Professional Documents

Culture Documents

Notes On INSURANCE LAW

Uploaded by

Althea Quijano0 ratings0% found this document useful (0 votes)

31 views5 pagesOriginal Title

Notes on INSURANCE LAW

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views5 pagesNotes On INSURANCE LAW

Uploaded by

Althea QuijanoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

III.

INSURANCE LAW Interest which a person is deemed to have

in the subject matter of the insurance where he

A. Basic Concepts has a relation or connection to it.

The person connected to it will derive

What is an Insurance Contract? pecuniary benefit or advantage from the

It is an agreement whereby one preservation of the subject matter or will

undertakes, for a consideration, to indemnify suffect pecuniary loss or damage from its

another against loss, damage or liability arising destruction, termination or injury by the

from an unknown or contingent event. happening of the event insured against it.

Contract of Surety **if the person applying for insurance has no

It should be considered as an insurance insurable interest on the insurance contract

contract only if made by a surety who or which, as then the contract is void**

such is doing an insurance business as defined by

the Insurance Code. What may be insured against?

1. Any contingent or unknown event, may it

Parties to a Contract of Insurance: be from the past or future

1. Insurer – assumes the risk of loss and Examples of Perils:

undertakes for a consideration to 1. Fire, and the risks allied to it

indemnify the insured upon the happening a. Lightning

of the designated peril. b. Windstorm

- every corporation, partnership c. Tornado

or association duly authorized d. Earthquake (and other similar

to transact insurance business risks)

by the Insurance commission

may be an insurer 2. Loss or damage in Marine Insurance

- a natural person is not allowed 3. Death or Injury

to be an insurer 4. Casualty or Liability in case of accident or

mishap

2. Insured – person whose loss is the 5. Non-performance by the principal debtor

occasion for the payment of the insurance of his obligation to the creditor

proceeds by the insurer. Anyone except a

public enemy is insured. Actuarial Risk

- Possibility that the assumption made by the

1. Elements of an Insurance Contract actuaries, in pricing specific insurance

policies, may prove to be inaccurate or wrong

a. Insured has an insurable interest capable of - Actuaries determine the chances of future

pecuniary estimation; risks, like birth, disability, accidental injury,

b. The insured is subject to a risk or loss by a fire, damage to property, need for medical

happening of a designated peril care, or premature death, and calculate the cost

c. Insurer assumes the risk of loss of financing these uncertain events by

d. Assumption of risk is part of general insurance or other related means.

scheme to distribute actual losses among a

large group of persons bearing a similar Insurance Premium

risk. - Amount of money a person pays for an

e. In consideration of the insurer’s promise, insurance policy in consideration for the

the insurer pays a premium. assumption by the insurance of the risk of loss

as a result of the happening of the designated

peril.

2. Characteristics and Nature of Insurance

Insurable Interest Contracts

ATQ Personal Notes for Bar 2023 1

1. Of Himself, of his spouse and of his

1. Consensual – perfected by the meeting of children

the minds 2. Of any person on whom he depends

2. Voluntary – not compulsory, parties may wholly or in part for education or support,

incorporate terms and conditions or in whom he has a pecuniary interest

3. Aleatory – depends upon a contingent 3. Of any person under a legal obligation to

event him for the payment of money, pr

4. Executory – as to the insurer respecting property or services, of which

5. Risk-distributing – risk of economic loss is death or illness might delay or prevent the

distributed among a large group or performance

substantial number of persons bearing the 4. Of any person upon whose life any estate

same or similar risk or interest vested in him depends

6. Uberrimae Fides Contract – or one of

perfect good faith **In life/Health interest, the beneficiary need not

7. A contract of Indemnity – insured is have an Insurable interest on the life of the

entitled to recover only the amount of total insured.**

loss actually sustained.

**Applicable only to Property Persons specified in Article 739 and as such

Insurance** cannot be designated beneficiary of the

8. Contract of Adhesion – it is a ready-made insured:

contract, other party generally adheres to 1. Persons in illicit relations – adultery or

the terms and conditions thereof concubinage (no need for conviction)

9. Personal Contract – each party has in mind 2. Persons found guilty of adultery or

the character, qualifications and conduct of concubinage

the other. 3. Public Officer or his wife, descendants or

ascendants

Additional Characteristics:

a. No contract or policy of insurance on **The Donees prohibited in Article 739 of the

property shall be enforceable except for Civil Code are also the ones prohibited being

the benefit of some person having an designated as beneficiaries in a life insurance

insurable interest in the property insured policy**

(Section 18, Insurance Code) - Reason: Life Insurance Policy is the same

b. Rule on Interpretation of Insurance from donation in terms where the

Contract: beneficiary is concerned. Life Insurance

i. In resolving ambiguities in the and Donation are both founded on

provision of the insurance contract, liberality. A beneficiary in life insurance is

the same are to be construed like a donee because the proceeds from the

liberally in favor of the insured and premiums of the policy came from the

strictly against the insurer who liberality of the insured to pay the

drafted the insurance policy. insurance contract.

3. Insurable Interest Guide to Insurable Interest:

a. Proceeds of a life insurance does not form

- An interest which a person is deemed to part of the estate of the insured

have in the subject matter of the insurance b. Insurance proceeds shall be applied

where he has a relation or connection to it exclusively to the proper interest of the

such that the person will either derive person in whose name or for whose benefit

pecuniary benefit from the preservation of the it is made unless otherwise specified in the

subject matter or will suffer pecuniary loss or policy.

damage from its destruction. c. A person has no insurable interest on the

life of his parents and other ascendants

Insurable Interest in Life/Health

ATQ Personal Notes for Bar 2023 2

except when he depends upon them for 2. Revocable Designation of Beneficiary

education and/or support. - A person who can be changed

d. A person can take insurance on the life of anytime during the lifetime of

another person and designate him as his the insured

beneficiary if he has pecuniary interest on - In case the insurance policy is

the person he is insuring. silent on the nature of the

designation, in such case, it will

Examples of persons under a Legal be deemed to be revocable

Obligation to him for the payment of

money, or respecting property or services, **General Rule: If the insured is silent about the

of which death or illness might delay or revocation of the beneficiary, then the

prevent the performance: beneficiary is deemed to be IRREVOCABLE,

unless he stipulates to the contrary**

a. A mortgagee can insure the life of the

mortgagor up to the extent of the mortgage Insurable Interest in Property:

debt to the mortgagee

b. A seller may insure the life of the buyer if An insurable interest in property may consist in:

the latter has the obligation to deliver a 1. An existing interest

specified property under a contract to sell. 2. An inchoate interest founded on an

c. A law firm may procure a keyman existing interest

insurance policy on its Managing Partner 3. An Expectancy coupled with an existing

d. An employer corporation has an insurable interest that out of which expectancy

interest on its manager where the death of arises.

the manager will be detrimental to the

corporation’s operations. Who does not have an insurable interest in

property?

Can an Insured Change his beneficiary? 1. A mere contingent or expectant insurable

Yes. An insured has the right to change his interest not founded on an actual right to

beneficiary he designated in the policy during his the thing

lifetime unless he expressly waived his right in

said policy. **The measure of an insurable interest in

The moment that the insured does not property is the extent to which the insured might

change the beneficiary during his lifetime, the be damnified by loss or injury thereof**

designation is irrevocable.

Existing Interest in Property:

Revocable vs. Irrevocable designation of 1. A carrier or depository of any kind has an

beneficiaries: insurable interest in a thing held by him as

1. Irrevocable Designation of Beneficiary such, to the extent of his liability but not to

- Person that was chosen to be a exceed the value thereof.

beneficiary has certain rights with 2. Both the mortgagor and mortgagee may

regard to the death benefit of the insure the mortgaged property against fire.

insured The mortgagor may insure it up to the

- A beneficiary you must consent to any extent of the value while the mortgagee up

changes an insurer may take in his to the extent of the mortgage debt.

insurance policy 3. A depositor may insure his deposits in

- Usually a primary beneficiary excess of the PDIC insurance coverage.

- The beneficiary acquires a vested right

on the life insurance policy Insurable Interest in Property Insurance vs.

- Any act on the part of the insured which Insurable property in Life Insurance

may impair the interest of the

irrevocable beneficiary is null and void. INSURABLE INTEREST

ATQ Personal Notes for Bar 2023 3

Property Life

Insurance Insurance Double Insurance vs. Over-Insurance

As to Value Actual Value of There is no limit Double (or multiple) insurance happens

of Insurance the Interest to the amount of when a single person is insured by 2 or more

therein is the limit insurance that

insurers separately with regard to the same subject

of the insurance may be taken

that can be validly upon life matter and interest.

place thereon (Exception: Over-insurance, on the other hand,

Creditor securing happens when the amount of the insurance is

the life of Debtor) greater than the insured's insurable interest. Both

As to Interest insured Insurable interest double and over-insurance may or may not exist

