Professional Documents

Culture Documents

10-Pitfalls of Licensing Agreement

10-Pitfalls of Licensing Agreement

Uploaded by

Yaqoob AliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10-Pitfalls of Licensing Agreement

10-Pitfalls of Licensing Agreement

Uploaded by

Yaqoob AliCopyright:

Available Formats

Seeing the Fire Behind the Smoke Jul 1, 2011 By: Todd C.

Davis Pharmaceutical Executive In today's market nothing is standard. The partnering landscape has become more pressured, competitive, and complex in terms of deal structure. But business development and licensing executives should not overlook certain license terms and conditions once the economics have been finalized. In fact, it is often boilerplate language or lack of common-sense terms that can derail or hinder the use of licensed assets and influence their long-term value. Licensing is a mainstay of biopharmaceutical companies and academia. Over 600 deals valued at approximately $25 billion were announced in 2010, and these numbers will continue to grow as large pharma increases its reliance on in-licensed technologies and new molecular entities to fill pipeline gaps. To maximize the value of intellectual property (IP) and not leave money on the table requires vigilance. While crafting license agreements involves all of the tactical tradeoffs expected in a negotiating dynamic, one should try to pay attention to these 10 licensing pitfalls: 1) Limited ability to assign or grant security interest in the license. Many years after the license is signed, when the product is being marketed and the licensor has moved on to other pursuits, the license agreement may well be considered a non-strategic financial asset. But with any financial asset, the more restrictions that exist, the less valuable it is. A license agreement that cannot be assigned (including assignment of the right to receive royalties), or one that cannot be pledged as collateral, is at a serious disadvantage if the holder wants to sell downstream. By clearing these hurdles upfront, the license agreement will be both more marketable and more valuable. 2) Complex and unclear royalty terms. Uncertainty reduces the value of any asset. It's the "ifs, ands, or buts" in these agreements that make it hard to decipher how much money is due and when; what seems clear to those who hammer out the deal can often be confusing years later. At a minimum, the license should clearly specify the royalty rate, how it is calculated, when it will be paid, and for how long. It seems like common sense, but clarity is critical when assessing how much the asset is worth. 3) Maintaining third-party royalty obligations. This can be a significant liability for a licensor, unless the contract explicitly makes them the obligation of the licensee. In the worst case, if the licensee were to stop paying royalties and the agreements don't appropriately address the issue, the licensor could still be on the hook for royalties due to any third-party royalty holders. These obligations can also complicate and ultimately impact how much money the licensor takes home. Once all the royalty payments have been calculated, a licensor's net percentage could be significantly less than the original forecast. Third-party obligations should be assumed by the licensee.

4) A narrowly defined royalty payment term. It is important to look at not only the patents to be licensed, but also at the underlying value of what is being transferred as part of the agreement. Leaving the know-how or other components unaccounted for can leave the innovator emptyhanded after delivering significant value. Take, for example, a license that ties specifically to one cell line. The licensee ultimately changes cell lines but still uses the additional art and know-how transferred as part of the deal. Unless the license requires payment for the know-how, the licensor will receive no royalties. Define the components of that value as broadly as possible. 5) Lack of information rights. A license for commercialized technology is one of a licensor's most important assets. Access to key pieces of information during the development and commercial stages is imperative. In the development stage, it is important not only to be able to validate how things are progressing but, at the most basic level, that the product is actually being developed. Once the product is on the market, it is critical to be able to validate the calculation of the royalty rate and estimated payments. Royalty reports by geography, audit rights and reports, regulatory information, and license communications will give a licensor the tools to do this and are indispensable parts of a well-crafted license agreement. In addition to having access, a licensor needs the ability to share this information confidentially with a potential acquirer or investor. Without that right, it will be impossible to fully realize value for this license downstream. Establishing these rights out of the gate will provide greater autonomy over the long term. 6) Inadequate termination rights. License agreements are formed and terminated every year. While every contract is drafted when the parties expect success, be certain to negotiate a reciprocal right to terminate under certain adverse conditions, including conditions of significant underperformance. It is also best to regain all of the rights owned prior to the agreement, such as ownership of the IP, upon termination of the license. Additionally, the effort and thought spent structuring the agreement to ensure that regulatory approvals and clinical data are available following termination will be richly rewarded by keeping the commercialization timeline as close to on track as possible. 7) Assigning versus licensing intellectual property. A license agreement has special protection in bankruptcy court that exists to ensure that any royalties due under the agreement be paid. Therefore if a licensee goes bankrupt, and the product or technology ends up in the hands of a new owner during the bankruptcy process, the rights to receive royalties and enforce the agreement maintain their value with the new licensee. If a licensor sells or assigns the IP, rather than licensing it, a bankruptcy trustee is free and clear to sell it in bankruptcy for the benefit of creditors, and the economic value is lost. Use a license agreement to transfer IP rights whenever possible, and especially whenever a material part of the value rests in downstream economic rights.

8) Combining a supply agreement with a license agreement. Combining these agreements can actually devalue a license. It also creates complexity once the product is commercialized. If the licensor decides to monetize the license, the potential acquirer could be subject to a tax liability in that the sale could be characterized as other income rather than as an asset purchase or a financing. This characterization creates incremental tax liability for some acquirers and would therefore reduce the value for them. Keep these agreements separate if possible. 9) No contingent valuation clause. Suboptimal circumstances arise that can impact the royalty rate of a license. Many of these circumstances can reduce the value, but do not eliminate the value of the license entirely. In these cases it is appropriate to have a stepped-down royalty rate rather than a complete termination of royalties due. One example of this may be to have a royalty step-down upon generic entry, or to leave a royalty rate in place upon generic entry as long as net sales remain above a certain threshold. Many licenses still hold significant value even after adverse events. That should be anticipated and provided for in the agreementnot after the event has taken place or during renegotiation. 10) Not defining comprehensive reversion rights. Licensees will commonly make improvements to a product during the development stage. But if a license doesn't adequately cover the rights to improvements, it could limit how the licensor uses its own underlying technology. This is a significant issue with platform technologies today. Work to ensure the freedom to exploit the IP outside of the field of use regardless of improvements made by the licensee within the field. Licensing is critical to product development, but many agreements are developed years before a product ever reaches the market. The baseline economic terms are important in terms of measuring and realizing the value of IP, but it is in negotiating the numerous key terms of the agreement that the full range of value, such as the "know-how" value of the IP, can be exploited. Experience has shown that clarity and attention to licensing terms will ease the due diligence process and simplify future transactions but, most importantly, also preserve the intended value of the deal in the myriad circumstances that will inevitably occur following the execution of the agreement. The time to optimize a license agreement is prior to signing, when the only certainty is the inability to predict the future. Attention to these key terms will reduce restrictions on the ability to respond to adverse situations, and will help a licensor better navigate the uncharted waters ahead. Todd C. Davis is managing director at Cowen Healthcare Royalty Partners. He can be reached at todd.davis@cowen.com

You might also like

- Trusts Chs1to4Document62 pagesTrusts Chs1to4Abdulla HoshimovNo ratings yet

- Example Exclusive Patent LicenseDocument13 pagesExample Exclusive Patent LicenseSam Han100% (1)

- Mentorship 101Document2 pagesMentorship 101Simon RobinsonNo ratings yet

- Design ContractDocument6 pagesDesign ContractOllie DesrochersNo ratings yet

- Using Commercial Contracts: A Practical Guide for Engineers and Project ManagersFrom EverandUsing Commercial Contracts: A Practical Guide for Engineers and Project ManagersNo ratings yet

- Intellectual Property BasicsDocument32 pagesIntellectual Property Basicsdbosnjak1467No ratings yet

- Lake Road Executive SummaryDocument7 pagesLake Road Executive SummarySam ParrNo ratings yet

- Lenders Non Disclosure AgreementDocument4 pagesLenders Non Disclosure AgreementOkan ErturhanNo ratings yet

- Floor Covering Installer - October 2015Document52 pagesFloor Covering Installer - October 2015David KošićNo ratings yet

- Best Practices DroneDocument23 pagesBest Practices DroneRudimar PetterNo ratings yet

- Digital Products Decommissioning Checklist: The Purpose of This Document Is ToDocument7 pagesDigital Products Decommissioning Checklist: The Purpose of This Document Is ToadiNo ratings yet

- Product Development Agreement TemplateDocument2 pagesProduct Development Agreement TemplateKRISHNo ratings yet

- NDA - Potential Investors - Investee CompanyDocument4 pagesNDA - Potential Investors - Investee CompanyRan DomNo ratings yet

- Shareholder Agreement - Legal GuideDocument7 pagesShareholder Agreement - Legal GuideCanadaLegal.comNo ratings yet

- Patent LicenseDocument4 pagesPatent Licensetallpaul09No ratings yet

- F.U. Property: Build a Property Portfolio That Empowers You to Tell Any Individual or Organisation to Go F*ck ThemselvesFrom EverandF.U. Property: Build a Property Portfolio That Empowers You to Tell Any Individual or Organisation to Go F*ck ThemselvesNo ratings yet

- DiMixing and Dissolution Times For A Cowles Diskssolution PaperDocument33 pagesDiMixing and Dissolution Times For A Cowles Diskssolution PaperYaqoob AliNo ratings yet

- Hedge Fund General Counsel in New York City Resume Claude BaumDocument2 pagesHedge Fund General Counsel in New York City Resume Claude BaumClaudeBaumNo ratings yet

- Commercial Radio OperatorsDocument11 pagesCommercial Radio OperatorsDiego VillaniaNo ratings yet

- IP Assignment AgreementDocument4 pagesIP Assignment AgreementAdam WynnsNo ratings yet

- Citizens' League of Freeworkers vs. Abbas, G.R. No. L-21212, September 23, 1966Document2 pagesCitizens' League of Freeworkers vs. Abbas, G.R. No. L-21212, September 23, 1966Lizzy LiezelNo ratings yet

- Busines PlanDocument21 pagesBusines PlanFatimah Binte AtiqNo ratings yet

- Digests Compilation 6Document25 pagesDigests Compilation 6G FNo ratings yet

- JV ContratcDocument6 pagesJV Contratcnesrinakram100% (1)

- Creative Commons LessigDocument261 pagesCreative Commons LessigpopskyNo ratings yet

- Oblicon QuestionsDocument5 pagesOblicon QuestionsAvril Reina67% (6)

- IP Due Diligence For Angel InvestorsDocument6 pagesIP Due Diligence For Angel InvestorsJay CreutzNo ratings yet

- Parent Company Guaranty PDFDocument3 pagesParent Company Guaranty PDFOrchis DONo ratings yet

- Joint VentureDocument13 pagesJoint VentureDeepa NairNo ratings yet

- Clean and Pure Steam SystemsDocument82 pagesClean and Pure Steam SystemsYaqoob Ali100% (3)

- Recoletos Law Center Notes On LaborDocument33 pagesRecoletos Law Center Notes On LabornikiboigeniusNo ratings yet

- Aquino Sarmiento V MoratoDocument1 pageAquino Sarmiento V MoratoTricia SibalNo ratings yet

- 07 Dungo Vs PeopleDocument6 pages07 Dungo Vs PeopleAleli BucuNo ratings yet

- BANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsDocument53 pagesBANK OF AMERICA VS. CA G.R. NO. 120135 MAR 31, 2003 FactsMacNo ratings yet

- ASTM D3035 Standard Specification For Polyethylene Plastics Pipe and Fittings Materials PDFDocument8 pagesASTM D3035 Standard Specification For Polyethylene Plastics Pipe and Fittings Materials PDFYaqoob AliNo ratings yet

- Restricted Source Code License ProvisionsDocument2 pagesRestricted Source Code License ProvisionsPeter KelmanNo ratings yet

- Dippin' Dots Inc. v. Frosty Bites Distribution LLC, 369 F.3d 1197, 11th Cir. (2004)Document14 pagesDippin' Dots Inc. v. Frosty Bites Distribution LLC, 369 F.3d 1197, 11th Cir. (2004)Scribd Government DocsNo ratings yet

- Strata LawDocument9 pagesStrata LawtamouhNo ratings yet

- Patent InfringementDocument29 pagesPatent InfringementbrainleagueNo ratings yet

- "Coexistence or No Existence" - Chances and Challenges of Coexistence Agreements Under General and German Trademark LawDocument4 pages"Coexistence or No Existence" - Chances and Challenges of Coexistence Agreements Under General and German Trademark LawChristian RichardsNo ratings yet

- Intellectual Property Rights: A Grant of Monopoly or An Aid To Competition?Document17 pagesIntellectual Property Rights: A Grant of Monopoly or An Aid To Competition?Core ResearchNo ratings yet

- 01 Distribution Agreement DraftDocument4 pages01 Distribution Agreement DraftTonyTonieNo ratings yet

- Final Legal Aspects of LogisticsDocument13 pagesFinal Legal Aspects of LogisticsPrasad ChamaraNo ratings yet

- Strengthening State Economic Development Systems: A Framework For ChangeDocument10 pagesStrengthening State Economic Development Systems: A Framework For ChangeMarco RamirezNo ratings yet

- This Memorandum of Understanding Is Made and Entered Into OnDocument2 pagesThis Memorandum of Understanding Is Made and Entered Into Onnom orenotes0% (1)

- Royalty Rate Report Example 1Document16 pagesRoyalty Rate Report Example 1savageNo ratings yet

- The Value of A PatentDocument11 pagesThe Value of A PatentfelisaavNo ratings yet

- BusinessDocument116 pagesBusinesshaji5No ratings yet

- Trademark Protection For Early Stage Companies and Start UpsDocument2 pagesTrademark Protection For Early Stage Companies and Start UpsFazlur TSPNo ratings yet

- Fitbug v. Fitbit - Trademark Laches DecisionDocument31 pagesFitbug v. Fitbit - Trademark Laches DecisionMark JaffeNo ratings yet

- Discussion Paper - Municipal BondsDocument3 pagesDiscussion Paper - Municipal BondsmalyalarahulNo ratings yet

- Assignment Question Project ManagementDocument4 pagesAssignment Question Project ManagementRana_hubaNo ratings yet

- Ip Due Deligence - IpvDocument12 pagesIp Due Deligence - IpvpravinsankalpNo ratings yet

- How To Create A Founders AgreementDocument15 pagesHow To Create A Founders Agreementsan_yadav76No ratings yet

- Winning The Patent Damages CaseDocument187 pagesWinning The Patent Damages CaseJosé Luis GutiérrezNo ratings yet

- IP Manual For Engineering TeamDocument227 pagesIP Manual For Engineering Teamandy_jean_2No ratings yet

- Louis Vuitton Malletier v. Dooney & Bourke Inc. - Resisting Expan PDFDocument20 pagesLouis Vuitton Malletier v. Dooney & Bourke Inc. - Resisting Expan PDFDonette AnthonyNo ratings yet

- 2005 Cick Guide Vol2 DesigningDocument62 pages2005 Cick Guide Vol2 DesigningVia AnapiNo ratings yet

- Photo Attorney "Leslie Burns" Settlement Demand LetterDocument5 pagesPhoto Attorney "Leslie Burns" Settlement Demand LetterExtortionLetterInfo.comNo ratings yet

- Renovation AgreementDocument1 pageRenovation AgreementNasa MyjNo ratings yet

- Sunny Boy SB2500 Tech ManualDocument33 pagesSunny Boy SB2500 Tech ManualCJ10aNo ratings yet

- HUD Letter of Findings of Non-ComplianceDocument29 pagesHUD Letter of Findings of Non-ComplianceJoe ToneNo ratings yet

- Unit 7 Intellectual PropertyDocument49 pagesUnit 7 Intellectual PropertyZulaikha ZulaikhaNo ratings yet

- Etta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Document44 pagesEtta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Peter M. HeimlichNo ratings yet

- Chief Executive Job DescriptionDocument6 pagesChief Executive Job DescriptionAroma FarhanNo ratings yet

- Energizer v. Camelion Battery - Trade Dress Complaint PDFDocument19 pagesEnergizer v. Camelion Battery - Trade Dress Complaint PDFMark JaffeNo ratings yet

- MouDocument6 pagesMouXenia YasminNo ratings yet

- Article - Teece - Towards A Solution For The Hold-Out ProblemDocument26 pagesArticle - Teece - Towards A Solution For The Hold-Out ProblemJim HarlanNo ratings yet

- 1 Royalty StackingDocument6 pages1 Royalty StackingPrajwal KumarNo ratings yet

- DetalleDocument1 pageDetalleMahan HindolNo ratings yet

- Scholtz 2016 AIChE - Journal PDFDocument12 pagesScholtz 2016 AIChE - Journal PDFYaqoob AliNo ratings yet

- Chem Consulting: Specification SheetDocument1 pageChem Consulting: Specification SheetYaqoob AliNo ratings yet

