Professional Documents

Culture Documents

Guaranty Pledge Mortgage: Real Estate Mortgage Chattel Mortgage Definition/ Concept

Uploaded by

Chet LlanesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guaranty Pledge Mortgage: Real Estate Mortgage Chattel Mortgage Definition/ Concept

Uploaded by

Chet LlanesCopyright:

Available Formats

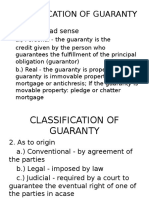

GUARANTY

Definition/ Concept

A person called the grantor, binds himself to the creditor to fulfil the obligation of the principal debtor in case the latter should fail to do so. 1. Guaranty in broad sense: a. Personal- the guarantee is the credit given by the person who guarantees the fulfilment of the principal obligation b. Real- the guarantee is the property, movable or immovable 2. As to origin: a. Conventional- are constituted by agreement of the parties b. Legal- one imposed by virtue of a provision of law c. Judicial- one required by a court to

PLEDGE

MORTGAGE

REAL ESTATE MORTGAGE CHATTEL MORTGAGE

Kinds/ Classification

guarantee the eventual right of one of the parties in case 3. As to consideration: a. Gratuitous- one where the guarantor does not receive any price or remuneration for acting as such b. Onerous- one where the guarantor receives valuable consideration for his or for his guaranty 4. As to person guaranteed: a. Single- one constituted solely to guarantee or secure performance of the principal obligation b. Double or subguaranty- one constituted to secure the fulfilment of a prior guaranty 5. As to its scope and extent: a. Definite- one where the guaranty is limited to the principal obligation

only or to a specific portion thereof b. Indefinite or simple- one where the guaranty includes not only the principal obligation but also its accessories including judicial costs.

Parties to the Contract Requisites Object of the Contract Form of the Contract/ Requirements for Validity or Enforceability Extent of the Contract Modes of Extinguishment/ Remedies of the Parties in Case of Non-payment

You might also like

- Classification of GuarantyDocument5 pagesClassification of GuarantyMarj AgustinNo ratings yet

- ON Guaranty: Submitted By: Jacobo, Jennefe Ludeña, Jorey Reverente, Godfrey ADocument6 pagesON Guaranty: Submitted By: Jacobo, Jennefe Ludeña, Jorey Reverente, Godfrey ACresteynTeyngNo ratings yet

- Classification of GuarantyDocument22 pagesClassification of GuarantyKobe BullmastiffNo ratings yet

- Guaranty and SuretyDocument29 pagesGuaranty and SuretyMing100% (1)

- Guaranty and SuretyDocument56 pagesGuaranty and SuretyArann PilandeNo ratings yet

- CREDIT TRANSACTIONS NotesDocument6 pagesCREDIT TRANSACTIONS NotesMaurene DinglasanNo ratings yet

- GUARANTYDocument4 pagesGUARANTYJulia San JoseNo ratings yet

- Surety Notes 1Document2 pagesSurety Notes 1Lably ReuyanNo ratings yet

- ContractDocument7 pagesContractfreebirdovkNo ratings yet

- Guaranty and SuretyDocument9 pagesGuaranty and SuretyCaren DumaliliNo ratings yet

- Guaranty and SuretyshipDocument14 pagesGuaranty and Suretyshiproansalanga100% (1)

- Module III Law On Pledge Real Estate Mortgage and Chattel MortgageDocument12 pagesModule III Law On Pledge Real Estate Mortgage and Chattel MortgageAYEZZA SAMSONNo ratings yet

- Guaranty and SuretyshipDocument3 pagesGuaranty and SuretyshipMary Joy Barlisan Calinao100% (3)

- Special Contracts Indemnity Grantee Bailment Pledge & AgencyDocument16 pagesSpecial Contracts Indemnity Grantee Bailment Pledge & AgencyRajveer Singh SekhonNo ratings yet

- DTL LB 090419Document32 pagesDTL LB 090419Palak ChawlaNo ratings yet

- Secured Transaction Outline 2012Document45 pagesSecured Transaction Outline 2012Isabella L100% (10)

- Guaranty and SuretyshipDocument10 pagesGuaranty and SuretyshipAngel AsisNo ratings yet

- PH Law On GuarantyDocument3 pagesPH Law On GuarantytransitxyzNo ratings yet

- Securities For AdvancesDocument3 pagesSecurities For AdvancesWaqas TariqNo ratings yet

- Business Law Week 6Document20 pagesBusiness Law Week 6s wNo ratings yet

- Guaranty ReviewerDocument3 pagesGuaranty ReviewerNikki Andrade100% (2)

- TRUST RECEIPTS LAW NOTES by SAPDocument5 pagesTRUST RECEIPTS LAW NOTES by SAPStephany PolinarNo ratings yet

- Chapter 2Document13 pagesChapter 2Aayush KaulNo ratings yet

- Law On Credit TransactionDocument48 pagesLaw On Credit TransactionDesiree Sogo-an PolicarpioNo ratings yet