Existence of must exist at the is enough to exist

Interest time when the at the time when together; it depends on the insured himself.

insurance takes the contract is In case there is over-insurance because of

effect and when made but not double/multiple insurance, the insurers are not

loss occurs necessarily during required to pay for the whole loss. Their

the time of loss obligation is only pro-rata. The insured, on the

As to Beneficiary must Anyone can be a

Beneficiary have insurable beneficiary

other hand, isn't allowed to recover more than his

interest over the (except those insurable interest.

property insured prohibited to

and must be receive donation)

covered by the even though he

insurance policy has no insurable

interest on the life

of the insured

Open Policy and Valued Policy Requisites for Double Insurance

Open Policy a. The person insured is the same

- An insurance policy which the amount b. Two or more insurers insuring separately

payable in the event of a claim is settled c. There is identity of the subject matter

after the loss or damage has occurred d. There is identity of interest insured

e. There is identity of the risk or peril insured

Valued Policy against

- Policy pays a predefined loss amount not

related in any way to the actual incurred If an insurance policy prohibits on the property

loss insured without the insurer’s consent, such

provision being valid and reasonable, a

Effect on change of interest in any part of a violation by the insured;

thing insured unaccompanied by a a. Reduces the value of the policy

corresponding change of interest in the b. Avoids the policy

insurance c. Offsets the value of the policy with the

1. Suspends the insurance in an equivalent additional insurances’ value

extent until the interest in the thing and the d. Forfeits premiums already paid

interest in the insurance are vested in the

same person. If insured is Over Insured by double insurance,

the insured is governed by the following rules:

4. Double Insurance and Over-Insurance

a. The insured may claim payment from the

Double Insurance insurers in such order as he may select, up

- Exists where the same person is insured to the amount for which the insurers are

by several insurers separately in respect severally liable under their respective

to the same subject and interest contracts, unless the policy otherwise

- Only applies to property insurance provides

ATQ Personal Notes for Bar 2023 4

b. If the policy under which the insured

claims is a valued policy, any sum

received by him under any other policy

shall be deducted from the value of the

policy without regard to the actual value of

the subject matter insured

c. If it is under an unvalued policy any sum

received by him under any policy shall be

deducted from the full insurable value for

any sum received by him under any policy

d. If the insured receives any sum exceeding

the value, if it is a valued policy, or if it

exceeds the insurable value if it is under an

unvalued policy, he must hold the excess

sum in trust for the insurers, according to

their right of contribution among

themselves.

e. Each insurer is bound, as between himself

and the other insurers, to contribute ratable

to the loss in proportion to the amount for

which he is liable under his contract. The

insurers, in double insurers are considered

as co-insurers.

Mortgage Redemption Insurance

ATQ Personal Notes for Bar 2023 5

You might also like

- INSURANCE Finals ReviewerDocument6 pagesINSURANCE Finals ReviewerMarivie UyNo ratings yet

- Insurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilsDocument12 pagesInsurance Code of The Philippines: Compensate The Other For Loss On A Specified Subject by Specified PerilskrstnkyslNo ratings yet

- Insurance Law Key ConceptsDocument5 pagesInsurance Law Key ConceptsMarc GelacioNo ratings yet

- Ra 10607Document15 pagesRa 10607mblopez1100% (1)

- Insurance Code of The PhilippinesDocument35 pagesInsurance Code of The PhilippinescarabaldovinoNo ratings yet

- Insurance Contracts and Parties ExplainedDocument7 pagesInsurance Contracts and Parties ExplainedElmer SarabiaNo ratings yet

- Insurance Code RevDocument13 pagesInsurance Code RevPaterno S. Brotamonte Jr.No ratings yet

- Complete Trans For Insurance PrelimsDocument8 pagesComplete Trans For Insurance PrelimsaybiicidiiNo ratings yet

- Business CombinationDocument7 pagesBusiness CombinationEmma Mariz GarciaNo ratings yet

- Negotiable Instruments Law-OverviewDocument35 pagesNegotiable Instruments Law-OverviewChristine joyce MagoteNo ratings yet

- Chapter 3 - Auditor's ResponsibilityDocument6 pagesChapter 3 - Auditor's ResponsibilityDemafilasan, Khyro Paul G.No ratings yet

- Credit Transaction 6 Pledge - Chattel MortgageDocument17 pagesCredit Transaction 6 Pledge - Chattel MortgageAubrey AquinoNo ratings yet

- Insurance Rev SyllabusxDocument50 pagesInsurance Rev SyllabusxPanzer OverlordNo ratings yet

- Guide to Family Code Support ProvisionsDocument6 pagesGuide to Family Code Support ProvisionsfangalanoNo ratings yet

- Loan Commodatum: The Awesome Notes Credit TransactionDocument36 pagesLoan Commodatum: The Awesome Notes Credit TransactionLiam AguilarNo ratings yet

- Insurance Code: Republic Act No. 10607Document14 pagesInsurance Code: Republic Act No. 10607John ReyNo ratings yet

- Insurance Lecture Notes ROXASDocument34 pagesInsurance Lecture Notes ROXASjerico lopezNo ratings yet

- Partnership - Reviewer Partnership - ReviewerDocument8 pagesPartnership - Reviewer Partnership - ReviewerJenny LelisNo ratings yet

- Insurance Law Case ListingDocument140 pagesInsurance Law Case ListingMJ Cadlaon SecretariaNo ratings yet

- Corporations Equity MCQDocument10 pagesCorporations Equity MCQMagdy KamelNo ratings yet

- Philippines Pre-Need Code establishes regulationDocument23 pagesPhilippines Pre-Need Code establishes regulationAicing Namingit-VelascoNo ratings yet

- Manila Banking V TeodoroDocument2 pagesManila Banking V Teodoroluiz ManieboNo ratings yet

- Sales Midterms ReviewerDocument8 pagesSales Midterms ReviewerJanz SerranoNo ratings yet

- Classifications of GuarantyDocument7 pagesClassifications of GuarantyArvi CalaguiNo ratings yet

- (ASC) Regulatory Framework and Legal Issues in BusinessDocument23 pages(ASC) Regulatory Framework and Legal Issues in BusinessRENZ ALFRED ASTRERONo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Rizal Vs Surety (Report)Document8 pagesRizal Vs Surety (Report)Nicky Galang IINo ratings yet

- Insurance Code RA 10607 1-9Document3 pagesInsurance Code RA 10607 1-9RIZA WOLFENo ratings yet

- RFBT-07-01a Law On Obligations Notes With MCQs Practice SetDocument110 pagesRFBT-07-01a Law On Obligations Notes With MCQs Practice SetAiza S. Maca-umbosNo ratings yet

- LIP MemaidDocument29 pagesLIP MemaidWon't TellNo ratings yet

- RFBT - Key Elements of PartnershipsDocument3 pagesRFBT - Key Elements of PartnershipsJinky Martinez100% (1)

- Credit transactions and loan obligations explainedDocument5 pagesCredit transactions and loan obligations explainedIm NayeonNo ratings yet

- Insurance Contract Definitions QuizDocument6 pagesInsurance Contract Definitions Quizmelaniem_1No ratings yet

- RFBT 05 17 Special Corporate LawsDocument65 pagesRFBT 05 17 Special Corporate LawsHarold Dan AcebedoNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- Q - Commercial Law Exam Last Minute TipsDocument10 pagesQ - Commercial Law Exam Last Minute TipsChare MarcialNo ratings yet

- Exam On AgencyDocument7 pagesExam On AgencyJohn TorresNo ratings yet

- Module 1 - Fundamental Principles - Lecture NotesDocument25 pagesModule 1 - Fundamental Principles - Lecture NotesRina Bico AdvinculaNo ratings yet

- Insurance law bar exam questionsDocument5 pagesInsurance law bar exam questionsMayroseTAquinoNo ratings yet

- Handout 5 Law On PartnershipDocument11 pagesHandout 5 Law On PartnershipChristopher Michael Ona100% (1)

- San Beda Insurance Mem AidDocument24 pagesSan Beda Insurance Mem AidchaypatotsNo ratings yet

- Montances, Bryan Ian L. Torts Monday 530 To 730pm Atty HiguitDocument1 pageMontances, Bryan Ian L. Torts Monday 530 To 730pm Atty HiguitJewel MP DayoNo ratings yet

- Sunlife Assurance Company Vs CADocument2 pagesSunlife Assurance Company Vs CApaul2574No ratings yet

- Obligations of The PrincipalDocument2 pagesObligations of The PrincipalaizaordonoNo ratings yet

- Insurance Code SummaryDocument42 pagesInsurance Code SummarymarkbulloNo ratings yet

- Supreme Court Rules on Dissenting Stockholders' Rights and Trust Fund DoctrineDocument4 pagesSupreme Court Rules on Dissenting Stockholders' Rights and Trust Fund Doctrinecarlo dumlaoNo ratings yet

