Professional Documents

Culture Documents

CMDAppeal Customers UCO

CMDAppeal Customers UCO

Uploaded by

Vaibhav GangwarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CMDAppeal Customers UCO

CMDAppeal Customers UCO

Uploaded by

Vaibhav GangwarCopyright:

Available Formats

UCO BANK

Head Office : Kolkata- 700 001

CUSTOMER SERVICE RATING APPEAL TO THE CUSTOMERS

Dear Customer, You are the most important person visiting our Bank. Your satisfaction is our concern. Our very existence is dependent on the patronage we receive from you and we owe you Service, which is your rightful claim. Our branch is the primary unit where service is rendered to you. Therefore, it is incumbent on our branches to be ever concerned about the standard of services offered by them. Keeping the above in mind we seek your co-operation by way of furnishing us your independent opinion regarding quality of services you receive from our branches through your free and frank responses noted in the questionnaire given below. Your views/suggestions for improving our services would be of immense help to the Bank and we assure you that the same will be kept confidential and will not be shared with the concerned branch. Please send your response directly to the Asstt. General Manager (Publicity & PR), Head Office 2, India Exchange Place, 3rd floor, Kolkata - 700 001. e-mail address- hopgr.calcutta@ucobank.co.in, Fax No. 033-2230 2559. Thanking you and with sincere regards, (V. Sridar) Chairman & Managing Director

QUESTIONNAIRE ON CUSTOMER SERVICE RATING NAME OF THE BRANCH....................................................................................

Please tick (3) following services / facilities based on your personal experience in dealing with the branch office : PART - A - QUALITATIVE ASPECTS

Sl. No. 1. 2. 3. 4. Services Cleanliness, Layout, Access to the entrance, Visibility of Signboards Space available for sitting / waiting / writing Easy availability of loose pay-in-slips, withdrawal slips, DDs / TTs forms & challans etc. Availability of services of staff members : a) For any enquiry b) Listening to your problems c) Guidelines for various deposit schemes, their advantages d) For procuring publicity related materials 5. 6. General behaviour of the members of staff Availability of services at Computerised Counters eg. Knowing the balance, Debit /Credit of instruments etc., and delivery of printed Pass Books / Statements V. Good V. Good V. Good V. Good V. Good V. Good V. Good V. Good V. Good Ratings Good Good Good Good Good Good Good Good Good Average Average Average Average Average Average Average Average Average Poor Poor Poor Poor Poor Poor Poor Poor Poor

7. 8. 9. 10. 11.

Expert services available in handling of import / export business Compliance of standing instructions Your experience about Locker Service rendered by the branch Availability of Complaint Register on demand Any complaint lodged by you is still to be redressed. If so please put the date of complaint lodged with the branch

V. Good V. Good V. Good

Good Good Good

Average Average Average

Poor Poor Poor

Easily available on Demand None

Not available Not attended (put date of lodgement of complaint)

PART - B - QUANTITATIVE ASPECTS Sl. No. Staff initiative to minimise waiting hours of the customers at the Counter 1. 2. Payment of Cash, Cheques, Demand Drafts Receipt of Cash in the accounts / purchase of DDs and in other accounts Delivery of Demand Drafts / Pay Orders / Bank Orders Delivery of Fixed Deposit Receipts Updating of Savings / RD Pass Books (Where entries are not more) Issue of Cheque Books in Current / SB a/cs within 15 mts. within 15 mts. within 20 mts. within 20 mts. Within 15 mts. Within 15 mts. Within 7 days Instantly Within 20 mts. Immediate Within 14 days Within 30 mts. 15-30 mts. 15-30 mts. 15-30 mts. 15-30 mts. 20-30 mts. 20-30 mts. More than 30 mts. More than 30 mts. More than 30 mts. More than 30 mts. More than 30 mts. More than 30 mts. More than 1 day More than 1 day More than 15 days More than 1 hour More than 30 mts. Not Done More than 21 days More than 60 mts.

3. 4. 5.

6.

7. 8. 9. 10. 11. 12.

Issue of Statement of Accounts (Manual) Issue of Statements of Accounts / Pass Books (on Computers) Credit of proceeds of domestic transfers Affording credit upto Rs. 15,000/- in respect of outstation cheques Time taken in realisation of proceeds of outstation cheques / bills Time taken in sanctioning of loans against Bank's deposits

7-15 days More than 30 mts. 20-30 mts. On Request 15-21 days 30-60 mts.

Your suggestions, if any, for improving Customer Service at the Branch : NAME : SIGNATURE : Account Number : Date : Branch :

You might also like

- Uco Bank: Head Office: Kolkata-700 001Document3 pagesUco Bank: Head Office: Kolkata-700 001itsmeadiNo ratings yet

- Customer Service RatingDocument3 pagesCustomer Service Ratingsangeeta_bais1827No ratings yet

- Perspective Management - Sem1 MMS-IDocument11 pagesPerspective Management - Sem1 MMS-Ibhagyashree_shinde0% (4)

- Citizen's Charter: Metro Cotabato Water DistrictDocument44 pagesCitizen's Charter: Metro Cotabato Water DistrictMaddie SyNo ratings yet

- Unnati Business AccountDocument4 pagesUnnati Business Accountmajhi.deepashreeNo ratings yet

- Umang Account IdbiDocument4 pagesUmang Account Idbimajhi.deepashreeNo ratings yet

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inrvtsudhakarNo ratings yet

- Introductionof New Current Account UCOCAREPLUSDocument4 pagesIntroductionof New Current Account UCOCAREPLUSDebasish100% (1)

- DBP Citizen'S CharterDocument38 pagesDBP Citizen'S CharterBien Bowie A. CortezNo ratings yet

- Basic Principle of AccountingDocument3 pagesBasic Principle of Accounting22ba045No ratings yet

- Housing Society Billing & Accounting: The Trial Demo Is Available at Our WebsiteDocument1 pageHousing Society Billing & Accounting: The Trial Demo Is Available at Our WebsiteKevin DsouzaNo ratings yet

- PK Saadiq EnglishDocument53 pagesPK Saadiq EnglishZeeshan AshrafNo ratings yet

- Internal Aijdit Report: Accounts Payable Finance Department April 3,2014Document8 pagesInternal Aijdit Report: Accounts Payable Finance Department April 3,2014ahmed khoudhiryNo ratings yet

- Soc 2018 (Finall)Document15 pagesSoc 2018 (Finall)Engr Hafiz Qasim AliNo ratings yet

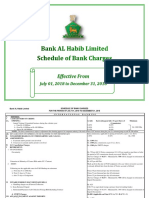

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairNo ratings yet

- PNB Suvidha Scheme (Deposits) : Categorization of Retail Lending SchemesDocument3 pagesPNB Suvidha Scheme (Deposits) : Categorization of Retail Lending Schemesnishi namitaNo ratings yet

- Mod SiDocument1 pageMod SiMuhammad Waleed KhanNo ratings yet

- 241120231058-Service ChargeDocument25 pages241120231058-Service ChargerakraspuraNo ratings yet

- Check List For Audit Irregularities Ba MangaluruDocument15 pagesCheck List For Audit Irregularities Ba MangaluruKislayNikharNo ratings yet

- Sample NotingsDocument21 pagesSample Notingsarun.arun.beheraNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377far03No ratings yet

- Mod AdDocument1 pageMod AdMuhammad Waleed KhanNo ratings yet

- Epson Advance Rc#2Document18 pagesEpson Advance Rc#2Shanthi GowthamNo ratings yet

- Stock Audit Report: Page 1 of 9Document9 pagesStock Audit Report: Page 1 of 9Gourav AryaNo ratings yet

- Forum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: ServicesDocument5 pagesForum R. Chudasama, MFM Batch Roll No. 215, Assignment 1: Servicesrohit kanojiaNo ratings yet

- Double SystemDocument10 pagesDouble SystemNatasha MugoniNo ratings yet

- Mod UdcDocument1 pageMod UdcMuhammad Waleed KhanNo ratings yet

- Your Authority BCA0020602Document5 pagesYour Authority BCA0020602CharanTheja RallaNo ratings yet

- Terms of Rtgs NeftDocument2 pagesTerms of Rtgs NeftJanhvi DixitNo ratings yet

- Eastwest Bank: Position Department/Division: Branch Banking Division Reports To SupervisesDocument10 pagesEastwest Bank: Position Department/Division: Branch Banking Division Reports To SupervisesShingieNo ratings yet

- NEFT Vs RTGSDocument4 pagesNEFT Vs RTGSneehuneehuneehu12345No ratings yet

- 150722-Revision in Service Charges Updated As On 30062022Document21 pages150722-Revision in Service Charges Updated As On 30062022Vinoth KumarNo ratings yet

- RgiptulluDocument25 pagesRgiptulluHelloNo ratings yet

- Andhra Pragathi: Eosedegl&soer5os UiuDocument3 pagesAndhra Pragathi: Eosedegl&soer5os Uiuprasaddevisetti2001No ratings yet

- Duty Sheet Award StaffDocument4 pagesDuty Sheet Award Staffkunalsara4No ratings yet

- Lnvjwlap 042301674501Document2 pagesLnvjwlap 042301674501pulapa umamaheswara raoNo ratings yet

- DepositSlip 10068722031011441572339Document1 pageDepositSlip 10068722031011441572339Jehad Ur RahmanNo ratings yet

- Schedule of Charges.2011 - 2Document20 pagesSchedule of Charges.2011 - 2Kazi HasanNo ratings yet

- Wa0011.Document8 pagesWa0011.utkarsh879No ratings yet

- Application For Closure of Demat Account (NSDL/CDSL) : ( Marked Is A Mandatory Field)Document2 pagesApplication For Closure of Demat Account (NSDL/CDSL) : ( Marked Is A Mandatory Field)Rahul SakareyNo ratings yet

- PK Saadiq Soc Jan To July 2024 EngDocument48 pagesPK Saadiq Soc Jan To July 2024 Engwaqas wattooNo ratings yet

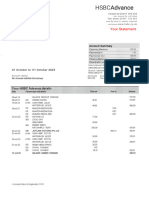

- HSBCBank Estatment202310Document3 pagesHSBCBank Estatment202310aksesorissamsulNo ratings yet

- 021122-Service Charges As On 30.09.2022Document26 pages021122-Service Charges As On 30.09.2022computerdebtaNo ratings yet

- Maturity Instruction: Payment Instruction (Maturity Proceeds/Residual)Document1 pageMaturity Instruction: Payment Instruction (Maturity Proceeds/Residual)Dr. Gollapalli NareshNo ratings yet

- Module 10 (Abhishek)Document12 pagesModule 10 (Abhishek)abhishek gautamNo ratings yet

- Tally Prime Course Account and IntroDocument15 pagesTally Prime Course Account and IntroAnkit Singh100% (2)

- Clcs Application - Obs Ridhi SidhiDocument28 pagesClcs Application - Obs Ridhi SidhiSURANA1973No ratings yet

- Cash Handling Charges Main Circular-1Document5 pagesCash Handling Charges Main Circular-1ChandreshSinghNo ratings yet

- Gram Unnati Business AccountDocument4 pagesGram Unnati Business Accountmajhi.deepashreeNo ratings yet

- Idebt Assist 1 - 2010Document7 pagesIdebt Assist 1 - 2010paulNo ratings yet

- Mod Sub Inspector Challan FormDocument1 pageMod Sub Inspector Challan FormMuhammad Rɘʜʌŋ BakhshNo ratings yet

- Faq Bulk Payment Via M2u BizDocument5 pagesFaq Bulk Payment Via M2u BizkavsabirNo ratings yet

- BRAC Bank Internet Banking FAQDocument5 pagesBRAC Bank Internet Banking FAQTariqul BariNo ratings yet

- Banking Operations - Bank of IndiaDocument21 pagesBanking Operations - Bank of IndiaEkta singhNo ratings yet

- Indusind Bank Customer-Request-FormDocument2 pagesIndusind Bank Customer-Request-FormShravani JayanthyNo ratings yet

- Ecircular: New Current Account VariantsDocument6 pagesEcircular: New Current Account VariantsMadhu DhakerNo ratings yet

- Accounting System 0Document24 pagesAccounting System 0ramyaa baluNo ratings yet

- Statement BOA-0505 May 2023Document8 pagesStatement BOA-0505 May 2023cmyburgh900No ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet