3 pagesAmreli Steels LTD: Price Performance Belies Fundamentals Reiterate BUY!K.QNo ratings yet

- ESSA Ammonia Price ForecastDocument16 pagesESSA Ammonia Price ForecastAndrea MaulanaNo ratings yet

- Group Presentation Feb 2023Document56 pagesGroup Presentation Feb 2023Jay PrajapatiNo ratings yet

- File No. MAS/T&P/344/2017/Vol-VI Subject: Procurement of LCD Projector and ScreenDocument4 pagesFile No. MAS/T&P/344/2017/Vol-VI Subject: Procurement of LCD Projector and ScreenRajat SharmaNo ratings yet

- Automotive Sector: June'11 - Car Sales Fall For A Good ReasonDocument1 pageAutomotive Sector: June'11 - Car Sales Fall For A Good ReasonMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFC Result PreviewDocument1 pageFertilizer Sector: FFC Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: LUCK - FY11 Result ExpectationDocument1 pageCement Sector: LUCK - FY11 Result ExpectationMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFBL Result PreviewDocument1 pageFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: Urea Production Witnessed A Five Year LowDocument2 pagesFertilizer Sector: Urea Production Witnessed A Five Year LowMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: ACPL - Easing Coal Prices Expected To Bode WellDocument1 pageCement Sector: ACPL - Easing Coal Prices Expected To Bode WellMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: FY2011 - A Year Dominated by Devils of Poor Demand and Rise in Input CostsDocument2 pagesCement Sector: FY2011 - A Year Dominated by Devils of Poor Demand and Rise in Input CostsMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFC Result PreviewDocument1 pageFertilizer Sector: FFC Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: All Eyes On 2HFY11Document1 pageCement Sector: All Eyes On 2HFY11Muhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: Dispatches Slow Down ContinuesDocument1 pageCement Sector: Dispatches Slow Down ContinuesMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: Poor Demand Continues To Hamper DispatchesDocument2 pagesCement Sector: Poor Demand Continues To Hamper DispatchesMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector - Yet Another Episode of Substantial Growth in EarningsDocument2 pagesFertilizer Sector - Yet Another Episode of Substantial Growth in EarningsMuhammad Sarfraz AbbasiNo ratings yet

- Automotive Sector: May - Not A Holy MonthDocument1 pageAutomotive Sector: May - Not A Holy MonthMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector - Yet Another Episode of Substantial Growth in EarningsDocument2 pagesFertilizer Sector - Yet Another Episode of Substantial Growth in EarningsMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: Poor Demand Continues To Hamper DispatchesDocument2 pagesCement Sector: Poor Demand Continues To Hamper DispatchesMuhammad Sarfraz AbbasiNo ratings yet

- Cement: DGKC - 9MFY11 Financial Performance PreviewDocument1 pageCement: DGKC - 9MFY11 Financial Performance PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFBL Result PreviewDocument1 pageFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: Numbers Spell Out An Upshot of Soaring PricesDocument1 pageFertilizer Sector: Numbers Spell Out An Upshot of Soaring PricesMuhammad Sarfraz AbbasiNo ratings yet

- Cement: DGKC - 9MFY11 Financial Performance PreviewDocument1 pageCement: DGKC - 9MFY11 Financial Performance PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: DGKC - Subdued Demand and Rising Input Costs Hurting Core BusinessDocument2 pagesCement Sector: DGKC - Subdued Demand and Rising Input Costs Hurting Core BusinessMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: FFBL Result PreviewDocument1 pageFertilizer Sector: FFBL Result PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: Export Demand Bounces BackDocument1 pageCement Sector: Export Demand Bounces BackMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: The War of Survival Is Still OnDocument2 pagesCement Sector: The War of Survival Is Still OnMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: LUCK Missing Luck As Volumes Remain DoomedDocument2 pagesCement Sector: LUCK Missing Luck As Volumes Remain DoomedMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector - CY10 Ended Up With Rock Solid EarningsDocument2 pagesFertilizer Sector - CY10 Ended Up With Rock Solid EarningsMuhammad Sarfraz AbbasiNo ratings yet

- Fertilizer Sector: Offtake Dropped by 22% YoYDocument1 pageFertilizer Sector: Offtake Dropped by 22% YoYMuhammad Sarfraz AbbasiNo ratings yet

- Cement: DGKC - 1HY11 Financial Performance PreviewDocument1 pageCement: DGKC - 1HY11 Financial Performance PreviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: ACPL - 1HFY11 Financial Performance ReviewDocument1 pageCement Sector: ACPL - 1HFY11 Financial Performance ReviewMuhammad Sarfraz AbbasiNo ratings yet

- Cement Sector: LUCK - 1H/FY11 Results PreviewDocument2 pagesCement Sector: LUCK - 1H/FY11 Results PreviewMuhammad Sarfraz AbbasiNo ratings yet