Professional Documents

Culture Documents

TAX107 Unit2 Activity12 Table

Uploaded by

EmilieLarue0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

TAX107_Unit2_Activity12_table

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageTAX107 Unit2 Activity12 Table

Uploaded by

EmilieLarueCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

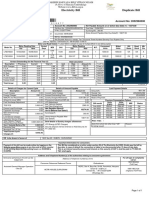

Taxation 107 – Unit 2

Activity 12: Calculation of capital allowances

Asset Additions Disposal details Decline details Closing

adjustable value

Acquired Effective life Cost Date Proceeds Profit/ Method Decline

(years) A$ (loss)

Air conditioner 01/07/06 20 45,000 DV 3,375 41,625

Espresso machine 01/01/07 13.33 65 DV 4 61

Payroll software 01/12/06 2.5 985 PC 229 756

Office furniture 01/02/07 13.33 32,000 DV 1,480 30,520

Ute 01/07/06 8 16,000 PC 2,000 14,000

Motor Vehicle 01/07/06 8 57,009 DV 10,689 46,320

Copyright 01/07/06 25 8,000 PC 320 7,680

Computer 01/07/06 4 3,000 DV 1,125 1,875

Unit 2: Capital gains, capital allowances and accounting for taxes

You might also like

- Upcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingDocument8 pagesUpcoming REG CC Changes Effective July 1, 2020: TD Business Premier CheckingJames FranklinNo ratings yet

- TD Personal Checking: Account # 008-182338743Document1 pageTD Personal Checking: Account # 008-182338743ZTECH71% (7)

- TD Bank StatementDocument3 pagesTD Bank StatementRoger kellyNo ratings yet

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Regions Bank StatementDocument2 pagesRegions Bank StatementEduardo Lozano100% (2)

- Salary Slip - June 2022 - UnlockedDocument2 pagesSalary Slip - June 2022 - UnlockedRmillionsque FinserveNo ratings yet

- Bhitar Gaon PDFDocument1 pageBhitar Gaon PDFNeha SinghNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 4548360000Document1 pageElectricity Bill Duplicate Bill: Account No: 4548360000Prem Batra100% (1)

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Madhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssDocument1 pageMadhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssRASULPUR TURKI PRODUCER COMPANY LIMITEDNo ratings yet

- View-Bill 6 Jun 2023 To 6 Aug 2023Document1 pageView-Bill 6 Jun 2023 To 6 Aug 2023Pankaj AgnihotriNo ratings yet

- Electricity Bill House No 113 Sector 38Document2 pagesElectricity Bill House No 113 Sector 38pawan singhalNo ratings yet

- Bill of Supply For Electricity: Due Date: 23-07-2019Document1 pageBill of Supply For Electricity: Due Date: 23-07-2019mohammed IbrahimNo ratings yet

- Repayment Schedule - 164916682Document1 pageRepayment Schedule - 164916682Shivashakthi MaheshNo ratings yet

- ACCO 20053 Lecture Notes 6 - Notes ReceivableDocument7 pagesACCO 20053 Lecture Notes 6 - Notes ReceivableVincent Luigil AlceraNo ratings yet

- Practice Competency 2021-2022 Final Edited-Format 1Document8 pagesPractice Competency 2021-2022 Final Edited-Format 1CATUGAL, LANCE ALECNo ratings yet

- Knet03 Jan 19Document2 pagesKnet03 Jan 19anand singhNo ratings yet

- Grand Total Premium: 96,234.00 Commission: 2,343.00Document1 pageGrand Total Premium: 96,234.00 Commission: 2,343.00s ramachandranNo ratings yet

- REF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00Document1 pageREF. NO.: - SCISS/ADMN/BRD/10-02-2021: Sub Total: A 8,853.00 8,437.00RajNo ratings yet

- Ele - Bill JuneDocument1 pageEle - Bill Juneabcd12345poiNo ratings yet

- CMP G 42000517953Document1 pageCMP G 42000517953VikasSainiNo ratings yet

- Practice Competency 2023 2024 AK Final v2Document39 pagesPractice Competency 2023 2024 AK Final v2Alhaider LagiNo ratings yet

