Professional Documents

Culture Documents

Marginal Costing

Marginal Costing

Uploaded by

prakkuu0 ratings0% found this document useful (0 votes)

9 views1 pageMarginal costing is a method of costing that involves calculating the cost of producing additional units of a product or service. It focuses only on variable costs and does not allocate fixed costs. Marginal costing is used to make pricing decisions by setting prices at or above the marginal cost to contribute to fixed costs, as well as for product discontinuation, make-or-buy decisions, and dealing with production constraints. In contrast, absorption costing allocates all fixed and variable costs to products.

Original Description:

Original Title

MARGINAL COSTING

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMarginal costing is a method of costing that involves calculating the cost of producing additional units of a product or service. It focuses only on variable costs and does not allocate fixed costs. Marginal costing is used to make pricing decisions by setting prices at or above the marginal cost to contribute to fixed costs, as well as for product discontinuation, make-or-buy decisions, and dealing with production constraints. In contrast, absorption costing allocates all fixed and variable costs to products.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageMarginal Costing

Marginal Costing

Uploaded by

prakkuuMarginal costing is a method of costing that involves calculating the cost of producing additional units of a product or service. It focuses only on variable costs and does not allocate fixed costs. Marginal costing is used to make pricing decisions by setting prices at or above the marginal cost to contribute to fixed costs, as well as for product discontinuation, make-or-buy decisions, and dealing with production constraints. In contrast, absorption costing allocates all fixed and variable costs to products.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

MARGINAL COSTING

Definition of Marginal Costing

The expenditure incurred by producing a further unit of a product or service, or the

expenditure saved by not producing it. Marginal cost pricing is the fixing of the price

of all units at the cost of producing the last unit.

Uses of Marginal Costing

For dropping a product or discontinuing a department.

Make or buy decisions.

Accepting a special order (at a lower price than normal).

Dealing with a limiting factor or multiple limiting factors.

What is different between marginal costing and absorption

costing?

Marginal costing is also known as contribution costing.

Its a costing method that’s includes only a variable cost of a product no

attempt is made to allocate or appropriate fixed costs to cost centers.

The setting of prices is basically based on the variable costs of making a

product.

If the prices are set above this unit cost then each item sold will make a

condition to fixed costs.

On the other hand absorption costing or full costing is an approach to the

costing of products that allocated all costs of production to cost centers. The

aim is to ensure that all business costs are covered.

You might also like

- Absorption Costing and Marginal CostingDocument10 pagesAbsorption Costing and Marginal CostingSara Khalid0% (1)

- Introduction To Marginal CostingDocument8 pagesIntroduction To Marginal CostingSaurabh Bansal100% (1)

- Marginal Costing and Absorption CostingDocument28 pagesMarginal Costing and Absorption Costingmanas_samantaray28No ratings yet

- Chapter 20 - Decision MakingDocument12 pagesChapter 20 - Decision MakingAgrawal PriyankNo ratings yet

- Components of Break-Even Analysis Fixed CostsDocument4 pagesComponents of Break-Even Analysis Fixed CostssuganNo ratings yet

- Costng Sem 2 FinalDocument22 pagesCostng Sem 2 FinalYatriShahNo ratings yet

- Concept of Marginal Cost, Marginal CostingDocument14 pagesConcept of Marginal Cost, Marginal CostingMaheen KhanNo ratings yet

- Marginal CostingDocument14 pagesMarginal CostingVijay DangwaniNo ratings yet

- Marginal Costing and Cost Volume Profit AnalysisDocument5 pagesMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanNo ratings yet

- Marginal & Absorption CostingDocument26 pagesMarginal & Absorption CostingPrachi VaishNo ratings yet

- Costing Pre Final ReviewerDocument3 pagesCosting Pre Final ReviewerRobin LusabioNo ratings yet

- Break Even Analysis - Avoidable Cost - Contribution MarginDocument15 pagesBreak Even Analysis - Avoidable Cost - Contribution MarginJeralyn GarayNo ratings yet

- Unit VDocument11 pagesUnit Vthella deva prasadNo ratings yet

- Marginal Costing and Absorption CostingDocument9 pagesMarginal Costing and Absorption CostingKhushboo AgarwalNo ratings yet

- Cost Accounting and Break-Even AnalysisDocument11 pagesCost Accounting and Break-Even AnalysisAnushka NigamNo ratings yet

- 202005272153381522au-Marginal Costing-2Document11 pages202005272153381522au-Marginal Costing-2GauravsNo ratings yet

- 18bco506 Applications of MCTDocument9 pages18bco506 Applications of MCT18BCO506 Dayanandh KNo ratings yet

- What Is Cost?: Fixed Cost and Variable CostDocument17 pagesWhat Is Cost?: Fixed Cost and Variable CostakshataNo ratings yet

- Marginal Costing PDFDocument26 pagesMarginal Costing PDFMasumiNo ratings yet

- Marginal Costing MCQ Last YearDocument245 pagesMarginal Costing MCQ Last YearSankalp ChavanNo ratings yet

