Professional Documents

Culture Documents

Assignment Study 6.5

Assignment Study 6.5

Uploaded by

agilitycapitalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Study 6.5

Assignment Study 6.5

Uploaded by

agilitycapitalCopyright:

Available Formats

THE DEVIL IS IN THE DETAILS: WHEN DID THE TRUST ACQUIRE THE NOTES AND MORTGAGES A STUDY OF 4,580

FLORIDA ASSIGNMENTS

BY LYNN E. SZYMONIAK, JUNE 5, 2011

In 2010, mortgage bankers involved with mortgage-backed securities adopted a mantra: The mortgage follows the note. Tom Deutsch, Executive Director of the American Securitization Forum (ASF), appeared before the U.S. Senate Banking Committee, and in speeches to mortgage bankers, to argue that $7 trillion dollars of securitized mortgage debt was transferred in a legally sound matter. The mantra became necessary as revelations piled up that mortgages had not been assigned to mortgage-backed trusts in the manner described in the trusts documents. The most important trust document, the Pooling and Servicing Agreement (PSA), spells out in the definitions section that mortgage file documents include the promissory note, the mortgage, a mortgage assignment and a title insurance policy. The trusts promised investors that they would obtain these documents for each loan in the pool of loans that make up the trusts. The manner in which the trust acquires the documents is also set out usually in Section 2.01 of the PSA which is usually titled Conveyances of Mortgages. This section specifies that the note itself should be the original note, indorsed to the trust or indorsed in blank. This recognizes that the trust was not the original lender and there were intervening owners of the note. The mortgage also needs to reflect that the trust is the owner of the mortgage. While notes are indorsed, usually on the last page of the note itself, mortgages are assigned, most often in a separate document. Many trust specify that the mortgage must be assigned to the trust. Some trusts allowed the mortgage to be assigned in blank if such assignment would be acceptable under the laws of the state where the property was located. A mortgage assigned in blank means that the name of the new owner, or assignee, is not specified. The name of the entity acquiring the mortgage is the only item that may be left blank on an assignment made in blank.

There were widespread problems with assignments in blank. In most states, the question of the validity of a blank assignment was undecided. In addition to the legal issue presented, there were massive technical difficulties. On many assignments, other information was also left blank particularly the effective date of the assignment. Under the terms of the PSA, assignments were to have been delivered to the trust in recordable form. This meant that even assignments with the assignee unspecified were supposed to have been signed and dated by the prior owner so that only the name of the trust could be inserted and the assignment filed if necessary. Many trusts obtained assignments, in blank, signed by an officer of the lender. A loan made by American Brokers Conduit, for example, was signed by an officer of American Brokers Conduit and notarized in Suffolk County, New York, where American Brokers Conduit was located. On tens of thousands of mortgages, however, the lender was not the mortgagee and, therefore, could not be the assignor. On these loans, Mortgage Electronic Registration Systems, Inc. (MERS) was identified as the mortgagee. At some point, this problems appears to have been recognized on many assignments. On these documents, where the name of the trust has been hand-written into the document an attempt has also been made to change the name of the assignor so that the words Mortgage Electronic Registration Systems Incorporated as Nominee For are inserted (hand-written) above the name of the assignor. These Assignor-fixed documents, however, are signed by an officer of the Lender, not MERS, and the signer identifies himself/herself as an officer of the Lender not MERS. On still other Assignments, the County and State where the document was notarized was also left blank. When the documents were filed, this information was also added hand-written to the document. Instead of the place of notarization, however, the place where the property was located was inserted. As a result, on many assignments, the Notary stamp states that the Notary is qualified in Suffolk County, New York (the location of American Home Mortgage) but the County and State where the document was notarized are identified as, for example, Lee County, Florida.

Many trusts did not require assignments for all loans in the asset pool. Many trusts permitted MERS loans to simply be transferred on the MERS system to the trust by the closing date of the trust. But even with MERS loans, the mortgage assignments prepared by the servicers from 2008 2011 (years after the closing dates of most of the trusts) showed that the loans were still registered on the MERS system in the names of the original lenders. With these many problems with the original mortgage assignments, it is not surprising that the ASF began aggressively asserting that mortgage assignments are not even necessary because of the common law principle that the mortgage follows the note. The ASF reported that 13 major law firms agreed with the ASF. Lesser-paid, but more objective authorities, particularly Georgetown Law Professor Adam Levitin, wrote an article/post, The Big Fail, after the U.S. Bankruptcy Court decision for the District of New Jersey in Kemp v. Countrywide Home Loans, Inc., where evidence was presented that the note never was delivered to the trust. Professor Levitin posited failure to properly transfer the mortgage meant that the mortgages were never actually securitized. The issue of mortgage assignments became increasingly important, because of the widespread appearance of fraudulent and forged mortgage assignments to mortgage-backed trusts, produced by over a dozen mortgage servicing companies, from 2008 through 2011. With the filing of these servicer-produced documents, the problem of missing documents was transformed into a problem of fraudulent documents. Moreover, these assignments not only call in to question whether and when the trusts received the mortgages they also call in to question whether and when the trusts received the NOTES. Almost all of these servicer-made assignments also purported to assign the NOTES. An examination was made of every assignment of mortgage filed in three Florida counties, Hillsborough, Lee and St. Lucie, to six groups of trusts: Bear Stearns, GSAMP, GSAA, Morgan Stanley, Structured Asset Investment Loans (SAIL) and Structured Asset Mortgage Investments (SAMI) trusts for a three-year period, 2008 2010. Every Assignment of Mortgage also included the PROMISSORY NOTE in the Assignment. There were no original documents (contemporaneously dated to correspond to the trust closing dates) in 3

