Professional Documents

Culture Documents

Book 1

Uploaded by

Timothy John Sosa Tiongson0 ratings0% found this document useful (0 votes)

13 views1 pageOriginal Title

Book1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views1 pageBook 1

Uploaded by

Timothy John Sosa TiongsonCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

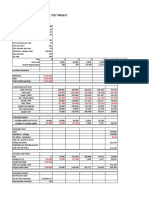

EPS/EBIT Analysis for KKD

Amount Needed: $1,000,000,000

Tax Rate: 38%

Interest Rate: 5%

Stock Price: $25/share

Annual Dividend: $2/share

EBIT Range: $100M to $1B

Outstanding Shares: 60,000,000 shares

COMMON STOCK DEBT 50% STOCK 50% DEBT

EBIT 100M 1B 100M 1B 100M 1B

Interest (5%) 0 0 (50M) (50M) (25M) (25M)

EBT 100M 1B 50M 950M 75M 975M

Taxes(38%) (38M) (380M) (19M) (361M) (28.5M) (370.5M)

EAT 62M 620M 31M 589M 46.5M 604.5M

Dividends (120M) (120M) (120M) (120M) (120M) (120M)

EATD (58M) 500M (89M) 469M (73.5M) 484.5M

No. of shares 100M 100M 60M 60M 80M 80M

EPS -0.58 5 -1.48 7.82 -0.92 6.06

Conclusion: KKD should use Common Stock Financing to raise capital if it has an EBIT of $100,000,000.

On the other hand, it should use Debt Financing if it has an EBIT of 1,000,000,000.

You might also like

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- Solar Energy Cash Flow Canadian Solar Share XLS Stripped 01Document40 pagesSolar Energy Cash Flow Canadian Solar Share XLS Stripped 01Bhaskar Vijay SinghNo ratings yet

- Corporate Finance Case Study WorkingDocument11 pagesCorporate Finance Case Study WorkingS.H. Rustam16% (19)

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- Hola KolaDocument3 pagesHola Kola17crushNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- Case 1 AnswerDocument10 pagesCase 1 AnswerEdwin EspirituNo ratings yet

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Final Exam - KW - Simulation - Tamal 2239890Document7 pagesFinal Exam - KW - Simulation - Tamal 2239890Tamal Sarkar100% (2)

- Loan Schedule: Comparable CompaniesDocument30 pagesLoan Schedule: Comparable CompaniesIrene Mae GuerraNo ratings yet

- Investment Plan Using Valuation Vs Trendline Log RegressionDocument12 pagesInvestment Plan Using Valuation Vs Trendline Log RegressionfoxNo ratings yet

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Document4 pagesProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNo ratings yet

- Sol.-Man. Chapter-14 Bvps 2021Document9 pagesSol.-Man. Chapter-14 Bvps 2021Jean Mira AribalNo ratings yet

- 26.08.2021 ZSE Price SheetDocument1 page26.08.2021 ZSE Price Sheetdenford dangayisoNo ratings yet

- Case 2 Marking SchemeDocument22 pagesCase 2 Marking SchemeHello100% (1)

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- BW Brief 11 June 2018Document1 pageBW Brief 11 June 2018BidWell ReportNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Capital Budgeting Example ExcelDocument1 pageCapital Budgeting Example ExcelNgoc Hong DuongNo ratings yet

- Case 6Document3 pagesCase 6Farhanie Nordin0% (1)

- Strategic Management - EPS and EBIT AnalysisDocument6 pagesStrategic Management - EPS and EBIT AnalysisHaris KhanNo ratings yet

- Sol. Man. - Chapter 14 - BVPS - 2021Document11 pagesSol. Man. - Chapter 14 - BVPS - 2021Crystal Rose TenerifeNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Fin Model Projects SensitivityDocument9 pagesFin Model Projects SensitivityjagpreetNo ratings yet

- Docit - Tips Metabical-CaseDocument4 pagesDocit - Tips Metabical-Casefatty acidNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- BREIT Monthly Performance - February 2020Document26 pagesBREIT Monthly Performance - February 2020MAYANK AGGARWALNo ratings yet

- NPV ExcelDocument7 pagesNPV Excelkhanfaiz4144No ratings yet

- Exercise Full and Partial Goodwill CMK Q&ADocument2 pagesExercise Full and Partial Goodwill CMK Q&ANur Dina AbsbNo ratings yet

- 10-14 InstallmentDocument4 pages10-14 InstallmentMary Ingrid Arellano RabulanNo ratings yet

- Exel Calculation (Version 1)Document10 pagesExel Calculation (Version 1)Timotius AnggaraNo ratings yet

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDocument13 pagesA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- EBIT-EPS AnalysisDocument15 pagesEBIT-EPS AnalysisKailas Sree ChandranNo ratings yet

- Strategic Management - EPS - EBITDocument1 pageStrategic Management - EPS - EBITHaris KhanNo ratings yet

- ET Sample Questions - SolnDocument4 pagesET Sample Questions - SolnShivamNo ratings yet

- BW Brief 19 June 2017Document1 pageBW Brief 19 June 2017BidWell ReportNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- FIS 2020-21 End Term AnswerDocument6 pagesFIS 2020-21 End Term AnswerAaryan SarupriaNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Bonos 19-06-18Document7 pagesBonos 19-06-18Maximiliano A. SireraNo ratings yet

- BW Brief 14 June 2018Document1 pageBW Brief 14 June 2018BidWell ReportNo ratings yet

- BWR 19 June 2018Document2 pagesBWR 19 June 2018BidWell ReportNo ratings yet

- Al-Jouf Q2Document1 pageAl-Jouf Q2Faris AlqhtaniNo ratings yet

- CA Lecture 2022Document25 pagesCA Lecture 2022Kristine Lei Del MundoNo ratings yet

- Ulrich SkeletonDocument227 pagesUlrich SkeletonParth Dhingra0% (3)

- CasesDocument74 pagesCasesPollsNo ratings yet

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- 3Document8 pages3YogeshPrakashNo ratings yet

- Complete Investment Appraisal - 2Document7 pagesComplete Investment Appraisal - 2Reagan SsebbaaleNo ratings yet

- Case Data: The ProposalDocument13 pagesCase Data: The ProposalРодион ЗдоровецNo ratings yet

- Du Pont Titanium ADocument15 pagesDu Pont Titanium AEshesh GuptaNo ratings yet

- Finals Quiz Assignment Private Equity Valuation Methods With AnswersDocument7 pagesFinals Quiz Assignment Private Equity Valuation Methods With AnswersRille Estrada CabanesNo ratings yet

- Manufacture & OutsourceDocument7 pagesManufacture & OutsourceRonyNo ratings yet

- Case 1 - TaylorDocument5 pagesCase 1 - TaylorEdwin EspirituNo ratings yet

- Capital BudgetingDocument20 pagesCapital BudgetingAngelo VilladoresNo ratings yet

- Total Max 1 Trillion $SIMP. 1 BNB For 225 Million $SIMP: Token Sale & DistributionDocument2 pagesTotal Max 1 Trillion $SIMP. 1 BNB For 225 Million $SIMP: Token Sale & Distributionwin rezpectNo ratings yet