- Yejide Porter Recent StubDocument1 pageYejide Porter Recent StubMalinda ShortNo ratings yet

- CM 807 20220901 00544807 PDFDocument3 pagesCM 807 20220901 00544807 PDFAsokan MadathilNo ratings yet

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89No ratings yet

- View Bill 1Document1 pageView Bill 1Mitali SrivastavaNo ratings yet

- Fisa Sintetica Simplificata: 1 Taxa Pe Valoarea AdaugataDocument19 pagesFisa Sintetica Simplificata: 1 Taxa Pe Valoarea AdaugataLevi MartonNo ratings yet

- Eztec Itr 1T13 Eng PDFDocument88 pagesEztec Itr 1T13 Eng PDFCultcom ComunicaçãoNo ratings yet

- Monitored Cap. (MW)Document35 pagesMonitored Cap. (MW)Data CentrumNo ratings yet

- CommissionBill 3Document1 pageCommissionBill 3sarbjeet kumarNo ratings yet

- Member - Loan - Ledger - 2023-03-09T104059.446Document3 pagesMember - Loan - Ledger - 2023-03-09T104059.446Maricon D.No ratings yet

- Valuation Report - by Country of Origin / CommodityDocument68 pagesValuation Report - by Country of Origin / CommodityVAT A2ZNo ratings yet

- Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument47 pagesCentral Electricity Authority Go&Dwing Operation Performance Monitoring Divisioncentrum arvindNo ratings yet

- Madhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssDocument1 pageMadhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssInder Kumar100% (1)

- ReportDocument1 pageReportmarty65432164No ratings yet

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- Aur020508176724 Soa BlyDocument5 pagesAur020508176724 Soa Blyganga.ram208No ratings yet

- Ajay Singh Electric BillDocument1 pageAjay Singh Electric Billyadavgourav377No ratings yet

- Ledger TalemboDocument2 pagesLedger TalemboAmalia Areola BuenoNo ratings yet

- View BillDocument1 pageView Billtarundua1607No ratings yet

- Paschimanchal Vidyut Vitaran Nigam LTDDocument1 pagePaschimanchal Vidyut Vitaran Nigam LTDkrishnaNo ratings yet

- View-Bill June 2023Document1 pageView-Bill June 2023Satish TejankarNo ratings yet

- Premium Recipt PDFDocument1 pagePremium Recipt PDFShaibal SenguptaNo ratings yet

- Fisa RolDocument45 pagesFisa RolipiNo ratings yet

- Sales Order Quotation - SERVICE KIT F11Document1 pageSales Order Quotation - SERVICE KIT F11nikson chitowamombeNo ratings yet

- Smart Tech BillDocument1 pageSmart Tech Billsiva chandraNo ratings yet

- View Bill731Document1 pageView Bill731ah95550154No ratings yet

- Monitored Cap. (MW)Document35 pagesMonitored Cap. (MW)Data CentrumNo ratings yet

- BARRA STORE IndiaDocument2 pagesBARRA STORE IndiaDeepak VishwakarmaNo ratings yet

- Income Statement: Managed Rite ConstructionDocument4 pagesIncome Statement: Managed Rite ConstructionJim SchuettNo ratings yet

- Analytical Balance - From January To December 2018: Cta Code Description Previous Balance Debit Credit Current BalanceDocument5 pagesAnalytical Balance - From January To December 2018: Cta Code Description Previous Balance Debit Credit Current BalancePatrícia AnziniNo ratings yet

- EWT/DST-Real Property Date of TransactionDocument3 pagesEWT/DST-Real Property Date of TransactionHanabishi RekkaNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 2671571485Document1 pageElectricity Bill Duplicate Bill: Account No: 2671571485Swapnil ChoudharyNo ratings yet

- Arvind Kumar e BillDocument1 pageArvind Kumar e BillMANISH SAININo ratings yet

- Dep EDDocument74 pagesDep EDRenante SorianoNo ratings yet

- Ele. Bill Aug 2023Document1 pageEle. Bill Aug 2023abcd12345poiNo ratings yet

- FCB Records Summarized 20-22Document8 pagesFCB Records Summarized 20-22Eric HopkinsNo ratings yet

- View BillDocument1 pageView BilljinvalmukundNo ratings yet