the 4,580 assignments filed in the three Florida counties. All of these assignments were prepared by mortgage servicers years later. When did the Bear Stearns, GSAMP, GSAA, Morgan Stanley, SAIL, and SAMI trusts acquire the mortgages AND NOTES that were the pooled assets of the trusts? According to these documents, in every case where an effective date was stated, the mortgages AND NOTES were not assigned to the trusts until several years after the closing dates of the trusts. A small percentage of these assignments state that the originals were lost or destroyed, but do not state when this loss or destruction occurred, other than on or before a date that corresponds to the filing of the foreclosure action. A small percentage also states that the assignments took place on or before a certain date, leaving the actual date unspecified. Only a very few assignments state in the document title that the assignment was an Assignment of Mortgage and Promissory Note. Most do not mention the promissory note in the title of the document, but include language in the mortgage assignment that specifically states that the note is also being assigned. Typically, the language regarding the promissory notes is included at the end of the first paragraph on these assignments stated as follows: "...together with the Note of Obligation described in said Mortgage(s), and the money due and to become, due thereon, with interest therein provided." Another common version states, immediately after the legal description: "...together with the Note and indebtedness secured thereby." Still another version states, immediately after the legal description: "Together with the note and each and every other obligation described in said mortgage and the money due and to become due thereon." A fourth version states: "...together with the note of obligation described in said Mortgage(s), 4

and the money due and to become, due thereon, with interest as therein provided." There is also a version that claims attorney's fees: "Together with any and all notes an obligations therein described or referred to, the debt respectively secured thereby and all sums of money due and to become due thereon, with interest thereon, and attorney's fees and all other charges." The DocX version states: "...the following described mortgage, securing the payment of a certain promissory note(s) for the sum listed below, together with all rights therein and thereto, all liens created or secured thereby, all obligations therein described, the money due and to become due thereon with interest, and all rights accrued or to accrue under such mortgage." These documents show that the note followed the mortgage and not vice-versa. An examination of these assignments shows that the parties to the transfer effectuated the transfer of the mortgages and notes years after the trusts closed. If the Trusts did not acquire these mortgages and notes until years after the closing dates of the trusts, what was in those pools of loans sold to investors? The trusts seem to have sold a list of loans they intended to acquire. A very few of these Assignments seem to recognize the problem of the Trust acquiring the mortgages and notes many years after the trust closing dates and include the following language: "Assignor hereby acknowledges that this assignment is being recorded as a formality pursuant to the requirements set forth under 701.02, but that such be the intention of the parties herein that delivery of the subject note and mortgage be established as evidenced by electronic or physical delivery, of the note and mortgage and related documents that such delivery occurred on occurred prior to date of any litigation, hereto for, and that date be the delivery date has been established by the expressed intention of the parties, herein." (Note: this is the EXACT wording of the paragraph - despite what 5

