Professional Documents

Culture Documents

011 Atlantic Efficient Market Theory

Uploaded by

altlanticCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

011 Atlantic Efficient Market Theory

Uploaded by

altlanticCopyright:

Available Formats

Atlantic International Partnership Madrid’s Professional Market Idea

A branch of financial imagined regarded as 'efficient marketplace theory' hypothesizes the stock marketplace is

nearly completely successful within the sense that asset values are pretty much completely priced when factoring

in all regarded information and facts. Taking this concept to the excessive would mean that a monkey randomly

choosing stocks would do no superior or even worse on regular than a Wall Road guru.

Atlantic International Partnership investors are uniquely dynamic individuals or groups of individuals. AIP investors

invest their capital in new or early stage companies. We have found that AIP investors are not a source of capital

alone but we have found them to make excellent mentors. As most AIP investors are in fact successful

entrepreneurs or business people themselves we have found that they are able to offer entrepreneurs advice and

helpful suggestions based on the experience that they have accumulated from their own businesses.

Some people subscribe to this theory. Their most important reasoning is that there are actually lots of proficient

persons that actively invest in stocks (imagine head fund managers, mutual fund managers, personal equity guys,

and so forth.) that all stocks are accurately valued. The one way to make extra dollars in the stock industry, or any

aasset class for that issue, will be to get on additional possibility. Otherwise, it's futile to try to look at to decide on

stocks due to the fact you will not come across any very good specials (others would have already located them

and bid up the stock's price).

Folks who believe on this idea frequently just make investments in broad, index money with small expense costs.

They try to diversify to mitigate risk (hence the appeal of ETFs or index money) as well as attempt to reduce

transaction expenses (yet again, the appeal of ETFs). By investing in ETFs and index fund, additionally they can just

park their cash while in the long-run, that will limit their tax liability.

The market does a fairly great job at precisely pricing stocks, and within the complete, most traders likely can't

beat a random monkey choosing stocks. But effective marketplace idea can't make clear why some traders

consistently beat the market, this kind of as legendary investors like Warren Buffet and George Soros. Additionally

it is stretch to consider the each day gyrations from the stock marketplace are fully rational.

It is also hard to describe the tech boom of 95-99 and subsequent crash in 2000-2002 by means of efficient market

place theory, since this was a rather apparent episode of extreme investor exuberance for tech stocks.

Also, while there's lots of .wise cash. while in the industry, this 'smart money' is often handicapped by large asset

bases. Nearly all of the very best investors have asset bases of $250 million+ to offer with, so they are not able to

place much of their money in to the stocks that they automatically feel are the greatest buys.

Such as, if a hedge fund manager who manages $500 million thinks a corporation that has a industry capitalization

of $500 million is an excellent acquire, he are not able to put very much of his asset base within their physically. If

he invested all of it, he would have bought the business! That, as well as using a sizeable infusion of cash would

have bid the stock.s total price up way past its value.

Moreover, as much sensible revenue is available, there may be also lots of dumb money as well. Plenty of people

don't understand what they.re performing, and they trade determined by emotion, primary to bad investment

decisions. It really is for these motives that when effective market place principle has its merits, it is a massive

stretch to imagine that present day financial markets are virtually entirely effective.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Delaware Incorporation Handbook (13th Edition, 2012) PDFDocument89 pagesDelaware Incorporation Handbook (13th Edition, 2012) PDFanonim_user100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Harbour Club USA PDFDocument30 pagesHarbour Club USA PDFAlina Ionita100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Bec Vantage Practice TestsDocument35 pagesBec Vantage Practice TestsYana S Stoyanova0% (1)

- Multiple Choice Question: General ControlsDocument20 pagesMultiple Choice Question: General ControlsEj TorresNo ratings yet

- FIN352 - Review Questions For Midterm ExamDocument23 pagesFIN352 - Review Questions For Midterm ExamChloe MillerNo ratings yet

- Chapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsDocument22 pagesChapter 15 Test Bank Partnerships - Formation, Operations, and Changes in Ownership InterestsOBC LingayenNo ratings yet

- Doing Business in The PhilippinesDocument29 pagesDoing Business in The Philippinestakyous100% (1)

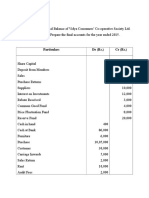

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- Financial Analysis of EbayDocument27 pagesFinancial Analysis of EbaySullivan Military0% (2)

- Nautica Canning Corp. vs. YumulDocument1 pageNautica Canning Corp. vs. YumulAnonymous 5MiN6I78I0No ratings yet

- Fong vs. DuenasDocument2 pagesFong vs. DuenasNathan Michael Vasquez100% (2)

- AC710 Solution - Chapter 1Document21 pagesAC710 Solution - Chapter 1Kathy Thanh PKNo ratings yet

- Atlantic International Partnership Madrid Exposing The Five Fallacies of Stock TradingDocument2 pagesAtlantic International Partnership Madrid Exposing The Five Fallacies of Stock TradingaltlanticNo ratings yet

- Atlantic International Partnership Madrid - How Come My Tracker Fund Is Volatile?Document2 pagesAtlantic International Partnership Madrid - How Come My Tracker Fund Is Volatile?altlanticNo ratings yet

- Atlantic International Partnership Review - Disaster Could Show As Japan's Stepping Stone To Economic DevelopmentDocument2 pagesAtlantic International Partnership Review - Disaster Could Show As Japan's Stepping Stone To Economic DevelopmentaltlanticNo ratings yet

- Atlantic International Partnership Madrid: Wall Street Falls With Euro-ZonesDocument2 pagesAtlantic International Partnership Madrid: Wall Street Falls With Euro-ZonesaltlanticNo ratings yet

- 014 Atlantic 3 Worst Income Selections You Can MakeDocument5 pages014 Atlantic 3 Worst Income Selections You Can MakealtlanticNo ratings yet

- 015 Atlantic Tax Write-Offs That Can Get You Into TroubleDocument2 pages015 Atlantic Tax Write-Offs That Can Get You Into TroublealtlanticNo ratings yet

- 013 Atlantic International Investment Research Due Diligence and AnalysisDocument1 page013 Atlantic International Investment Research Due Diligence and AnalysisaltlanticNo ratings yet

- 012 Atlantic International Partnership - Commodities and BondsDocument2 pages012 Atlantic International Partnership - Commodities and BondsaltlanticNo ratings yet

- India's Market Oulined by Atlantic International PartnershipDocument1 pageIndia's Market Oulined by Atlantic International PartnershipaltlanticNo ratings yet

- India's Market Oulined by Atlantic International PartnershipDocument1 pageIndia's Market Oulined by Atlantic International PartnershipaltlanticNo ratings yet

- 08 Atlantic Retirement - Investing - Experts - Tips - HVCDocument1 page08 Atlantic Retirement - Investing - Experts - Tips - HVCaltlanticNo ratings yet

- UntitledDocument1 pageUntitledaltlanticNo ratings yet

- Financial Markets and Institutions SYLLABUSDocument5 pagesFinancial Markets and Institutions SYLLABUSmuralikrishnav100% (1)

- Emerging Manager Event 2015 Event DirectoryDocument44 pagesEmerging Manager Event 2015 Event DirectoryEstherTanNo ratings yet

- Quiz (2)Document13 pagesQuiz (2)zeyad GadNo ratings yet

- Ronda 2 ResultadosDocument3 pagesRonda 2 ResultadosCristian MiunsipNo ratings yet

- Book-Keeping and Accounts L2Document18 pagesBook-Keeping and Accounts L2Wing Yan Katie100% (1)

- Lecture 08 - Relative Valuation - Using Market ComparablesDocument76 pagesLecture 08 - Relative Valuation - Using Market ComparablesDanila GallaratoNo ratings yet

- Will These '20s Roar?: Global Asset Management 2019Document28 pagesWill These '20s Roar?: Global Asset Management 2019Nicole sadjoliNo ratings yet

- Analysis of Working Capital Management: A Project Report OnDocument39 pagesAnalysis of Working Capital Management: A Project Report OngitarghawaleNo ratings yet

- Resultado Mercado LivreDocument12 pagesResultado Mercado LivreBruno Enrique Silva AndradeNo ratings yet

- Business Finance: Introduction To Financial ManagementDocument9 pagesBusiness Finance: Introduction To Financial ManagementAprhile Darlene ObagNo ratings yet

- General Counsel in New York NY Resume Adele FreedmanDocument3 pagesGeneral Counsel in New York NY Resume Adele FreedmanAdeleFreedmanNo ratings yet

- The Effects of Mergers and Acquisitions On Stock Prices: Evidence From International Transactions From 2001-2016Document39 pagesThe Effects of Mergers and Acquisitions On Stock Prices: Evidence From International Transactions From 2001-2016Shee LokandeNo ratings yet

- Absorption and Marginal CostingDocument3 pagesAbsorption and Marginal CostingZaira AneesNo ratings yet

- Merger &acquisitionDocument150 pagesMerger &acquisitionMadhvendra BhardwajNo ratings yet

- F7irl 2010 Dec AnsDocument11 pagesF7irl 2010 Dec AnsNghiêm Thị Mai AnhNo ratings yet

- Santamaria Vs HSBCDocument6 pagesSantamaria Vs HSBCT Cel MrmgNo ratings yet

- CIR Versus CA (Trust Fund Doctrine)Document8 pagesCIR Versus CA (Trust Fund Doctrine)Hv EstokNo ratings yet

- Drillers and Dealers June 2012Document47 pagesDrillers and Dealers June 2012ross_s_campbellNo ratings yet