- Aplification of Marginal Costing in Terms of Cost ControlDocument4 pagesAplification of Marginal Costing in Terms of Cost ControlRamesh PaladuguNo ratings yet

- Management Accounting GlossaryDocument10 pagesManagement Accounting GlossaryPooja GuptaNo ratings yet

- Marginal CostingDocument42 pagesMarginal CostingAbdifatah SaidNo ratings yet

- Marginal Costing PDFDocument86 pagesMarginal Costing PDFarts lifeNo ratings yet

- Marginal CostingDocument25 pagesMarginal Costingsucheta_kanchiNo ratings yet

- Pricing Policies and DecisionsDocument10 pagesPricing Policies and DecisionsayushdixitNo ratings yet

- Marginal Costing - DefinitionDocument15 pagesMarginal Costing - DefinitionShivani JainNo ratings yet

- 5 Marginal CostingDocument31 pages5 Marginal CostingAkash GuptaNo ratings yet

- Characteristics of Marginal CostingDocument2 pagesCharacteristics of Marginal CostingLJBernardoNo ratings yet

- Unit III - Marginal CostingDocument19 pagesUnit III - Marginal Costingsubhash dalviNo ratings yet

- CostingDocument32 pagesCostingnidhiNo ratings yet

- Marginal Costing: A Management Technique For Profit Planning, Cost Control and Decision MakingDocument17 pagesMarginal Costing: A Management Technique For Profit Planning, Cost Control and Decision Makingdivyesh_variaNo ratings yet

- Cost Accounting DefinationsDocument7 pagesCost Accounting DefinationsJâmâl HassanNo ratings yet

- Learning ObjectivesDocument10 pagesLearning ObjectivesShraddha MalandkarNo ratings yet

- Marginal Costing IntroductionDocument5 pagesMarginal Costing IntroductionPavan AcharyaNo ratings yet

- PRICEDocument22 pagesPRICEelladomingo54No ratings yet

- Pricing Strategy Midterm HandoutDocument39 pagesPricing Strategy Midterm HandoutBryan ArenasNo ratings yet

- Marginal Costing: Definition: (CIMA London)Document4 pagesMarginal Costing: Definition: (CIMA London)Pankaj2cNo ratings yet

- Marginal Costing and Absorption CostingDocument10 pagesMarginal Costing and Absorption Costingferos100% (12)

- DR Rachna Mahalwala - B.Com III Year Management AccountingDocument5 pagesDR Rachna Mahalwala - B.Com III Year Management AccountingAnonymous 3yqNzCxtTzNo ratings yet

- Chapter OneDocument19 pagesChapter OneChera HabebawNo ratings yet

- Marginal Costing and Profit PlanningDocument12 pagesMarginal Costing and Profit PlanningHarsh KhatriNo ratings yet

- Introduction To Food CostingDocument17 pagesIntroduction To Food CostingSunil YogiNo ratings yet

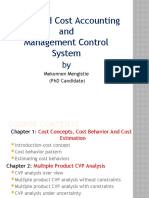

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunNo ratings yet

- Break Even Analysis: Costing Systems and Techniques For Engineering CompaniesDocument6 pagesBreak Even Analysis: Costing Systems and Techniques For Engineering Companiesasimrafiq12No ratings yet

- 4 - Cost Analysis For Decision MakingDocument2 pages4 - Cost Analysis For Decision MakingPattraniteNo ratings yet

- Chapter 3 - Pricing Objectives and Price DeterminationDocument7 pagesChapter 3 - Pricing Objectives and Price DeterminationChierhy Jane BayudanNo ratings yet

- Marginal and Absorption CostingDocument5 pagesMarginal and Absorption CostingHrutik DeshmukhNo ratings yet

- Exam Study NoteDocument8 pagesExam Study Notezayyar htooNo ratings yet

- Pre-Study Session 4Document10 pagesPre-Study Session 4Narendralaxman ReddyNo ratings yet

- Lecture11 TE 13may BreakevenAnalysisDocument3 pagesLecture11 TE 13may BreakevenAnalysisFassikaw EjjiguNo ratings yet

- PF CostingDocument3 pagesPF CostingKimberly MarquezNo ratings yet

- Marginal and Absorption CostingDocument4 pagesMarginal and Absorption CostingNabeel Ismail/GDT/BCR/SG4No ratings yet

- Pricing: K.Rajesh Khanna ChowdaryDocument11 pagesPricing: K.Rajesh Khanna Chowdarykhannachowdary4No ratings yet

- Pricing Strategy TermsDocument3 pagesPricing Strategy TermsVernie N. PiamonteNo ratings yet

- Unit 2 Acct312-UnlockedDocument16 pagesUnit 2 Acct312-UnlockedTilahun GirmaNo ratings yet

- Answer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Document2 pagesAnswer:: Q1. What Is Marginal Costing? Explain and How Is It Different From Absorption Costing?Jay PatelNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet