Professional Documents

Culture Documents

PF Esi Calculation Sheet

PF Esi Calculation Sheet

Uploaded by

GuruRJ0 ratings0% found this document useful (0 votes)

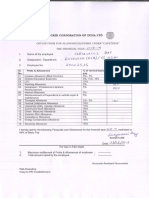

13 views2 pagesThis document is a calculation sheet for an employee's provident fund (PF) and employee state insurance (ESI) contributions. It lists the employee's name and basic salary, then calculates the amounts to be deducted from the employee's salary and contributed by the employer for PF across multiple accounts. It also calculates the employee and employer contribution amounts for ESI based on the employee's gross salary. The total amounts to be paid by the employer to the relevant funds are shown as zero, indicating this is a template rather than a completed form.

Original Description:

Original Title

Pf_esi_calculation_sheet

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a calculation sheet for an employee's provident fund (PF) and employee state insurance (ESI) contributions. It lists the employee's name and basic salary, then calculates the amounts to be deducted from the employee's salary and contributed by the employer for PF across multiple accounts. It also calculates the employee and employer contribution amounts for ESI based on the employee's gross salary. The total amounts to be paid by the employer to the relevant funds are shown as zero, indicating this is a template rather than a completed form.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesPF Esi Calculation Sheet

PF Esi Calculation Sheet

Uploaded by

GuruRJThis document is a calculation sheet for an employee's provident fund (PF) and employee state insurance (ESI) contributions. It lists the employee's name and basic salary, then calculates the amounts to be deducted from the employee's salary and contributed by the employer for PF across multiple accounts. It also calculates the employee and employer contribution amounts for ESI based on the employee's gross salary. The total amounts to be paid by the employer to the relevant funds are shown as zero, indicating this is a template rather than a completed form.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

NAME OF THE COMPANY

LALIT AGGARWAL

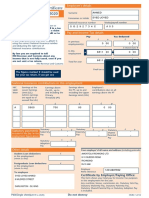

CALCULATION SHEET OF PROVIDENT FUND & ESI PF TO BE DEDUCTED

ON BASIC SALARY

PROVIDENT FUND PAYABLE <=6500/-PM

BASIC SALARY

EMPLOYEES CONTRIBUTION TO PF 12% 0

EMPLOYERS CONTRIBUTION TO PFAS UNDER

A/C NO. 1 3.67% 0

A/C NO. 2 1.10% 0 LA

PU

A/C NO. 10 8.33% 0 SA

A/C NO. 21 0.50% 0

A/C NO. 22 0.01% 0

EMPLOYERS CONTRIBUTION TO PF 13.61% 0

TOTAL TO BE PAID TO EPFO 0

NAME OF THE COMPANY

CALCULATION SHEET OF ESI

ESI PAYABLE ON GROSS SALARY

LALIT AGGARWAL

GROSS SALARY PUT THE TOTAL GROSS

SALARY ONLY.

EMPLOYEES CONTRIBUTION TO ESI 1.75% 0

EMPLOYERS CONTRIBUTION TO PF 4.75% 0

TOTAL TO BE PAID TO ESIC 0

LALIT AGGARWAL

ESI TO BE DEDUCTED

ON GROSS SALARY

<=15000/-PM W.E.F

01.05.2010.

You might also like

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- Tax Calculator 2008-09Document1 pageTax Calculator 2008-09sukumarsukumaranNo ratings yet

- Salary Structure For 2008-2009Document28 pagesSalary Structure For 2008-2009anon-289280No ratings yet

- Quikchex CTC CalculatorDocument8 pagesQuikchex CTC CalculatoriamgodrajeshNo ratings yet

- Payment Advice: Labour Solutions Australia PTY LTDDocument1 pagePayment Advice: Labour Solutions Australia PTY LTDZulfiqar AliNo ratings yet

- Naga 1Document1 pageNaga 1Anonymous IaKbBoPRNo ratings yet

- Jocata Financial Advisory & Technology Pay Slip: Attendance Details ValueDocument1 pageJocata Financial Advisory & Technology Pay Slip: Attendance Details ValueAshuNo ratings yet

- Salary SlipDocument2 pagesSalary SlipDhruvil Radadiya0% (2)

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- Salary Slip: Month Employee Name: Year Designation: School Name Income Tax PANDocument2 pagesSalary Slip: Month Employee Name: Year Designation: School Name Income Tax PANMohamad SallihinNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- EIN CP 575 - 2Document2 pagesEIN CP 575 - 2minhdang03062017No ratings yet

- Annex C RR 11 2018 PDFDocument1 pageAnnex C RR 11 2018 PDFMahko albert RslesNo ratings yet

- PayslipDocument1 pagePayslipSudheer Jangala50% (2)

- Model CTC Calculation 420000 Heads %age P.A. (RS.) P.M. (RS.) Fixed or VariableDocument2 pagesModel CTC Calculation 420000 Heads %age P.A. (RS.) P.M. (RS.) Fixed or Variableranjana sharmaNo ratings yet

- 4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Document6 pages4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Charles Mateo100% (3)

- Income Tax 2010-11Document11 pagesIncome Tax 2010-11Peddireddy Koti ReddyNo ratings yet

- Summary Epfo1Document1 pageSummary Epfo1sudhirNo ratings yet

- Fd's Rate of Interest Smc1.29pmwedmar142012Document3 pagesFd's Rate of Interest Smc1.29pmwedmar142012VenkatachalapathySubbarajNo ratings yet

- PF Calculation & Challan ExcelDocument5 pagesPF Calculation & Challan ExcelRahul Dhumal50% (2)

- Instructions: Mohd Jawad (Javi 'S) Typist Mpp. EllanthakuntaDocument28 pagesInstructions: Mohd Jawad (Javi 'S) Typist Mpp. EllanthakuntaJavi NicekNo ratings yet

- A1 Distributor IncDocument1 pageA1 Distributor IncDean Dean DeanNo ratings yet

- RequisitionDocument1 pageRequisitionBahirkhand SchoolNo ratings yet

- List of Fixed Deposit Schemes For The Month of January 2013Document6 pagesList of Fixed Deposit Schemes For The Month of January 2013Kalpesh ShahNo ratings yet

- E Liwag 01312007 OLDDocument2 pagesE Liwag 01312007 OLDdaqs06No ratings yet

- Income Tax Amendments Nov 2020Document25 pagesIncome Tax Amendments Nov 2020Cloxan India Pvt LtdNo ratings yet

- 11.total Premium Rs.21,75,422Document2 pages11.total Premium Rs.21,75,422Arpit SharmaNo ratings yet

- Provident FundDocument18 pagesProvident FundsedunairNo ratings yet

- Lkoa 05952Document2 pagesLkoa 05952Rajan RastogiNo ratings yet

- Epf Ecr Apr'20 371-1Document20 pagesEpf Ecr Apr'20 371-1K KumarNo ratings yet

- '1. Employee: 3A) Lasa (Al 2.: / 3 3. Employeeno.:: Ra/ En6Rnter' 6ooo3534Document1 page'1. Employee: 3A) Lasa (Al 2.: / 3 3. Employeeno.:: Ra/ En6Rnter' 6ooo3534RAJESH PARIKSYANo ratings yet

- Payslip For The Month of August - 2022Document1 pagePayslip For The Month of August - 2022Rameshram Accet RamNo ratings yet

- Fill in The Data Below: V. Murali Krishna 1 Male APCPM5840M S.G.T O/o M.E.O., S. N. PADUDocument21 pagesFill in The Data Below: V. Murali Krishna 1 Male APCPM5840M S.G.T O/o M.E.O., S. N. PADUyerrajo2009No ratings yet

