Professional Documents

Culture Documents

Iboe

Uploaded by

Hossein ParastehOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iboe

Uploaded by

Hossein ParastehCopyright:

Available Formats

How to check IBOE for Private Placement Please state whether or not your organization has access to the

Private Side of the US Treasury or the Federal Reserve. If so, Please state that your organization has knowledge of this type of Instrument and that your organization can get the IBOE authenticated or state that your organization has enough understanding of this type of instrument to proceed with signing of a contract and receiving the Original Instrument. The Drawer of the Instrument has stated that the information surrounding this particular instrument is highly Confidential and can only be used by those individuals or Entities who have the knowledge to .negotiate it and/or has a Private relationship with the above named US agencies

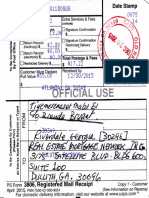

These IBOEs will not be on the Fed system because that part of it is Private. The Feds have an off book and an on book ledger and the IBOE because of the .Confidentiality surrounding the IBOE is an OFF BOOK transaction That is why it is screened through the SECRETARY OF STATE OF GEORGIA which is also called the Commercial Registry and the Regional Registry for GEORGIA .and the Commercial Registry The Affidavit you will get is ONLY for the people in YOUR Platform. Also, the Registry lists BEN as the Secured Party via an Assignment for these IBOEs which means that BEN can assign that collateral free and clear if there is a default. If there is no default during the contract period, at the expiration of the trading .contract the instrument has to be returned to the Drawer

Two ways of checking these IBOEs

In regards to verifying the IBOE there are 2 ways you can verify it. Very Important: The Assignees and or their Banks have direct access to the private side of the Federal Reserve or the Private Side of the US Treasury. Direct Access is the most expeditious way to verify the IBOE's. The 2nd most expeditious way is to verify the filing of the IBOE through the Commercial Registry (UCC screen). That date base shows the Secured Party or Assignees as it relates to Assets/Collateral (IBOE's) that are linked to the Federal Reserve, IRS and US Treasury, but I am Positive you already know all that. We look forward in a LONG .Term relation with you and your bank

The law requires that each Federal Reserve Bank hold collateral that equals at least 100 percent of the value of the currency it issues. Most of that collateral is in U.S. Government securities owned by the Federal Reserve System. It also includes gold certificates, special drawing rights or other "eligible" paper. Eligible paper can be bills of exchange or promissory notes, and some foreign .government or agency securities obtained by the Federal Reserve

,KIND REGARDS HOSSEIN PARASTEH

You might also like

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- Limited Power of AttorneyDocument2 pagesLimited Power of AttorneyJoseph_Carapuc_1850No ratings yet

- Bill of ExchangeDocument1 pageBill of ExchangeFreeman Lawyer100% (9)

- INTERNATIONAL BILL OF EXCHANGE - OdtDocument1 pageINTERNATIONAL BILL OF EXCHANGE - OdtMarsha MainesNo ratings yet

- Ucc 1 Sample Text Block 11-07Document1 pageUcc 1 Sample Text Block 11-07Jason Henry100% (1)

- ChargeBack Order ABH-122009-CO101 PDFDocument2 pagesChargeBack Order ABH-122009-CO101 PDFAllen-nelson of the Boisjoli familyNo ratings yet

- 50-50 Bonded Promissory Note Template 10-15-08Document2 pages50-50 Bonded Promissory Note Template 10-15-08Michael Nguyen Thornton100% (2)

- Bill of Exchange GuideDocument0 pagesBill of Exchange Guidemy hoangNo ratings yet

- 3 - Points & Authorities BoE Bill of Exchange ActDocument15 pages3 - Points & Authorities BoE Bill of Exchange ActDoc PhaqNo ratings yet

- Private Bond Instructions Letter v1 1Document1 pagePrivate Bond Instructions Letter v1 1gordon scottNo ratings yet

- Promissory Note HBPDocument3 pagesPromissory Note HBPMike SiscoNo ratings yet

- IRS Notice Form for Fiduciary RelationshipDocument2 pagesIRS Notice Form for Fiduciary Relationshipphard2345100% (1)

- Certificate of Ownership-Auth-TDA Account PDFDocument1 pageCertificate of Ownership-Auth-TDA Account PDFrisovi100% (6)

- Acceptance Letter of Credit PDFDocument5 pagesAcceptance Letter of Credit PDFmackjblNo ratings yet

- Collateral Text For UCC-1Document2 pagesCollateral Text For UCC-1Anonymous nYwWYS3ntV100% (4)

- Notice of Fiduciary Relationship for Financial InstitutionsDocument2 pagesNotice of Fiduciary Relationship for Financial InstitutionsNor100% (1)