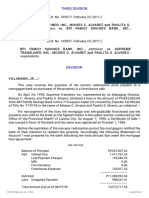

appears to be obvious errors and nonsense.) In Hillsborough County in 2008, 2009, and 2010, there were 641 Assignments to Bear Stearns Trusts; 298 Assignments to GSAMP Trusts; 163 Assignments to GSAA Trusts; and 746 Assignments to Morgan Stanley Trusts, 153 Assignments to SAIL Trusts; 429 Assignments to SAMI Trusts; or 2,430 Assignments total. In Lee County in 2008, 2009, and 2010, there were 506 Assignments to Bear Stearns Trusts; 203 Assignments to GSAMP Trusts; 188 Assignments to GSAA Trusts; 607 Assignments to Morgan Stanley Trusts, 100 Assignments to SAIL Trusts; 373 Assignments to SAMI Trusts; or 1,789 Assignments total. In St. Lucie County in 2008, 2009, and 2010, there were 78 Assignments to Bear Stearns Trusts; 61 Assignments to GSAMP Trusts; 24 Assignments to GSAA Trusts; 161 Assignments to Morgan Stanley Trusts, 11 Assignments to SAIL Trusts; 26 Assignments to SAMI Trusts; or 361 Assignments total. Courts will be deciding issues related to the assignments of mortgages and notes for years to come. Did servicers produce millions of assignments of mortgages and notes to trusts with the effective dates of the assignments wrongly states usually by several years? If the original documents were missing, did the trustees, document custodians and accountants report to the Securities & Exchange Commission that they had discovered a failure to comply with Regulation AB, Item 1122(d)(4)(ii): Mortgage loan and related documents are safeguarded as required by the transaction agreements. The transaction agreements, including the PSAs, almost universally told investors that the mortgage documents defined as the indorsed note, the mortgage and the mortgage assignment would be safely kept in the fireproof vault of the document custodian. Did the securitizers and subsequent trustees and custodians make thousands of false statements to investors and the SEC about obtaining and maintaining the loan documents?

Have foreclosures by trusts gone forward where the evidence of ownership of the note, the mortgage or both has been manufactured by the trusts or their agents? What is the most equitable relief for investors and homeowners? The recovery of the American economy rests on this answer.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 2015Document35 pagesLawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 201583jjmack100% (2)

- JPM Mbs Primer Dec2006Document120 pagesJPM Mbs Primer Dec2006Rajadhyaksha NarayananNo ratings yet

- 04.20.17 Secretary's Certificate (LEG-028 (04-17) TMP) - RawDocument3 pages04.20.17 Secretary's Certificate (LEG-028 (04-17) TMP) - Rawjayar medico100% (1)

- Global Credit Exposure Management Policy - 2019Document110 pagesGlobal Credit Exposure Management Policy - 2019ଦେବୀ ପ୍ରସାଦ ପଟନାୟକNo ratings yet

- Statement of Financial Position - PPT - Accounts TitlesDocument23 pagesStatement of Financial Position - PPT - Accounts TitlesMg GarciaNo ratings yet

- Appellant Brief - Alan Jacobs As Trustee For The New Century Liquidating TrustDocument94 pagesAppellant Brief - Alan Jacobs As Trustee For The New Century Liquidating Trust83jjmack100% (3)

- The Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 2015Document36 pagesThe Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 201583jjmack100% (2)

- FEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may15Document361 pagesFEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may1583jjmack100% (1)

- Landmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD FormatDocument32 pagesLandmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD Format83jjmack100% (2)

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- New Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.Document4 pagesNew Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.83jjmack100% (1)

- In-Re-MERS V Robinson 12 June 2014Document31 pagesIn-Re-MERS V Robinson 12 June 2014Mortgage Compliance InvestigatorsNo ratings yet

- New Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For HomeownerDocument34 pagesNew Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For Homeowner83jjmack100% (2)

- Amicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third CircuitDocument29 pagesAmicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third Circuit83jjmack100% (1)

- AIG Offer To Buy Maiden Lane II SecuritiesDocument43 pagesAIG Offer To Buy Maiden Lane II Securities83jjmackNo ratings yet

- Answering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq ServicingDocument31 pagesAnswering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq Servicing83jjmackNo ratings yet

- In The Helen Galope Matter - Plaintiffs Revised Statement of Genuine IssuesDocument28 pagesIn The Helen Galope Matter - Plaintiffs Revised Statement of Genuine Issues83jjmack100% (1)

- LPS COURT EXHIBIT #7 Service Providers Even Lexis NexisDocument6 pagesLPS COURT EXHIBIT #7 Service Providers Even Lexis Nexis83jjmackNo ratings yet

- Violations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good NewsDocument2 pagesViolations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good News83jjmackNo ratings yet

- Glaski Stands Published Feb. 26 2014 in Decision by The California Supreme CourtDocument4 pagesGlaski Stands Published Feb. 26 2014 in Decision by The California Supreme Court83jjmack100% (1)

- Analysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.Document8 pagesAnalysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.83jjmackNo ratings yet

- Homeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering BriefDocument57 pagesHomeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering Brief83jjmackNo ratings yet

- Audit of The Department of Justice's Efforts To Address Mortgage FraudDocument57 pagesAudit of The Department of Justice's Efforts To Address Mortgage FraudSam E. AntarNo ratings yet

- Bank of New York V RomeroDocument19 pagesBank of New York V RomeroMortgage Compliance InvestigatorsNo ratings yet

- The Helen Galope 9th Circuit Filed Appellant Reply Brief Case 12 56892Document73 pagesThe Helen Galope 9th Circuit Filed Appellant Reply Brief Case 12 56892dbush2778No ratings yet

- Valentine's Day Surprise - A Win For Bruce in Colorado - Order For Dismissal-2014Document5 pagesValentine's Day Surprise - A Win For Bruce in Colorado - Order For Dismissal-201483jjmackNo ratings yet

- Results For "Carrington Mortgage" From The SEC EDGAR: 20 RegistrantsDocument2 pagesResults For "Carrington Mortgage" From The SEC EDGAR: 20 Registrants83jjmackNo ratings yet

- Mers List of Signing OfficersDocument4 pagesMers List of Signing Officers83jjmackNo ratings yet

- JacarandaDocument2 pagesJacarandaAsoj CherukatNo ratings yet

- Taxation Law 2 (TaxRevDocument61 pagesTaxation Law 2 (TaxRevCrnc NavidadNo ratings yet

- Chapter 8-1. ProblemsDocument10 pagesChapter 8-1. ProblemsCloudKielGuiangNo ratings yet

- Re: Your Medical Card Review - : Reference Number 5361176Document7 pagesRe: Your Medical Card Review - : Reference Number 5361176Cristian NistorNo ratings yet

- Applied Auditing: 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645Document7 pagesApplied Auditing: 3/F F. Facundo Hall, B & E Bldg. Matina, Davao City Philippines Phone No.: (082) 305-0645Bryan PiañarNo ratings yet

- Teodora de Buencamino vs. Maria de Matias, G.R. No. L-19397, April 30, 1966Document3 pagesTeodora de Buencamino vs. Maria de Matias, G.R. No. L-19397, April 30, 1966Lou Ann AncaoNo ratings yet

- Petitioners Vs Vs Respondent: Third DivisionDocument10 pagesPetitioners Vs Vs Respondent: Third DivisionPatty PerezNo ratings yet

- Msdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleDocument24 pagesMsdi Alcala de Henares, Spain: Click To Edit Master Subtitle StyleShashank Shekhar100% (1)

- About Us: Car Repair Broomfield Auto Repair in Broomfield CoDocument11 pagesAbout Us: Car Repair Broomfield Auto Repair in Broomfield CoKemberly Semaña PentonNo ratings yet

- 100 Mau Thu Thuong Mai Tieng AnhDocument85 pages100 Mau Thu Thuong Mai Tieng AnhNguyễn M. VũNo ratings yet

- Saving & Third Party Fund Management Manual FinalDocument77 pagesSaving & Third Party Fund Management Manual Finalendale50% (2)

- Death Claim Check List: JLG Name: Branch Name: Loan AmountDocument2 pagesDeath Claim Check List: JLG Name: Branch Name: Loan AmountShanu RaghuwanshiNo ratings yet

- Gold Star Mining V Lim JimenoDocument2 pagesGold Star Mining V Lim JimenoRaya Alvarez TestonNo ratings yet

- Preference of Credits 1. NCC 2241-2251 NCC 110, Labor Code Carried Lumber v. ACCFA, April 22, 1975, 63 SCRA 411Document29 pagesPreference of Credits 1. NCC 2241-2251 NCC 110, Labor Code Carried Lumber v. ACCFA, April 22, 1975, 63 SCRA 411Roberto S. Suarez IINo ratings yet

- Navarro V SolidumDocument2 pagesNavarro V SolidumkimcaityNo ratings yet

- Lim Ching Tai JDocument3 pagesLim Ching Tai JJesavil SinghbalNo ratings yet

- Syndicate Bank 60Document62 pagesSyndicate Bank 60kharoteh9402No ratings yet

- Vintage AnalysisDocument16 pagesVintage AnalysisHalim AvdiuNo ratings yet

- Allgemaine Vs Metrobank Case DigestDocument2 pagesAllgemaine Vs Metrobank Case Digestkikhay11No ratings yet

- Introduction To Financial Planning-VK-2015Document31 pagesIntroduction To Financial Planning-VK-2015Vinod Krishna MakkimaneNo ratings yet

- Financial InstitutionsDocument54 pagesFinancial InstitutionsSukhwinder SinghNo ratings yet

- When Does A Letter of Comfort Becomes A Contract of GuaranteeDocument11 pagesWhen Does A Letter of Comfort Becomes A Contract of GuaranteeJ Imam100% (3)

- Banking-Laws MCQsDocument5 pagesBanking-Laws MCQsLeny Joy DupoNo ratings yet

- Quiz Week 2Document7 pagesQuiz Week 2Jepernick EspaderoNo ratings yet

- A90 Report 1Document22 pagesA90 Report 1Jewel Mae MercadoNo ratings yet

- Commerce Lesson PlanDocument6 pagesCommerce Lesson PlanPrince Victor0% (1)