- Suretyship: Sections 177-180, Title 4 The Insurance CodeDocument25 pagesSuretyship: Sections 177-180, Title 4 The Insurance Codealjazzerusad100% (1)

- III. Law On Pledge and Mortgage Notes PDFDocument10 pagesIII. Law On Pledge and Mortgage Notes PDFChristine OrdoñezNo ratings yet

- Credit Midterms ReviewerDocument83 pagesCredit Midterms Reviewermelaniem_1No ratings yet

- GUARANTYDocument16 pagesGUARANTYmcris101100% (1)

- Special Case For Contract Act UGC NETDocument8 pagesSpecial Case For Contract Act UGC NETGaurav SharmaNo ratings yet

- Indemnity and GuaranteeDocument42 pagesIndemnity and GuaranteeAbhyudaya GargNo ratings yet

- Rights of SuretiesDocument6 pagesRights of Suretiessushmita100% (2)

- Credit FinalsDocument69 pagesCredit FinalsElaineFaloFallarcunaNo ratings yet

- Guaranty and SuretyshipDocument40 pagesGuaranty and SuretyshipTsuuundereeNo ratings yet

- Guaranty & Surety NotesDocument5 pagesGuaranty & Surety NotesMelDominiLicardoEboNo ratings yet

- Credit Transactions NotesDocument15 pagesCredit Transactions NotesLorenzo Angelo Acmor OcampoNo ratings yet

- Notes On INSURANCE LAWDocument5 pagesNotes On INSURANCE LAWAlthea QuijanoNo ratings yet

- Assignment No. 4 - JAReyes - COMMREVDocument7 pagesAssignment No. 4 - JAReyes - COMMREVReyes JericksonNo ratings yet

- Special Contracts NotesDocument61 pagesSpecial Contracts NotesSHRAAY BHUSHANNo ratings yet

- Unit 2Document77 pagesUnit 2Manas GurnaniNo ratings yet

- RFLB Reviewer (Module 2)Document9 pagesRFLB Reviewer (Module 2)Monica's iPadNo ratings yet

- Contract 2Document5 pagesContract 2Sujit JadhavNo ratings yet

- Credit Trans Reviewer Nature of Guaranty and SuretyshipDocument12 pagesCredit Trans Reviewer Nature of Guaranty and Suretyshipzal50% (2)

- 9236 - Pledge and Mortgage NotesDocument5 pages9236 - Pledge and Mortgage NotesmozoljayNo ratings yet

- Basic Principles of InsuranceDocument46 pagesBasic Principles of InsuranceZdréàmêr MélâkűNo ratings yet

- 18bco35s U5Document11 pages18bco35s U5arajesh07No ratings yet

- Law On Pledge and MortgageDocument3 pagesLaw On Pledge and MortgageKiana FernandezNo ratings yet

- Credit RevDocument3 pagesCredit RevCARLO JOSE BACTOLNo ratings yet

- Indemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.Document6 pagesIndemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.shinwarrikhanNo ratings yet

- Insurance Code: P.D. 612 R.A. 10607 Atty. Jobert O. Rillera, CPA, REB, READocument85 pagesInsurance Code: P.D. 612 R.A. 10607 Atty. Jobert O. Rillera, CPA, REB, REAChing ApostolNo ratings yet

- Kinds of Credit Transactions: Example: Mortgage and PledgeDocument26 pagesKinds of Credit Transactions: Example: Mortgage and PledgeOliverMastileroNo ratings yet

- Law Relating To Special Contracts (Document10 pagesLaw Relating To Special Contracts (deepaksri26No ratings yet

- Regulatory Framework For Business Transactions: Page 1 of 12Document12 pagesRegulatory Framework For Business Transactions: Page 1 of 12Mr BaitNo ratings yet

- Chapter 18Document13 pagesChapter 18Chante HurterNo ratings yet

- Chapter 5 - Insurance LawDocument11 pagesChapter 5 - Insurance LawMarrick MbuiNo ratings yet

- Guaranty & Suretyship: Chapter 1-Nature & Extent of Guaranty #2047Document8 pagesGuaranty & Suretyship: Chapter 1-Nature & Extent of Guaranty #2047Zyra C.No ratings yet

- Contract IiDocument19 pagesContract IioxcelestialxoNo ratings yet

- Credit Transaction - Midterm Coverage (Guaranty, Surety and Pledge)Document8 pagesCredit Transaction - Midterm Coverage (Guaranty, Surety and Pledge)LRMNo ratings yet

- LawDocument53 pagesLawPauline YambaoNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Laws Affecting Health NursingDocument12 pagesLaws Affecting Health NursingChet LlanesNo ratings yet

- DrugsDocument3 pagesDrugsChet LlanesNo ratings yet

- Journal in NCM 104Document14 pagesJournal in NCM 104Chet LlanesNo ratings yet

- Malaria Journal (RLE 104 Lec.)Document3 pagesMalaria Journal (RLE 104 Lec.)Chet LlanesNo ratings yet