- Letter of Credit 2023 Version OneDocument7 pagesLetter of Credit 2023 Version OnePhillip Kakuru50% (2)

- A4V Processes and ProceduresDocument4 pagesA4V Processes and Proceduresrmaq100% (4)

- Convenção UPU 1897Document20 pagesConvenção UPU 1897Antonio Gilberto Ortega HartzNo ratings yet

- 13-1 - Assignment of Reverionary Interest ShroutDocument14 pages13-1 - Assignment of Reverionary Interest ShroutFreeman Lawyer80% (5)

- 01 Introduction To Administrative RemedyDocument3 pages01 Introduction To Administrative Remedyajinxa100% (2)

- Bankers Acceptance Document for Purchase FinancingDocument2 pagesBankers Acceptance Document for Purchase Financingcktee77No ratings yet

- Bill of ExchangeDocument4 pagesBill of ExchangeSara SanamNo ratings yet

- H H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesDocument4 pagesH H I A: OLD Armless AND Ndemnity Greement No. 05091989QNWHHIA Non Negotiable Between The PartiesQueenNicole WilliamsNo ratings yet

- Letter of Credit FormDocument3 pagesLetter of Credit Formwidyarahmadesbita100% (1)

- Private Document Tender of PaymentDocument2 pagesPrivate Document Tender of PaymentPennyDoll94% (17)

- Absolute RightsDocument1 pageAbsolute Rightsmoneyspout5403100% (2)

- A 4 VDocument3 pagesA 4 VRebecca Turner83% (6)

- Accepted For Honor PDFDocument31 pagesAccepted For Honor PDFRena Quintanilla100% (3)

- US Internal Revenue Service: p1212 - 2004Document109 pagesUS Internal Revenue Service: p1212 - 2004IRS100% (2)

- SPC Done With U ApplicationDocument8 pagesSPC Done With U ApplicationJose Juan Gil100% (1)

- Stamp Duty Act Amended To 2019-01Document58 pagesStamp Duty Act Amended To 2019-01Issa BoyNo ratings yet

- Letter With A4V To Judge TobiasDocument39 pagesLetter With A4V To Judge TobiasTehuti Shu Maat AmenRa Eil(c)TM100% (4)

- Revocation of Power of Attorney FormDocument2 pagesRevocation of Power of Attorney FormLord Mr. Sasa Alexander VugloveckiNo ratings yet

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (1)

- Sav1455 PDFDocument6 pagesSav1455 PDFTed100% (1)

- Form 56 Remittance FormDocument13 pagesForm 56 Remittance Formcristine gomobar100% (1)

- History and definition of bills of exchangeDocument15 pagesHistory and definition of bills of exchangedcsshit100% (2)

- Bankers Acceptance CondensedDocument5 pagesBankers Acceptance CondensedLuka Ajvar100% (1)

- Form OC-10 Appl 4 FRNDocument51 pagesForm OC-10 Appl 4 FRNBenne James100% (4)

- John Doe UCC 1Document10 pagesJohn Doe UCC 1Bunny Fontaine100% (2)

- Bankers AcceptanceDocument2 pagesBankers AcceptanceKudzanai Allen Paraffin100% (5)

- Letter of AdviceDocument3 pagesLetter of AdviceGreg Wilder100% (13)

- Affidavit of Birth: FurthermoreDocument3 pagesAffidavit of Birth: FurthermoreAashi50% (2)

- Board of Governors Non-Negotiable InstrumentDocument7 pagesBoard of Governors Non-Negotiable Instrumentbmhall65100% (3)

- Bankers AcceptanceDocument1 pageBankers AcceptanceVarad LaghateNo ratings yet

- 07 Affidavit Cover LetterDocument2 pages07 Affidavit Cover LetterTerry Green100% (3)

- Form 231Document2 pagesForm 231Anissa Madewa100% (1)

- A4v Discharge Real Estate Mortgage NetworkDocument13 pagesA4v Discharge Real Estate Mortgage NetworkJohnson Damita100% (1)

- MR Lou Seminar NotesDocument18 pagesMR Lou Seminar NotesNova100% (3)

- Sav 1455Document6 pagesSav 1455Michael100% (5)

- Security Agreement 1Document6 pagesSecurity Agreement 1Nate Bruce100% (2)

- Bill of ExchangeDocument14 pagesBill of ExchangeMa Angelica Micah Labitag100% (8)

- FS Form 5188Document3 pagesFS Form 51882Plus100% (4)

- Loan Agreements Hauser Chris ExampleDocument3 pagesLoan Agreements Hauser Chris ExampleJusta100% (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)