- Nov 2019 PF ECR PolserDocument2 pagesNov 2019 PF ECR PolserMela RavalNo ratings yet

- Income Tax 2010-11Document7 pagesIncome Tax 2010-11gsreddyNo ratings yet

- Periodo: Mayo - 2016 RUC: 20200575644 Razon Social: El Andino S.A.C. Planilla de RemuneracionesDocument3 pagesPeriodo: Mayo - 2016 RUC: 20200575644 Razon Social: El Andino S.A.C. Planilla de RemuneracionesYovica EdelmiraNo ratings yet

- Comparing The Compensation of A PSU and A StartupDocument11 pagesComparing The Compensation of A PSU and A Startuphuga lalaNo ratings yet

- Law Consulting Sales Pitch by SlidesgoDocument21 pagesLaw Consulting Sales Pitch by SlidesgoAnupriyaNo ratings yet

- Total NCA 1110: 75,000 OverstatedDocument2 pagesTotal NCA 1110: 75,000 OverstatedJade MarkNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- 10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Document1 page10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Kuldeep KushwahaNo ratings yet

- Ngo Payslip Jan'22Document1,094 pagesNgo Payslip Jan'22raghurajawat98No ratings yet

- Vigours Hospitalities Services Pvt. Ltd. Sr. No. Description HK Cum Office Boy 9 Hrs A Monthly PaymentsDocument4 pagesVigours Hospitalities Services Pvt. Ltd. Sr. No. Description HK Cum Office Boy 9 Hrs A Monthly PaymentsRamdas NagareNo ratings yet

- Income Tax 2010-11Document5 pagesIncome Tax 2010-11gsreddyNo ratings yet

- Oct SalarysDocument4 pagesOct SalarysshekharNo ratings yet

- C Far Be MP Co Success StoryDocument7 pagesC Far Be MP Co Success StoryJaellaine BaldoveNo ratings yet

- Rahul Kumar - CM Assignment - 1Document12 pagesRahul Kumar - CM Assignment - 1Rahul KumarNo ratings yet

- Ravi Pay SlipsDocument3 pagesRavi Pay SlipsAnonymous CsD87Y7No ratings yet

- Illustration On Net Take Home, For The Salary Structure Provided in The Annexure - A of The Offer Cum Appointment LetterDocument2 pagesIllustration On Net Take Home, For The Salary Structure Provided in The Annexure - A of The Offer Cum Appointment LetterTejaswini M MNo ratings yet

- Illustration On Net Take Home, For The Salary Structure Provided in The Annexure - A of The Offer Cum Appointment LetterDocument2 pagesIllustration On Net Take Home, For The Salary Structure Provided in The Annexure - A of The Offer Cum Appointment LetterTejaswini M MNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document5 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Sandeep KumarNo ratings yet

- 1 Jan-24 EcrDocument16 pages1 Jan-24 EcrshashankstsNo ratings yet

- F3ltd-Payroll With Payslip FormatDocument6 pagesF3ltd-Payroll With Payslip FormatSonu PathakNo ratings yet

- Understanding Offset #1Document2 pagesUnderstanding Offset #1WCCO - CBS MinnesotaNo ratings yet

- Wipro Philippines Inc.: Print PayslipDocument1 pageWipro Philippines Inc.: Print PayslipLeoni Francis LagramaNo ratings yet

- DRRMDocument1 pageDRRMMark Jefferson PranzaNo ratings yet

- Dec 10Document1 pageDec 10kmskarthiNo ratings yet

- Main Tables (Lower Version)Document2 pagesMain Tables (Lower Version)vishalbharatshah2776No ratings yet

- Book 1Document4 pagesBook 1lpp_rajpatelNo ratings yet

- 2 Feb-24 EcrDocument16 pages2 Feb-24 EcrshashankstsNo ratings yet

- Ashok Leyland LTD: E-Auction SaleDocument7 pagesAshok Leyland LTD: E-Auction SaleSanmuga SrinivasNo ratings yet