- Trust: TRUST Is A Fiduciary Relationship Concerning Property Which Obliges TheDocument6 pagesTrust: TRUST Is A Fiduciary Relationship Concerning Property Which Obliges TheKingNo ratings yet

- IV. INSURANCE CODE (Republic Act No. 10607, As Amended) : A. Concept of InsuranceDocument5 pagesIV. INSURANCE CODE (Republic Act No. 10607, As Amended) : A. Concept of InsuranceTrinca DiplomaNo ratings yet

- EH403 TAXATION MIDTERMS Estate and Donors - EditedDocument22 pagesEH403 TAXATION MIDTERMS Estate and Donors - Editedethel hyugaNo ratings yet

- Party To Facilitate The Borrowing Activities BetweenDocument7 pagesParty To Facilitate The Borrowing Activities BetweenMikaela Amigan Evangelista100% (1)

- Lecture Notes On Insurance: What Laws Govern InsuranceDocument63 pagesLecture Notes On Insurance: What Laws Govern InsuranceAnonymous UbeKTjH3UJNo ratings yet

- Transpo Codal SummaryDocument3 pagesTranspo Codal SummaryJosiah DavidNo ratings yet

- Part 3 Credit TransactionsDocument8 pagesPart 3 Credit TransactionsClint AbenojaNo ratings yet

- Loc and Trust ReceiptsDocument86 pagesLoc and Trust ReceiptsSam B. PinedaNo ratings yet

- Marina Port Services, Inc. v. National Labor Relations Commission G.R. No. 80962. January 28, 1991, Cruz, J. FactsDocument2 pagesMarina Port Services, Inc. v. National Labor Relations Commission G.R. No. 80962. January 28, 1991, Cruz, J. FactsTiff DizonNo ratings yet

- Law On Agency New 2Document24 pagesLaw On Agency New 2Aileen CempronNo ratings yet

- Provrem Bar Q & ADocument1 pageProvrem Bar Q & AJerwin Cases TiamsonNo ratings yet

- Law 315 Reviewer by FJDocument41 pagesLaw 315 Reviewer by FJjerico lopezNo ratings yet

- MercRev - InsuranceDocument18 pagesMercRev - InsuranceA GrafiloNo ratings yet

- Elements of Insurance: RD RDDocument4 pagesElements of Insurance: RD RDGoody DulayNo ratings yet

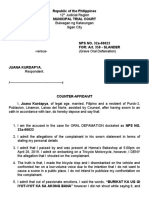

- Judicial Counter Affidavit - Juana KurdapyaDocument3 pagesJudicial Counter Affidavit - Juana KurdapyaAlthea QuijanoNo ratings yet

- 2019 BOC Taxation Law Reviewer PDFDocument295 pages2019 BOC Taxation Law Reviewer PDFEdu Fajardo100% (2)

- Counter Affidavit SAMPLEDocument2 pagesCounter Affidavit SAMPLEHappy Malacas Aragon85% (73)

- SAMPLE: Direct and Cross Examination of AccusedDocument1 pageSAMPLE: Direct and Cross Examination of AccusedAlthea QuijanoNo ratings yet

- Sample: Judicial AffidavitDocument4 pagesSample: Judicial AffidavitAlthea QuijanoNo ratings yet

- Answer Key 2017 Civil Service ExaminationsDocument2 pagesAnswer Key 2017 Civil Service ExaminationsAlthea QuijanoNo ratings yet

- SAMPLE: Direct and Cross Examination of Private CommplainantDocument1 pageSAMPLE: Direct and Cross Examination of Private CommplainantAlthea QuijanoNo ratings yet

- 2017 Civil Service QuestionsDocument13 pages2017 Civil Service QuestionsAlthea QuijanoNo ratings yet

- Songs For Palm Sunday Mass (Cebuano)Document2 pagesSongs For Palm Sunday Mass (Cebuano)Althea QuijanoNo ratings yet

- Songs For Feast of Sto Nino (Cebuano)Document2 pagesSongs For Feast of Sto Nino (Cebuano)Althea QuijanoNo ratings yet

- Sentence TransformationDocument23 pagesSentence TransformationAn ThuNo ratings yet

- 1.3.3 Executed Option Agreement 15072014Document97 pages1.3.3 Executed Option Agreement 15072014Jorge De Lama VargasNo ratings yet

- Car LoanDocument3 pagesCar LoanFrank FattohiNo ratings yet

- Name: - Year and Section: - Industry and Environmental Analysis Business Opportunity Identification ExercisesDocument3 pagesName: - Year and Section: - Industry and Environmental Analysis Business Opportunity Identification ExercisesAngelyn LingatongNo ratings yet

- Top 7 Quality Management Tools For Productivity A Handy Cheat Sheet PDFDocument2 pagesTop 7 Quality Management Tools For Productivity A Handy Cheat Sheet PDFSolhaNo ratings yet

- Mirjana Radović-Marković, Borislav Đukonović - Macroeconomics of Western Balkans in The Context of The Global Work and Business Environment-Information Age Publishing (2022)Document180 pagesMirjana Radović-Marković, Borislav Đukonović - Macroeconomics of Western Balkans in The Context of The Global Work and Business Environment-Information Age Publishing (2022)pakor79No ratings yet

- Corrugated Paper BoxDocument13 pagesCorrugated Paper BoxGulfCartonNo ratings yet

- BF ASN InvestmentDocument1 pageBF ASN InvestmentkeuliseutinNo ratings yet

- Nba Advanced - Happy Hour Co - DCF Model v2Document10 pagesNba Advanced - Happy Hour Co - DCF Model v221BAM045 Sandhiya SNo ratings yet

- Board of Editors List of Contact Details For Internships (In Alphabetical Order)Document4 pagesBoard of Editors List of Contact Details For Internships (In Alphabetical Order)Navneet BhatiaNo ratings yet

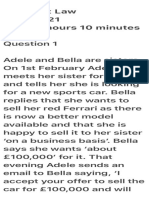

- Graded Assignment 2 JCDocument12 pagesGraded Assignment 2 JCJustineNo ratings yet

- 2022 Q2 Netherlands Marketbeat-IndustrialDocument1 page2022 Q2 Netherlands Marketbeat-IndustrialjihaneNo ratings yet

- Gill Marcus: Issues For Consideration in Mergers and Takeovers From A Regulatory PerspectiveDocument12 pagesGill Marcus: Issues For Consideration in Mergers and Takeovers From A Regulatory PerspectiveTushar AhujaNo ratings yet

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- Multifactor Models QuestionsDocument5 pagesMultifactor Models QuestionsJosh Brodsky0% (1)

- Key Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Document6 pagesKey Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Ritu RajNo ratings yet

- Causes of Project Failure Financed by Ethiopia's Development BankDocument48 pagesCauses of Project Failure Financed by Ethiopia's Development Bankmohammed abdellaNo ratings yet

- Financial Statement Analyses of Tata Motors LimitedDocument12 pagesFinancial Statement Analyses of Tata Motors LimitedJADUNATH HEMBRAMNo ratings yet

- Jedec Standard: Arrowhead QADocument32 pagesJedec Standard: Arrowhead QAdaveNo ratings yet

- 10.1108@ijpdlm 05 2013 0112Document22 pages10.1108@ijpdlm 05 2013 0112Tú Vũ QuangNo ratings yet

- Maharashtra Real Estate Project RegistrationDocument1 pageMaharashtra Real Estate Project RegistrationbennymahaloNo ratings yet

- Test 2Document6 pagesTest 2Saadat Bin SiddiqueNo ratings yet

- Term of Reference - Midline Study FAIR4AllDocument8 pagesTerm of Reference - Midline Study FAIR4AllDodon YaminNo ratings yet

- This Study Resource Was: Vibhava Chemicals: Case AnalysisDocument3 pagesThis Study Resource Was: Vibhava Chemicals: Case AnalysisNidhi JoshiNo ratings yet

- Human Resources Performance Measurement Approaches Compared To Measures Used in Master's Theses in ASUDocument7 pagesHuman Resources Performance Measurement Approaches Compared To Measures Used in Master's Theses in ASUHugo Enrique Oblitas SalinasNo ratings yet

- Credit Card Enrollment Cabaluna 2022Document3 pagesCredit Card Enrollment Cabaluna 2022Tracy AdraNo ratings yet

- Lecture03 SlidesDocument50 pagesLecture03 Slidesaditya jainNo ratings yet

- Government's MSE Development SchemeDocument8 pagesGovernment's MSE Development SchemeSanskriti sahuNo ratings yet

- Nov Spotlight PDFDocument156 pagesNov Spotlight PDFRajat KandolaNo ratings yet

- Mangudya Monetary Policy Bashed For Ignoring FundamentalsDocument2 pagesMangudya Monetary Policy Bashed For Ignoring FundamentalsElias ManyiseNo ratings yet