- Questionnaire: I. Items To Be WashedDocument6 pagesQuestionnaire: I. Items To Be WashedYaqoob AliNo ratings yet

- PharmaBiotech Flyer 105x210mm Low 140312Document16 pagesPharmaBiotech Flyer 105x210mm Low 140312Yaqoob AliNo ratings yet

- Purge CalcDocument132 pagesPurge CalcAjaykumar TiwariNo ratings yet

- Vle of Hcl-WaterDocument6 pagesVle of Hcl-WaterYaqoob Ali0% (1)

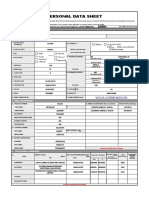

- Analyn Pds 2Document6 pagesAnalyn Pds 2Reynaldo RolanNo ratings yet

- Apple V SamsungDocument20 pagesApple V Samsungerica_ogg6810No ratings yet

- Suzue Toshiro-If He Doesn't See Your FaceDocument35 pagesSuzue Toshiro-If He Doesn't See Your FaceKevin AbaniNo ratings yet

- INSURANCE (Recit Questions) - STA. BarbaraDocument4 pagesINSURANCE (Recit Questions) - STA. BarbaraLucky James AbelNo ratings yet

- Moday v. CADocument3 pagesModay v. CAuranusneptune20No ratings yet

- 3 1 2 A LanduseanddevelopmentDocument6 pages3 1 2 A Landuseanddevelopmentapi-276367162No ratings yet

- E1061 1479757-1Document3 pagesE1061 1479757-1Thaweekarn ChangthongNo ratings yet

- Principles of Natural JusticeDocument19 pagesPrinciples of Natural JusticeKumar AnkitNo ratings yet

- Contract Report 2015 B PDFDocument12 pagesContract Report 2015 B PDFSultan MughalNo ratings yet

- Unit 11 Boyle Charles GayLussac and Combined Gas Law Worksheet Gas WS 1 2010Document2 pagesUnit 11 Boyle Charles GayLussac and Combined Gas Law Worksheet Gas WS 1 2010Pablo AlconzNo ratings yet

- Tan Andal GR No. 196359 (Full Text)Document38 pagesTan Andal GR No. 196359 (Full Text)Anton DavidNo ratings yet

- Comparison of IFRS and U.S GAAP in Relation To Intangible AssetsDocument6 pagesComparison of IFRS and U.S GAAP in Relation To Intangible AssetsVimal SoniNo ratings yet

- Mohamad Barakat Case ReportDocument4 pagesMohamad Barakat Case ReportinforumdocsNo ratings yet

- Ojjdp: Journal Juvenile JusticeDocument107 pagesOjjdp: Journal Juvenile JusticeFrancisco EstradaNo ratings yet

- Constitutional Reform in Saint LuciaDocument38 pagesConstitutional Reform in Saint LuciaOneil O. Sprott Sr.No ratings yet

- Sole ProprietorshipDocument6 pagesSole ProprietorshipMuhammad Moiz HasanNo ratings yet

- Berris Vs AbyadangDocument6 pagesBerris Vs AbyadangcehuonlicaeNo ratings yet

- 12 11 11 Final Motion For New Trial City of Reno V Coughlin RMC 11 CR 22176 (12 11 11 Final Motion For New Trial City of Reno V Coughlin RMC 11 CR 22176 PDFDocument107 pages12 11 11 Final Motion For New Trial City of Reno V Coughlin RMC 11 CR 22176 (12 11 11 Final Motion For New Trial City of Reno V Coughlin RMC 11 CR 22176 PDFNevadaGadflyNo ratings yet

- In Re New England Carpet Co., Debtor. Gravel, Shea & Wright, Ltd. v. Bank of New England, The Merchants Bank, and Vermont Development Credit Corporation, 744 F.2d 16, 2d Cir. (1984)Document2 pagesIn Re New England Carpet Co., Debtor. Gravel, Shea & Wright, Ltd. v. Bank of New England, The Merchants Bank, and Vermont Development Credit Corporation, 744 F.2d 16, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- Sexual Harassment ProjectDocument13 pagesSexual Harassment ProjectSayan ChatterjeeNo ratings yet

- Test Jay PatelDocument1 pageTest Jay PatelJuhil PatelNo ratings yet

- Gonzales vs. CADocument8 pagesGonzales vs. CAJay CruzNo ratings yet