- Ngakl1017779000 93712584 1693292121252 2023082944721253705Document2 pagesNgakl1017779000 93712584 1693292121252 2023082944721253705Mr. A. A. PandeNo ratings yet

- Perks & Allowances - A ReviewDocument37 pagesPerks & Allowances - A Reviewv_sonkerNo ratings yet

- Online - Applicant - PFInvoice - Aspx - 400kvDocument1 pageOnline - Applicant - PFInvoice - Aspx - 400kvmybsnlamazon1No ratings yet

- Tax Deferral Plans Quiz CSIDocument4 pagesTax Deferral Plans Quiz CSI991514982aNo ratings yet

- Provisions On Taxation or Revenue SharingDocument2 pagesProvisions On Taxation or Revenue SharingAustin Coles33% (3)

- Prathmesh PayslipDocument6 pagesPrathmesh PayslipPrathmesh VhatkarNo ratings yet

- RMC No. 117-2021 Clarification On Submission of 2307 and 2316Document2 pagesRMC No. 117-2021 Clarification On Submission of 2307 and 2316Gerald SantosNo ratings yet

- Classification of TaxesDocument2 pagesClassification of TaxesJoliza CalingacionNo ratings yet

- Agricultural IncomeDocument12 pagesAgricultural Incomedhwani shahNo ratings yet

- Taxation 1 ExercisesDocument2 pagesTaxation 1 ExercisesJohn Rey Bantay RodriguezNo ratings yet

- The Following Payroll Liability Accounts Are Included in The Ledger 118383Document1 pageThe Following Payroll Liability Accounts Are Included in The Ledger 118383M Bilal SaleemNo ratings yet

- Full Name of Party Filing Document: Affidavit Verifying IncomeDocument2 pagesFull Name of Party Filing Document: Affidavit Verifying Incomejoy doleNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Price List of Plots, Shankarpally PDFDocument1 pagePrice List of Plots, Shankarpally PDFmtashNo ratings yet

- 2018 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2018 TSP Catch-Up Contributions and Effective Date ChartAnonymous O6Pgmls4No ratings yet

- Dogs Lips Are ThicDocument1 pageDogs Lips Are ThicAdarsh SinghalNo ratings yet

- Pan Verification Record EVWPD7928B: Permanent Account NumberDocument1 pagePan Verification Record EVWPD7928B: Permanent Account Numberajit dhanjeNo ratings yet

- Computation Format For Individual Tax Liability For The Year of Assessment 20XXDocument4 pagesComputation Format For Individual Tax Liability For The Year of Assessment 20XXannastasia luyah100% (1)

- INT085 Payslip to Print Report Design 03-12-2024 (1)Document1 pageINT085 Payslip to Print Report Design 03-12-2024 (1)lesliedariqusNo ratings yet

- D17 F6RUS-Section B Ans CleanDocument6 pagesD17 F6RUS-Section B Ans CleanZulaikha AbdulmuminNo ratings yet

- Tax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Document5 pagesTax Invoice: (See Rule 5 Under Tax Invoice, Credit and Debit Note Rules)Bharat DafalNo ratings yet

- GST AssignmentDocument16 pagesGST AssignmentDroupathyNo ratings yet

- Estimate / Quotation: Activity - Window CostingDocument1 pageEstimate / Quotation: Activity - Window CostingM.K. JaiswalNo ratings yet

- Australia NABDocument2 pagesAustralia NABphungvcungNo ratings yet

- TURBO-C CODE EXAMPLE (Compute For The Total Net Income)Document9 pagesTURBO-C CODE EXAMPLE (Compute For The Total Net Income)Yzza Veah EsquivelNo ratings yet

- Income Taxation Bir FormDocument2 pagesIncome Taxation Bir FormVince AbabonNo ratings yet

- 8115674Document3 pages8115674sumit pandeyNo ratings yet